Delaware Approval of senior management executive incentive plan

Description

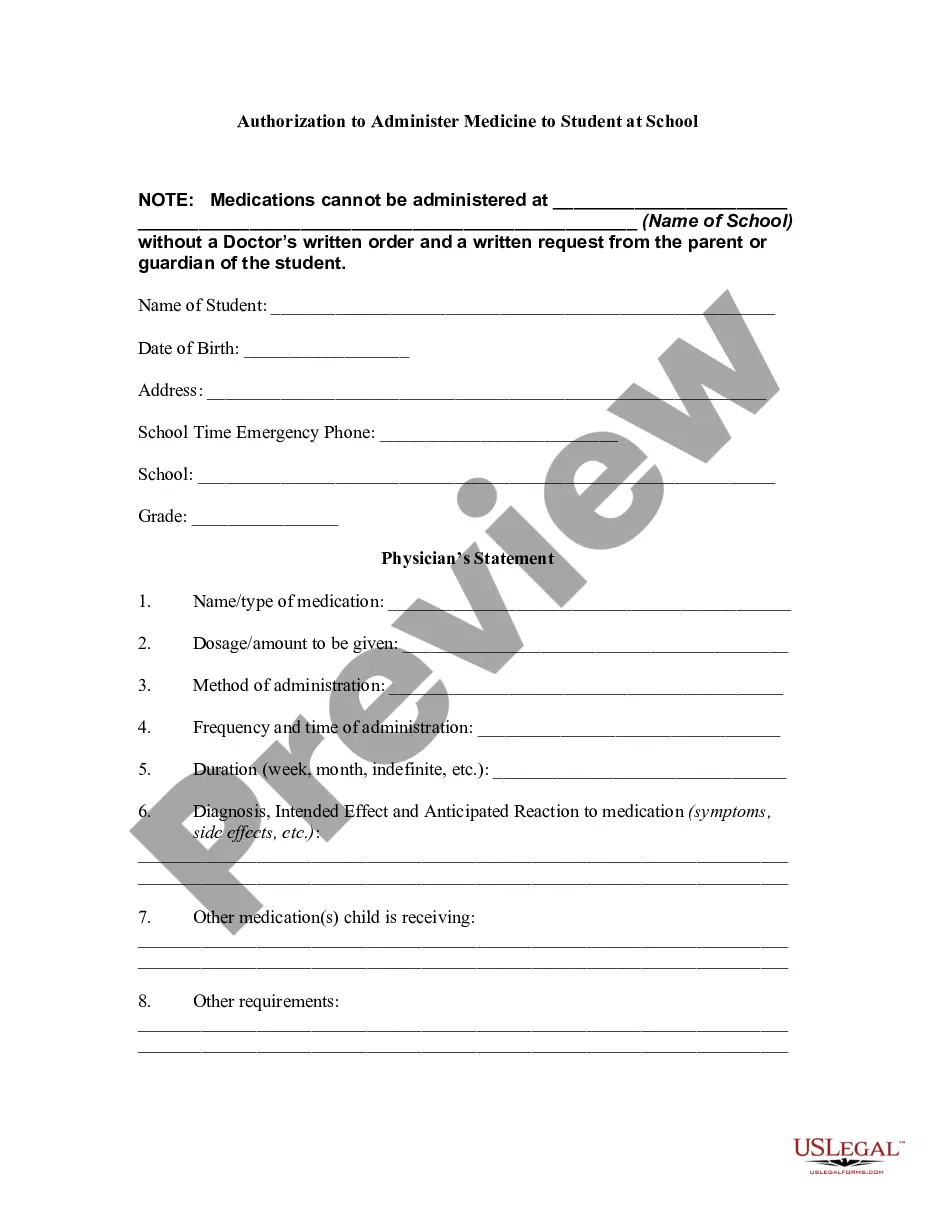

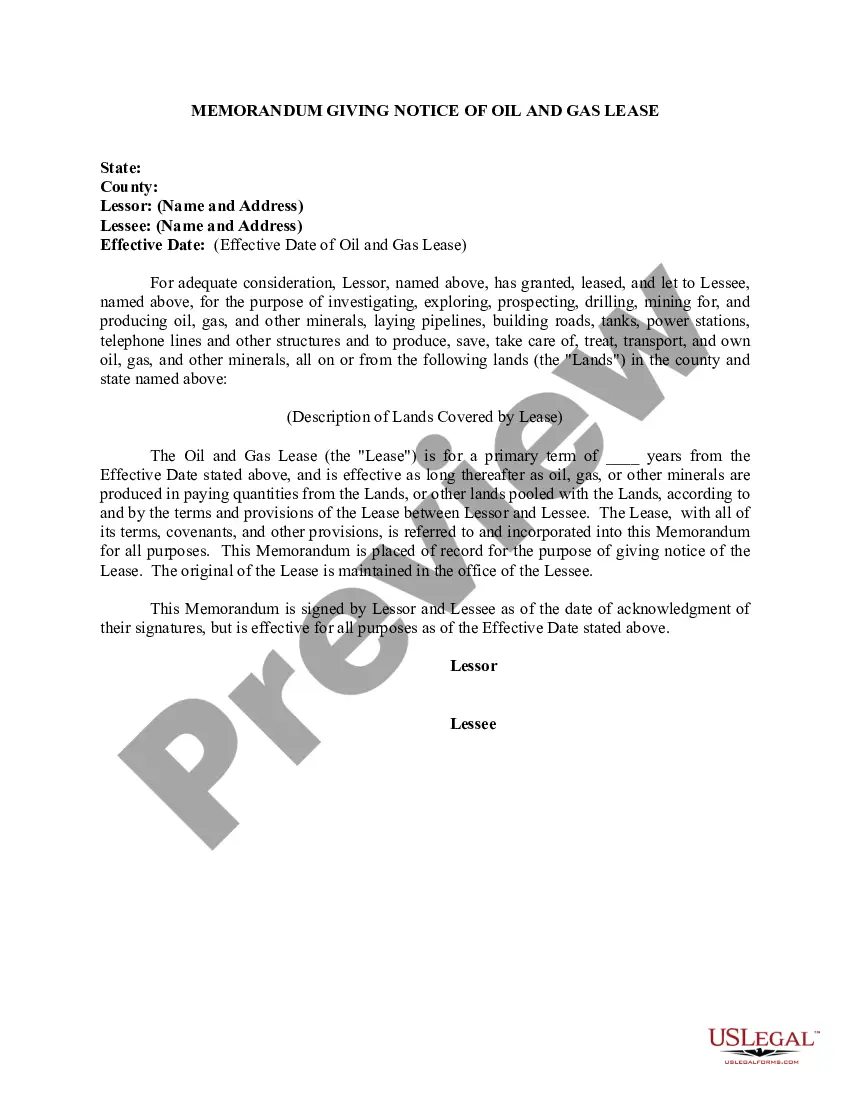

How to fill out Approval Of Senior Management Executive Incentive Plan?

If you wish to comprehensive, download, or print out authorized papers templates, use US Legal Forms, the biggest collection of authorized varieties, that can be found on-line. Take advantage of the site`s simple and practical search to find the documents you need. Various templates for business and personal functions are categorized by groups and states, or key phrases. Use US Legal Forms to find the Delaware Approval of senior management executive incentive plan in a couple of mouse clicks.

When you are currently a US Legal Forms buyer, log in to your profile and click on the Acquire key to have the Delaware Approval of senior management executive incentive plan. You may also entry varieties you earlier saved inside the My Forms tab of your respective profile.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for your appropriate metropolis/nation.

- Step 2. Take advantage of the Preview method to look over the form`s articles. Do not forget to read the outline.

- Step 3. When you are unsatisfied with the kind, use the Research industry on top of the display to locate other versions in the authorized kind format.

- Step 4. Once you have discovered the shape you need, click the Get now key. Opt for the pricing program you like and include your references to register on an profile.

- Step 5. Method the purchase. You can utilize your credit card or PayPal profile to accomplish the purchase.

- Step 6. Select the format in the authorized kind and download it on your own device.

