Delaware Plan of Merger between two corporations

Description

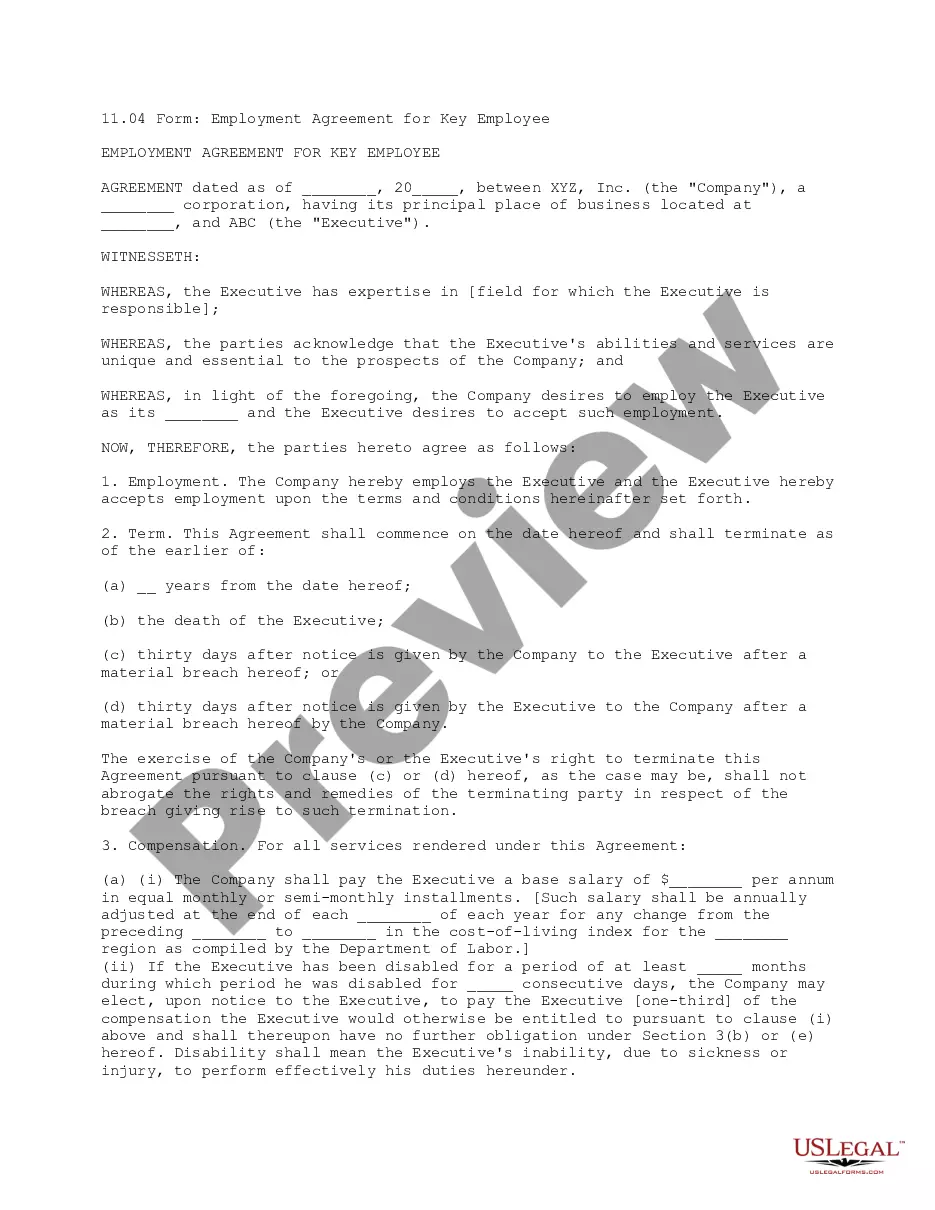

How to fill out Plan Of Merger Between Two Corporations?

