Delaware Subscription Agreement

Description

How to fill out Subscription Agreement?

Are you currently inside a place where you will need files for both company or specific uses just about every day? There are tons of authorized record layouts accessible on the Internet, but discovering ones you can depend on isn`t simple. US Legal Forms offers a huge number of type layouts, just like the Delaware Subscription Agreement, that happen to be composed to satisfy state and federal needs.

In case you are previously knowledgeable about US Legal Forms site and have an account, just log in. Afterward, it is possible to download the Delaware Subscription Agreement format.

Unless you come with an accounts and want to begin to use US Legal Forms, abide by these steps:

- Get the type you need and make sure it is for the appropriate area/state.

- Use the Preview option to review the form.

- Browse the explanation to actually have selected the appropriate type.

- If the type isn`t what you are seeking, use the Look for industry to get the type that suits you and needs.

- If you discover the appropriate type, click on Buy now.

- Choose the rates program you would like, fill in the desired details to produce your bank account, and pay for your order utilizing your PayPal or credit card.

- Pick a practical data file file format and download your version.

Locate all the record layouts you have purchased in the My Forms food selection. You can obtain a additional version of Delaware Subscription Agreement at any time, if required. Just click the required type to download or produce the record format.

Use US Legal Forms, probably the most extensive collection of authorized kinds, to conserve time as well as stay away from mistakes. The assistance offers professionally produced authorized record layouts that can be used for a selection of uses. Make an account on US Legal Forms and commence generating your life a little easier.

