Delaware Stock Option Agreement between Shore wood Packaging Corp. and Jefferson Capital Group, Ltd A Delaware Stock Option Agreement is a legally binding contract between Shore wood Packaging Corp. and Jefferson Capital Group, Ltd that outlines the terms and conditions of stock option grants. This agreement allows Jefferson Capital Group, Ltd to purchase a specified number of shares of Shore wood Packaging Corp.'s stock at a predetermined price within a specified timeframe. The Delaware Stock Option Agreement is designed to promote a mutually beneficial relationship between the two parties. By granting stock options to Jefferson Capital Group, Ltd, Shore wood Packaging Corp. aims to incentivize and retain talented individuals within their organization. On the other hand, Jefferson Capital Group, Ltd benefits from the potential appreciation of the company's stock value over time. Key Keywords: Delaware Stock Option Agreement, Shore wood Packaging Corp., Jefferson Capital Group, Ltd, stock options, terms and conditions, legally binding contract, stock option grants, purchase, shares, predetermined price, specified timeframe, incentivize, retain, talented individuals, organization, appreciation, stock value Different Types of Delaware Stock Option Agreements between Shore wood Packaging Corp. and Jefferson Capital Group, Ltd: 1. Incentive Stock Options (SOS): These are stock options that provide certain tax advantages to the employee. SOS typically carry specific eligibility and holding period requirements. They are intended to incentivize key employees by offering them the opportunity to purchase company stock at a favorable price. 2. Non-Qualified Stock Options (SOS): Unlike SOS, SOS do not offer the same tax advantages. However, they provide more flexibility in terms of eligibility, allowing a wider range of employees to participate. SOS can be granted to consultants, advisors, and employees who do not meet the requirements set for SOS. 3. Restricted Stock Units (RSS): While not technically stock options, RSS are often included in Delaware Stock Option Agreements. RSS is a promise to deliver shares of stock at a future date based on predetermined vesting criteria. RSS can be advantageous as they do not require an upfront purchase price and align the interests of employees with those of the company's shareholders. 4. Performance Stock Options: These stock options are granted to employees based on the achievement of specific performance goals. By tying the stock options to measurable targets like revenue growth or market share, the company can motivate the employees to contribute directly to the organization's success. In summary, the Delaware Stock Option Agreement between Shore wood Packaging Corp. and Jefferson Capital Group, Ltd is a crucial document that governs the granting and exercise of stock options. It provides clear terms and conditions, ensuring that both parties understand their rights and obligations. By offering various types of stock options, the agreement aims to align the interests of key employees with the long-term growth and success of the company.

Delaware Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd

Description

How to fill out Delaware Stock Option Agreement Between Shorewood Packaging Corp. And Jefferson Capital Group, Ltd?

Are you currently in a place that you need paperwork for sometimes enterprise or person functions almost every time? There are tons of legal record web templates available on the net, but getting kinds you can trust isn`t simple. US Legal Forms gives a huge number of develop web templates, like the Delaware Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd, which can be composed to satisfy state and federal demands.

In case you are already informed about US Legal Forms website and get a merchant account, basically log in. Next, you may acquire the Delaware Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd design.

Should you not have an bank account and need to begin using US Legal Forms, adopt these measures:

- Obtain the develop you want and make sure it is to the proper city/area.

