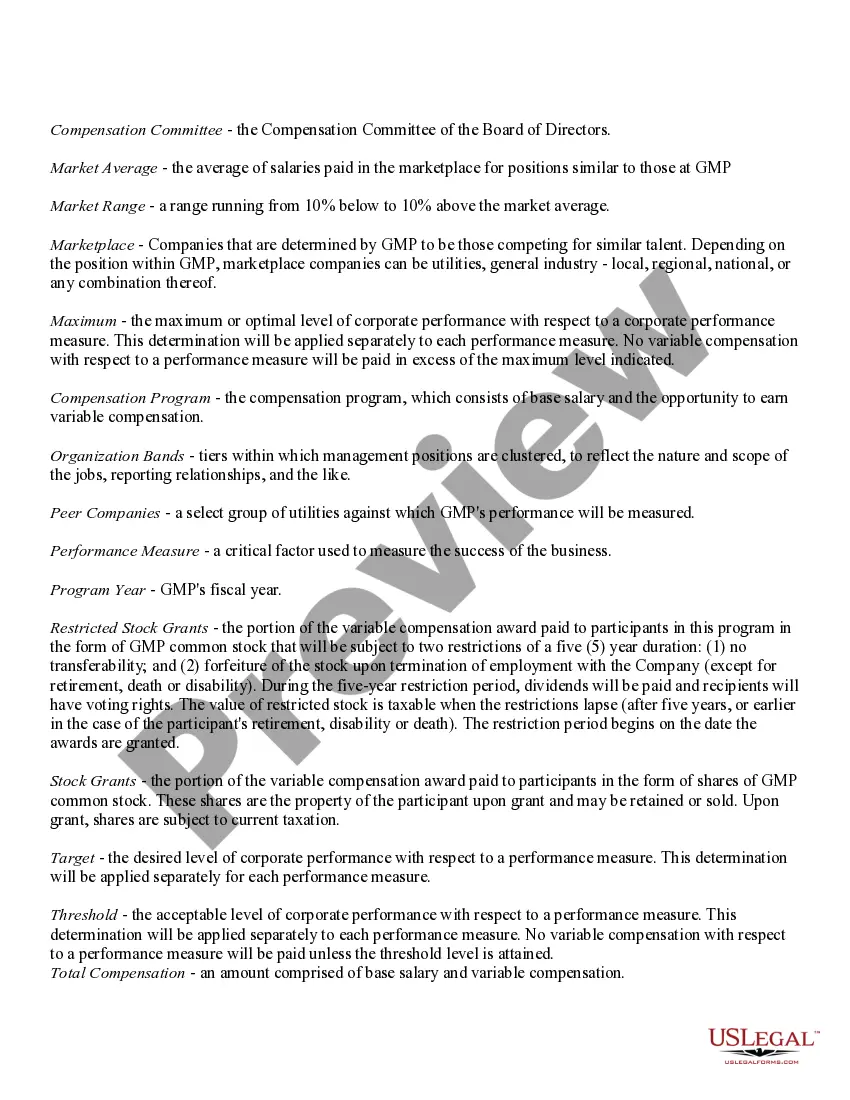

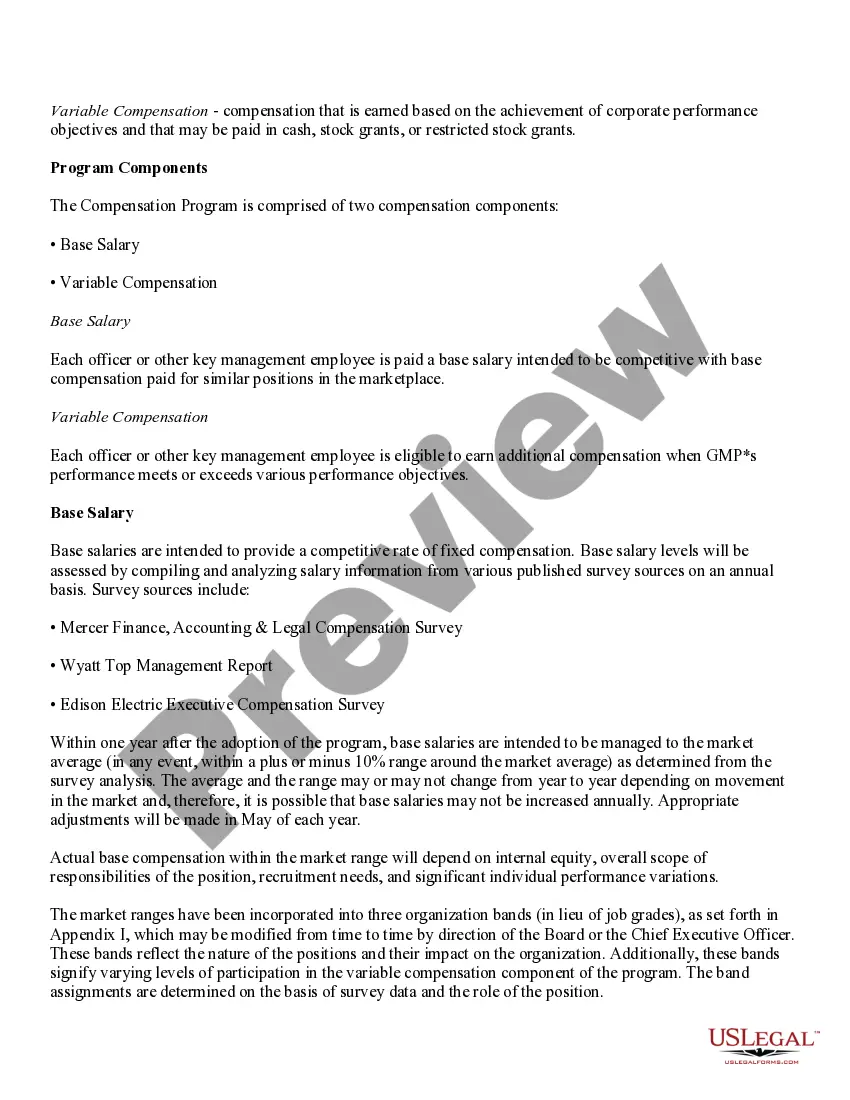

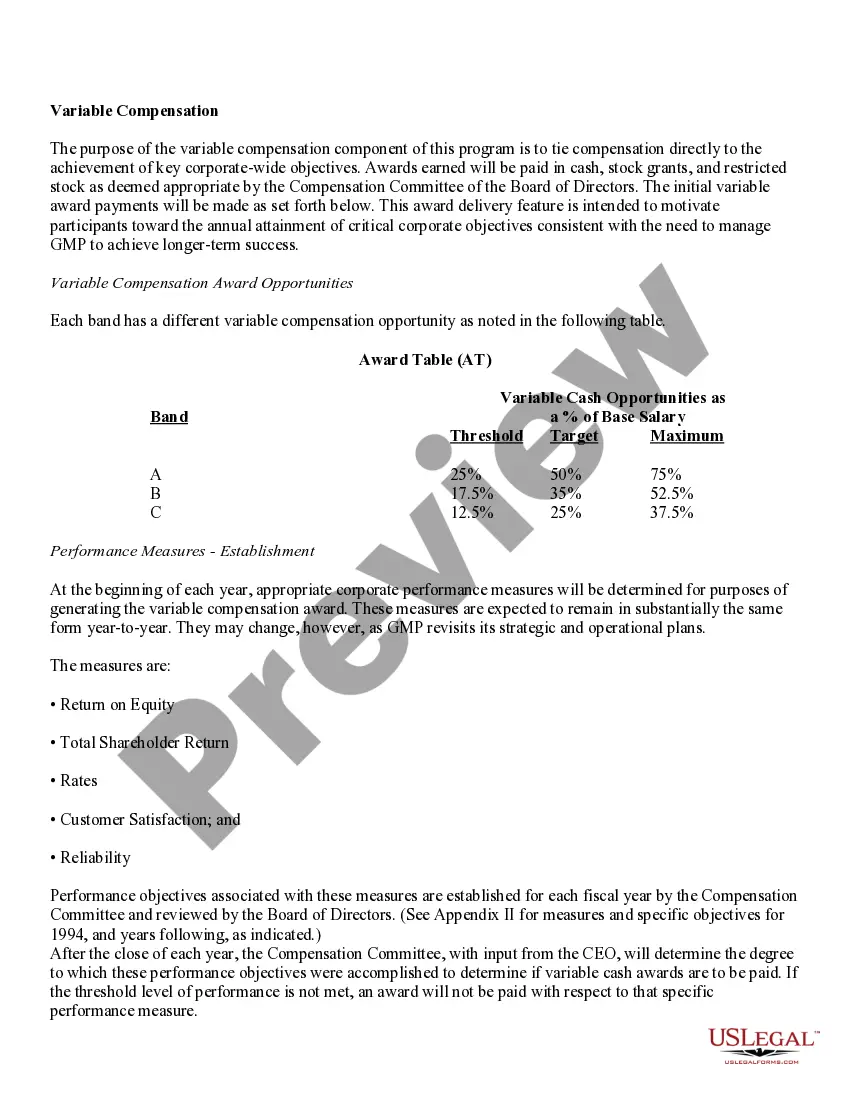

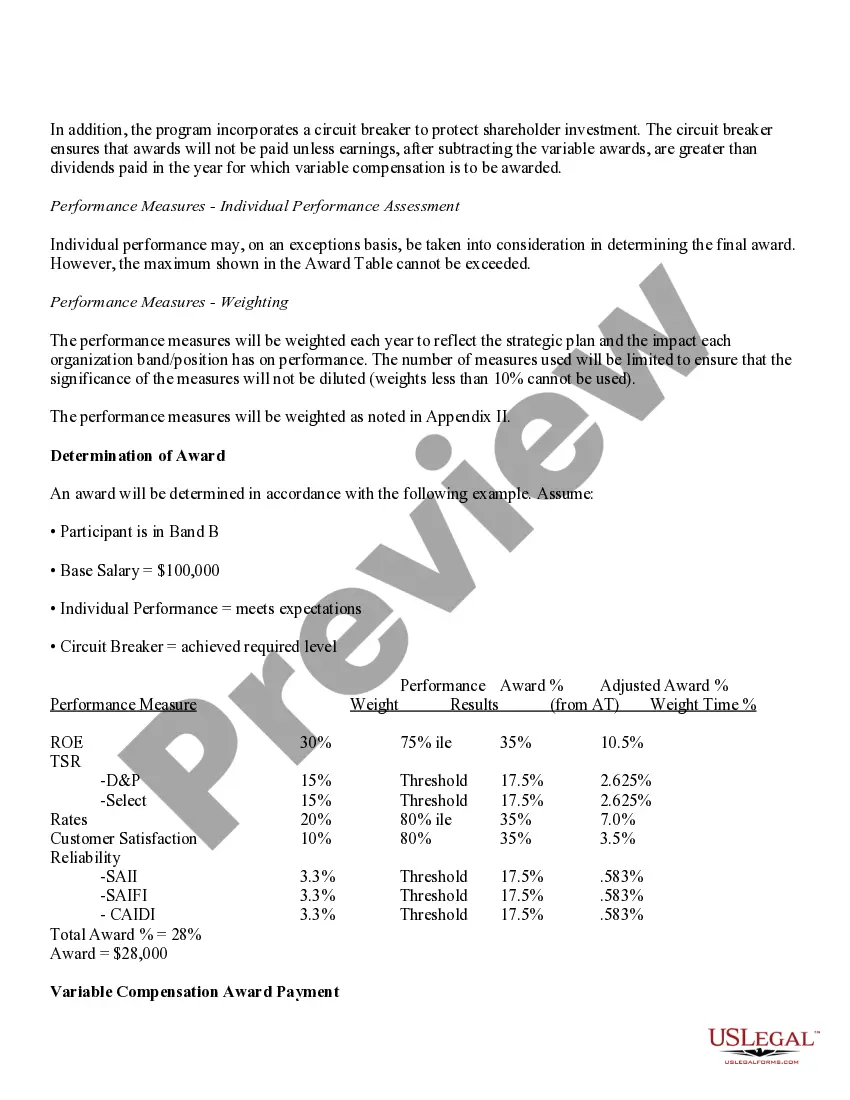

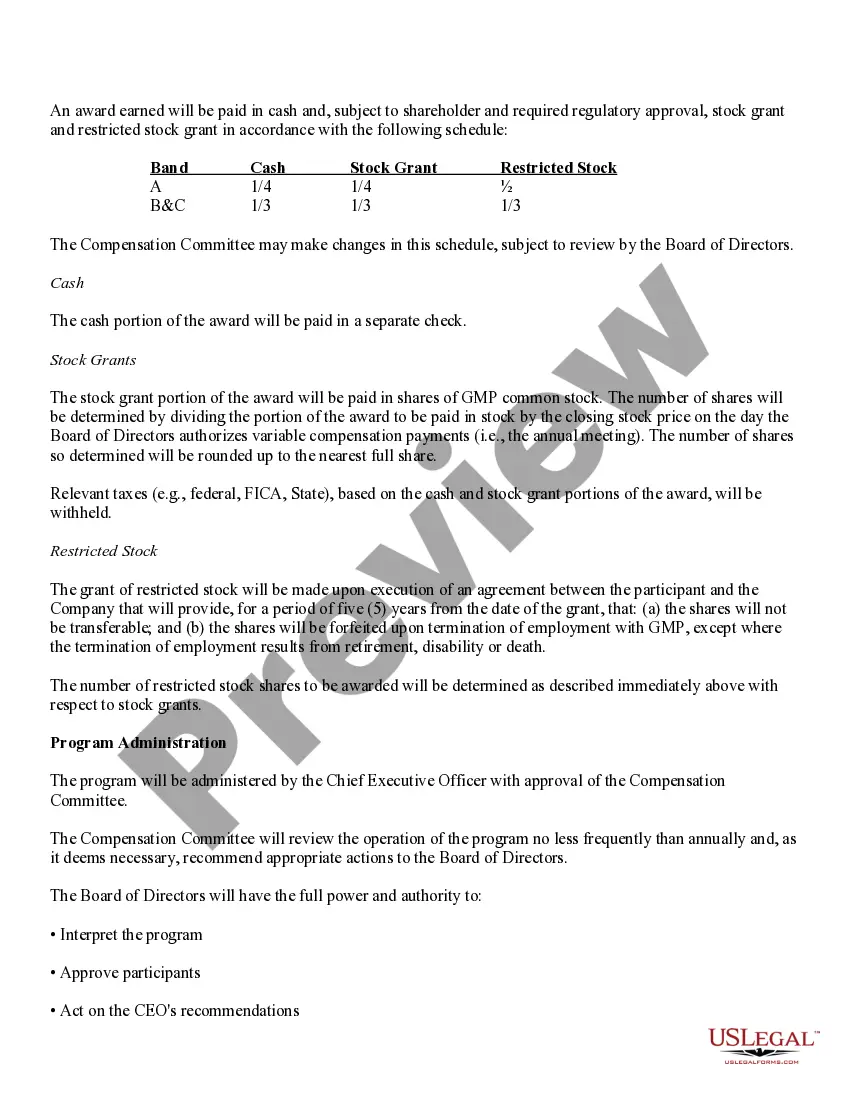

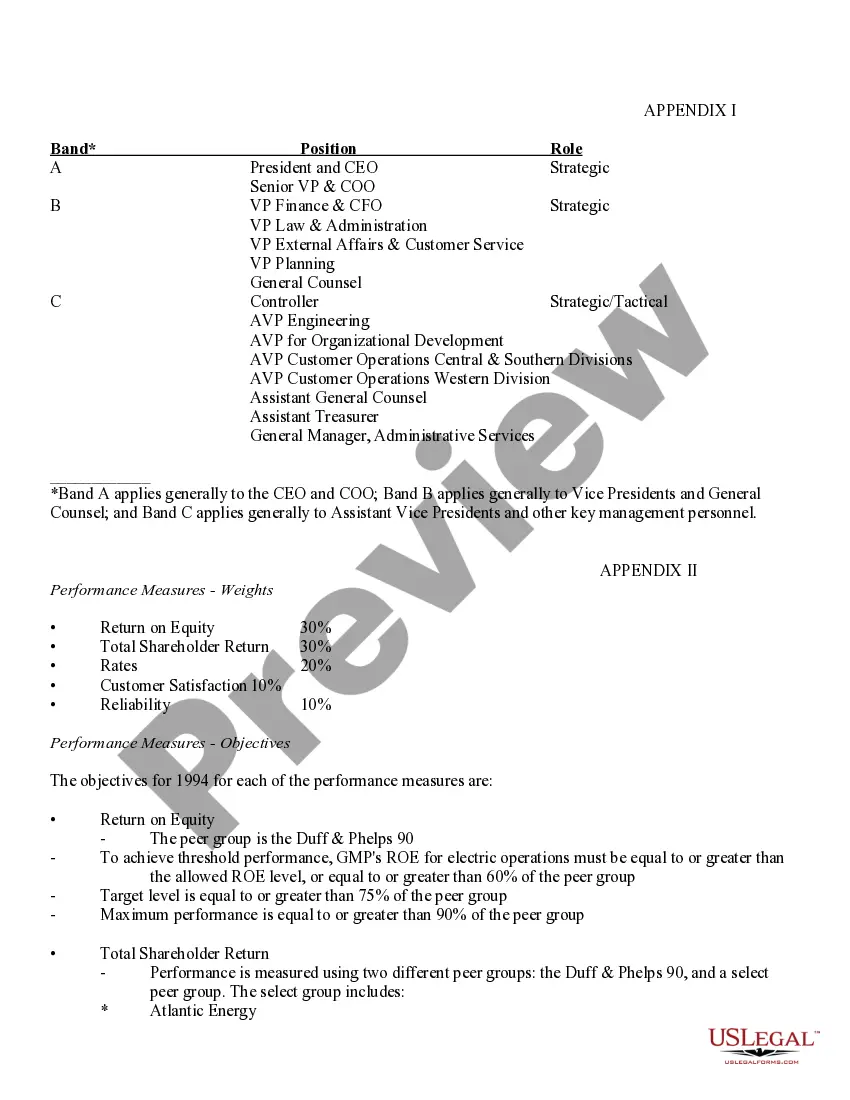

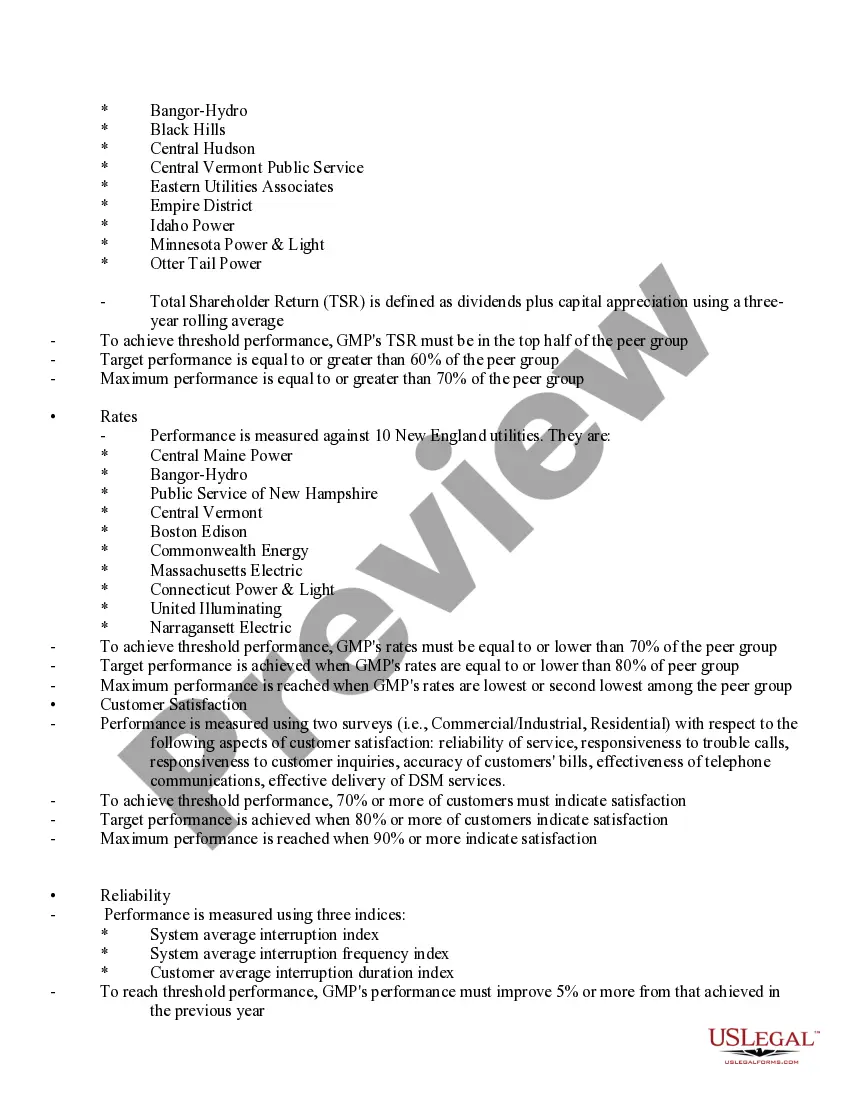

Delaware Compensation Program for Officers and Certain Key Management Personnel is a comprehensive and structured compensation plan designed to attract, retain, and motivate top-level executives and key management personnel within Delaware-based organizations. This program adheres to regulatory requirements and aims to align the interests of these individuals with the long-term success of the company. Key Features: 1. Base Salary: The compensation program starts with a competitive base salary based on an individual's role, experience, and market benchmarks. This ensures a fair starting point for remuneration. Keywords: Delaware Compensation Program, Officers, Key Management Personnel, base salary, remuneration. 