- Step 7. Full, modify and print out or signal the Delaware Approval of senior management executive incentive plan.

Each authorized papers format you get is your own property forever. You may have acces to every kind you saved with your acccount. Select the My Forms section and decide on a kind to print out or download once more.

Remain competitive and download, and print out the Delaware Approval of senior management executive incentive plan with US Legal Forms. There are thousands of professional and status-distinct varieties you may use for the business or personal demands.

Form popularity

FAQ

The duty of loyalty is governed by state law. See also duty of care. Under Section 102(b)(7) of the Delaware General Corporation Law, Delaware corporations cannot eliminate or limit the personal liability of directors for breaches of the duty of loyalty, even though they can do so for breaches of the duty of care.

A classic example of a breach of the duty of loyalty is where a director profits at the corporation's expense, meaning that a director acts in furtherance of his or her own personal financial interests, separate business interests, or a family member's business.

2d 75, 84 (Del. 1992) (explaining that the duty of candor ?represents nothing more than the well-recognized proposition that directors of Delaware corporations are under a fiduciary duty to disclose fully and fairly all material information within the board's control when it seeks shareholder action?) (emphasis added).

The duty of loyalty mandates that a director act in good faith and with a reasonable belief that what she does is in the corporation's best interests. A director must refrain from self-dealing and place the interests of the corporation and its stockholders ahead of her own.

