A Delaware Voting Agreement is a legal contract between Clear works Integration Services, United Computing Group, United Consulting Group, and Kevin Casey that governs the voting rights and obligations of the parties involved in the sale of outstanding common stock. It establishes the terms and conditions under which the stockholders agree to vote their shares in a specific manner during the sale process. The purpose of the Delaware Voting Agreement is to ensure that all parties act in a coordinated manner and vote in favor of the sale of outstanding common stock. By doing so, the agreement helps to streamline the decision-making process and facilitate the successful completion of the sale. The agreement typically includes provisions regarding the number of shares each party owns and their respective voting power, the specific terms of the sale transaction, and the conditions under which the agreement may be terminated or amended. It may also outline any shareholder rights or obligations related to the sale, such as restrictions on the transfer of shares or the requirement for approval by a certain percentage of shareholders. Different types of Delaware Voting Agreements may exist between Clear works Integration Services, United Computing Group, United Consulting Group, and Kevin Casey depending on the specific circumstances of the sale of outstanding common stock. Some possible variations or additional agreements may include: 1. Majority Voting Agreement: In this type of agreement, the parties may agree that a certain majority of votes is required to approve the sale. This can provide more certainty and minimizes the risk of a small minority blocking the transaction. 2. Lock-up Agreement: This agreement may include provisions that restrict the sale or transfer of shares by the parties involved for a certain period of time to maintain stability and prevent sudden market fluctuations. 3. Standstill Agreement: A standstill agreement may be included to prevent any party from taking actions that could interfere with the sale process or disrupt the negotiations. It typically prohibits activities such as acquiring additional shares, launching a hostile takeover bid, or soliciting proxies from other shareholders. 4. Tag-Along and Drag-Along Rights: These rights may be included to protect the interests of minority shareholders. Tag-along rights allow minority shareholders to participate in a sale transaction on the same terms and conditions as the majority shareholders, while drag-along rights allow majority shareholders to force minority shareholders to sell their shares if a certain threshold is reached. In summary, a Delaware Voting Agreement is a crucial component when selling outstanding common stock, as it establishes the rules and obligations for the parties involved. The specific type of agreement can vary depending on the circumstances and objectives of the parties, and may include variations such as majority voting, lock-up, standstill, tag-along, or drag-along provisions.

Delaware Voting Agreement between Clearworks Integration Services, United Computing Group, United Consulting Group, and Kevan Casey regarding sale of outstanding common stock