2. Performance-Based Incentives: In addition to the base salary, the program includes various performance-based incentives to reward exceptional performance and achievement of predefined goals. These incentives can be in the form of bonuses, profit-sharing plans, or stock options. Keywords: performance-based incentives, bonuses, profit-sharing plans, stock options. 3. Long-Term Incentive Plans: To promote loyalty and retention, the program offers long-term incentive plans such as restricted stock units (RSS), stock appreciation rights (SARS), or performance shares. These plans provide an opportunity for executives to share in the company's long-term growth and success. Keywords: long-term incentive plans, restricted stock units, stock appreciation rights, performance shares. 4. Deferred Compensation: The Delaware Compensation Program also provides options for executives and key management personnel to defer a portion of their compensation, allowing for potential tax advantages and asset growth over time. Keywords: deferred compensation, tax advantages, asset growth. 5. Retirement Benefits: The program offers robust retirement benefits, including contribution-matching programs, pension plans, or 401(k) plans. These benefits aim to provide financial security to executives and key personnel during their retirement years. Keywords: retirement benefits, contribution-matching programs, pension plans, 401(k) plans. Attachments: 1. Compensation Program Overview: This attachment provides a detailed overview of the Delaware Compensation Program, including its objectives, principles, and eligibility criteria. 2. Sample Compensation Agreement: This attachment presents a sample agreement that outlines the terms and conditions of an executive's participation in the program, covering various compensation components and performance metrics. 3. Performance Metrics Guide: This attachment assists executives and key personnel in understanding the performance metrics employed to determine incentive payments or stock grants. It outlines key performance indicators, targets, and evaluation methodologies. 