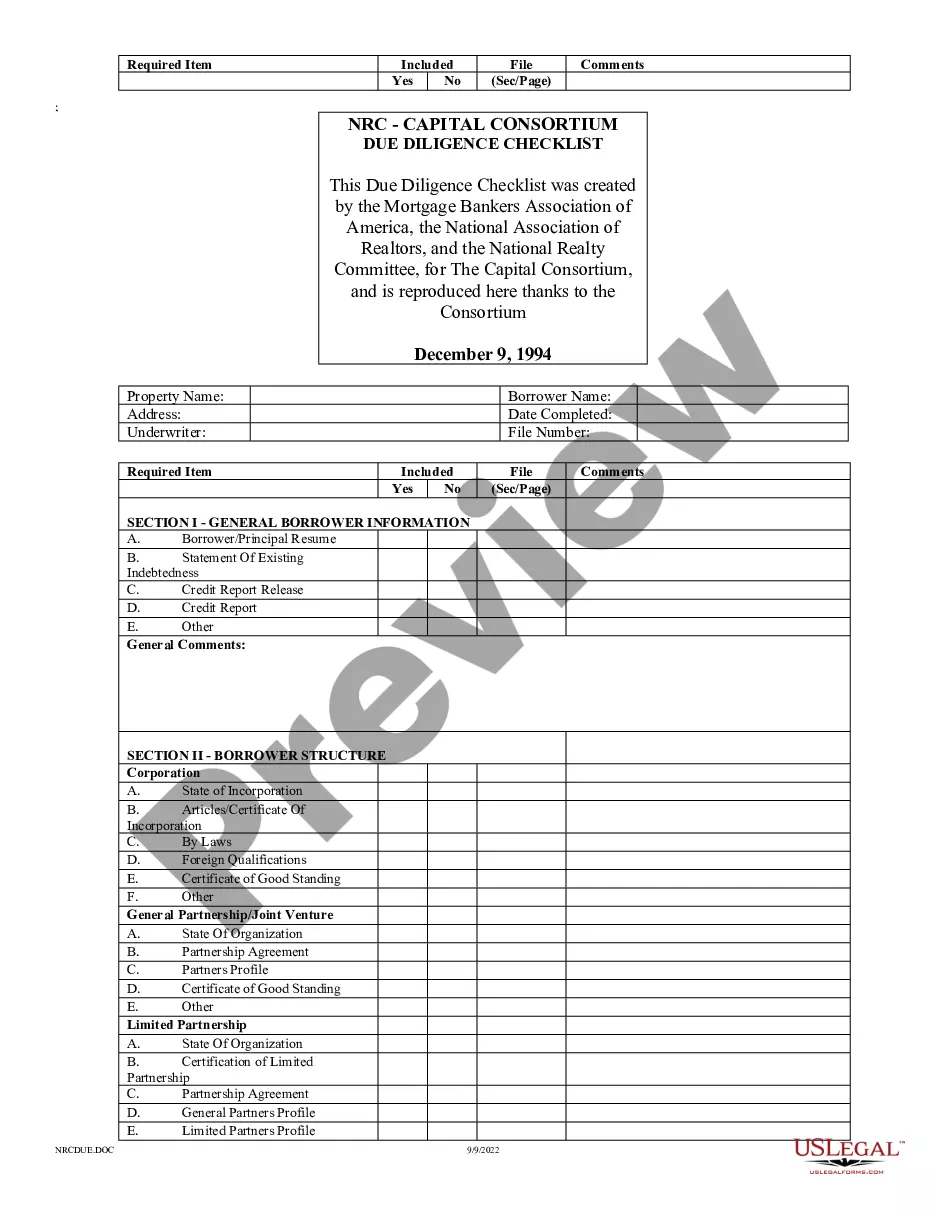

"Capital Consortium Due Diligence Checklist" is a American Lawyer Media form. This form is a checklist that was created by the Mortgage Bankers Association of America, the National Association of Realtors, and the National Realty Committee, for The Capital Consortium.

