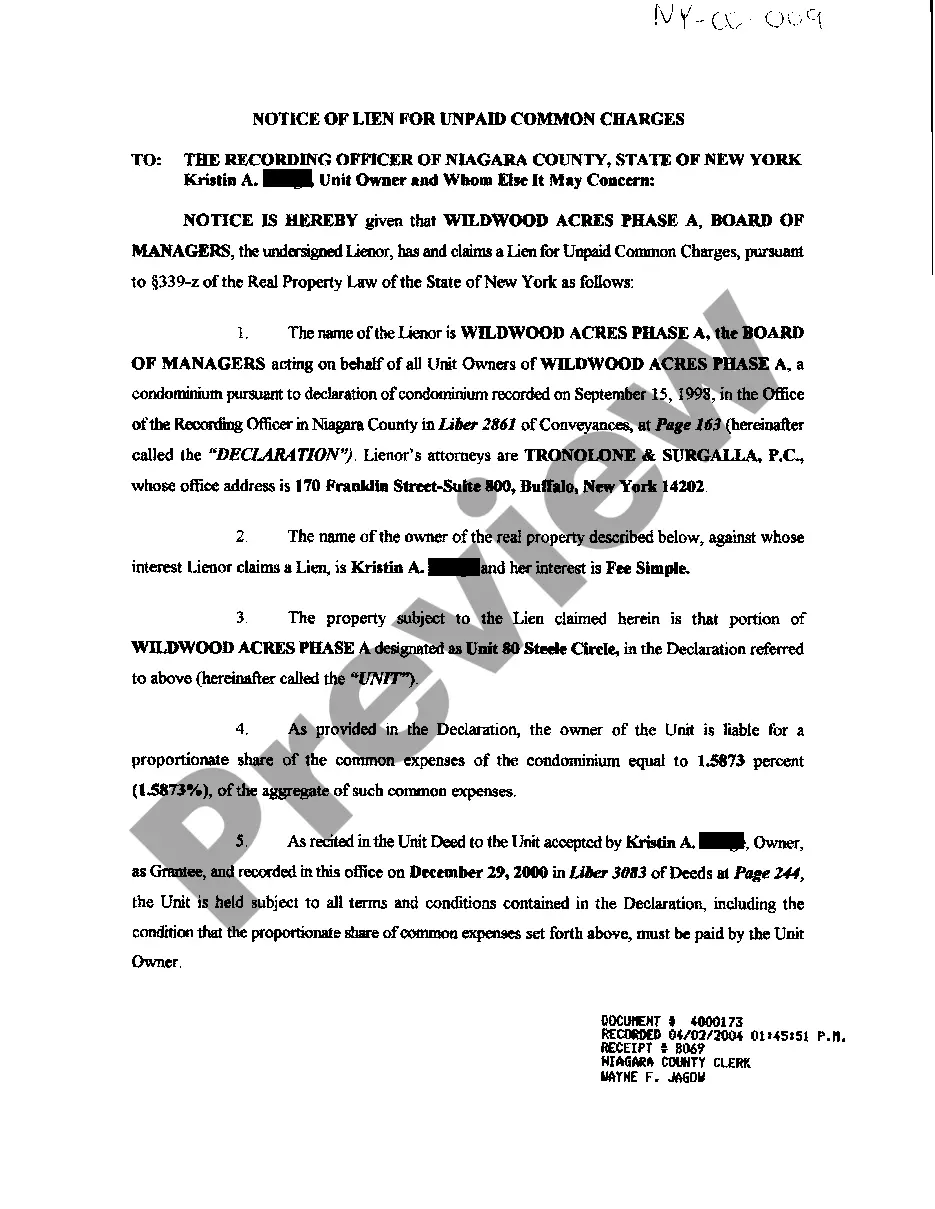

Delaware Purchase by Company of Its Stock: Understanding the Basics In the corporate world, companies have various methods to acquire their own stock. One such method is a Delaware Purchase, a legal framework allowing companies to purchase their own shares from the open market or existing shareholders. It is a widely-used strategy that offers several advantages to corporations, including increased control over their stock structure, consolidation of ownership, and enhanced shareholder value. In this article, we will delve into the details of Delaware Purchase by Company of Its Stock, exploring its different types and highlighting its key features. Types of Delaware Purchase by Company of Its Stock: 1. Open Market Purchase: In this type of Delaware Purchase, a company acquires its stock from public stock exchanges or over-the-counter markets. By directly buying shares from the open market, companies can control the timing and volume of their purchases, ensuring flexibility in managing their stock structure. 2. Negotiated Purchase: Also known as a privately negotiated or off-market purchase, this type involves a company directly negotiating with existing shareholders to buy back their shares. This approach allows companies to target specific shareholders, including major institutional investors or key stakeholders, to optimize the ownership structure and improve corporate governance. Key Features and Benefits of Delaware Purchase: 1. Stock Repurchase Authorization: Before initiating a Delaware Purchase, a company must obtain approval from its board of directors and shareholders. This authorization sets the maximum number of shares the company is permitted to repurchase and defines the timeframe within which the repurchases can occur. 2. Capital Allocation and Financial Efficiency: Delaware Purchase provides companies with an effective means of utilizing excess capital or surplus funds. By repurchasing its stock, a company can return value to shareholders, indirectly boosting share prices, and improving financial ratios such as earnings per share (EPS) and return on equity (ROE). 3. Consolidation of Ownership and Voting Rights: Repurchasing stock enables a company to consolidate ownership by reducing the number of outstanding shares in the market. This consolidation can lead to increased voting power for remaining shareholders, granting them more influence over governance decisions and potentially deterring hostile takeovers. 4. Earnings Distribution Efficiency: Delaware Purchase allows companies to distribute earnings to shareholders in a tax-efficient manner. Rather than paying dividends to all shareholders, which could incur higher tax liabilities, repurchasing shares provides a more targeted approach to capital distribution. 5. Signal of Confidence: Repurchasing stock can signal confidence in the company's future prospects to the market. By investing in its own stock, a company implies that it considers the shares to be undervalued and believes in the long-term growth potential. This can subsequently attract positive attention from investors and potentially lead to share price appreciation. In conclusion, Delaware Purchase by Company of Its Stock is an essential component of corporate financial management. Whether engaged in open market purchases or privately negotiated transactions, companies employ this strategy to gain control over their stock structure, enhance shareholder value, and optimize capital allocation. As always, it is advisable for companies to consult legal and financial professionals to navigate the intricate regulatory landscape associated with Delaware Purchase and to tailor the approach to their specific needs.

Delaware Purchase by company of its stock

Description

How to fill out Delaware Purchase By Company Of Its Stock?

You can spend hours on-line trying to find the lawful file format that meets the state and federal needs you want. US Legal Forms provides 1000s of lawful varieties which can be evaluated by professionals. It is simple to obtain or printing the Delaware Purchase by company of its stock from the assistance.

