Delaware Stockholder proposal of Occidental Petroleum Corp. to provide that each officer and director be subject to mandatory retirement at age 70

Description

How to fill out Stockholder Proposal Of Occidental Petroleum Corp. To Provide That Each Officer And Director Be Subject To Mandatory Retirement At Age 70?

US Legal Forms - one of the most significant libraries of legitimate kinds in the USA - gives an array of legitimate document web templates it is possible to down load or print. Using the web site, you can get 1000s of kinds for enterprise and individual functions, categorized by groups, suggests, or key phrases.You will discover the most recent variations of kinds such as the Delaware Stockholder proposal of Occidental Petroleum Corp. to provide that each officer and director be subject to mandatory retirement at age 70 within minutes.

If you currently have a registration, log in and down load Delaware Stockholder proposal of Occidental Petroleum Corp. to provide that each officer and director be subject to mandatory retirement at age 70 from your US Legal Forms collection. The Obtain option will show up on each develop you view. You have access to all previously downloaded kinds in the My Forms tab of your accounts.

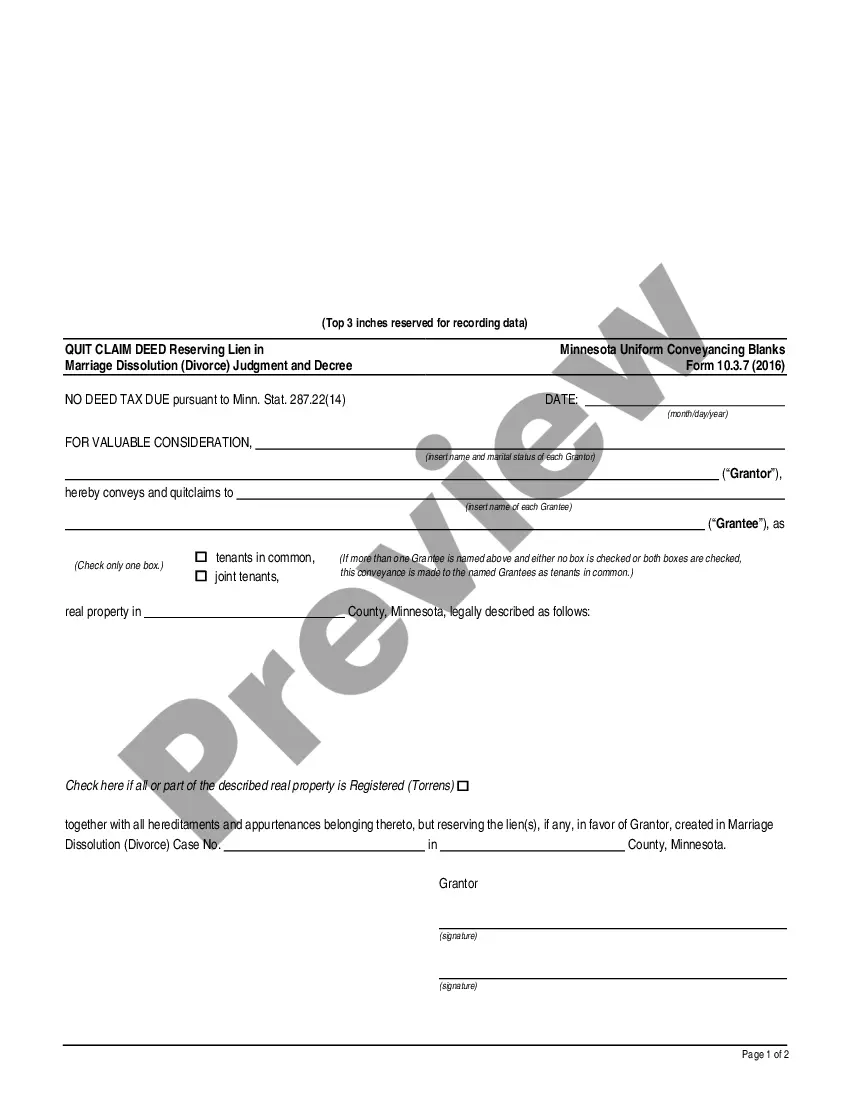

If you would like use US Legal Forms for the first time, here are simple recommendations to help you began:

- Ensure you have chosen the proper develop to your town/region. Click on the Preview option to examine the form`s information. Browse the develop information to ensure that you have chosen the right develop.

- In case the develop does not match your specifications, make use of the Search discipline near the top of the display screen to obtain the the one that does.

- When you are satisfied with the shape, affirm your decision by simply clicking the Get now option. Then, choose the costs plan you want and provide your references to register for an accounts.

- Procedure the financial transaction. Make use of bank card or PayPal accounts to accomplish the financial transaction.

- Pick the format and down load the shape on your own gadget.

- Make adjustments. Fill up, change and print and indication the downloaded Delaware Stockholder proposal of Occidental Petroleum Corp. to provide that each officer and director be subject to mandatory retirement at age 70.

Every format you put into your money lacks an expiration time and is yours eternally. So, in order to down load or print another copy, just visit the My Forms segment and click on about the develop you will need.

Obtain access to the Delaware Stockholder proposal of Occidental Petroleum Corp. to provide that each officer and director be subject to mandatory retirement at age 70 with US Legal Forms, one of the most substantial collection of legitimate document web templates. Use 1000s of expert and state-particular web templates that fulfill your company or individual requirements and specifications.

Form popularity

FAQ

Is OXY Stock a Buy, ing to Analysts? On TipRanks, OXY comes in as a Moderate Buy based on six Buys, seven Holds, and one Sell rating assigned by analysts in the past three months. The average Occidental Petroleum price target is $71.43, implying 16% upside potential.

What Is Occidental Petroleum's Debt? The image below, which you can click on for greater detail, shows that Occidental Petroleum had debt of US$19.1b at the end of June 2023, a reduction from US$22.0b over a year. However, it does have US$486.0m in cash offsetting this, leading to net debt of about US$18.6b.

Top 10 Owners of Occidental Petroleum Corp StockholderStakeShares ownedBerkshire Hathaway, Inc. (Investm...25.78%228,051,027Dodge & Cox10.32%91,303,640The Vanguard Group, Inc.6.46%57,167,328SSgA Funds Management, Inc.5.02%44,375,2266 more rows

Occidental's $57 Billion Acquisition of Anadarko, Contingent $8.8 Billion Sale of Anadarko African Assets to Total and $10 Billion Investment from Berkshire Hathaway.

Occidental Petroleum's mission statement is "Develop energy resources safely, profitably and responsibly to maximize value."

The Audit Committee of the Board of Directors of Occidental has selected KPMG LLP as independent auditor to audit the consolidated financial statements of Occidental and its subsidiaries for the year ending December 31, 2021.

The oil and gas company reported a $1.18 a share profit compared to average Wall Street analyst forecasts for an 84 cent a share profit, ing to LSEG. Adjusted earnings fell by more than half to $1.13 billion compared to the same quarter last year.