Description

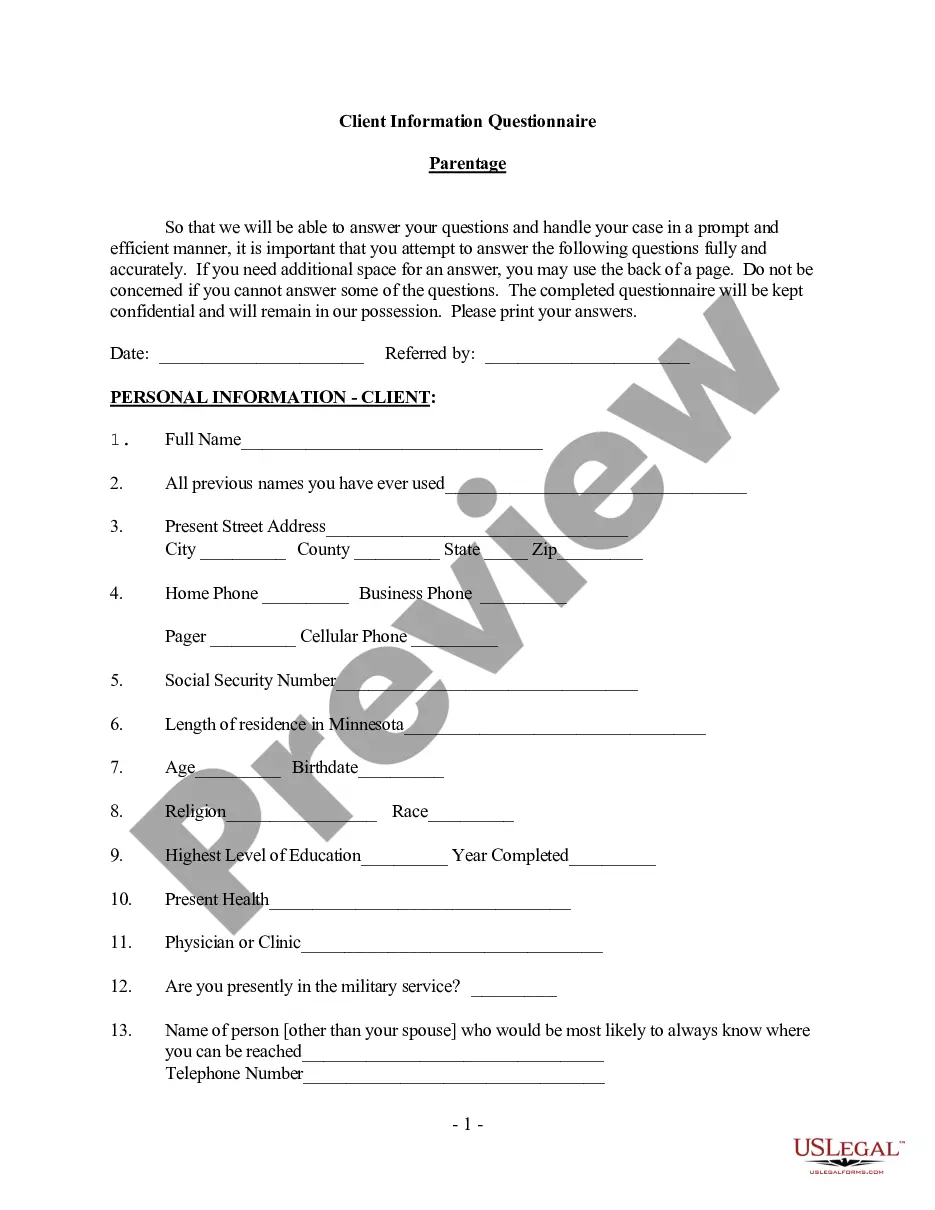

How to fill out Delaware Voting Agreement Between Clearworks Integration Services, United Computing Group, United Consulting Group, And Kevan Casey Regarding Sale Of Outstanding Common Stock?

Choosing the right legitimate record design can be quite a struggle. Naturally, there are a variety of templates available online, but how would you discover the legitimate kind you require? Make use of the US Legal Forms web site. The assistance offers a large number of templates, for example the Delaware Voting Agreement between Clearworks Integration Services, United Computing Group, United Consulting Group, and Kevan Casey regarding sale of outstanding common stock, which you can use for company and personal needs. All the kinds are examined by specialists and meet state and federal demands.

When you are currently authorized, log in in your profile and click the Acquire option to obtain the Delaware Voting Agreement between Clearworks Integration Services, United Computing Group, United Consulting Group, and Kevan Casey regarding sale of outstanding common stock. Use your profile to appear throughout the legitimate kinds you have ordered earlier. Proceed to the My Forms tab of the profile and acquire yet another version from the record you require.

When you are a whole new consumer of US Legal Forms, listed here are basic recommendations for you to adhere to:

- Initial, ensure you have selected the proper kind to your metropolis/county. You may check out the shape using the Review option and look at the shape information to guarantee it is the right one for you.

- In the event the kind is not going to meet your expectations, use the Seach area to get the correct kind.

- When you are certain the shape would work, click on the Get now option to obtain the kind.

- Select the costs plan you would like and type in the essential info. Make your profile and purchase your order with your PayPal profile or credit card.

- Choose the data file file format and acquire the legitimate record design in your system.

- Comprehensive, edit and print and indicator the obtained Delaware Voting Agreement between Clearworks Integration Services, United Computing Group, United Consulting Group, and Kevan Casey regarding sale of outstanding common stock.

US Legal Forms is definitely the biggest local library of legitimate kinds for which you will find various record templates. Make use of the company to acquire skillfully-produced papers that adhere to express demands.