Delaware Bylaws of Mitchell Hutchins Securities Trust is a set of rules and regulations that govern the operations and activities of the trust. These bylaws outline the rights, responsibilities, and procedures that need to be followed by the board of trustees, officers, and other personnel associated with the Mitchell Hutchins Securities Trust, a Delaware-based entity. The bylaws specify the structure and composition of the board of trustees, including the process of electing or appointing trustees, their terms of office, and their qualifications. They also set forth the powers and duties of the board, such as overseeing the investment management process, establishing investment strategies, and making decisions related to the trust's assets. Furthermore, the bylaws cover various administrative aspects, including the scheduling of board meetings, the quorum required for decision-making, and the procedures for voting and record-keeping. They may also define the roles and responsibilities of officers, such as the chairperson, treasurer, secretary, and other individuals involved in managing the trust's affairs. These bylaws serve as a framework for ensuring transparency, accountability, and fairness within the Mitchell Hutchins Securities Trust. They establish protocols for conflict resolution, fiduciary responsibilities, and compliance with applicable laws and regulations. While the specific content of Delaware Bylaws of Mitchell Hutchins Securities Trust may vary based on the trust's unique circumstances and requirements, some possible variations may include: 1. Investment Guidelines Bylaws: These bylaws may outline specific investment strategies, including asset allocation, risk management, and limitations on investment types or sectors, to guide the trust's portfolio management process. 2. Distribution Policies Bylaws: These bylaws can define the procedures and criteria for distributing income, dividends, or capital gains to beneficiaries or unit holders of the trust. 3. Governance and Nomination Bylaws: These bylaws may detail the process for nominating and electing trustees, establishing board committees, and defining their respective roles and responsibilities. 4. Amendment and Termination Bylaws: These bylaws might explain the procedures and requirements for amending or terminating the trust, including obtaining the necessary approvals from the board or beneficiaries. It is important to note that the specific nature and extent of the bylaws will depend on the particular trust's objectives, structure, and legal requirements. Compliance with Delaware state laws and regulations is crucial in the development and implementation of these bylaws to ensure the smooth and efficient functioning of Mitchell Hutchins Securities Trust.

Delaware Bylaws of Mitchell Hutchins Securities Trust

Description

How to fill out Delaware Bylaws Of Mitchell Hutchins Securities Trust?

You are able to invest hrs on the Internet searching for the lawful papers format which fits the state and federal specifications you need. US Legal Forms provides thousands of lawful types that happen to be examined by pros. You can easily acquire or printing the Delaware Bylaws of Mitchell Hutchins Securities Trust from the support.

If you have a US Legal Forms accounts, you can log in and click the Down load key. Following that, you can total, revise, printing, or sign the Delaware Bylaws of Mitchell Hutchins Securities Trust. Every single lawful papers format you purchase is your own permanently. To obtain an additional copy of any bought type, go to the My Forms tab and click the corresponding key.

If you are using the US Legal Forms internet site for the first time, follow the simple recommendations listed below:

