Delaware Proposal to Approve Material Terms of Stock Appreciation Right Plan: An In-Depth Explanation Introduction: A Delaware Proposal to Approve Material Terms of Stock Appreciation Right (SAR) Plan is an essential process undertaken by companies in Delaware to expand their compensation practices for employees. This proposal outlines the impactful terms and conditions of introducing an SAR plan, which is a popular form of equity-based incentive compensation often provided to key employees. This article will provide a comprehensive understanding of the Delaware proposal by exploring its purpose, benefits, and potential variations. Keywords: Delaware, Proposal, Approve, Material Terms, Stock Appreciation Right Plan 1. Purpose of the Delaware Proposal: The primary purpose of this Delaware proposal is to seek approval from the company's shareholders to implement an SAR plan. The plan is designed to incentivize and retain talented employees by granting them the opportunity to benefit from stock appreciation without actually owning stock. It aims to align the interests of employees with the long-term growth and success of the company. 2. Benefits of the SAR Plan: — Retention and Reward: The SAR plan helps retain valuable employees by providing them with a financial stake in the company's performance. It motivates employees to contribute to the company's growth and profitability. — Non-Dilutive Equity Compensation: Unlike stock options, SARS do not dilute existing shareholders' ownership. SARS are settled in cash rather than shares, reducing the potential dilution. — Attractive Incentive: SAR plans offer employees the opportunity to benefit from stock price appreciation without requiring them to invest their own funds to acquire company stock. — Long-Term FocusSARSRs often have vesting periods, encouraging employees to stay with the company over the long term and align their interests with the overall business objectives. 3. Material Terms of the SAR Plan: — Eligibility Criteria: The Delaware proposal should outline the defined criteria for employees to be eligible to participate in the SAR plan. This can include job position, years of service, performance standards, or any other criteria deemed necessary. — Calculation of SAR Value: The proposal should provide a detailed explanation of the calculation methodology to determine the SAR value, ensuring clarity and fairness for all participants. — Vesting Schedule: The proposal should specify the proposed vesting schedule, indicating when SARS will become exercisable, promoting employee retention and long-term commitment. — Exercise Period: The proposal should outline the exercise period during which employees can exercise their SARS, typically set within a predetermined window after vesting. — Payment and Settlement: The proposal should define the payment terms upon SAR exercise, allowing for either cash settlement, stock settlement, or a combination of both, based on predetermined formulas or market conditions. — TerminatiobearersRs: The proposal should address the treatment of outstanding SARS upon termination, be it from retirement, resignation, or other circumstances, ensuring fair treatment for participants. Types of Delaware Proposals to Approve Material Terms of Stock Appreciation Right Plan: 1. Initial Implementation Proposal: This type of proposal seeks approval for the initiation of an SAR plan, establishing the framework and material terms for upcoming grants. 2. Amendment Proposal: If a company already has an existing SAR plan, this type of proposal seeks to amend specific terms, such as eligibility criteria, vesting periods, or payment terms, to meet changing business needs. 3. Termination Proposal: In unique situations, a termination proposal may be presented, seeking approval to discontinue or terminate an SAR plan due to specific circumstances. In conclusion, the Delaware Proposal to Approve Material Terms of Stock Appreciation Right Plan is crucial for companies aiming to enhance their compensation practices. This comprehensive proposal outlines the purpose, benefits, and necessary terms for the implementation of an SAR plan, while also highlighting potential variations based on specific business needs. By seeking shareholder approval through this proposal, companies can effectively attract, retain, and motivate talent while aligning employee interests with long-term company growth.

Delaware Proposal to approve material terms of stock appreciation right plan

Description

How to fill out Delaware Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

US Legal Forms - one of many largest libraries of legitimate kinds in the United States - offers a wide range of legitimate file templates you can acquire or printing. Utilizing the internet site, you will get 1000s of kinds for organization and specific functions, sorted by types, suggests, or keywords and phrases.You will discover the most recent variations of kinds much like the Delaware Proposal to approve material terms of stock appreciation right plan in seconds.

If you have a subscription, log in and acquire Delaware Proposal to approve material terms of stock appreciation right plan from the US Legal Forms local library. The Acquire switch can look on every single kind you perspective. You get access to all previously acquired kinds inside the My Forms tab of the account.

