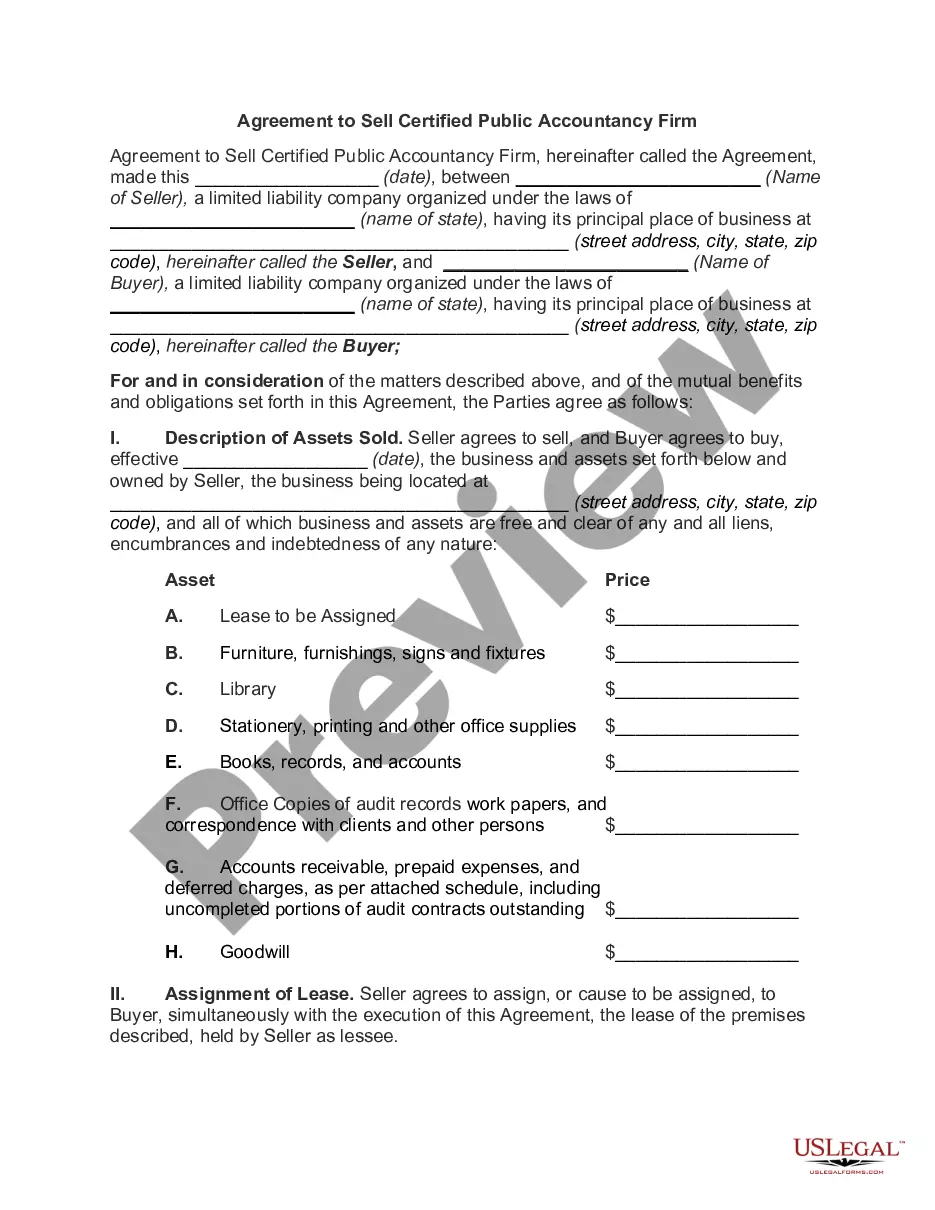

The Delaware Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation is a legally binding document that outlines the terms and conditions of the merger between the two companies. It is a comprehensive agreement that covers various aspects of the merger, including the transition of assets, liabilities, and operations. Keywords: Delaware Merger Agreement, Bay Micro Computers, Inc., BMC Acquisition Corporation, merger, terms and conditions, assets, liabilities, operations. There are different types of Delaware Merger Agreements that Bay Micro Computers, Inc. and BMC Acquisition Corporation may consider, depending on their specific needs and circumstances. Some common types include: 1. Statutory Merger: This type of agreement involves merging two or more corporations into a single merged entity. The surviving corporation assumes all the assets, liabilities, and operations of the merged entities. 2. Consolidation: In a consolidation agreement, two or more corporations pool their assets, liabilities, and operations to form a brand-new entity. Both companies cease to exist, and a new corporation is created. 3. Cash Merger: This type of agreement involves the acquiring company offering a cash payment to the shareholders of the target company in exchange for the ownership of their shares. The target company ceases to exist after the merger, and its shareholders become shareholders of the acquiring company. 4. Stock-for-Stock Merger: In a stock-for-stock merger agreement, the acquiring company offers its shares to the shareholders of the target company in exchange for their shares. This allows the shareholders of the target company to become shareholders of the acquiring company. 5. Asset Acquisition: In an asset acquisition agreement, the acquiring company purchases specific assets or business divisions of the target company. The target company retains its legal existence but transfers the identified assets to the acquiring company. These are just a few examples of the types of Delaware Merger Agreements that Bay Micro Computers, Inc. and BMC Acquisition Corporation may consider. The specific type of agreement will depend on their strategic goals, business objectives, and legal requirements. It is essential for both parties to seek legal counsel to ensure that the agreement meets all necessary legal and regulatory standards.

Delaware Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation

Description

How to fill out Delaware Merger Agreement Between Bay Micro Computers, Inc. And BMC Acquisition Corporation?

If you wish to total, acquire, or printing authorized document templates, use US Legal Forms, the greatest assortment of authorized varieties, which can be found on the web. Make use of the site`s simple and easy handy lookup to find the papers you require. Numerous templates for organization and specific uses are sorted by types and suggests, or keywords. Use US Legal Forms to find the Delaware Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation with a few click throughs.

If you are previously a US Legal Forms customer, log in for your accounts and click on the Obtain button to have the Delaware Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation. You can also access varieties you in the past saved in the My Forms tab of your accounts.

If you work with US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have selected the form for that proper city/region.

- Step 2. Utilize the Review method to look over the form`s articles. Don`t neglect to read through the information.

- Step 3. If you are not satisfied using the type, use the Lookup area on top of the display to find other models of your authorized type web template.

- Step 4. After you have discovered the form you require, click the Buy now button. Choose the pricing program you prefer and put your credentials to sign up for an accounts.

- Step 5. Method the deal. You can use your bank card or PayPal accounts to complete the deal.

- Step 6. Pick the file format of your authorized type and acquire it on your own system.

- Step 7. Total, change and printing or signal the Delaware Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation.

Each and every authorized document web template you get is your own property permanently. You possess acces to every type you saved in your acccount. Select the My Forms section and decide on a type to printing or acquire again.

Be competitive and acquire, and printing the Delaware Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation with US Legal Forms. There are many skilled and state-specific varieties you can use for the organization or specific requirements.