Title: Delaware Employee Stock Ownership Trust Agreement: Understanding its Types and Detailed Description Introduction: The Delaware Employee Stock Ownership Trust Agreement (ESO) is a legal document that establishes an Employee Stock Ownership Plan (ESOP) trust in Delaware. This agreement outlines the terms and conditions of stock ownership by employees in a closely held corporation or a privately-held company. By creating an ESO, the company can transfer ownership to the employees gradually, promoting company loyalty, engagement, and wealth accumulation for participating employees. Detailed Description: 1. Purpose and Structure: The Delaware ESO Agreement is designed to facilitate the transition of company ownership to employees while providing numerous benefits to all parties involved. It establishes a qualified trust where the company's stock is held, governed, and managed by the ESO for the benefit of eligible employees. 2. Key Parties Involved: a) Employer/Sponsor: The company or organization offering the ESO program. b) Trustee: An independent trustee responsible for managing the trust and acting in the best interest of ESOP participants. c) Plan Administrator: Administers day-to-day activities related to the ESO plan, including communication, reporting, and compliance. d) ESOP Participants: Eligible employees who participate in the ESO program. 3. Types of Delaware ESO Agreement: a) Leveraged ESO: In this type, the trust borrows money from the company or external lenders to acquire company shares, thereby creating a debt. The company then repays the borrowed amount using tax-deductible contributions, dividends paid on ESOT-owned shares, or profits. b) Non-Leveraged ESO: Here, the trust acquires company shares over time without incurring debt. The company contributes its stock or offers newly issued shares to the trust for the benefit of the ESO participants. c) Hybrid ESO: This type combines elements of both leveraged and non-leveraged Sots. It involves partly borrowing funds to acquire shares and partly acquiring shares through direct company contributions. 4. Benefits for Employees: a) Direct Ownership: Participating employees become beneficial owners of the company's stock, fostering a sense of loyalty, pride, and commitment towards the organization. b) Wealth Accumulation: As the company's value increases over time, participants can benefit from potential stock appreciation and dividend distributions, enhancing their wealth and financial security. c) Retirement Planning: The ESO serves as a retirement savings vehicle, providing employees with a retirement nest egg while enjoying various tax advantages. d) Corporate Governance: ESO participants often gain a voice in company decisions, attending annual meetings and casting votes on significant matters. Conclusion: The Delaware Employee Stock Ownership Trust Agreement paves the way for established companies in Delaware to offer their employees an opportunity to become partial or total owners. Whether leveraged, non-leveraged, or hybrid, an ESO can create a win-win situation by aligning the interests of the company, its employees, and the stockholders. Through this mechanism, employees can accumulate wealth, contribute to their retirement, and actively participate in corporate decision-making, fostering a stronger, more engaged workforce.

