Delaware Stock Option Agreement of Quantum Effect Devices, Inc.

Description

How to fill out Stock Option Agreement Of Quantum Effect Devices, Inc.?

You may devote hrs on the Internet searching for the authorized document template that meets the state and federal demands you require. US Legal Forms gives 1000s of authorized kinds which are examined by pros. It is possible to down load or print out the Delaware Stock Option Agreement of Quantum Effect Devices, Inc. from my service.

If you already possess a US Legal Forms accounts, it is possible to log in and click on the Download key. Next, it is possible to comprehensive, edit, print out, or indicator the Delaware Stock Option Agreement of Quantum Effect Devices, Inc.. Every single authorized document template you purchase is yours for a long time. To obtain an additional duplicate of the purchased develop, visit the My Forms tab and click on the corresponding key.

If you use the US Legal Forms website initially, follow the basic guidelines beneath:

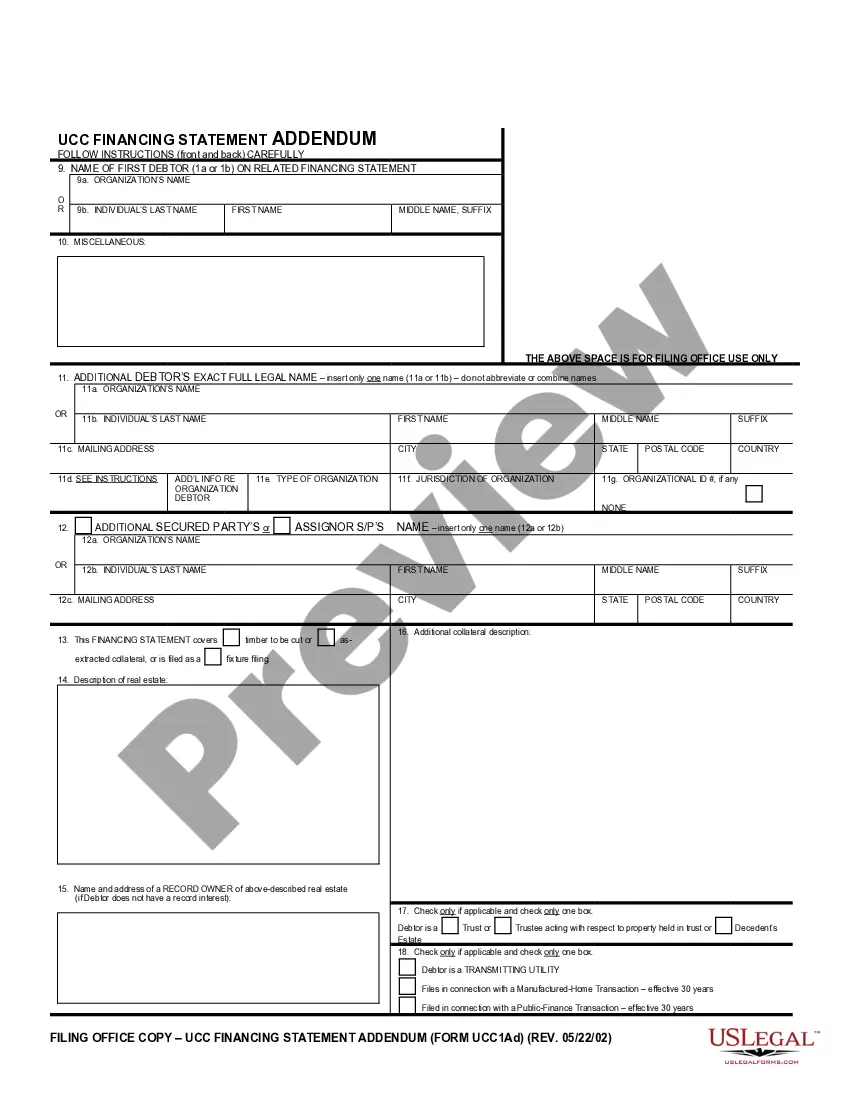

- Very first, ensure that you have selected the right document template to the county/town of your choice. Read the develop explanation to make sure you have picked the right develop. If readily available, make use of the Preview key to look from the document template at the same time.

- In order to find an additional model in the develop, make use of the Search discipline to get the template that suits you and demands.

- After you have identified the template you need, just click Purchase now to move forward.

- Select the prices plan you need, enter your credentials, and sign up for your account on US Legal Forms.

- Full the deal. You may use your charge card or PayPal accounts to pay for the authorized develop.

- Select the structure in the document and down load it for your device.

- Make modifications for your document if needed. You may comprehensive, edit and indicator and print out Delaware Stock Option Agreement of Quantum Effect Devices, Inc..

Download and print out 1000s of document web templates utilizing the US Legal Forms Internet site, which provides the biggest collection of authorized kinds. Use expert and status-particular web templates to deal with your small business or person requires.