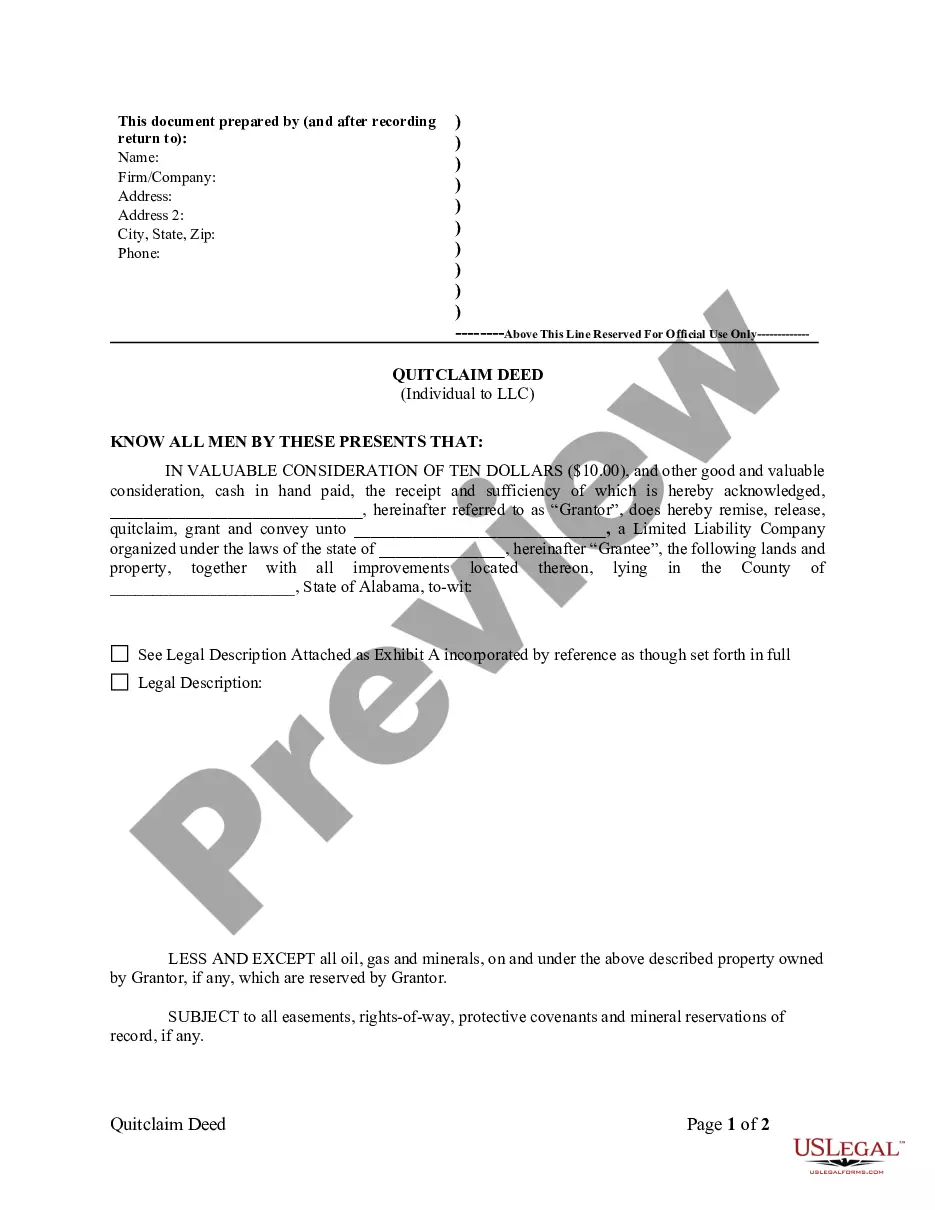

- Make use of the Review key to review the form.

- Read the explanation to actually have selected the right develop.

- In the event the develop isn`t what you`re searching for, take advantage of the Lookup discipline to find the develop that suits you and demands.

- Once you obtain the proper develop, simply click Get now.

- Opt for the costs strategy you need, fill in the desired info to make your bank account, and pay for the order utilizing your PayPal or Visa or Mastercard.

- Select a convenient paper structure and acquire your version.

Locate all of the record web templates you may have bought in the My Forms menus. You may get a more version of Delaware Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd any time, if required. Just click on the needed develop to acquire or printing the record design.

Use US Legal Forms, the most substantial selection of legal forms, to save efforts and stay away from errors. The services gives expertly created legal record web templates which can be used for a range of functions. Generate a merchant account on US Legal Forms and start making your way of life easier.

Form popularity

FAQ

Unit Option Agreement means an agreement in writing between the Participant and one or more Affiliates that shall specify the Grant Value of each Unit Option, the duration of each Unit Option, the number of Unit Options granted, the effect of any Termination on Restricted Units, and such other terms and conditions as ...

An option contract is an agreement used to facilitate a possible transaction between two parties. It governs the right to buy or sell an underlying asset or security, such as a stock, at a specific price. This is called the strike price, and it's fixed until the contract's expiration date.

Unit Option means the conditional right to receive a cash payment equal to the difference between the Closing Price of one share of Common Stock on the Surrender Date and the Grant Value, if such difference is greater than zero.

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.

If the stock value increases, you could make significant financial gains?but only if you've exercised (purchased) your options. And you can only do that if you've accepted your grant. The earlier you understand your options and the financial implications of exercising, the sooner you can make smart financial decisions.