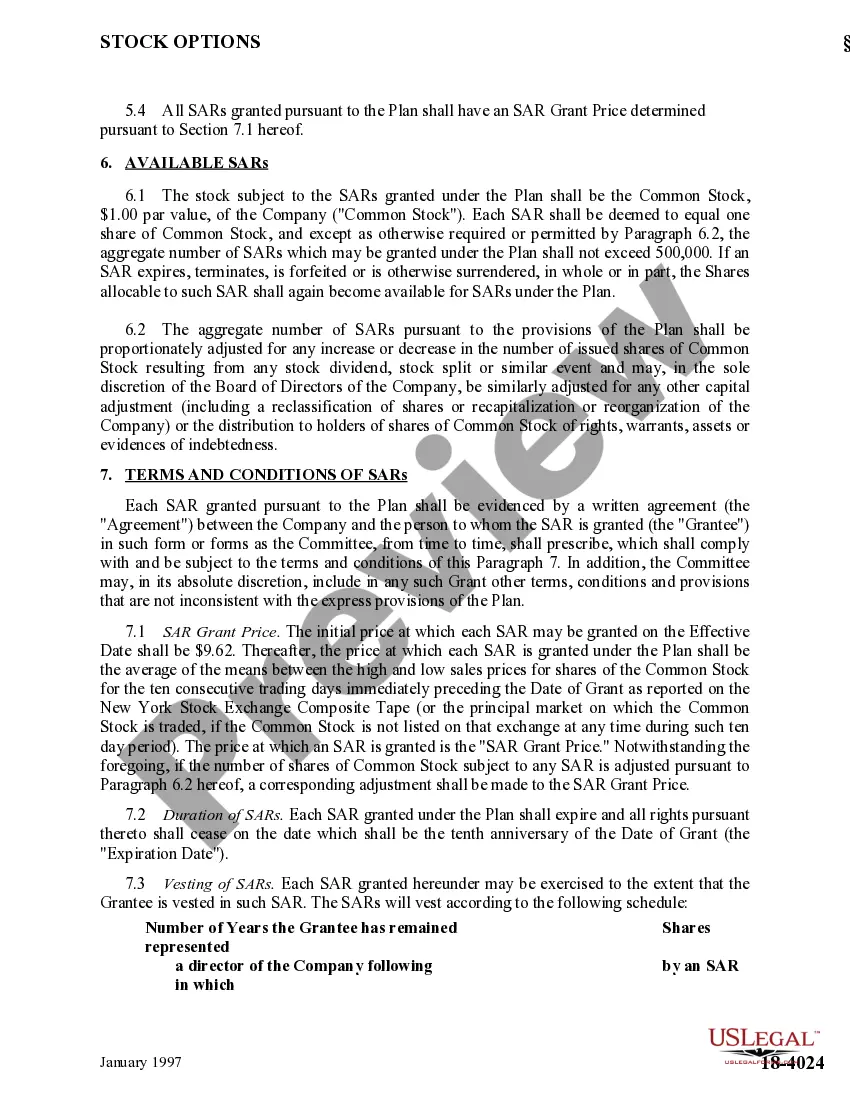

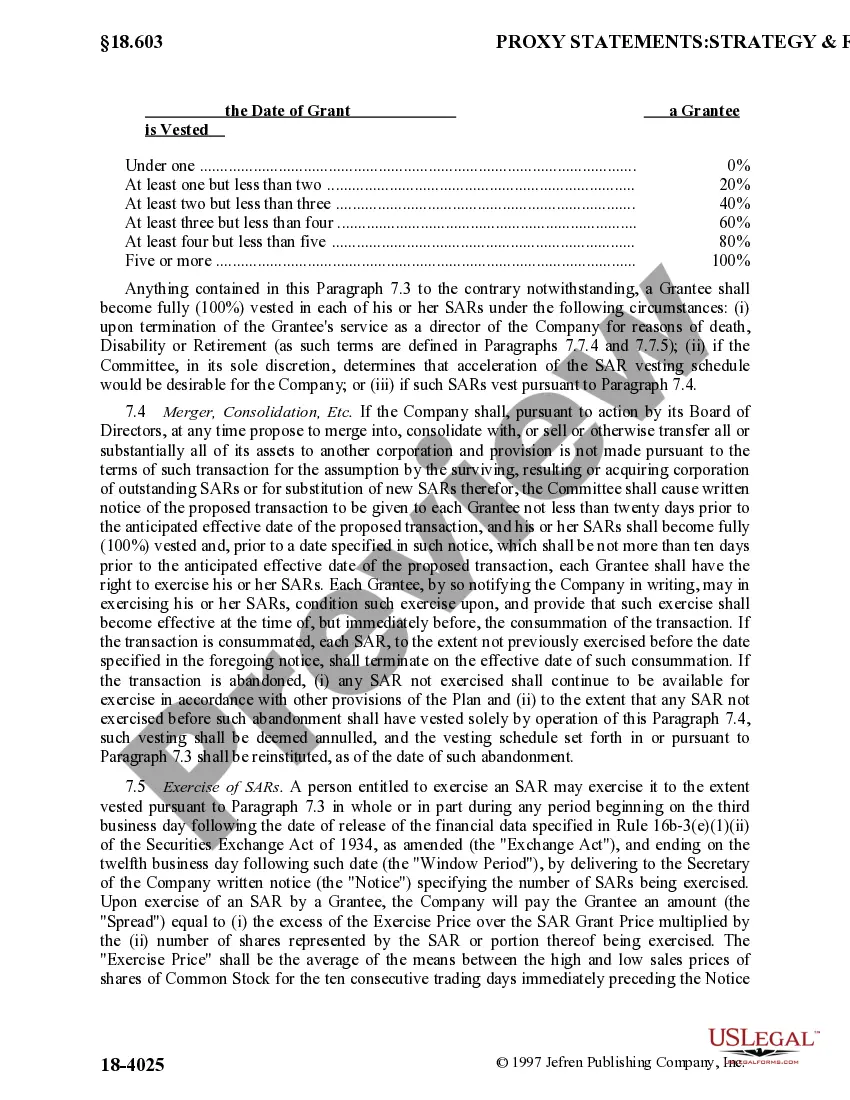

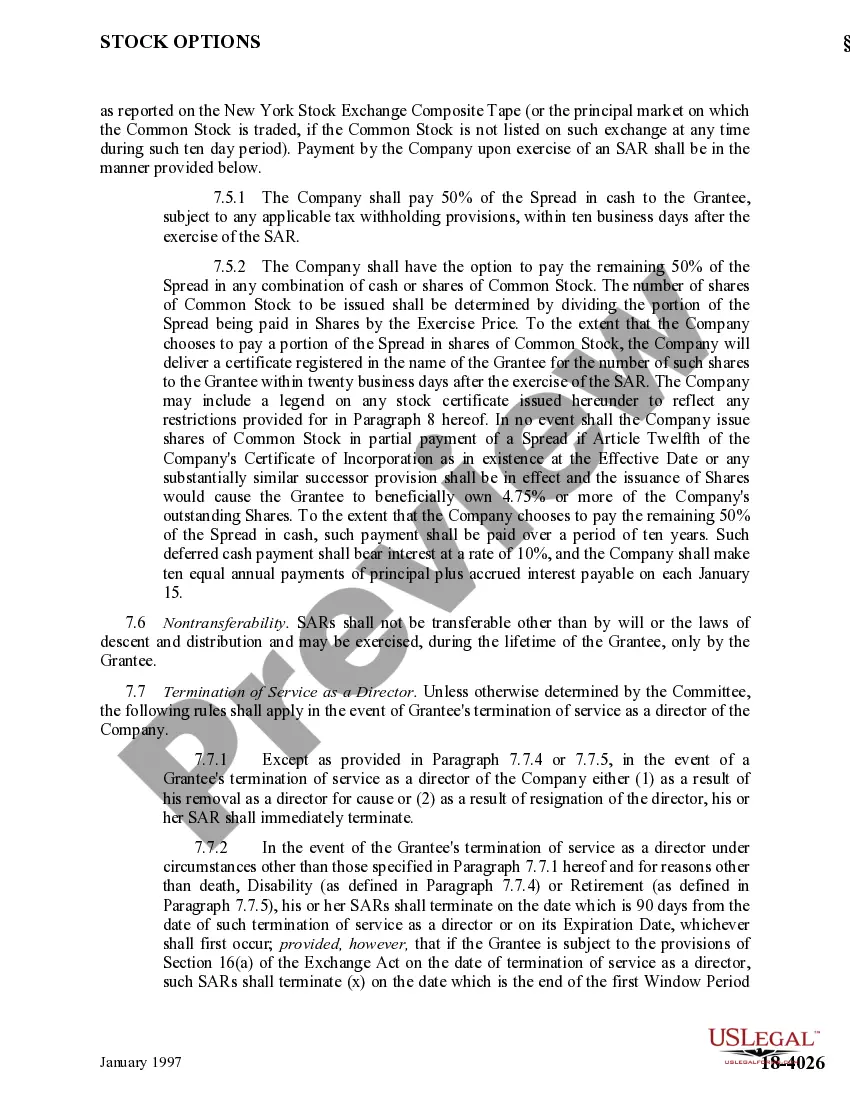

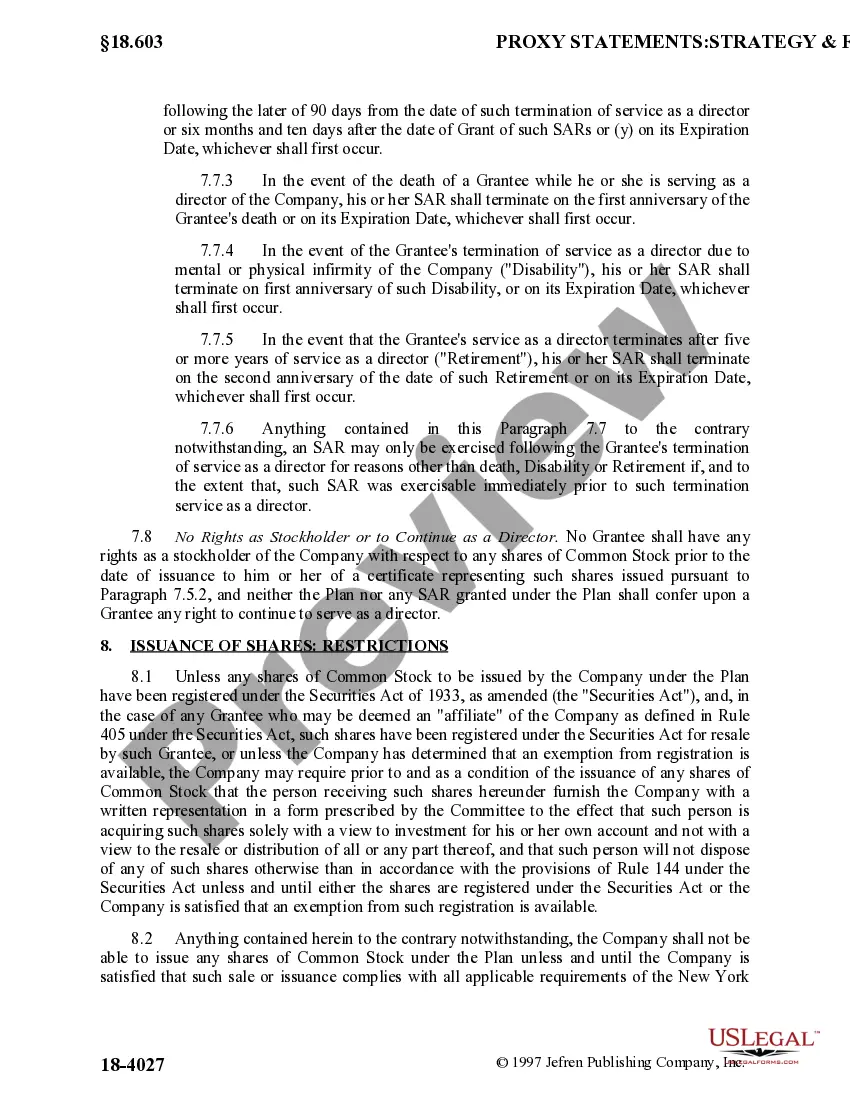

Delaware Directors Stock Appreciation Rights Plan: A comprehensive overview of American Annuity Group, Inc.'s innovative initiative American Annuity Group, Inc. has introduced the Delaware Directors Stock Appreciation Rights Plan, a groundbreaking incentive program aimed at providing stock appreciation rights (SARS) to the directors of the company. This unique plan offers various benefits and opportunities to participating directors, fostering a sense of ownership and aligning their interests with the company's growth. Key features of the Delaware Directors Stock Appreciation Rights Plan: 1. Stock Appreciation Rights (SARS): The plan grants directors the right to receive a certain value, equivalent to the increase in the company's stock price during a specified period. This approach cultivates a direct link between the directors' contributions and the company's financial performance. 2. Delaware Jurisdiction: American Annuity Group, Inc. has opted to establish this plan under Delaware jurisdiction, leveraging the state's robust legal framework and favorable business environment. The incorporation of Delaware laws ensures the plan's adherence to established regulations, providing additional security for participating directors. 3. Customizable Plans: The Delaware Directors Stock Appreciation Rights Plan is designed to accommodate variations in compensation and performance-based incentives. American Annuity Group, Inc. offers the flexibility to tailor the plan according to the specific needs and preferences of its directors, thus ensuring an equitable and personalized approach. 4. Vesting and Exercise Periods: The plan entails both vesting and exercise periods, typically predetermined by the company. Vesting periods signify the duration during which directors must wait before exercising their SARS, whereas exercise periods define the timeframe within which directors can claim their appreciation rights. 