Delaware Capital Consortium Due Diligence Checklist is a comprehensive tool designed to guide investors, lenders, and financial institutions through the process of conducting due diligence for potential investment opportunities in Delaware. This checklist is invaluable for assessing the viability, stability, and profitability of a target company or project before committing substantial financial resources. The Delaware Capital Consortium Due Diligence Checklist encompasses various key areas to scrutinize, ensuring a thorough analysis of the investment opportunity. It covers legal, financial, operational, and strategic aspects, allowing investors to make informed decisions. By adhering to this checklist, individuals can mitigate risks and identify any areas of concern that may hinder the success of a venture. In terms of different types, there may be variations of the Delaware Capital Consortium Due Diligence Checklist, tailored to specific industries or investment types. For example, there could be an industry-specific checklist for technology startups, real estate developments, or healthcare ventures. Each type would address industry-specific considerations, regulations, and market dynamics. The checklist commences with a legal assessment, reviewing legal contracts, agreements, and licenses to ensure compliance and identify any potential legal risks. It also examines the company's ownership structure and conducts background checks on key personnel. Financial due diligence is another crucial section of the checklist. It scrutinizes financial statements, tax records, cash flow reports, and balance sheets to evaluate the target company's financial health, profitability, and growth potential. This section may also involve analyzing any outstanding debts, loans, or pending litigation. Operational due diligence is undertaken to assess the efficiency and effectiveness of a company's operational processes, supply chain management, and production capabilities. This includes evaluating the quality of products or services offered, reviewing customer satisfaction levels, and analyzing the competitive landscape. Strategic due diligence is equally vital and involves examining the target company's market positioning, competitive advantages, and growth prospects. This section often entails conducting market research, analyzing industry trends, and assessing the target company's competitive landscape. In conclusion, the Delaware Capital Consortium Due Diligence Checklist is a comprehensive tool for thoroughly evaluating investment opportunities in Delaware. By conducting a detailed assessment of legal, financial, operational, and strategic aspects, investors can make informed decisions and minimize risks. While various industries may require tailored versions of the checklist, the underlying principles remain consistent across different types of due diligence checklists.Delaware Capital Consortium Due Diligence Checklist is a comprehensive tool designed to guide investors, lenders, and financial institutions through the process of conducting due diligence for potential investment opportunities in Delaware. This checklist is invaluable for assessing the viability, stability, and profitability of a target company or project before committing substantial financial resources. The Delaware Capital Consortium Due Diligence Checklist encompasses various key areas to scrutinize, ensuring a thorough analysis of the investment opportunity. It covers legal, financial, operational, and strategic aspects, allowing investors to make informed decisions. By adhering to this checklist, individuals can mitigate risks and identify any areas of concern that may hinder the success of a venture. In terms of different types, there may be variations of the Delaware Capital Consortium Due Diligence Checklist, tailored to specific industries or investment types. For example, there could be an industry-specific checklist for technology startups, real estate developments, or healthcare ventures. Each type would address industry-specific considerations, regulations, and market dynamics. The checklist commences with a legal assessment, reviewing legal contracts, agreements, and licenses to ensure compliance and identify any potential legal risks. It also examines the company's ownership structure and conducts background checks on key personnel. Financial due diligence is another crucial section of the checklist. It scrutinizes financial statements, tax records, cash flow reports, and balance sheets to evaluate the target company's financial health, profitability, and growth potential. This section may also involve analyzing any outstanding debts, loans, or pending litigation. Operational due diligence is undertaken to assess the efficiency and effectiveness of a company's operational processes, supply chain management, and production capabilities. This includes evaluating the quality of products or services offered, reviewing customer satisfaction levels, and analyzing the competitive landscape. Strategic due diligence is equally vital and involves examining the target company's market positioning, competitive advantages, and growth prospects. This section often entails conducting market research, analyzing industry trends, and assessing the target company's competitive landscape. In conclusion, the Delaware Capital Consortium Due Diligence Checklist is a comprehensive tool for thoroughly evaluating investment opportunities in Delaware. By conducting a detailed assessment of legal, financial, operational, and strategic aspects, investors can make informed decisions and minimize risks. While various industries may require tailored versions of the checklist, the underlying principles remain consistent across different types of due diligence checklists.