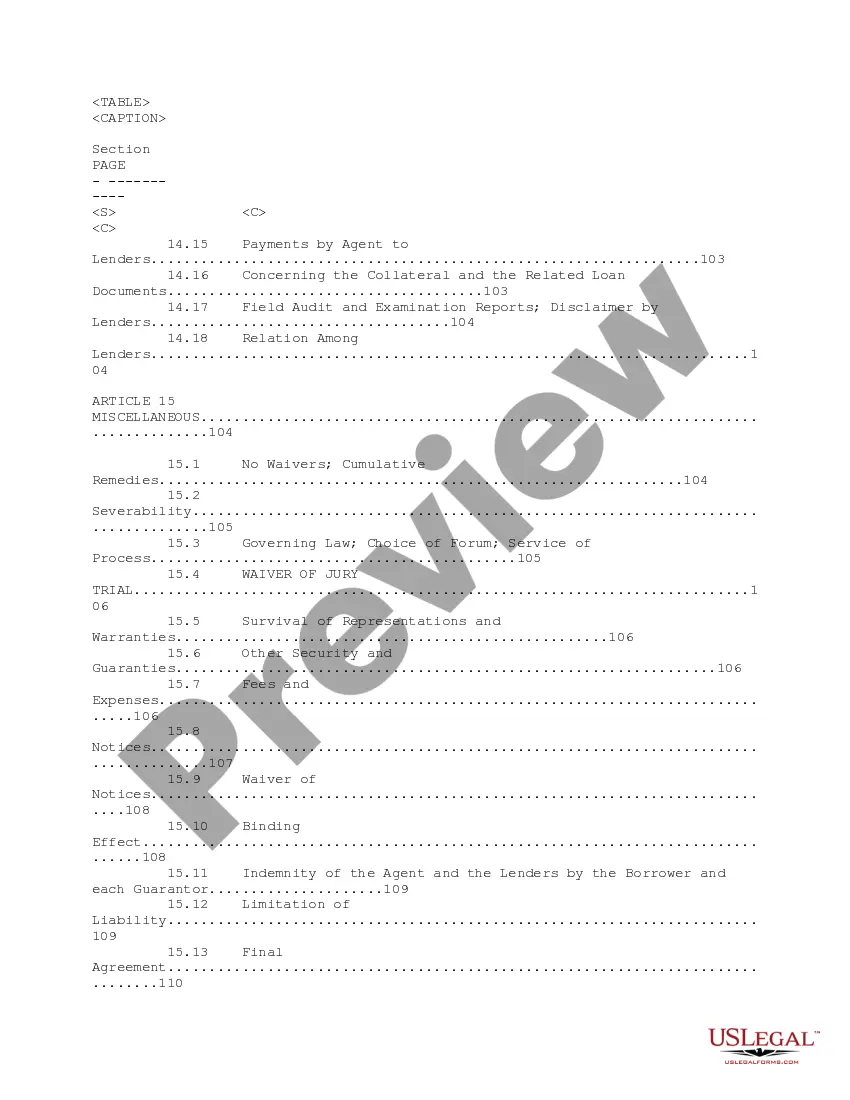

Title: Exploring Delaware Post-Petition Loan and Security Agreement for Revolving Line of Credit: A Comprehensive Overview Description: Delaware has gained recognition as a hub for financial agreements, especially revolving lines of credit, which empower businesses to meet their ongoing financial needs. This article sheds light on the Delaware Post-Petition Loan and Security Agreement, a vital instrument employed by various financial institutions in managing revolving credit facilities. What is a Post-Petition Loan and Security Agreement? A Delaware Post-Petition Loan and Security Agreement refers to an agreement executed between different financial institutions and parties involved in a bankruptcy case. It enables the debtor, post-filing for a bankruptcy petition, to obtain additional funds known as "post-petition loans" while providing the lender security interests over the debtor’s collateral. This agreement is commonly used within the context of revolving lines of credit, offering borrowers ongoing access to quick funds. Key Features and Clauses: 1. Parties Involved: The agreement typically involves the debtor (the borrower), the lenders (financial institutions), and any potential guarantors/agencies facilitating the process. 2. Revolving Line of Credit: The agreement establishes a revolving line of credit, allowing the debtor to access funds whenever necessary. Unlike traditional loans, borrowers have the flexibility to borrow, repay, and re-borrow from the established credit limit during the agreed-upon period. 3. Post-Petition Loans: This refers to additional funds accessible to the debtor after filing for bankruptcy. The agreement sets guidelines for the availability, disbursement, and limits of post-petition loans, often subject to court approval. 4. Security Interests: The lenders are granted security interests over specific collateral, typically including the debtor's assets, accounts receivable, inventory, real estate, and intellectual property rights. This ensures repayment should the debtor default on the loan. Types of Delaware Post-Petition Loan and Security Agreements: While the Delaware Post-Petition Loan and Security Agreement itself outlines the general terms, several variations exist based on factors such as the specific financial institution involved, the industry, or the debtor's unique circumstances. Some notable types include: 1. Bank Post-Petition Loan and Security Agreement: Involving traditional banks, this type focuses on businesses seeking additional funds to effectively manage their operations during a bankruptcy scenario. 2. Private Equity Post-Petition Loan and Security Agreement: This form of agreement involves private equity firms that provide post-petition financing solutions to businesses undergoing bankruptcy, aiming to restructure and optimize existing operations. 3. Hedge Fund Post-Petition Loan and Security Agreement: Hedge funds often play a role in providing post-petition loans to distressed debtor entities, seeking potential high-yield opportunities through such agreements. Overall, the Delaware Post-Petition Loan and Security Agreement caters to various financial institutions, enabling them to provide flexible funding solutions while protecting their interests. By further exploring the specific types mentioned or analyzing context-specific agreements, businesses can navigate bankruptcy scenarios more effectively, leveraging the opportunities offered by revolving lines of credit.