5. Performance Metrics: To incentivize optimal performance and align directors' interests with the organization's goals, the plan incorporates performance metrics. These metrics can vary and might be based on financial indicators, market share growth, customer satisfaction ratings, or other key performance indicators (KPIs), ensuring a focus on enhancing overall organizational performance. 6. Tax Considerations: The Delaware Directors Stock Appreciation Rights Plan takes into account the tax implications for both the company and participating directors. American Annuity Group, Inc. ensures compliance with relevant tax laws, aiming to provide advantageous tax treatment for the directors while maintaining tax efficiency for the organization. Different types of Delaware Directors Stock Appreciation Rights Plans offered by American Annuity Group, Inc.: 1. Standard Directors SAR Plan: The primary offering under the Delaware Directors Stock Appreciation Rights Plan, it encompasses the aforementioned features, providing directors with stock appreciation rights based on specified performance metrics. 2. Performance-based Directors SAR Plan: This variation of the plan focuses primarily on performance-based metrics and may offer higher potential value for directors who excel in achieving ambitious goals outlined by the company. This type of plan encourages outstanding performance and rewards directors accordingly. In conclusion, the Delaware Directors Stock Appreciation Rights Plan by American Annuity Group, Inc. stands as an innovative and flexible compensation program aimed at aligning the interests of directors with the organization's growth. This plan offers directors the opportunity to be recognized for their contributions by granting them stock appreciation rights based on predetermined performance metrics. Through the incorporation of Delaware jurisdiction and customizable features, the company underscores its commitment to ensuring fairness, compliance, and a tailored approach for participating directors.

