A Delaware Voting Trust Certificate is a legal document that represents an agreement between the shareholders or owners of a corporation, known as beneficiaries, and a designated trustee. This certificate grants the trustee the authority to exercise voting rights on behalf of the shareholders for a specific period or until certain conditions are met. The purpose of a Delaware Voting Trust Certificate is to consolidate the voting power of the shareholders under the trustee's control. It is often utilized in situations where shareholders want to consolidate their voting power to achieve a unified decision-making process or to protect their interests in a potentially contentious situation. The trustee, who is typically an individual or a trusted entity, holds legal ownership over the shares during the duration specified in the certificate. However, the trustee does not obtain any beneficial interest or ownership of the shares. Instead, they act as the agent of the shareholders and are bound to exercise their voting rights solely in accordance with the terms outlined in the trust agreement. There are various types of Delaware Voting Trust Certificates, each catering to specific needs or circumstances: 1. Temporary Voting Trust Certificate: This type of certificate is utilized for a specified period, usually during transitions such as mergers, acquisitions, or corporate restructuring. It allows shareholders to pool their voting rights temporarily to achieve a common goal or desired outcome. 2. Permanent Voting Trust Certificate: In contrast to the temporary trust, a permanent voting trust is established for a longer duration, often without a specified termination date. It enables shareholders to maintain a unified voice in the company's decision-making processes over an extended period. 3. Voting Trust Certificate for Controlling Interests: This type of certificate is employed when majority shareholders seek to consolidate their voting power to maintain control over the corporation. By pooling their shares, they can protect their interests and ensure a coherent approach to running the company. 4. Voting Trust Certificate for Proxy Solicitation: This type of trust certificate is used when shareholders need assistance in gathering proxies for annual meetings or other voting events. The trustee, through the trust agreement, is authorized to gather and vote these proxies on the beneficiaries' behalf. In conclusion, a Delaware Voting Trust Certificate is a legally binding document that empowers a designated trustee to exercise voting rights on behalf of shareholders for a specific duration or under certain conditions. It helps shareholders consolidate voting power, achieve collective decision-making, or protect their interests. The different types of Delaware Voting Trust Certificates include temporary, permanent, controlling interests, and proxy solicitation trusts, each serving specific shareholder needs.

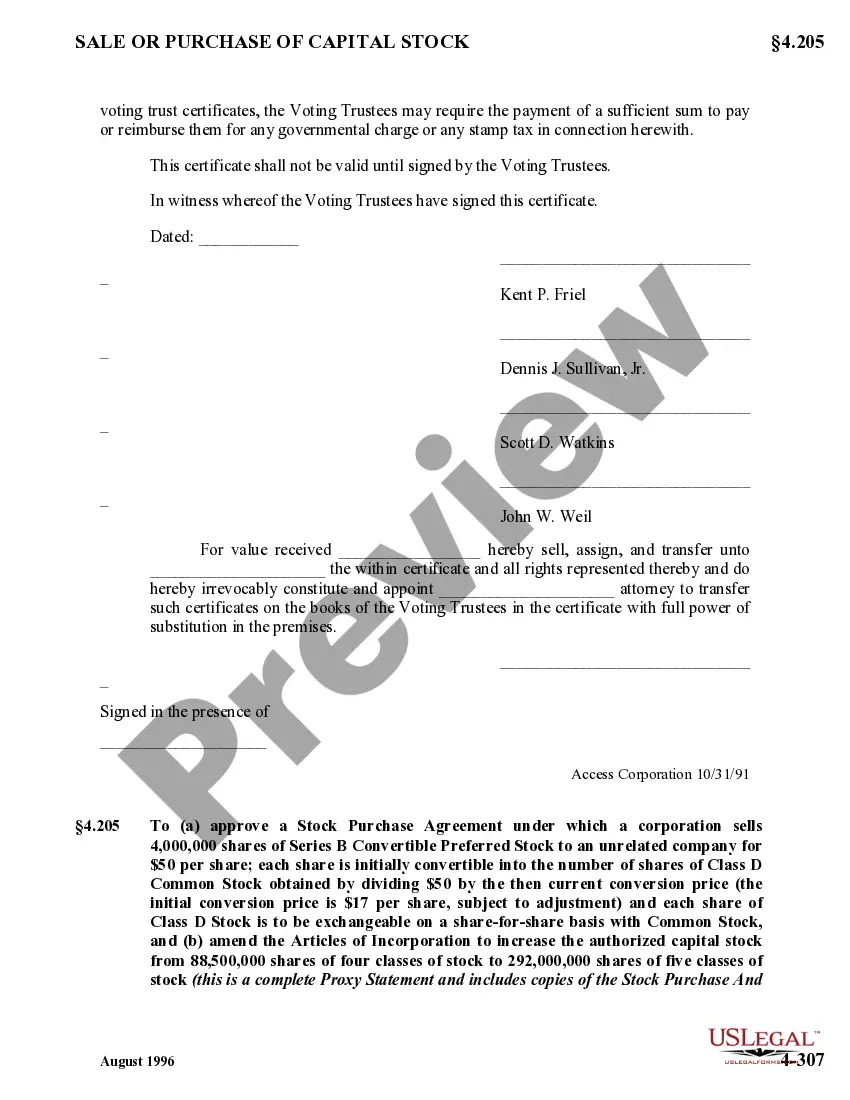

Delaware Voting Trust Certificate

Description

How to fill out Delaware Voting Trust Certificate?

Choosing the best legal file design can be quite a struggle. Needless to say, there are tons of themes accessible on the Internet, but how would you get the legal develop you want? Use the US Legal Forms website. The support offers a large number of themes, for example the Delaware Voting Trust Certificate, which can be used for company and personal requires. Each of the varieties are inspected by specialists and satisfy state and federal needs.

If you are previously signed up, log in in your accounts and then click the Obtain switch to find the Delaware Voting Trust Certificate. Make use of accounts to check throughout the legal varieties you have ordered earlier. Visit the My Forms tab of your respective accounts and have another copy of your file you want.

If you are a new user of US Legal Forms, listed here are straightforward instructions that you should follow:

- Very first, ensure you have chosen the correct develop for your metropolis/state. You may examine the shape utilizing the Review switch and study the shape explanation to make sure this is basically the right one for you.

- When the develop will not satisfy your preferences, make use of the Seach area to get the proper develop.

- Once you are positive that the shape would work, go through the Get now switch to find the develop.

- Choose the rates program you want and enter in the necessary info. Design your accounts and buy the order making use of your PayPal accounts or charge card.

- Select the data file file format and download the legal file design in your device.

- Complete, edit and printing and indication the acquired Delaware Voting Trust Certificate.

US Legal Forms will be the biggest library of legal varieties in which you can discover various file themes. Use the company to download expertly-created files that follow state needs.