Delaware Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit

Description

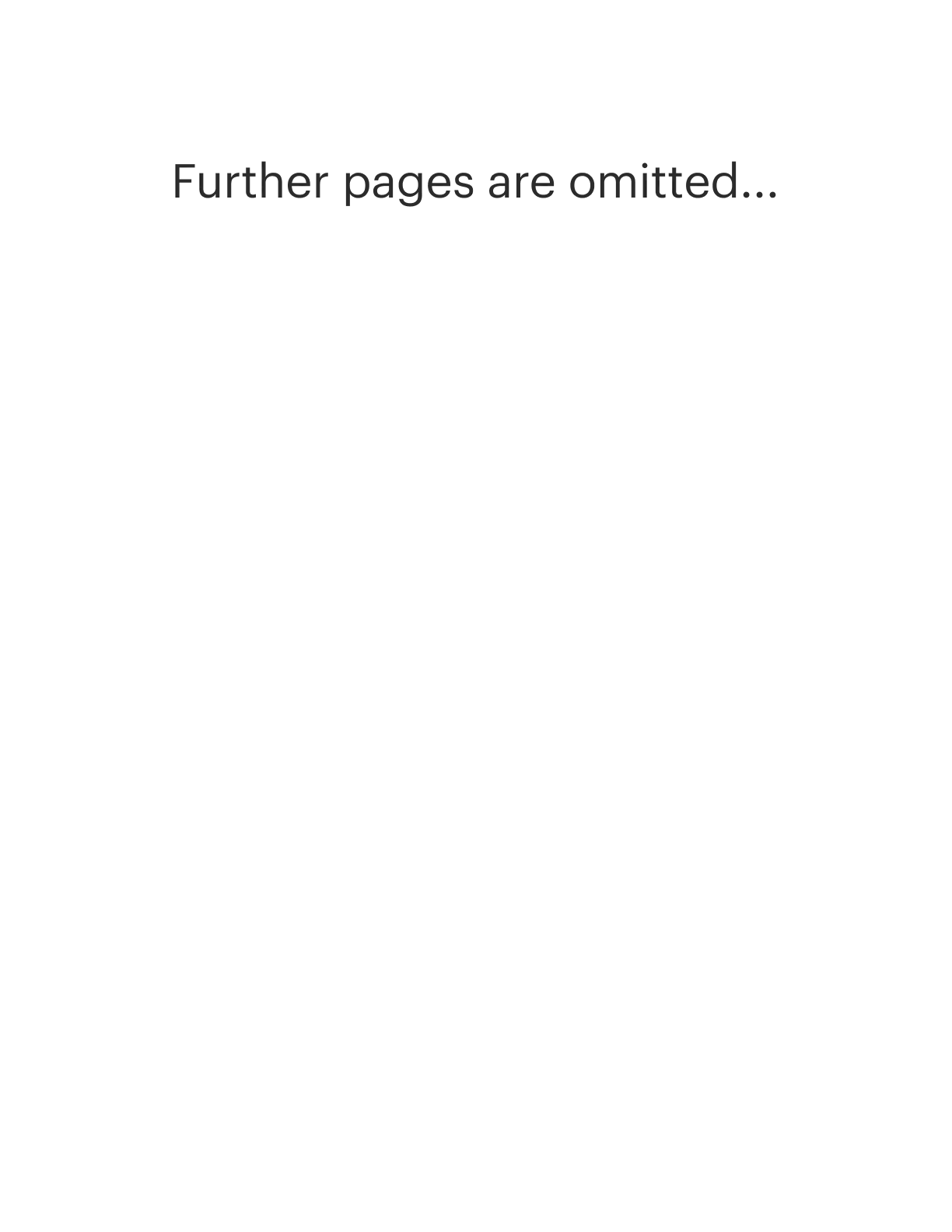

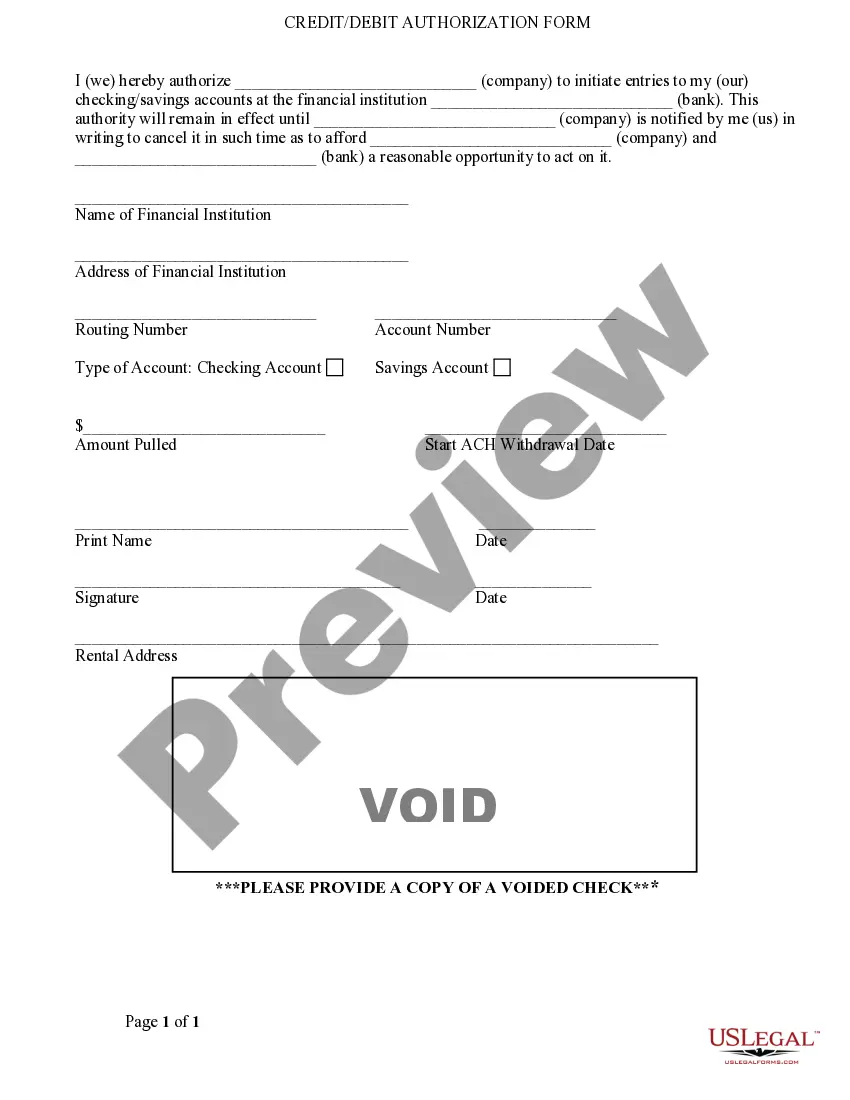

How to fill out Delaware Post-Petition Loan And Security Agreement Between Various Financial Institutions Regarding Revolving Line Of Credit?

You are able to spend several hours on the web searching for the authorized papers template that meets the state and federal demands you want. US Legal Forms gives thousands of authorized varieties that are examined by experts. It is simple to obtain or print out the Delaware Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit from our service.

If you have a US Legal Forms accounts, you are able to log in and click on the Obtain button. Afterward, you are able to complete, modify, print out, or sign the Delaware Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit. Every authorized papers template you acquire is yours for a long time. To get another version associated with a bought develop, proceed to the My Forms tab and click on the related button.

If you use the US Legal Forms web site the very first time, keep to the basic directions under:

- First, make certain you have selected the best papers template for the region/area that you pick. Look at the develop information to make sure you have selected the right develop. If available, make use of the Review button to search with the papers template too.

- If you wish to find another model in the develop, make use of the Look for field to discover the template that fits your needs and demands.

- After you have found the template you would like, simply click Purchase now to proceed.

- Find the rates program you would like, enter your accreditations, and register for a free account on US Legal Forms.

