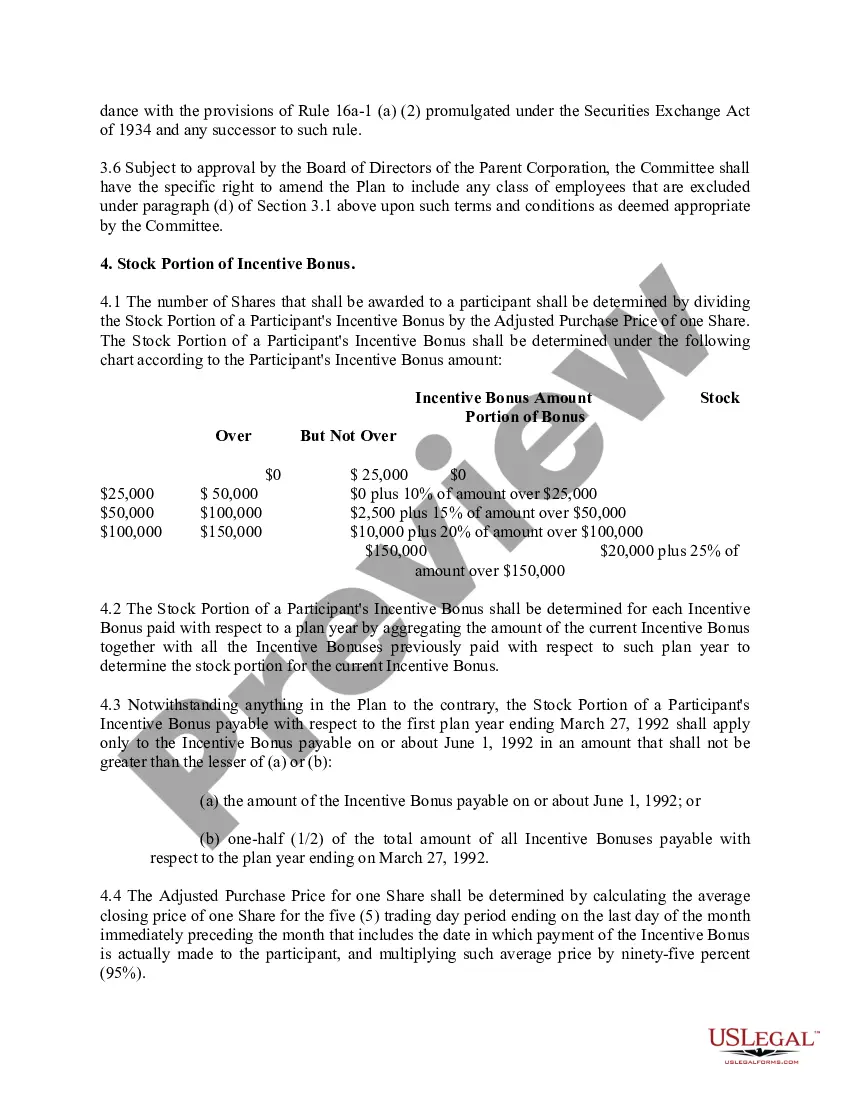

The Delaware Restricted Stock Bonus Plan of McDonald and Company Investments, Inc. is a comprehensive employee benefit program offered by the company to reward and incentivize its employees. This plan is designed to motivate employees to contribute to the company's success by granting them restricted stock in addition to their regular compensation. Under this plan, eligible employees of McDonald and Company Investments, Inc. are provided with a specific number of restricted stock units (RSS) based on predetermined criteria such as rank, seniority, performance, or a combination thereof. This RSS represents ownership interest in the company but are restricted in terms of when they can be fully vested and sold. The Delaware Restricted Stock Bonus Plan aims to align the interests of the employees with those of the company's shareholders, encouraging employees to work towards enhancing the company's long-term value. By offering RSS, employees have a stake in the company's growth and success, as their stock units increase in value along with the company's performance. The plan typically sets a vesting schedule that specifies when the RSS will become fully vested and transferable. This means that employees usually need to remain employed with the company for a specific period of time or achieve certain performance objectives to gain ownership rights to the RSS. Once vested, the employees can sell the RSS on the open market or hold onto them as an investment, potentially benefiting from any future appreciation in the company's stock price. Delaware Restricted Stock Bonus Plan of McDonald and Company Investments, Inc. may have different variations or sub-plans tailored to meet specific employee needs or positions. Some potential types of plans could include: 1. Executive Restricted Stock Bonus Plan: This plan is formulated specifically for high-ranking executives within the company and may offer more substantial RSU grants and accelerated vesting schedules to align with executive compensation strategies. 2. Performance-based Restricted Stock Bonus Plan: This type of plan links the vesting of RSS to the achievement of predefined performance targets or goals. It aims to motivate employees to exceed performance metrics and drive the company's overall success. 3. Long-Term Incentive Restricted Stock Bonus Plan: This plan focuses on rewarding employees for their commitment to the company over a more extended period. It may offer additional RSS for each year of service or align vesting with long-term milestones. In conclusion, the Delaware Restricted Stock Bonus Plan of McDonald and Company Investments, Inc. is a comprehensive employee benefit program designed to reward and motivate employees by granting them restricted stock units. It aligns their interests with those of the company's shareholders and encourages long-term commitment and performance. Different variations of the plan, such as executive plans or performance-based plans, may exist to cater to specific employee needs and objectives.

Delaware Restricted Stock Bonus Plan of McDonald and Company Investments, Inc.

Description

How to fill out Restricted Stock Bonus Plan Of McDonald And Company Investments, Inc.?

