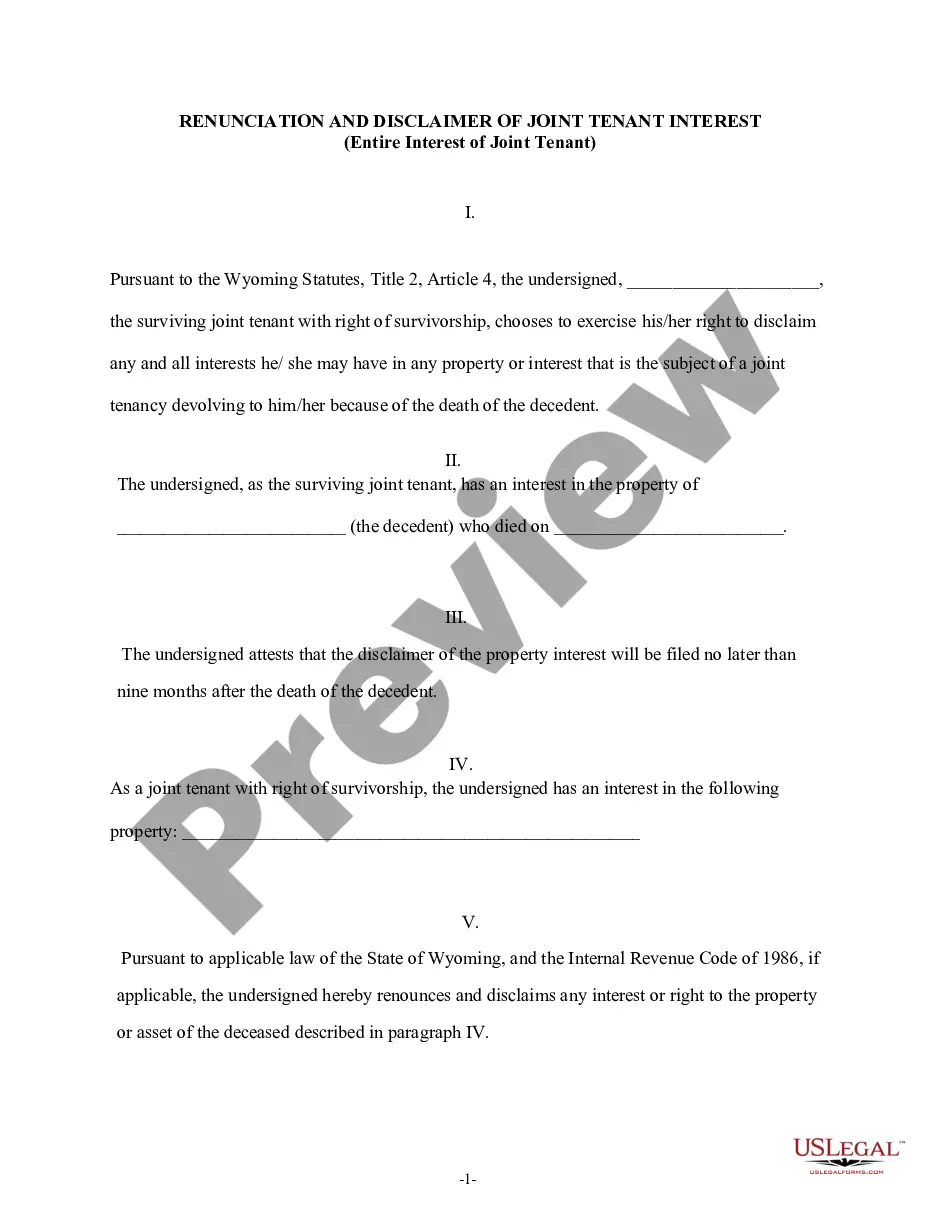

Delaware Notice of Violation of Fair Debt Act — Improper Document Appearance is a legal notification that addresses the violation of the Fair Debt Collection Practices Act (FD CPA) by a debt collector in the state of Delaware. This notice pertains specifically to the improper appearance or formatting of the documents provided by the debt collector during the debt collection process. When it comes to the Delaware Notice of Violation of Fair Debt Act — Improper Document Appearance, there could be several types or instances of violations, including but not limited to: 1. Illegible or unclear documents: Debt collectors are required to provide clear and legible documentation to ensure that the borrower can understand the details of the debt being collected upon. If the documents are difficult to read, poorly photocopied, or contain blurred or faded text, it may constitute a violation. 2. Inconsistent formatting: The FD CPA mandates that the debt collection documents should be presented in a clear and consistent format. If the debt collector changes font styles, sizes, or layout across different sections of the document, it may be considered a violation of the Act. 3. Omission or alteration of required information: Debt collectors must accurately provide all the necessary information concerning the debt being collected. If any vital details are missing or altered, such as the debtor's name, account number, outstanding balance, or the name of the original creditor, it can be seen as a violation of the Fair Debt Collection Practices Act. 4. Unauthorized use of official letterhead or logos: The use of official government letterhead, logos, or symbols without proper authorization is strictly prohibited. Debt collectors must refrain from creating an impression that their collection efforts are endorsed or affiliated with any governmental entity or agency. 5. Misrepresentation of legal consequences: Debt collectors must not misrepresent the potential legal consequences of failing to pay a debt. If the documents include misleading language or false threats of legal action, it is a violation of the Act. 6. Non-compliance with specified formatting requirements: The Fair Debt Collection Practices Act outlines certain requirements for debt collection notices, including the size and type of font, formatting style, and placement of relevant information. Failure to adhere to these specified formatting guidelines may result in a violation of the Act. The Delaware Notice of Violation of Fair Debt Act — Improper Document Appearance serves as a vital tool for individuals who believe that their rights under the FD CPA have been violated due to improper document appearance. This notice can help debtors seek remedies, such as potential legal action, and ensure that debt collectors adhere to the guidelines established by the Fair Debt Collection Practices Act.