- Complete the financial transaction. You can use your charge card or PayPal accounts to purchase the authorized develop.

- Find the formatting in the papers and obtain it in your device.

- Make modifications in your papers if needed. You are able to complete, modify and sign and print out Delaware Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit.

Obtain and print out thousands of papers web templates utilizing the US Legal Forms website, that provides the largest selection of authorized varieties. Use specialist and status-certain web templates to handle your organization or personal demands.

Form popularity

FAQ

Revolving credit agreements allow borrowers to have flexible access to funds; however, they are subjected to interest rates that must be paid to the lender. Revolving credit agreements will often include information like the total amount of funds available, a set interest rate, and a payment due date.

Examples of revolving credit include credit cards, lines of credit, and home equity lines of credit (HELOCs).

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

Revolving credit is an agreement that permits an account holder to borrow money repeatedly up to a set limit while repaying in installments.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

A term loan involves borrowing a fixed amount of money, repaying this sum with interest over a specified term. Conversely, a revolving credit facility operates similarly to a credit card, affording businesses a credit limit that they can borrow against, repay and borrow again.

The Cons of Revolving Line of Credit They Have Higher Interest Rates than Traditional Installment Loans. Since revolving lines of credit are flexible, they inherently carry more risk for business financing lenders. ... There Are Commitment Fees. ... They Have Lower Credit Limits (In Comparison to Traditional Loans)