The Delaware Stockholders' Rights Plan, also known as a "poison pill" strategy, is a key tool employed by Radarscope Corp. to protect the interests of its stockholders in the event of hostile takeover attempts or unsolicited offers from potential acquirers. This plan is based on the Delaware General Corporation Law, which provides legal framework and guidelines for implementing such measures. Under the Delaware Stockholders' Rights Plan, Radarscope Corp. grants its existing stockholders certain rights that are triggered upon the occurrence of specified events. These events typically include an individual or entity acquiring a certain percentage of the company's outstanding shares, often referred to as a "triggering event." Once triggered, the plan allows stockholders to purchase additional shares at a discounted price, effectively diluting the holdings of the acquiring party. The ultimate goal of this plan is to make the acquisition expensive and undesirable, deterring potential hostile takeovers and preserving the independence and values of Radarscope Corp. By utilizing this tactic, the company aims to protect the long-term interests of its stockholders and maintain control over its strategic direction. There might be different types or variations of the Delaware Stockholders' Rights Plan implemented by Radarscope Corp., such as: 1. Flip-in Rights Plan: This type of plan allows existing stockholders to purchase additional shares of the company's stock at a discounted price when a triggering event occurs. The discounted price makes it more attractive for stockholders to prevent a hostile takeover and maintain control. 2. Flip-over Rights Plan: In a flip-over rights plan, if a triggering event occurs, stockholders have the option to purchase shares of the acquiring company at a discounted price, usually after completion of the acquisition. This allows stockholders to benefit from the potential upside of the acquiring company. 3. Preferred Stock Rights Plan: Radarscope Corp. may issue preferred stock to existing stockholders, which grants them certain rights and privileges, such as higher voting power or increased dividends. This type of plan aims to make a hostile takeover financially unattractive. It's important to note that the specific structure and provisions of the Delaware Stockholders' Rights Plan of Radarscope Corp. may vary, as these plans can be customized based on the company's needs and objectives. This description provides a general overview of the purpose and mechanisms typically associated with such plans.

Delaware Stockholders' Rights Plan of Datascope Corp.

Description

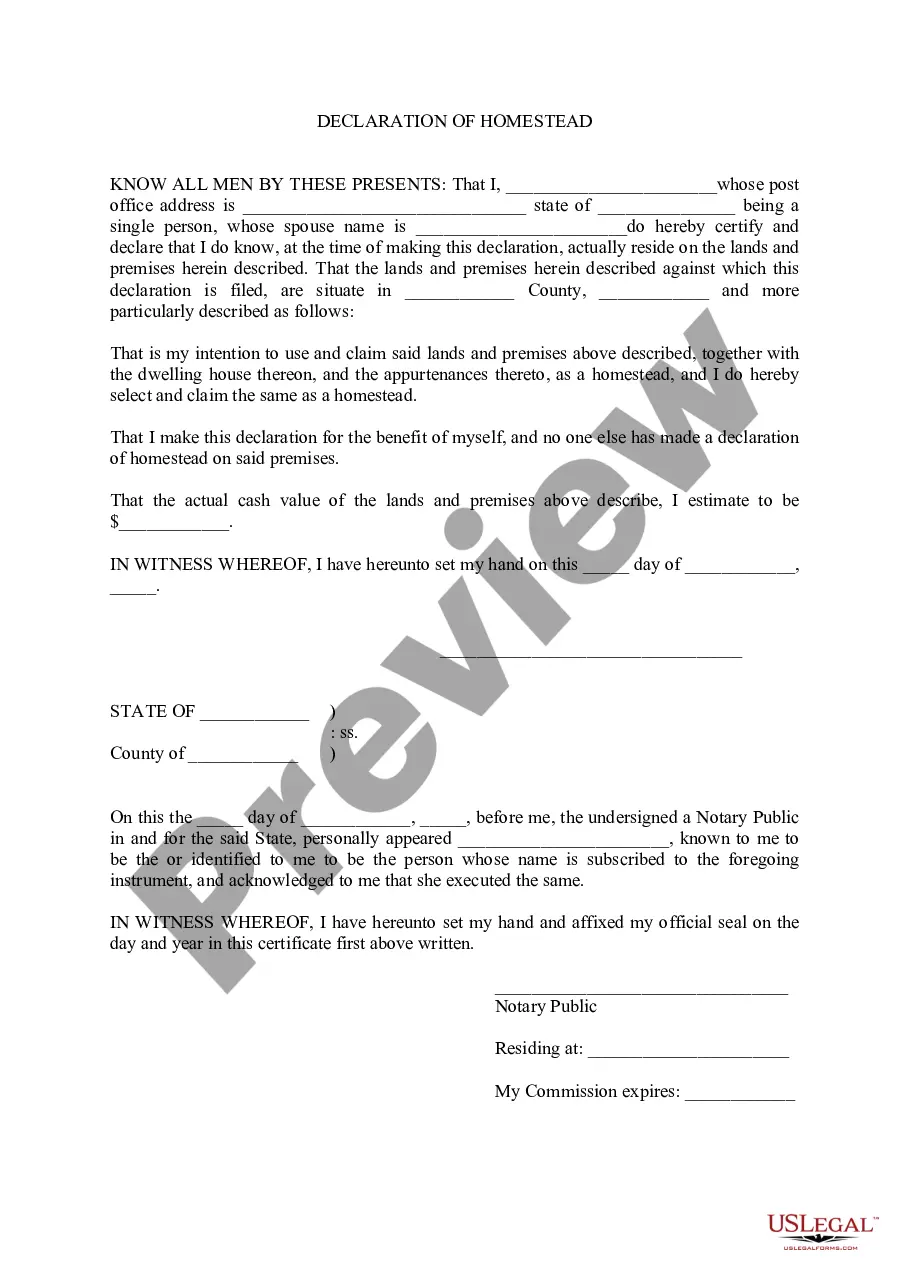

How to fill out Delaware Stockholders' Rights Plan Of Datascope Corp.?

Choosing the right legal record template can be a battle. Obviously, there are plenty of templates available on the Internet, but how do you find the legal develop you will need? Make use of the US Legal Forms website. The services provides a huge number of templates, including the Delaware Stockholders' Rights Plan of Datascope Corp., which can be used for organization and private demands. Every one of the types are checked out by pros and satisfy federal and state requirements.

In case you are currently authorized, log in in your bank account and then click the Acquire switch to obtain the Delaware Stockholders' Rights Plan of Datascope Corp.. Use your bank account to appear from the legal types you might have acquired in the past. Visit the My Forms tab of your bank account and have one more duplicate of the record you will need.

In case you are a fresh user of US Legal Forms, here are simple instructions for you to stick to:

- Initial, be sure you have selected the appropriate develop for your city/state. You may look through the form while using Preview switch and look at the form explanation to ensure this is the best for you.

- If the develop does not satisfy your preferences, make use of the Seach industry to get the correct develop.

- When you are certain that the form would work, go through the Purchase now switch to obtain the develop.

- Select the rates prepare you want and type in the essential information and facts. Create your bank account and purchase the order utilizing your PayPal bank account or charge card.

- Select the data file format and acquire the legal record template in your system.

- Full, change and print and indicator the attained Delaware Stockholders' Rights Plan of Datascope Corp..

US Legal Forms is definitely the most significant catalogue of legal types that you will find various record templates. Make use of the company to acquire expertly-made documents that stick to express requirements.