?In essence, the duty of care consists of an obligation to act on an informed basis; the duty of loyalty requires the board and its directors to maintain, in good faith, the corporation's and its shareholders' best interests over anyone else's interests.? Shoen v.

However, the corporate opportunity waiver allows corporate fiduciaries to invest in such opportunities without the obligation of disclosing them to the corporation or obtaining its approval.

Breach of the Duty of Loyalty. Breach of the duty of loyalty can occur in a variety of ways. Generally, however, any breach of the duty of loyalty will occur when the director acts in a manner that benefits himself or others at the expense of the company or its shareholders.

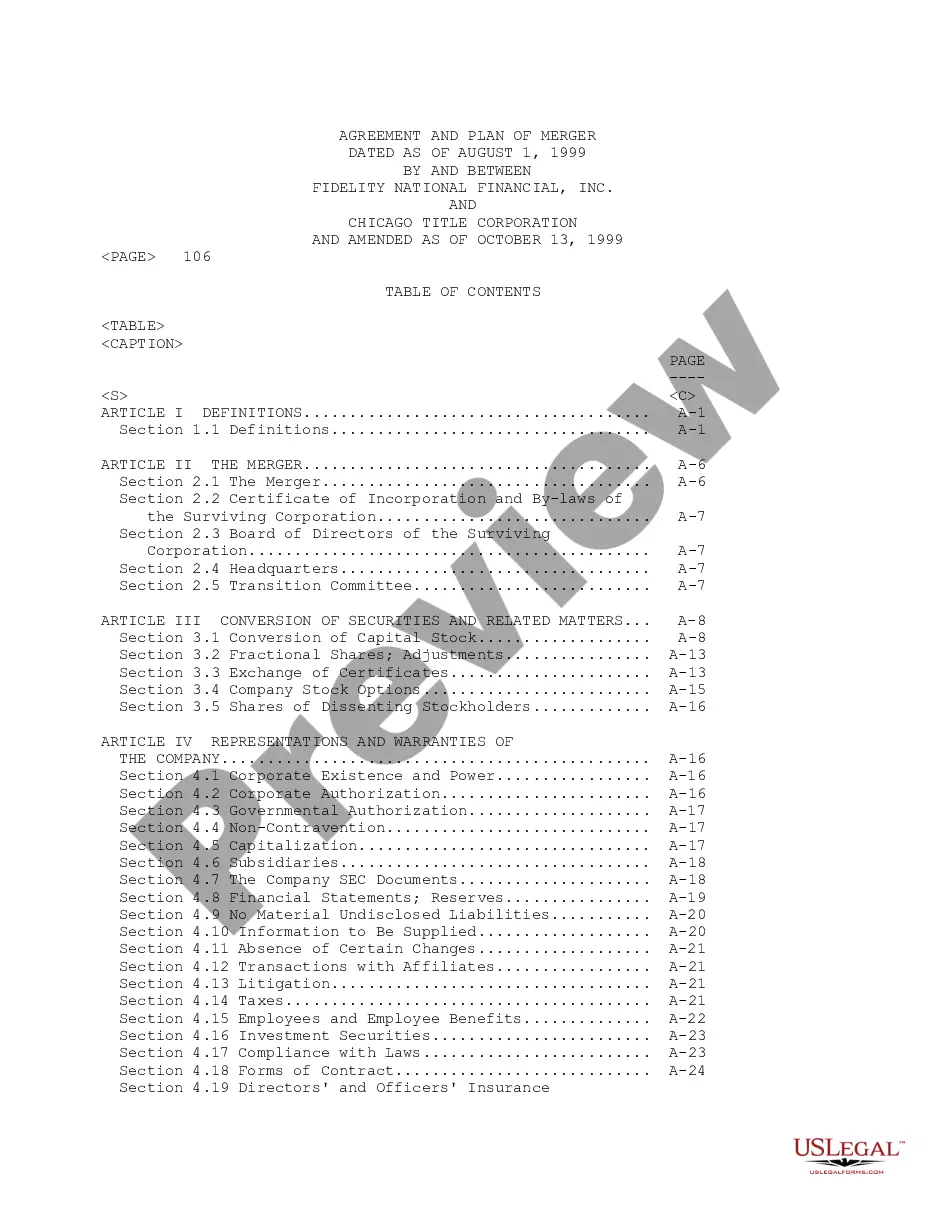

Under Delaware law, stockholder approval is required (i) for any amendment to the corporation's certificate of incorporation to increase the authorized capital and (ii) for the issuance of stock in a direct merger transaction where the number of shares exceeds 20% of the corporation's shares outstanding prior to the ...