If you would like use US Legal Forms initially, listed here are simple directions to obtain started out:

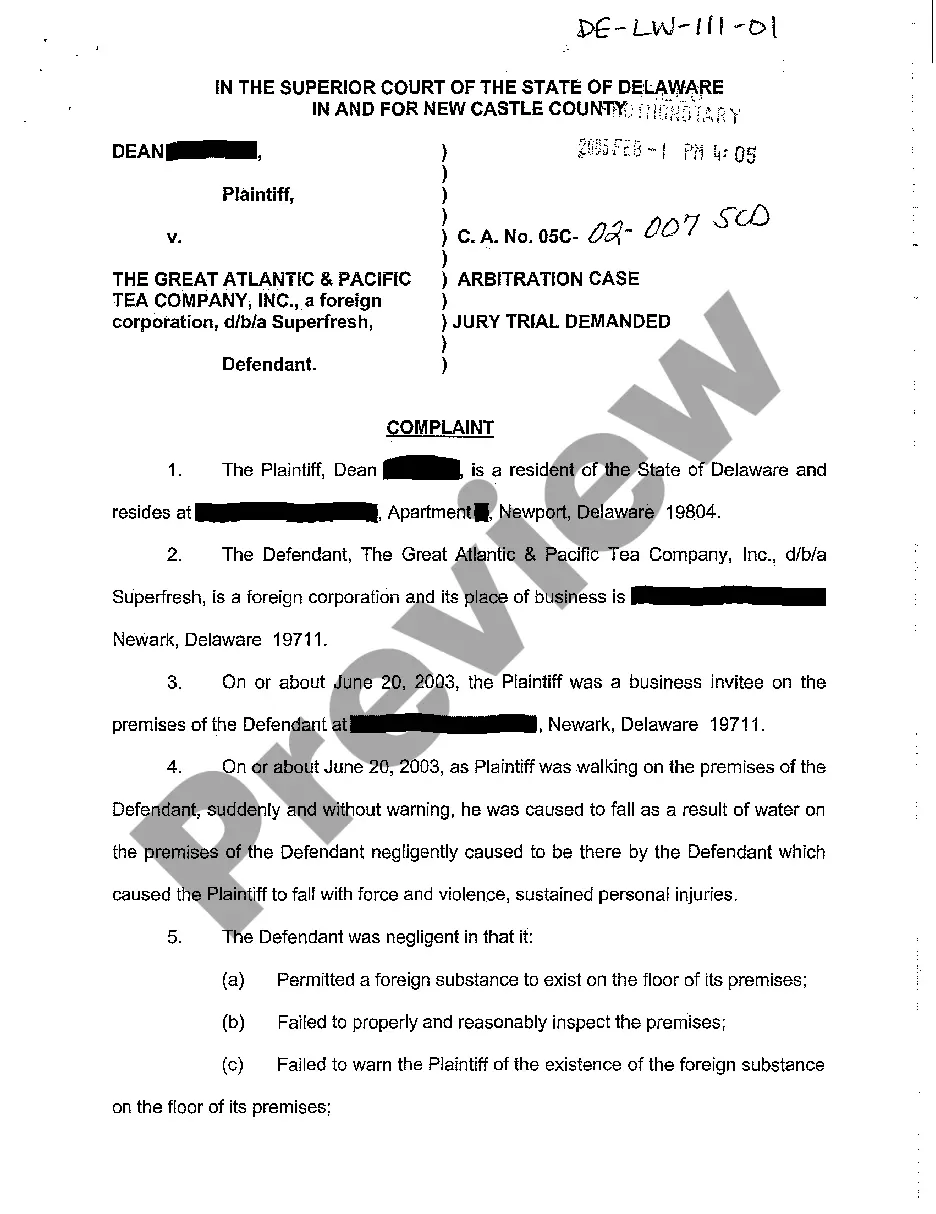

- Be sure you have picked out the right kind for the area/area. Click the Review switch to analyze the form`s content. Look at the kind description to ensure that you have selected the correct kind.

- When the kind does not suit your requirements, take advantage of the Research field near the top of the monitor to get the one who does.

- When you are content with the shape, affirm your option by visiting the Get now switch. Then, opt for the pricing program you favor and offer your references to sign up on an account.

- Process the deal. Make use of bank card or PayPal account to complete the deal.

- Choose the format and acquire the shape in your system.

- Make modifications. Complete, edit and printing and signal the acquired Delaware Proposal to approve material terms of stock appreciation right plan.

Every single format you included with your money does not have an expiration day which is the one you have forever. So, if you would like acquire or printing another duplicate, just go to the My Forms segment and then click about the kind you require.

Gain access to the Delaware Proposal to approve material terms of stock appreciation right plan with US Legal Forms, probably the most considerable local library of legitimate file templates. Use 1000s of specialist and state-certain templates that meet your small business or specific demands and requirements.