A Delaware Trust Agreement is a legal document that establishes a trust relationship between Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. This agreement outlines the terms and conditions under which the trust assets are managed and distributed. The Delaware Trust Agreement is often used in the financial industry to protect and manage assets on behalf of clients. It serves as a framework for administering the trust and ensuring that the interests of all parties involved are safeguarded. The primary goal of this agreement is to provide clarity and guidance on how the trust assets will be managed, invested, and distributed. It outlines the roles and responsibilities of each party, such as Nike Securities, L.P. as the trust creator, The Chase Manhattan Bank as the trustee, and First Trust Advisors, L.P. as the investment advisor. This agreement includes provisions regarding the selection and appointment of trustees, the powers and duties of the trustee, investment guidelines, and reporting requirements. It also addresses the terms and conditions for the distribution of trust income and principal, the manner of handling disputes, and potential amendments to the agreement. Different types of Delaware Trust Agreements between Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. may include: 1. Revocable Trust Agreement: This type of trust agreement allows the trust creator (Nike Securities, L.P.) to modify or revoke the trust during their lifetime. It offers flexibility and the ability to make changes as circumstances evolve. 2. Irrevocable Trust Agreement: In contrast to the revocable trust, an irrevocable trust agreement cannot be modified or revoked without the consent of all parties involved. This type of agreement provides more certainty and asset protection. 3. Charitable Trust Agreement: A charitable trust agreement is created with the intention of benefiting a charitable organization or public interest cause. It allows Nike Securities, L.P. to distribute assets to designated charities while enjoying potential tax benefits. 4. Testamentary Trust Agreement: This type of trust agreement goes into effect after the trust creator's death and is specified in their will. It ensures that assets are managed and distributed according to their wishes. These are some different types of Delaware Trust Agreements that may exist between Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. Each agreement is tailored to the specific needs and goals of the parties involved, providing a clear framework for managing trust assets.

Delaware Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.

Description

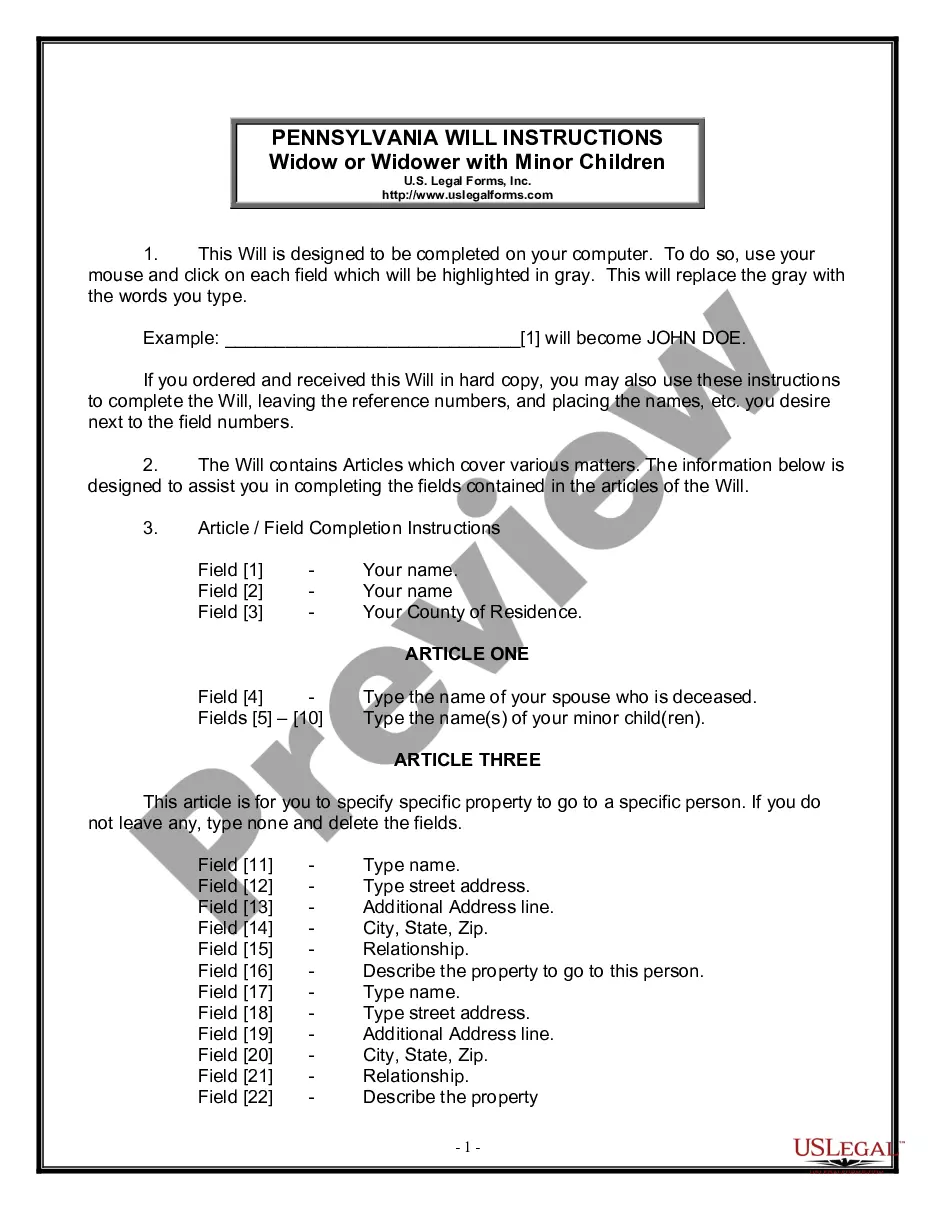

How to fill out Delaware Trust Agreement Between Nike Securities, L.P., The Chase Manhattan Bank And First Trust Advisors, L.P.?

US Legal Forms - among the biggest libraries of legitimate varieties in the USA - offers a variety of legitimate record themes you can acquire or produce. Using the website, you may get a large number of varieties for enterprise and person purposes, categorized by groups, suggests, or keywords.You can find the latest versions of varieties just like the Delaware Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. within minutes.

If you already have a subscription, log in and acquire Delaware Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. through the US Legal Forms catalogue. The Download switch can look on each type you view. You have access to all previously saved varieties from the My Forms tab of your respective profile.

In order to use US Legal Forms initially, listed below are straightforward recommendations to get you started out:

- Be sure you have selected the right type for your town/region. Go through the Preview switch to analyze the form`s information. Browse the type outline to actually have chosen the correct type.

- When the type doesn`t match your demands, use the Lookup discipline on top of the monitor to obtain the the one that does.

- If you are content with the form, verify your selection by visiting the Buy now switch. Then, select the costs program you favor and provide your accreditations to register for an profile.

- Approach the deal. Utilize your credit card or PayPal profile to finish the deal.

- Pick the format and acquire the form on the gadget.

- Make changes. Load, revise and produce and signal the saved Delaware Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P..

Each format you put into your money lacks an expiration day and it is your own for a long time. So, in order to acquire or produce one more copy, just proceed to the My Forms area and click on around the type you need.

Obtain access to the Delaware Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. with US Legal Forms, one of the most comprehensive catalogue of legitimate record themes. Use a large number of expert and state-distinct themes that satisfy your organization or person requirements and demands.