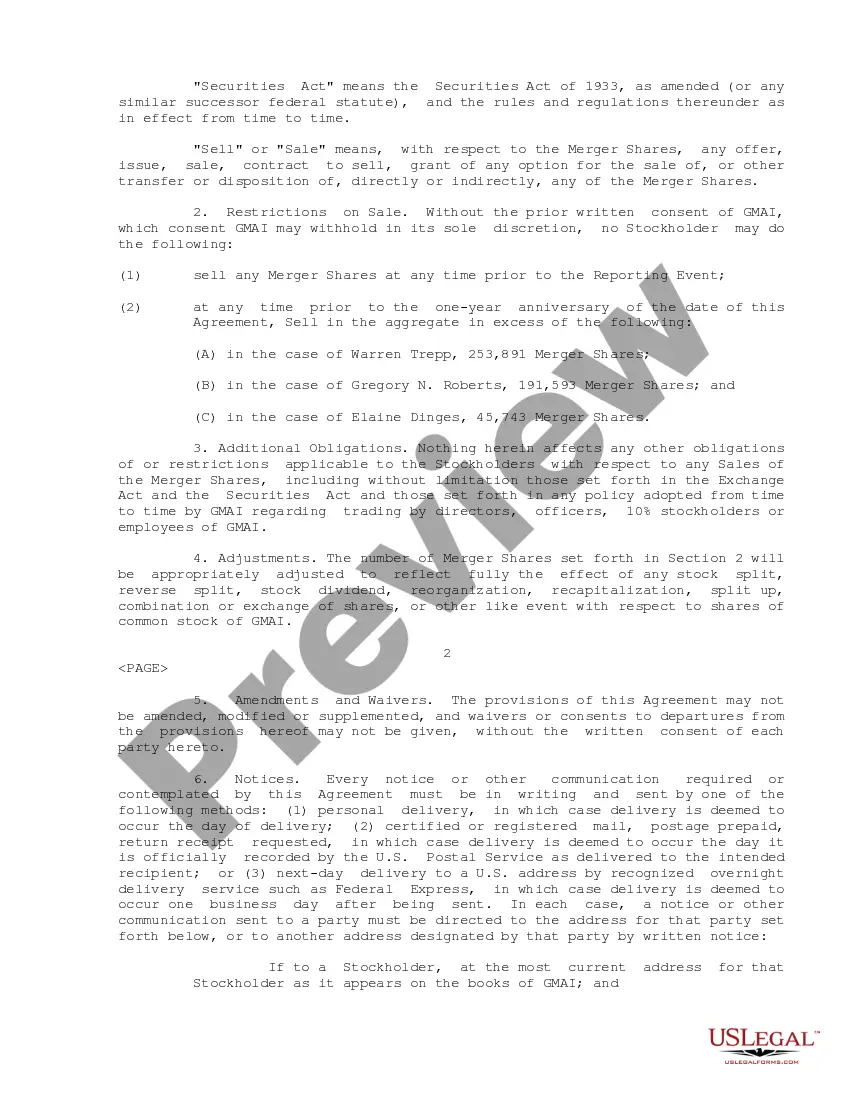

Delaware Stock Agreement between Greg Manning Auctions, Inc., et al

Description

How to fill out Stock Agreement Between Greg Manning Auctions, Inc., Et Al?

Choosing the best authorized record web template could be a struggle. Naturally, there are plenty of themes accessible on the Internet, but how do you discover the authorized develop you will need? Make use of the US Legal Forms site. The services delivers 1000s of themes, like the Delaware Stock Agreement between Greg Manning Auctions, Inc., et al, which can be used for organization and private requires. Each of the types are checked by specialists and satisfy federal and state requirements.

When you are already listed, log in for your accounts and click the Download key to have the Delaware Stock Agreement between Greg Manning Auctions, Inc., et al. Make use of your accounts to appear with the authorized types you may have ordered in the past. Visit the My Forms tab of your accounts and get another copy of your record you will need.

When you are a whole new consumer of US Legal Forms, allow me to share basic recommendations that you can stick to:

- Initial, make certain you have selected the appropriate develop for your metropolis/state. You are able to examine the form making use of the Preview key and read the form outline to ensure this is the best for you.

- In case the develop will not satisfy your needs, utilize the Seach industry to discover the appropriate develop.

- When you are certain the form is proper, click the Acquire now key to have the develop.

- Pick the rates prepare you want and type in the essential details. Create your accounts and purchase an order making use of your PayPal accounts or Visa or Mastercard.

- Pick the file file format and download the authorized record web template for your gadget.

- Full, edit and printing and indicator the acquired Delaware Stock Agreement between Greg Manning Auctions, Inc., et al.

US Legal Forms is definitely the greatest library of authorized types in which you will find a variety of record themes. Make use of the company to download skillfully-produced files that stick to status requirements.

Form popularity

FAQ

An asset purchase (or asset sale) is when a buyer purchases the assets owned by the selling entity. After signing the APA, the seller's business entity transfers ownership of its assets to the buyer's entity, while the seller retains legal ownership of the surviving entity.

Typically, the buyer starts by sending a signed PSA to the seller. If the seller accepts the terms, they will sign it. If the seller counteroffers, they will sign the counteroffer and send it to the buyer.

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

Consult a business attorney to help write your stock purchase agreement or review it and make suggestions before you present it to your investor. A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks.

Following negotiation of the terms of the SPA and the due diligence process, the parties each sign the SPA, the buyer pays the purchase price and the shares are formally transferred to the buyer using a stock transfer form. Usually, this takes place on the same day.

Unless the certificate of incorporation or bylaws of a professional corporation, or a separate contract among all of the shareholders of the professional corporation, provides otherwise for the manner in which such sale or transfer of shares as permitted under this section is to take place, the sale or transfer may be ...

A stock purchase agreement is a contract signed by two parties when they buy or sell stock in a corporation in the US. Small firms that sell stock frequently use these agreements. Stock can be sold to buyers by either the corporation or its shareholders.