Choosing the best lawful file web template can be quite a struggle. Needless to say, there are tons of web templates available on the Internet, but how can you get the lawful type you want? Utilize the US Legal Forms internet site. The services provides 1000s of web templates, including the Delaware Restricted Stock Bonus Plan of McDonald and Company Investments, Inc., which you can use for organization and private needs. Every one of the varieties are checked out by professionals and meet up with state and federal needs.

Should you be presently listed, log in to the account and then click the Acquire key to have the Delaware Restricted Stock Bonus Plan of McDonald and Company Investments, Inc.. Use your account to check with the lawful varieties you have purchased formerly. Go to the My Forms tab of your respective account and have an additional duplicate of the file you want.

Should you be a brand new end user of US Legal Forms, here are easy recommendations so that you can adhere to:

- Initial, make sure you have selected the proper type for your personal metropolis/county. You may check out the form using the Review key and study the form explanation to make certain this is the best for you.

- When the type does not meet up with your expectations, use the Seach industry to get the right type.

- When you are sure that the form is proper, click the Get now key to have the type.

- Opt for the pricing program you need and enter the required information and facts. Create your account and buy the order with your PayPal account or charge card.

- Choose the data file format and down load the lawful file web template to the gadget.

- Full, modify and print out and indicator the received Delaware Restricted Stock Bonus Plan of McDonald and Company Investments, Inc..

US Legal Forms is the greatest local library of lawful varieties in which you will find various file web templates. Utilize the company to down load appropriately-manufactured paperwork that adhere to status needs.

Form popularity

FAQ

$ 267.70 CloseChgChg %$267.790.880.33%

McDonald's has a conensus rating of Strong Buy which is based on 22 buy ratings, 5 hold ratings and 0 sell ratings. The average price target for McDonald's is $310.42. This is based on 27 Wall Streets Analysts 12-month price targets, issued in the past 3 months.

How to buy shares in McDonald's Corporation Choose a platform. If you're a beginner, our stock trading table below can help you choose. Open your account. Provide your personal information and sign up. Confirm your payment details. ... Search the platform for stock code: MCD in this case. Research stocks. ... Buy your stocks.

McDirect Shares is a McDonald's stock purchase plan through which you are eligible to build your share ownership and reinvest dividends. You can purchase stock through convenient payroll deductions and a minimal start up fee. It's more important than ever to save for retirement.

A Registered Shareholder holds shares directly with Computershare, McDonald's Stock Transfer Agent. Computershare representatives can provide assistance or information regarding the direct stock purchase and dividend reinvestment plan (DSPP/DRIP), statements, transactions or other administrative matters.