Form popularity

FAQ

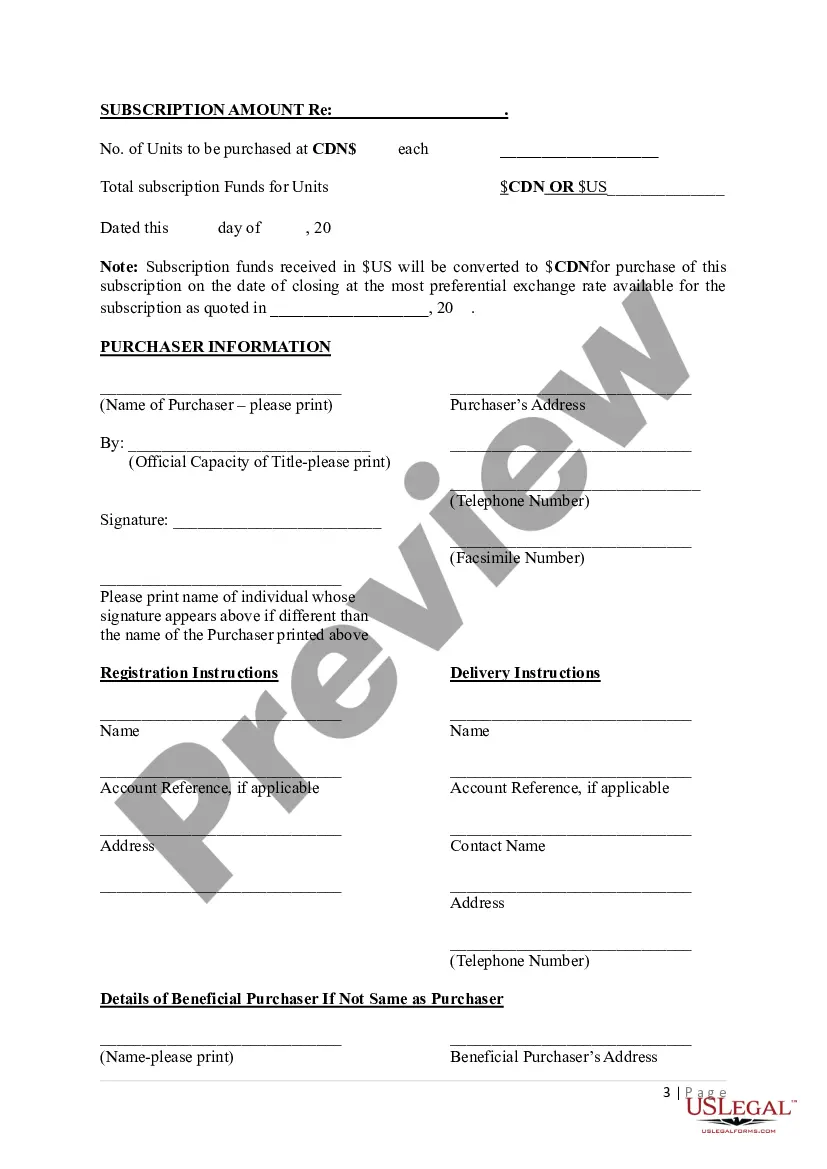

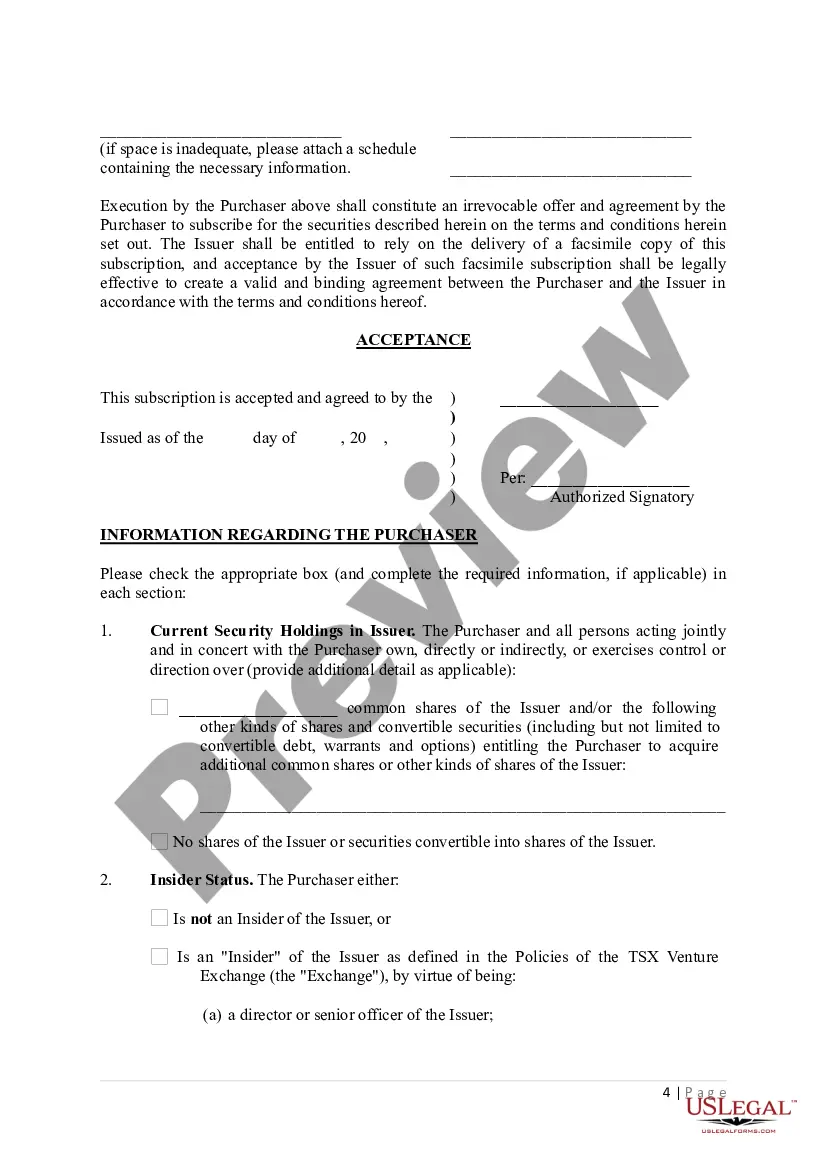

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

The subscription agreement refers to the shareholders' agreement and typically they are signed at the same time. Sometimes, these documents are merged to one big document (often called investment agreement) but for clarity they are usually separated.