Delaware Notice of Violation of Fair Debt Act — Improper Document Appearance is a legal notification that addresses the violation of the Fair Debt Collection Practices Act (FD CPA) by a debt collector in the state of Delaware. This notice pertains specifically to the improper appearance or formatting of the documents provided by the debt collector during the debt collection process. When it comes to the Delaware Notice of Violation of Fair Debt Act — Improper Document Appearance, there could be several types or instances of violations, including but not limited to: 1. Illegible or unclear documents: Debt collectors are required to provide clear and legible documentation to ensure that the borrower can understand the details of the debt being collected upon. If the documents are difficult to read, poorly photocopied, or contain blurred or faded text, it may constitute a violation. 2. Inconsistent formatting: The FD CPA mandates that the debt collection documents should be presented in a clear and consistent format. If the debt collector changes font styles, sizes, or layout across different sections of the document, it may be considered a violation of the Act. 3. Omission or alteration of required information: Debt collectors must accurately provide all the necessary information concerning the debt being collected. If any vital details are missing or altered, such as the debtor's name, account number, outstanding balance, or the name of the original creditor, it can be seen as a violation of the Fair Debt Collection Practices Act. 4. Unauthorized use of official letterhead or logos: The use of official government letterhead, logos, or symbols without proper authorization is strictly prohibited. Debt collectors must refrain from creating an impression that their collection efforts are endorsed or affiliated with any governmental entity or agency. 5. Misrepresentation of legal consequences: Debt collectors must not misrepresent the potential legal consequences of failing to pay a debt. If the documents include misleading language or false threats of legal action, it is a violation of the Act. 6. Non-compliance with specified formatting requirements: The Fair Debt Collection Practices Act outlines certain requirements for debt collection notices, including the size and type of font, formatting style, and placement of relevant information. Failure to adhere to these specified formatting guidelines may result in a violation of the Act. The Delaware Notice of Violation of Fair Debt Act — Improper Document Appearance serves as a vital tool for individuals who believe that their rights under the FD CPA have been violated due to improper document appearance. This notice can help debtors seek remedies, such as potential legal action, and ensure that debt collectors adhere to the guidelines established by the Fair Debt Collection Practices Act.