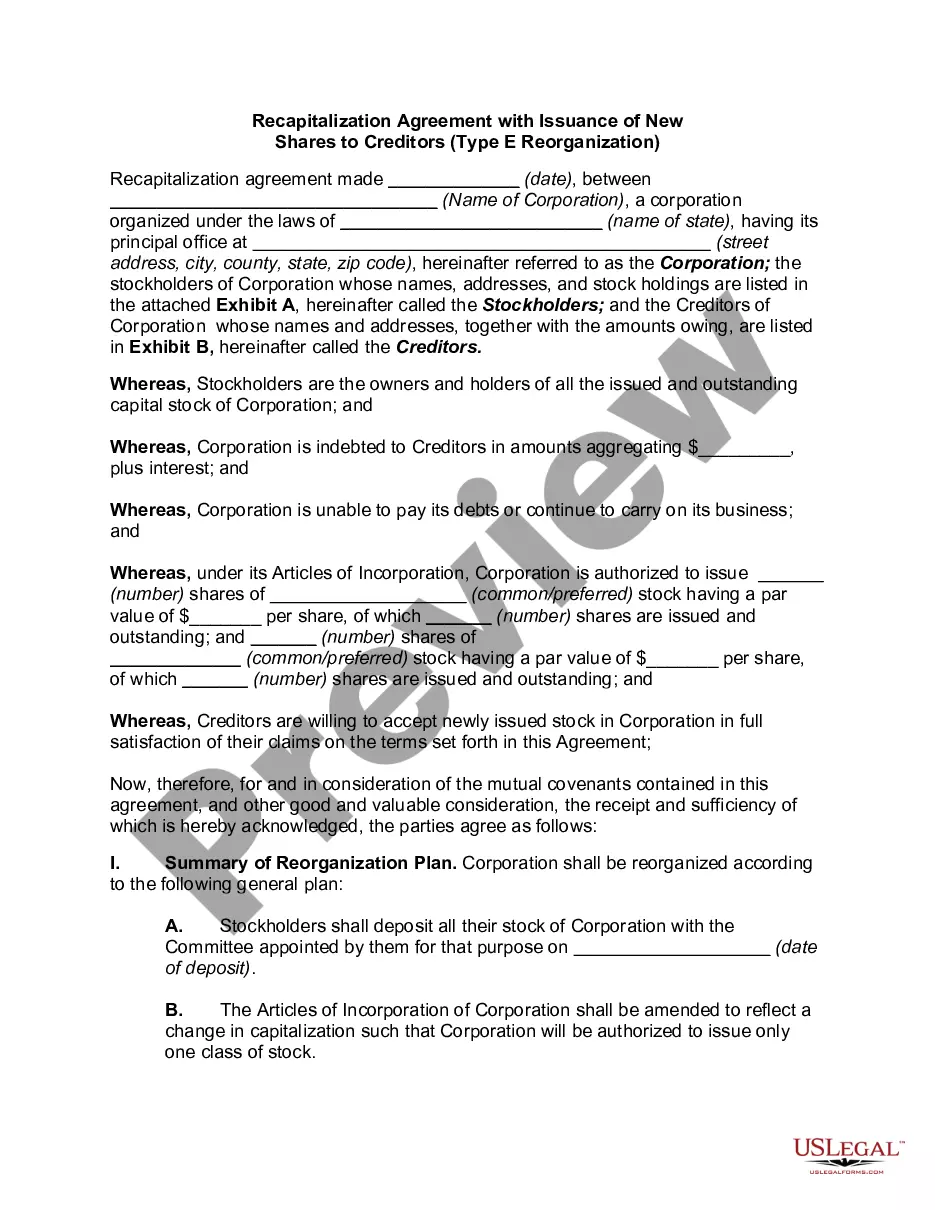

Delaware Recapitalization Agreement

Description

How to fill out Recapitalization Agreement?

Are you currently in a place that you require files for either business or person uses almost every time? There are a variety of lawful document templates accessible on the Internet, but discovering versions you can rely on is not simple. US Legal Forms delivers a huge number of type templates, like the Delaware Recapitalization Agreement, that are created to satisfy state and federal demands.

When you are already acquainted with US Legal Forms site and get a free account, basically log in. After that, you may down load the Delaware Recapitalization Agreement template.

Unless you come with an bank account and want to start using US Legal Forms, follow these steps:

- Discover the type you require and make sure it is for your proper city/state.

- Take advantage of the Review switch to examine the form.

- Look at the explanation to actually have chosen the correct type.

- In the event the type is not what you are searching for, use the Search area to get the type that fits your needs and demands.

- If you obtain the proper type, click Get now.

- Pick the rates strategy you desire, submit the specified info to create your money, and pay for your order with your PayPal or Visa or Mastercard.

- Decide on a convenient data file formatting and down load your duplicate.

Locate all of the document templates you may have purchased in the My Forms food selection. You may get a additional duplicate of Delaware Recapitalization Agreement any time, if necessary. Just select the needed type to down load or print the document template.

Use US Legal Forms, by far the most substantial selection of lawful forms, to save efforts and avoid errors. The services delivers appropriately created lawful document templates that can be used for an array of uses. Produce a free account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

How to Make Stock Amendments Hold an internal company meeting and have any changes approved by the company's appropriate authorities. Prepare a Certificate of Amendment for the Delaware Secretary of State's office. ... Have the document signed by an Authorized Officer of the company. File the certificate with the state.

Recapitalization is the restructuring of a company's debt and equity ratio. The purpose of recapitalization is to stabilize a company's capital structure. Some of the reasons a company may consider recapitalization include a drop in its share price, to defend against a hostile takeover, or bankruptcy.

Under Delaware law, any changes to the certificate of incorporation must be agreed to by a majority of shareholders. Companies must call a meeting of the board of directors and open a discussion about the proposed change.

Unless the certificate of incorporation or bylaws of a professional corporation, or a separate contract among all of the shareholders of the professional corporation, provides otherwise for the manner in which such sale or transfer of shares as permitted under this section is to take place, the sale or transfer may be ...

Section 203 is an antitakeover statute in Delaware which provides that if a person or entity (an ?interested stockholder?) acquires 15% or more of the voting stock of a Delaware corporation (the ?target?) without prior approval of the target's board, then the interested stockholder may not engage in a business ...

In a general Delaware corporation, you can easily issue shares to outsiders of the company in exchange for funding. A corporation gets a list of authorized stock when the company is incorporated, from which you can then issue the shares from. Shares of stock are the units of equity ownership in a corporation.