If you already have a US Legal Forms profile, you are able to log in and click on the Obtain option. After that, you are able to comprehensive, change, printing, or sign the Delaware Purchase by company of its stock. Every lawful file format you get is your own property forever. To have another backup of any purchased develop, visit the My Forms tab and click on the related option.

If you use the US Legal Forms website the first time, stick to the basic directions under:

- Initial, ensure that you have selected the right file format for that county/city that you pick. Browse the develop explanation to make sure you have picked the right develop. If offered, make use of the Review option to search through the file format at the same time.

- In order to discover another version from the develop, make use of the Look for discipline to get the format that suits you and needs.

- When you have identified the format you would like, click Get now to continue.

- Pick the pricing program you would like, type in your qualifications, and register for your account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal profile to fund the lawful develop.

- Pick the formatting from the file and obtain it to the product.

- Make changes to the file if possible. You can comprehensive, change and sign and printing Delaware Purchase by company of its stock.

Obtain and printing 1000s of file layouts using the US Legal Forms website, that offers the most important selection of lawful varieties. Use skilled and state-specific layouts to take on your small business or individual requires.

Form popularity

FAQ

§ 253. Merger of parent corporation and subsidiary corporation or corporations. (2) The terms and conditions of the merger shall obligate the surviving corporation to provide the agreement, and take the actions, required by § 252(d) of this title or § 258(c) of this title, as applicable.

Because of the extensive experience of the Delaware courts, Delaware has a more well-developed body of case law than other states, which serves to give corporations and their counsel greater guidance on matters of corporate governance and transaction liability issues.

Section 170 - Dividends; payment; wasting asset corporations (a) The directors of every corporation, subject to any restrictions contained in its certificate of incorporation, may declare and pay dividends upon the shares of its capital stock either: (1) Out of its surplus, as defined in and computed in ance with ...

Ratification of Defective Corporate Acts Section 204 of the DGCL provides the procedure by which corporations may ratify a defective corporate act that is otherwise void or voidable due to a failure to properly authorize these acts, such as officer or director appointments or stock issuances.

If the name of the foreign corporation conflicts with the name of a corporation, partnership, limited partnership, limited liability company or statutory trust organized under the laws of this State, or a name reserved for a corporation, partnership, limited partnership, limited liability company or statutory trust to ...

Section 160 provides that no corporation may purchase or redeem its shares when the capital of the corporation is impaired or would be impaired as a result of such purchase or redemption. A repurchase impairs capital if the funds used for the repurchase exceed the amount of the surplus.

Section 160 - Corporation's powers respecting ownership, voting, etc., of its own stock; rights of stock called for redemption (a) Every corporation may purchase, redeem, receive, take or otherwise acquire, own and hold, sell, lend, exchange, transfer or otherwise dispose of, pledge, use and otherwise deal in and with ...

§ 174. Liability of directors for unlawful payment of dividend or unlawful stock purchase or redemption; exoneration from liability; contribution among directors; subrogation.

Section 203 is an antitakeover statute in Delaware which provides that if a person or entity (an ?interested stockholder?) acquires 15% or more of the voting stock of a Delaware corporation (the ?target?) without prior approval of the target's board, then the interested stockholder may not engage in a business ...