Delaware Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.

Description

How to fill out Directors Stock Appreciation Rights Plan Of American Annuity Group, Inc.?

US Legal Forms - among the biggest libraries of authorized varieties in the States - delivers a wide range of authorized document templates you may down load or produce. Using the web site, you can get 1000s of varieties for business and person functions, categorized by types, claims, or keywords.You can get the most up-to-date types of varieties like the Delaware Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. in seconds.

If you already possess a subscription, log in and down load Delaware Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. through the US Legal Forms collection. The Obtain button will appear on every kind you view. You have access to all earlier delivered electronically varieties in the My Forms tab of your respective bank account.

If you would like use US Legal Forms the very first time, listed here are basic recommendations to obtain started out:

- Make sure you have picked the best kind to your town/county. Select the Preview button to check the form`s content. Look at the kind description to ensure that you have chosen the appropriate kind.

- When the kind does not match your needs, use the Lookup discipline at the top of the screen to discover the one which does.

- If you are pleased with the form, verify your option by simply clicking the Get now button. Then, opt for the rates strategy you like and offer your accreditations to sign up for the bank account.

- Approach the purchase. Utilize your Visa or Mastercard or PayPal bank account to finish the purchase.

- Find the file format and down load the form on your product.

- Make alterations. Complete, modify and produce and indication the delivered electronically Delaware Directors Stock Appreciation Rights Plan of American Annuity Group, Inc..

