Delaware Private Placement Subscription Agreement is a legally binding contract utilized in private placements, enabling companies to raise capital from accredited investors within the state of Delaware. This agreement outlines the terms and conditions under which investors agree to purchase securities, typically common stock or preferred stock, from the issuing company. The Delaware Private Placement Subscription Agreement includes various key elements such as: 1. Parties Involved: It clearly identifies the issuing company or issuer and the accredited investor(s) participating in the private placement. 2. Purchase Details: The agreement highlights the type and number of securities being offered, including the purchase price and the total investment amount committed by each investor. 3. Investment Representations: It includes representations and warranties made by the investor regarding their accredited status, ensuring compliance with regulatory requirements. 4. Transfer Restrictions: The agreement may specify restrictions on the transferability of the purchased securities to maintain compliance with securities laws. 5. Investor Rights: It outlines any specific rights granted to investors, such as voting rights or rights to receive dividends or distributions. 6. Confidentiality: If applicable, the agreement may include provisions for the protection of confidential information shared during the private placement process. 7. Governing Law: The agreement specifies that it is governed by the laws of Delaware, ensuring consistency with the state's legal frameworks. Different types of Delaware Private Placement Subscription Agreements may exist depending on specific circumstances or investment structures. These may include: 1. Equity Subscription Agreement: This type is used when investors purchase shares of common or preferred stock. It outlines the terms of the equity investment, including the price per share and the number of shares being purchased. 2. Convertible Note Subscription Agreement: When investors are acquiring convertible notes, this agreement addresses the terms of the loan, including interest rates, maturity dates, and conversion rights. 3. SAFE (Simple Agreement for Future Equity) Subscription Agreement: Safes are a form of investment instrument that allows investors to provide capital in exchange for the right to acquire equity in the future. This agreement stipulates the terms of the SAFE, such as the triggering events for conversion and valuation caps. 4. Debt Subscription Agreement: In situations where companies opt to raise capital through debt offerings, this type of agreement governs the terms of the loan, including principal amount, interest rate, repayment terms, and any security or collateral provided. It is essential for both issuers and investors to carefully review and understand the terms of the Delaware Private Placement Subscription Agreement, as it accurately reflects the commitments and rights associated with the private placement transaction. Seeking legal advice is recommended to ensure compliance with applicable securities laws and regulations.

Delaware Private Placement Subscription Agreement

Description

How to fill out Delaware Private Placement Subscription Agreement?

You may devote several hours on-line trying to find the lawful papers design that suits the state and federal requirements you will need. US Legal Forms provides a large number of lawful varieties which are examined by professionals. It is possible to obtain or print out the Delaware Private Placement Subscription Agreement from my assistance.

If you already have a US Legal Forms bank account, you are able to log in and click on the Acquire option. Afterward, you are able to comprehensive, revise, print out, or indicator the Delaware Private Placement Subscription Agreement. Every lawful papers design you purchase is the one you have permanently. To get another copy of the obtained develop, go to the My Forms tab and click on the related option.

If you use the US Legal Forms web site the first time, adhere to the easy guidelines below:

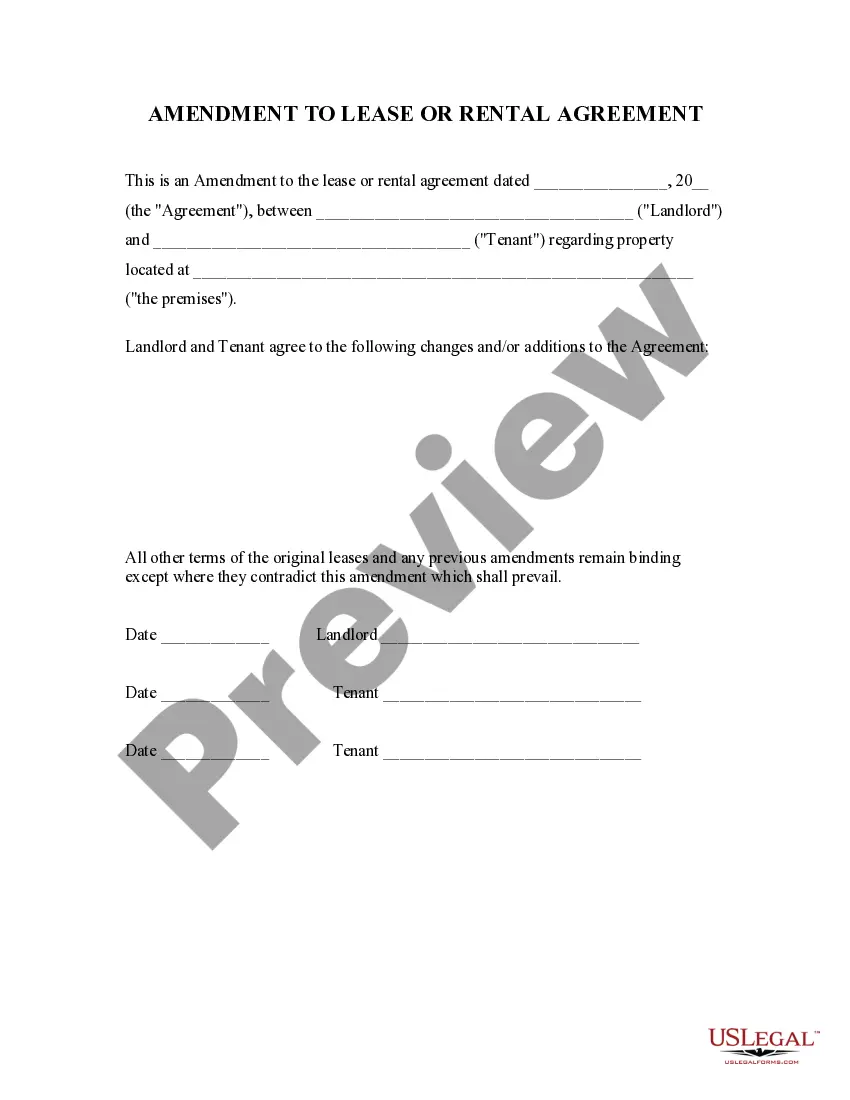

- Very first, make sure that you have chosen the correct papers design for the region/city of your liking. See the develop outline to make sure you have chosen the right develop. If offered, make use of the Review option to check throughout the papers design too.

- If you wish to find another model of your develop, make use of the Research discipline to discover the design that meets your needs and requirements.

- Upon having located the design you need, simply click Get now to carry on.

- Select the costs prepare you need, enter your references, and register for a merchant account on US Legal Forms.

- Full the purchase. You can use your bank card or PayPal bank account to cover the lawful develop.

- Select the formatting of your papers and obtain it to your system.

- Make changes to your papers if possible. You may comprehensive, revise and indicator and print out Delaware Private Placement Subscription Agreement.

Acquire and print out a large number of papers themes utilizing the US Legal Forms web site, that provides the largest selection of lawful varieties. Use specialist and express-specific themes to deal with your organization or specific demands.