Delaware Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp.

Description

How to fill out Agreement And Plan Of Reorganization By Wedgestone Realty Investors Trust And Wedgestone Advisory Corp.?

Are you currently within a position the place you require papers for possibly enterprise or individual uses almost every day? There are plenty of authorized record templates available on the Internet, but discovering ones you can rely is not effortless. US Legal Forms offers 1000s of form templates, like the Delaware Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp., which can be written to meet state and federal requirements.

If you are already acquainted with US Legal Forms internet site and also have your account, basically log in. Following that, you may acquire the Delaware Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp. design.

If you do not provide an profile and wish to begin using US Legal Forms, follow these steps:

- Find the form you want and ensure it is for the right area/area.

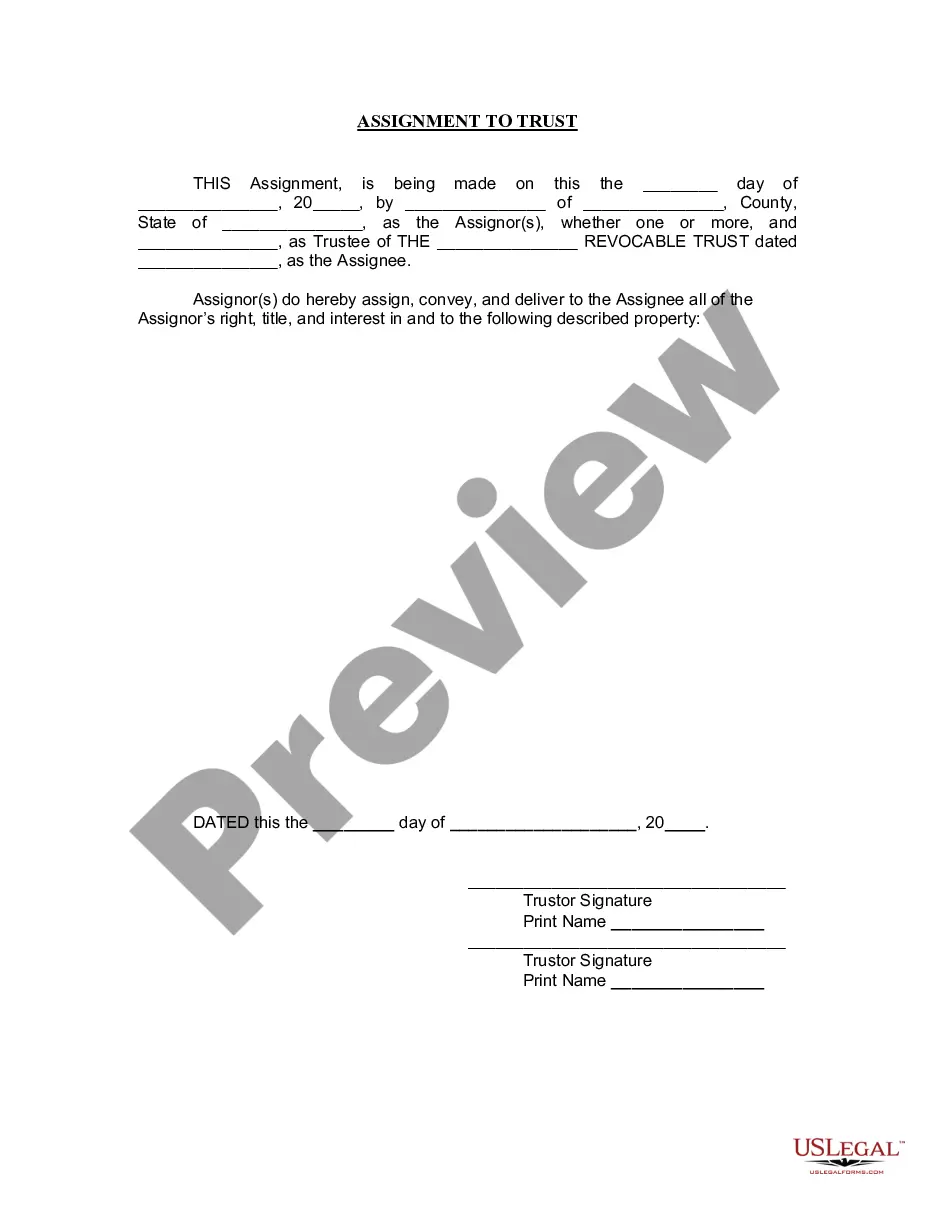

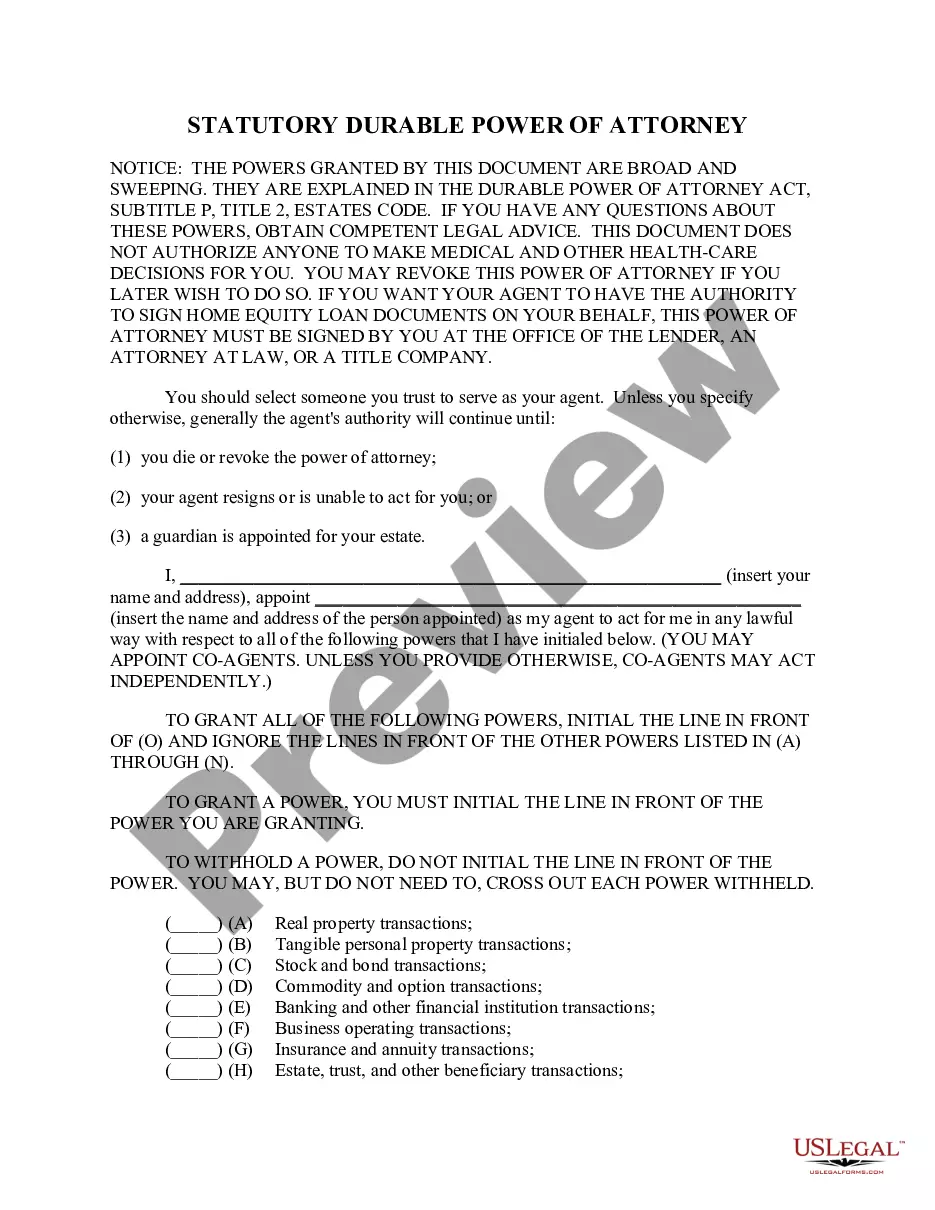

- Make use of the Review button to examine the form.

- See the outline to actually have selected the correct form.

- If the form is not what you are trying to find, take advantage of the Search area to obtain the form that suits you and requirements.

- If you get the right form, click Purchase now.

- Choose the pricing plan you would like, complete the required info to produce your bank account, and pay money for an order making use of your PayPal or Visa or Mastercard.

- Pick a convenient paper formatting and acquire your version.

Find each of the record templates you have purchased in the My Forms food selection. You can aquire a more version of Delaware Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp. whenever, if required. Just click on the required form to acquire or produce the record design.

Use US Legal Forms, the most comprehensive collection of authorized forms, to save lots of time and avoid mistakes. The assistance offers appropriately manufactured authorized record templates which can be used for an array of uses. Produce your account on US Legal Forms and commence generating your way of life a little easier.