Delaware ATM Service Agreement pertains to a legally binding document that outlines the terms and conditions between a financial institution and a client (either an individual or a business) for accessing and utilizing ATM services in Delaware. The agreement serves as a crucial tool in ensuring a smooth and secure interaction between the client and the financial institution. The Delaware ATM Service Agreement delineates the rights, responsibilities, and obligations of both parties involved, thereby establishing a transparent framework for ATM usage. It typically covers aspects like account access, transaction limits, fees and charges, security protocols, dispute resolution, and equipment maintenance. This agreement serves as a protective measure for both the financial institution and the client, ensuring the facilitation of reliable, accessible, and convenient ATM services. Different types of Delaware ATM Service Agreements might exist, customized to cater to various stakeholders or specific ATM service offerings: 1. Individual ATM Service Agreement: This type of agreement is designed to address the needs and requirements of individual clients who hold personal accounts with the financial institution. It outlines terms specific to individual usage patterns, withdrawal limits, account access, and associated fees. 2. Business ATM Service Agreement: Aimed at businesses, this agreement provides terms and conditions for companies or organizations that utilize ATM services for their financial operations. It may include additional features like cash management, multiple user access, or integration with business accounting systems. 3. ATM Network Service Agreement: In cases where a financial institution forms alliances or partnerships with other banks or ATM networks, this agreement outlines the terms and responsibilities of all participating entities. It helps regulate ATM sharing, interoperability, and transaction settlement processes across different networks or financial institutions. Regardless of the specific type, Delaware ATM Service Agreements are vital to foster trust, security, and efficiency in ATM operations. These agreements ensure compliance with applicable laws and regulations while providing a framework for resolving disputes and meeting the needs of both the financial institution and its clients.

Delaware ATM Service Agreement

Description

How to fill out Delaware ATM Service Agreement?

It is possible to spend several hours on-line attempting to find the authorized record format that suits the state and federal requirements you require. US Legal Forms gives a large number of authorized kinds that are examined by professionals. You can actually download or printing the Delaware ATM Service Agreement from our service.

If you already possess a US Legal Forms accounts, you are able to log in and then click the Down load option. After that, you are able to total, modify, printing, or signal the Delaware ATM Service Agreement. Each and every authorized record format you get is your own property for a long time. To obtain an additional version for any obtained form, visit the My Forms tab and then click the related option.

Should you use the US Legal Forms site the very first time, keep to the basic instructions beneath:

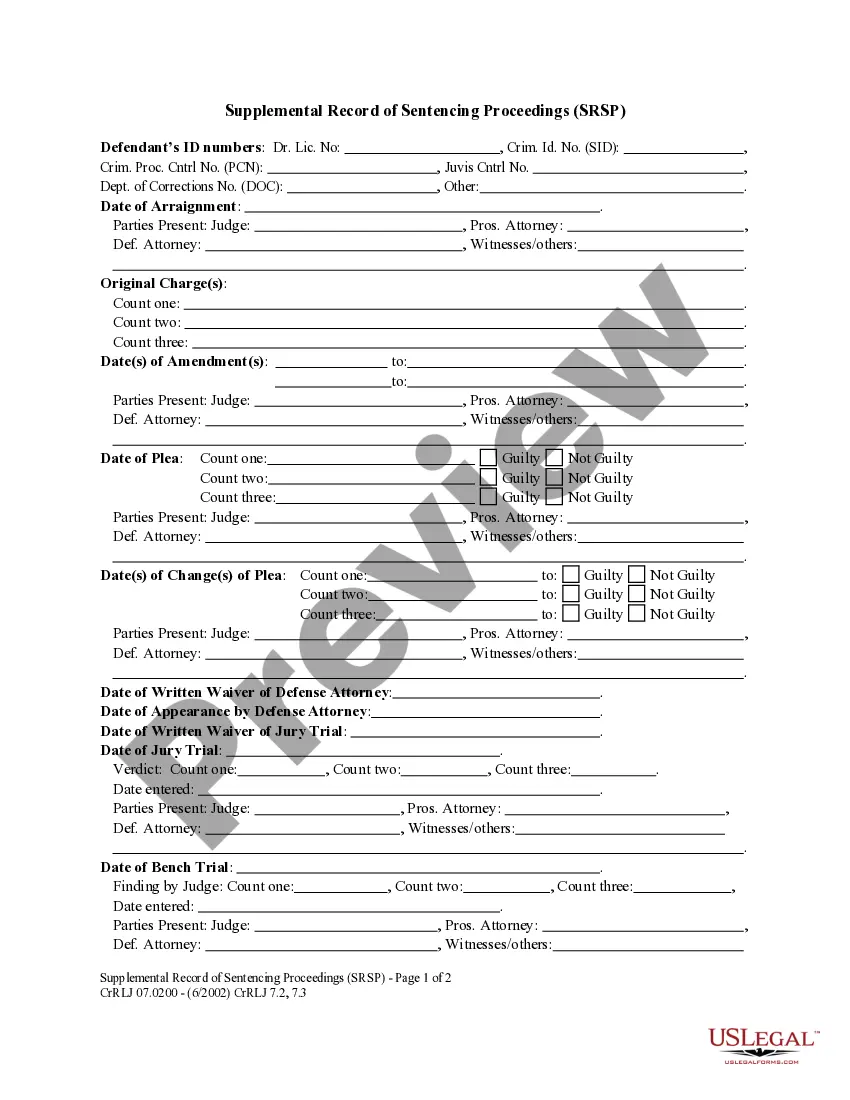

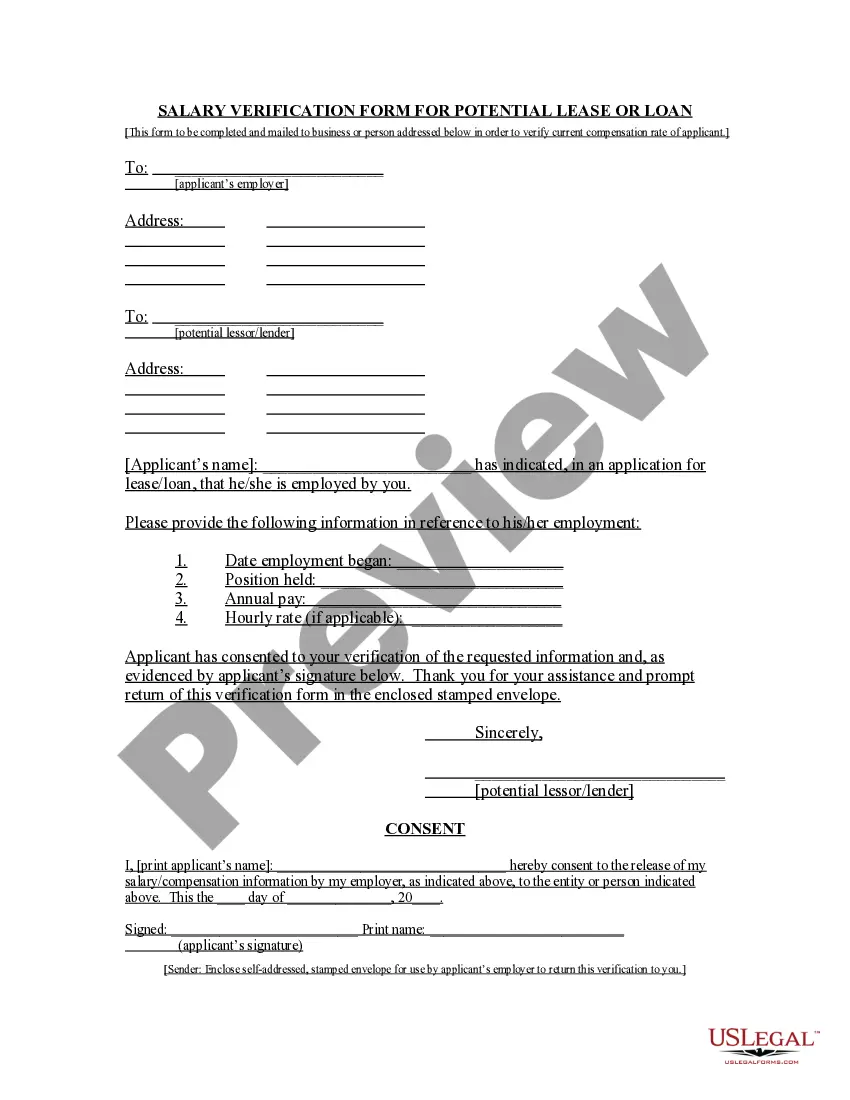

- Very first, make certain you have selected the best record format to the region/city of your liking. Read the form outline to ensure you have chosen the correct form. If accessible, use the Review option to appear through the record format too.

- In order to find an additional edition in the form, use the Research area to obtain the format that suits you and requirements.

- When you have found the format you want, simply click Purchase now to move forward.

- Find the pricing plan you want, type your credentials, and register for a merchant account on US Legal Forms.

- Comprehensive the deal. You may use your charge card or PayPal accounts to pay for the authorized form.

- Find the file format in the record and download it to the gadget.

- Make adjustments to the record if needed. It is possible to total, modify and signal and printing Delaware ATM Service Agreement.

Down load and printing a large number of record layouts using the US Legal Forms website, which provides the biggest collection of authorized kinds. Use skilled and condition-certain layouts to handle your organization or individual demands.

Form popularity

FAQ

As an owner of an ATM machine you make money each time a customer uses your ATM to take out cash. A convenience fee or charge is placed on the machine and you collect that fee and are paid on a daily basis. Here is a complete starter guide of how to make money and build your ATM Business.

The ATM processing agreement lists your rights and obligations as the ATM owner as well as the rights and obligations of the ATM processor. This will be the legal contract between you and the ATM processor that runs your ATM machine program. This contract also ensures your payment as agreed upon.

Those seven elements are: Identification (Defining all the parties involved) Offer (The agreement) Acceptance (Agreement mirrored by other parties) Mutual consent (Signatory consent of all parties) Consideration (The value exchanged for the offer) Capacity (Legal/mental competence of all parties)

How to Write an ATM business plan? Executive Summary. An executive summary is the first section of the business plan intended to provide an overview of the whole business plan. ... Business Overview. ... Market Analysis. ... Products And Services. ... Sales And Marketing Strategies. ... Operations Plan. ... Management Team. ... Financial Plan.

An ATM agreement or ?at-the-market? (?ATM?) agreement is one in which newly issued securities are sold at a price related to the current market price of the securities. The continuous offerings mechanism provides a flexible way for issuers to raise modest amounts of capital with minimal market impact.

The contract should specify the location where the ATM will be installed and the responsibilities of each party related to the installation, maintenance, and repair of the machine. This may include requirements for electrical and phone line connections and any necessary permits or approvals.

As well as budgeting for the initial cost, you'll also need to consider how much cash you need for it. For example, average retail ATM machines go through between $6,000 to $8,000 per month, meaning you need between $1,500 and $3,000 per week.

The ATM processing agreement lists your rights and obligations as the ATM owner as well as the rights and obligations of the ATM processor. This will be the legal contract between you and the ATM processor that runs your ATM machine program. This contract also ensures your payment as agreed upon.