Delaware Securityholders Agreement between GST Telecommunications, Inc. and Ocean Horizon, SRL

Description

How to fill out Securityholders Agreement Between GST Telecommunications, Inc. And Ocean Horizon, SRL?

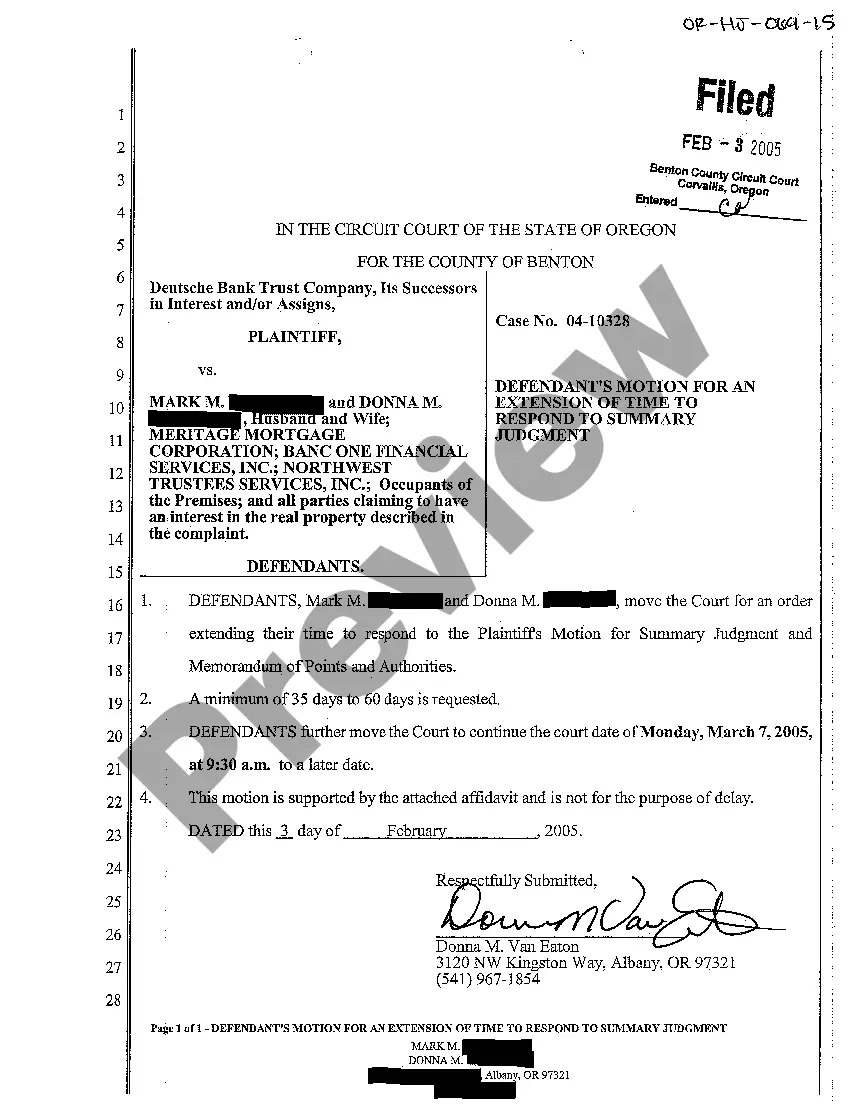

Are you currently in a situation in which you will need paperwork for both business or individual reasons almost every time? There are a variety of legal file themes accessible on the Internet, but getting kinds you can rely on is not effortless. US Legal Forms offers a huge number of type themes, much like the Delaware Securityholders Agreement between GST Telecommunications, Inc. and Ocean Horizon, SRL, that are written to fulfill federal and state demands.

In case you are previously knowledgeable about US Legal Forms web site and possess an account, simply log in. Afterward, you can download the Delaware Securityholders Agreement between GST Telecommunications, Inc. and Ocean Horizon, SRL template.

Should you not offer an profile and wish to begin to use US Legal Forms, follow these steps:

- Discover the type you will need and make sure it is to the appropriate area/region.

- Take advantage of the Preview button to examine the shape.

- Look at the outline to ensure that you have selected the right type.

- In the event the type is not what you are trying to find, utilize the Look for industry to obtain the type that meets your needs and demands.

- Once you discover the appropriate type, click Buy now.

- Opt for the pricing prepare you want, fill in the required information to create your money, and pay money for the transaction utilizing your PayPal or credit card.

- Decide on a practical file structure and download your version.

Discover all of the file themes you may have bought in the My Forms food selection. You can aquire a more version of Delaware Securityholders Agreement between GST Telecommunications, Inc. and Ocean Horizon, SRL any time, if possible. Just select the required type to download or print out the file template.

Use US Legal Forms, probably the most considerable selection of legal types, to conserve time as well as steer clear of faults. The support offers skillfully manufactured legal file themes which you can use for a range of reasons. Generate an account on US Legal Forms and commence making your lifestyle easier.