4. Taxation Guidelines: This attachment offers guidance on the tax implications associated with the compensation program, covering deferred compensation, stock options, and other aspects that could impact an individual's tax obligations and planning. Different Types of Delaware Compensation Programs: There can be variations of the Delaware Compensation Program tailored to specific industries, sectors, or organizations. Examples could include specialized equity-based plans for technology startups or nonprofits, or industry-specific performance metrics for financial institutions or healthcare companies. Keywords: specialized compensation programs, equity-based plans, industry-specific metrics.

Delaware Compensation Program for Officers and Certain Key Management Personnel with attachments

Description

How to fill out Delaware Compensation Program For Officers And Certain Key Management Personnel With Attachments?

If you have to comprehensive, acquire, or print out legitimate papers web templates, use US Legal Forms, the biggest selection of legitimate varieties, which can be found on the web. Use the site`s easy and hassle-free look for to obtain the papers you want. Numerous web templates for company and individual uses are sorted by types and claims, or keywords. Use US Legal Forms to obtain the Delaware Compensation Program for Officers and Certain Key Management Personnel with attachments in a couple of clicks.

Should you be previously a US Legal Forms consumer, log in to the account and then click the Download button to get the Delaware Compensation Program for Officers and Certain Key Management Personnel with attachments. Also you can access varieties you previously downloaded from the My Forms tab of the account.

If you work with US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the shape for your proper town/land.

- Step 2. Use the Preview choice to look through the form`s information. Don`t forget about to learn the information.

- Step 3. Should you be unsatisfied with the form, use the Look for industry at the top of the monitor to locate other models of the legitimate form design.

- Step 4. When you have located the shape you want, click on the Get now button. Pick the rates prepare you prefer and add your qualifications to register to have an account.

- Step 5. Process the purchase. You should use your charge card or PayPal account to accomplish the purchase.

- Step 6. Pick the formatting of the legitimate form and acquire it on your own gadget.

- Step 7. Full, edit and print out or sign the Delaware Compensation Program for Officers and Certain Key Management Personnel with attachments.

Every single legitimate papers design you get is the one you have eternally. You possess acces to each form you downloaded inside your acccount. Select the My Forms segment and choose a form to print out or acquire yet again.

Contend and acquire, and print out the Delaware Compensation Program for Officers and Certain Key Management Personnel with attachments with US Legal Forms. There are thousands of professional and state-particular varieties you can utilize for your company or individual needs.