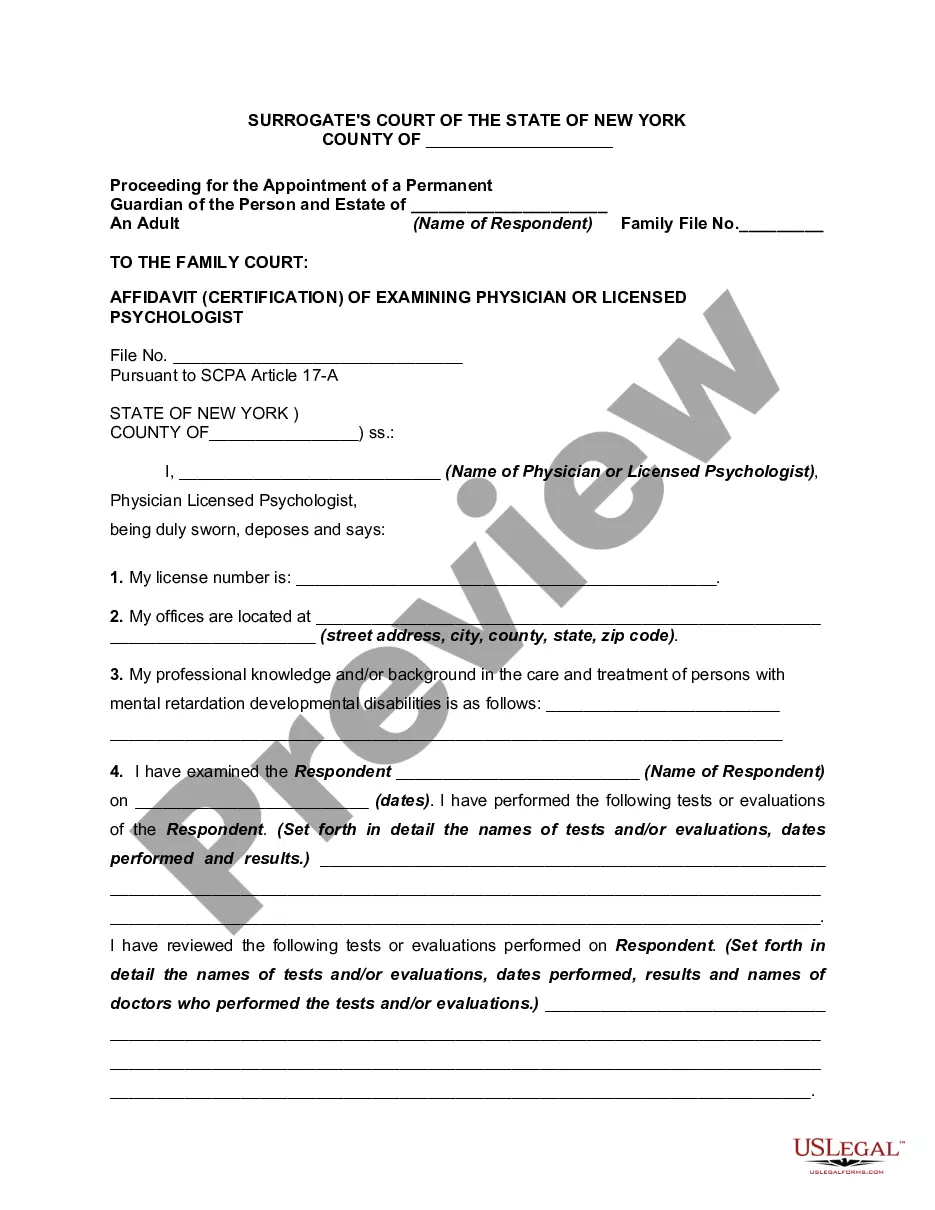

Delaware Letter to limited partners

Description

How to fill out Letter To Limited Partners?

Discovering the right authorized document design can be quite a have a problem. Obviously, there are tons of templates available on the Internet, but how do you obtain the authorized form you need? Make use of the US Legal Forms web site. The services gives a huge number of templates, for example the Delaware Letter to limited partners, that you can use for business and personal demands. Every one of the kinds are checked out by professionals and fulfill state and federal needs.

Should you be previously authorized, log in in your accounts and click on the Acquire option to get the Delaware Letter to limited partners. Make use of accounts to check from the authorized kinds you possess acquired earlier. Visit the My Forms tab of the accounts and acquire an additional version in the document you need.

Should you be a new consumer of US Legal Forms, listed here are straightforward guidelines so that you can follow:

- First, make certain you have selected the proper form for your metropolis/region. You are able to look over the form making use of the Review option and read the form information to guarantee it will be the best for you.

- If the form will not fulfill your needs, make use of the Seach field to obtain the correct form.

- When you are sure that the form would work, select the Purchase now option to get the form.

- Opt for the rates strategy you desire and type in the needed information. Build your accounts and buy an order using your PayPal accounts or charge card.

- Choose the document structure and obtain the authorized document design in your system.

- Total, edit and print out and indicator the received Delaware Letter to limited partners.

US Legal Forms may be the greatest catalogue of authorized kinds in which you will find different document templates. Make use of the service to obtain skillfully-made paperwork that follow state needs.

Form popularity

FAQ

A limited partnership is a partnership formed by two or more persons under the provisions of Section 1702 of this Chapter having as members one or more general partners and one or more limited partners. The limited partner or partners as such shall not be bound by the obligations of the partnership. § 1702. Formation.

A limited partnership is a specialized form of general partnership. While it is very similar to a general partnership in most aspects, the limited partnership is made up of at least one or more general partners and at least one or more limited partners.

What is a Delaware Limited Partnership? Delaware Limited Partnerships (DLPs) are a type of business entity in the United States. They are formed by filing a certificate of limited partnership with the Delaware Secretary of State. DLPs have two types of partners: general partners and limited partners.

§ 17-303. Liability to third parties. (a) A limited partner is not liable for the obligations of a limited partnership unless he or she is also a general partner or, in addition to the exercise of the rights and powers of a limited partner, he or she participates in the control of the business.

A limited partnership formed under this chapter shall be a separate legal entity, the existence of which as a separate legal entity shall continue until cancellation of the limited partnership's certificate of limited partnership.

Types of Partnerships General partnerships offer simple, flexible operation, but do not provide partners with limited liability. ... Limited partnerships offer limited liability for partners who are not involved in management (limited partners).

A certificate of limited partnership must be signed by all the general partners and state their names and addresses. A partnership agreement is not required to be publicly filed or recorded, and the names of the limited partners are not required to be set forth in the certificate of limited partnership.