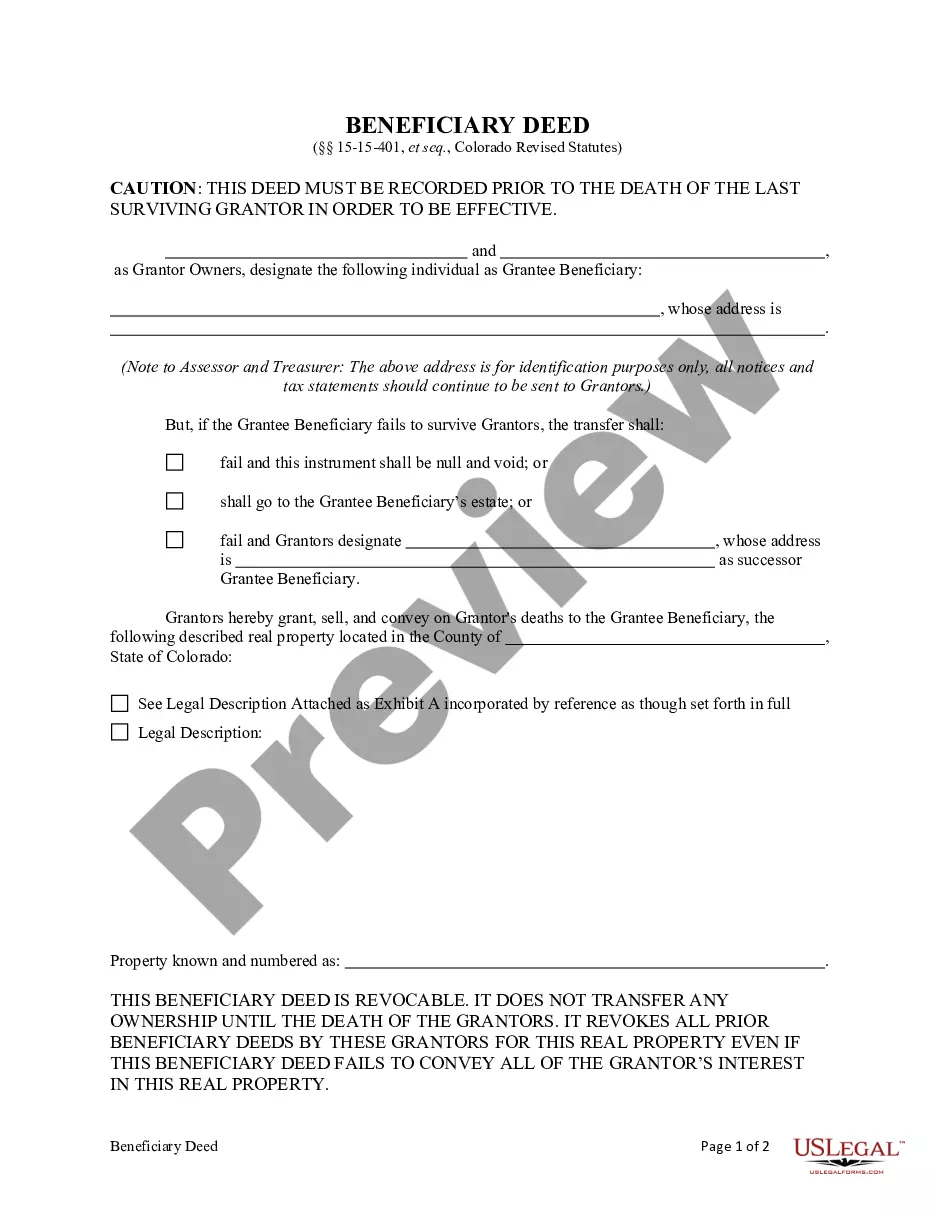

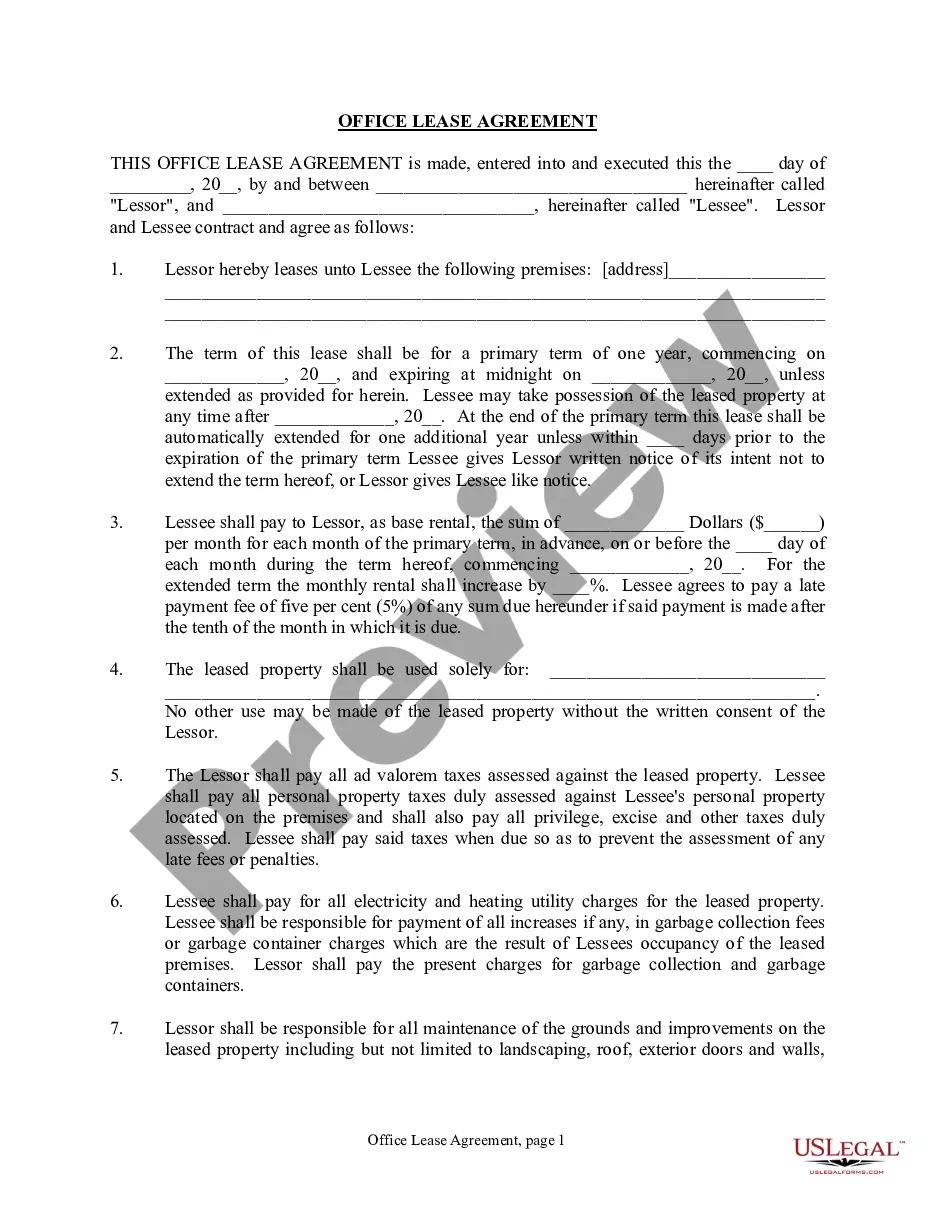

- Initial, ensure that you have selected the right papers format for the county/area of your choice. Look at the type information to ensure you have picked the proper type. If offered, make use of the Preview key to check from the papers format at the same time.

- If you would like discover an additional variation from the type, make use of the Search area to discover the format that meets your requirements and specifications.

- After you have identified the format you would like, click Acquire now to proceed.

- Find the pricing prepare you would like, key in your references, and register for a merchant account on US Legal Forms.

- Complete the purchase. You may use your charge card or PayPal accounts to pay for the lawful type.

- Find the format from the papers and acquire it to your gadget.

- Make modifications to your papers if required. You are able to total, revise and sign and printing Delaware Bylaws of Mitchell Hutchins Securities Trust.

Down load and printing thousands of papers layouts using the US Legal Forms website, that provides the biggest selection of lawful types. Use specialist and status-particular layouts to tackle your business or individual needs.