Delaware Employee Stock Ownership Trust Agreement

Description

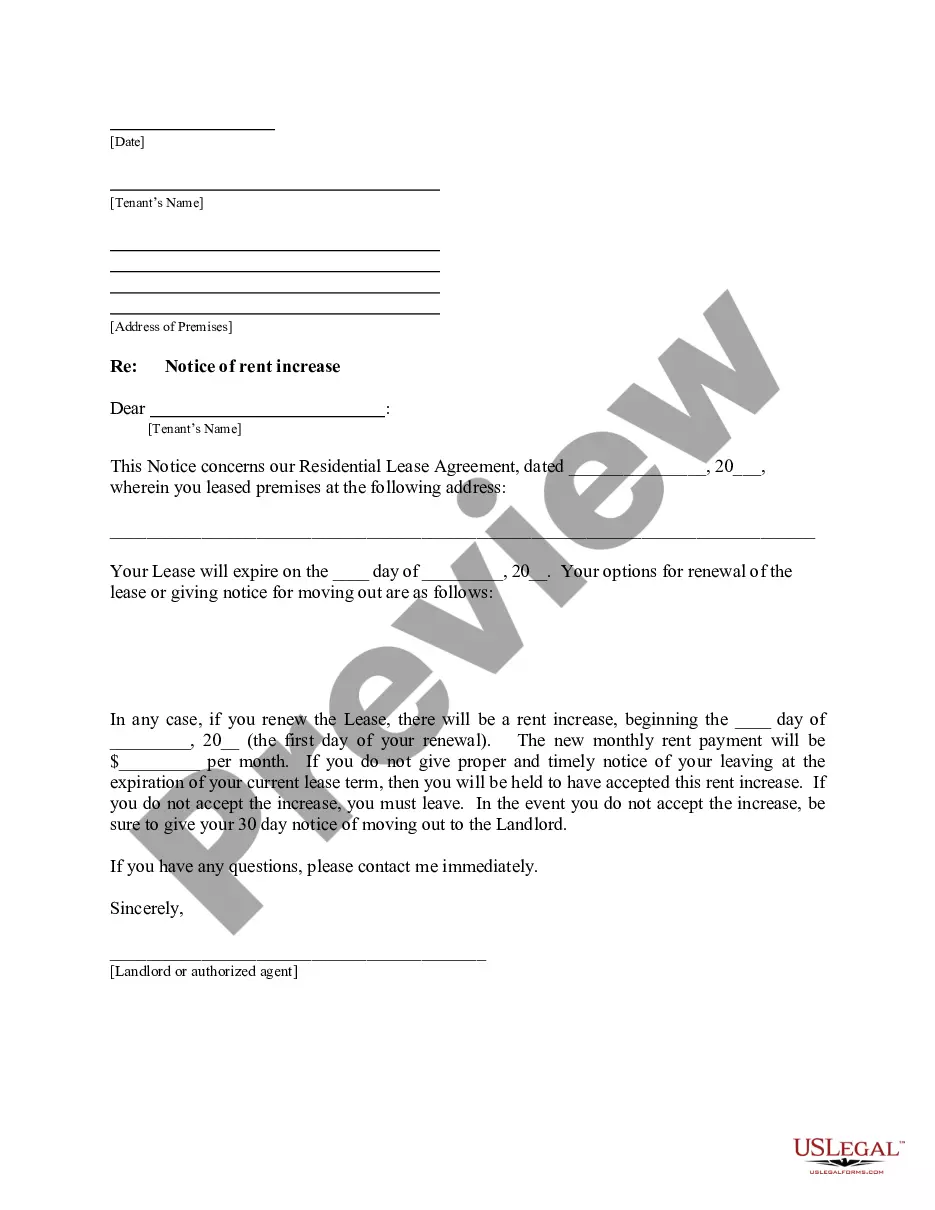

How to fill out Employee Stock Ownership Trust Agreement?

Are you presently within a situation the place you require files for both enterprise or personal uses nearly every day? There are plenty of authorized papers web templates accessible on the Internet, but locating kinds you can rely isn`t easy. US Legal Forms provides 1000s of type web templates, much like the Delaware Employee Stock Ownership Trust Agreement, that happen to be written in order to meet state and federal demands.

When you are currently familiar with US Legal Forms site and possess a merchant account, basically log in. After that, you can acquire the Delaware Employee Stock Ownership Trust Agreement format.

If you do not come with an bank account and wish to begin using US Legal Forms, adopt these measures:

- Get the type you need and make sure it is to the proper metropolis/county.

- Use the Review key to check the form.

- Look at the description to actually have chosen the proper type.

- If the type isn`t what you`re seeking, utilize the Search discipline to obtain the type that suits you and demands.

- When you get the proper type, simply click Get now.

- Select the prices program you need, complete the specified details to generate your money, and pay for your order making use of your PayPal or bank card.

- Decide on a practical file structure and acquire your version.

Discover each of the papers web templates you have bought in the My Forms food selection. You can aquire a further version of Delaware Employee Stock Ownership Trust Agreement at any time, if possible. Just click the needed type to acquire or produce the papers format.

Use US Legal Forms, one of the most considerable assortment of authorized kinds, to save lots of some time and prevent faults. The assistance provides skillfully created authorized papers web templates which can be used for a range of uses. Create a merchant account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

An employee share ownership trust (ESOT) is a stock program that allows for the acquisition of a company's shares by its employees. An ESOT works through a profit-sharing scheme and a trust that acquires the shares. Employees and the company can benefit through tax incentives by using an ESOT.

With an ESOP, the company is structured as a C or S corporation where the stock is held by an ESOP trust, which is administered by a trustee on employees' behalf.

ESOPs facilitate an entrepreneur's succession and transition strategy, allowing the entrepreneur to graduate slowly from CEO to board chair to retirement while helping to preserve the value and values of the Company.

By enabling employees to acquire an ownership interest in their employer, the ESOP provides employees with a direct and vested interest in the success of their company, creates an identity of interest between management and labor, permits employees to share in the capital growth of the company, builds employee loyalty ...

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. ESOPs are most commonly used to facilitate succession planning, allowing a company owner to sell his or her. shares and transition flexibly out of the business.

There are many advantages to ESOPs, including the following: Flexibility: Shareholders have the option of withdrawing funds slowly over time or only selling a portion of their shares. They can stay active even after releasing their portion of the company.

After the employee terminates, the company can make the distribution in shares, cash, or some of both. Cash is paid to the employee directly. Often, company shares are immediately repurchased by the ESOP, and the employee receives cash equivalent to fair market value as determined by the most recent annual valuation.

ESOPs must follow rules about which employees participate in the plan and on what terms, while EOTs offer great flexibility. Employee ownership can also be set up without creating a trust. See our pages on equity compensation plans and on other kinds of employee ownership options, including direct share ownership.