If you have to comprehensive, obtain, or printing authorized record themes, use US Legal Forms, the greatest variety of authorized forms, which can be found on-line. Take advantage of the site`s easy and convenient research to find the documents you will need. Various themes for organization and person reasons are sorted by types and claims, or keywords. Use US Legal Forms to find the Delaware Plan of Merger between two corporations in just a number of click throughs.

When you are presently a US Legal Forms client, log in to your accounts and click the Download switch to find the Delaware Plan of Merger between two corporations. You can even entry forms you previously downloaded within the My Forms tab of your respective accounts.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Ensure you have chosen the shape for your proper area/region.

- Step 2. Take advantage of the Review solution to look over the form`s information. Never forget to read the explanation.

- Step 3. When you are unhappy with the kind, make use of the Research field on top of the monitor to locate other types in the authorized kind design.

- Step 4. Upon having identified the shape you will need, go through the Buy now switch. Choose the pricing program you like and add your references to sign up for the accounts.

- Step 5. Process the financial transaction. You can use your Мisa or Ьastercard or PayPal accounts to finish the financial transaction.

- Step 6. Find the format in the authorized kind and obtain it on your own device.

- Step 7. Complete, revise and printing or sign the Delaware Plan of Merger between two corporations.

Every authorized record design you get is your own for a long time. You may have acces to each kind you downloaded inside your acccount. Select the My Forms segment and decide on a kind to printing or obtain yet again.

Remain competitive and obtain, and printing the Delaware Plan of Merger between two corporations with US Legal Forms. There are thousands of skilled and state-certain forms you can utilize to your organization or person requirements.

Form popularity

FAQ

In general, appraisal rights (a/k/a dissenters' rights) under the DGCL grant a stockholder the right to an appraisal by the Delaware Court of Chancery of the fair value of the stockholder's shares of stock upon the occurrence of a merger or other similar transaction, subject to certain provisions.

A Delaware certificate of merger for the merger of a Delaware corporation and a Delaware LLC with the Delaware LLC as the surviving company. This Standard Document has integrated notes with important explanations and drafting tips. Certificate of Merger (DE): LLCs | Practical Law - Westlaw westlaw.com ? document ? Certificat... westlaw.com ? document ? Certificat...

§ 253. Merger of parent corporation and subsidiary corporation or corporations. (2) The terms and conditions of the merger shall obligate the surviving corporation to provide the agreement, and take the actions, required by § 252(d) of this title or § 258(c) of this title, as applicable. Title 8 - Delaware Code Online delaware.gov ? title8 delaware.gov ? title8

Merger of parent corporation and subsidiary corporation or corporations. (2) The terms and conditions of the merger shall obligate the surviving corporation to provide the agreement, and take the actions, required by § 252(d) of this title or § 258(c) of this title, as applicable.

(a) Any 2 or more corporations of this State may merge into a single surviving corporation, which may be any 1 of the constituent corporations or may consolidate into a new resulting corporation formed by the consolidation, pursuant to an agreement of merger or consolidation, as the case may be, complying and approved ...

Delaware law provides that the affirmative vote of a majority of the outstanding shares of common stock is generally required to merge with a Delaware company (DGCL, § 251).

The Certificate of Merger must be signed and acknowledged by each constituent other business entity as set forth in Sections 1113(g)(1) or (2), 3203(g)(1) or (2), 6019.1(f), 8019.1(g), 12540.1(g), 15911.14(a), 16915(b) or 17710.14(a). Certificate of Merger (Form OBE MERG) - CA.gov ca.gov ? forms ? obe-merger-gp ca.gov ? forms ? obe-merger-gp

Chapter 8 of the Delaware Code stipulates that the process of a Delaware corporate merger can be accomplished by filing a merger certificate in the office of the Secretary of State Delaware Secretary of State, or by writing the agreement of the USA company's merger. Delaware LLC Merger: Requirements, Advantages ... ondemandint.com ? blog ? delaware-llc-merger-g... ondemandint.com ? blog ? delaware-llc-merger-g...