Each web template you added to your money lacks an expiry day and is also yours forever. So, if you wish to down load or produce one more copy, just visit the My Forms segment and then click around the kind you will need.

Obtain access to the Delaware Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. with US Legal Forms, probably the most substantial collection of authorized document templates. Use 1000s of professional and express-particular templates that fulfill your business or person needs and needs.

Form popularity

FAQ

Stock Appreciation Rights (SARs) SARs differ from ESOPs in that they do not grant direct ownership to employees, but rather give them the right to receive a cash payout equal to the value of the stock appreciation.

?SARs? means stock appreciation rights entitling the holder thereof to receive a cash payment in an amount equal to the appreciation in the Common Shares over a specified period, as set forth in this Plan and in the applicable Grant Agreement.

A ?Stock Appreciation Right? is the right to receive a payment from the Company in an amount equal to the ?Spread,? which is defined as the excess of the Fair Market Value (as defined in Plan) of one share of common stock, $1.00 par value (the ?Stock?) of the Company at the Exercise Date (as defined below) over a ...

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

A Stock Appreciation Right (SAR) refers to the right to be paid compensation equivalent to an increase in the company's common stock price over a base or the value of appreciation of the equity shares currently being traded on the public market.

Stock Appreciation Rights (SARs) SARs also provide the benefit of appreciation without giving actual stock. But unlike phantom stock, SARs tend to resemble stock options, where employees can choose when to exercise them. Vested SARs generally may be exercised any time between vesting and expiration.