There are advantages as well as disadvantages of each agreement. A share purchase agreement differs from a share subscription agreement because a share purchase agreement has a seller that is not the business itself. In a subscription agreement, the business agrees to sell shares to a subscriber.

Issued share capital is the value of shares actually held by investors. Subscribed share capital is the value of shares investors have promised to buy when they are released.

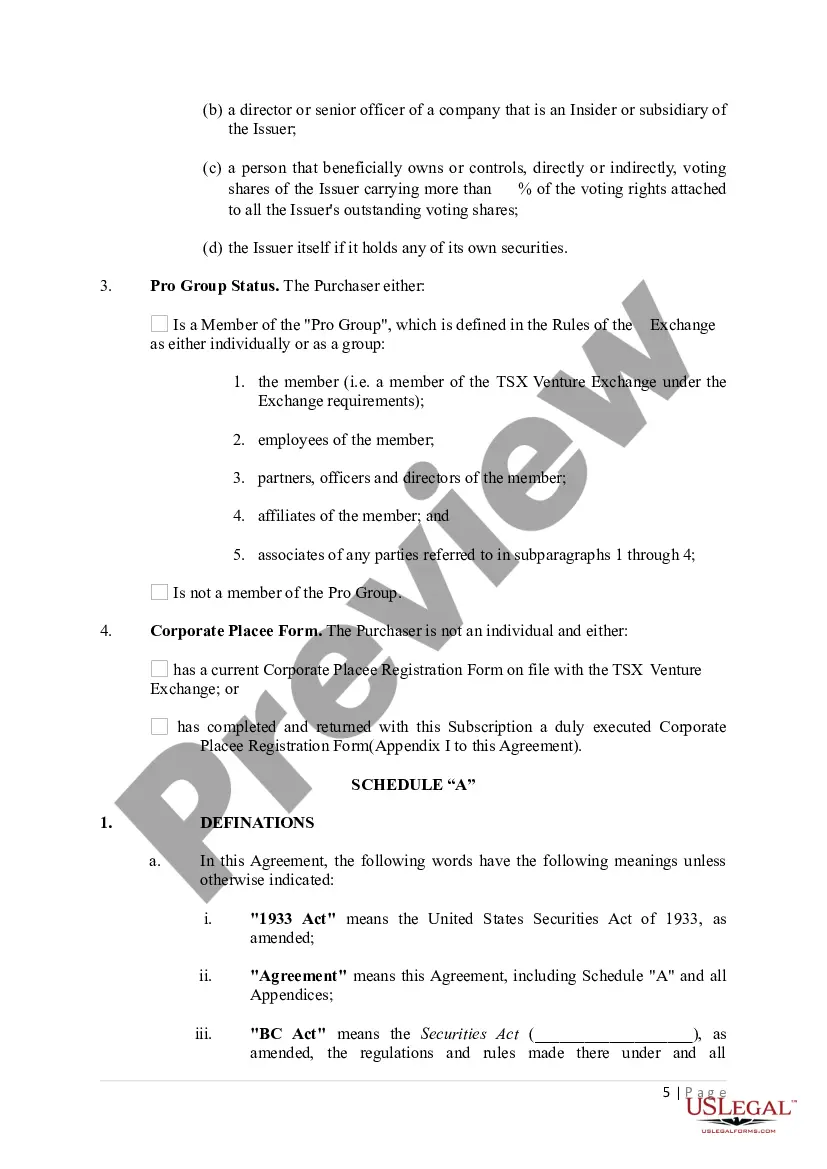

A company executes a Share subscription agreement (SSA) in case of a fresh issue of shares. A shareholders' agreement (SHA) is a contract that contains the rights and obligations of the shareholders in a company.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

Stock subscriptions are a mechanism for allowing employees and investors to consistently purchase shares of company stock over a long period of time, usually at a price that does not include a broker commission. Because there is no commission, the price at which shares are purchased represents a good deal for buyers.