To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

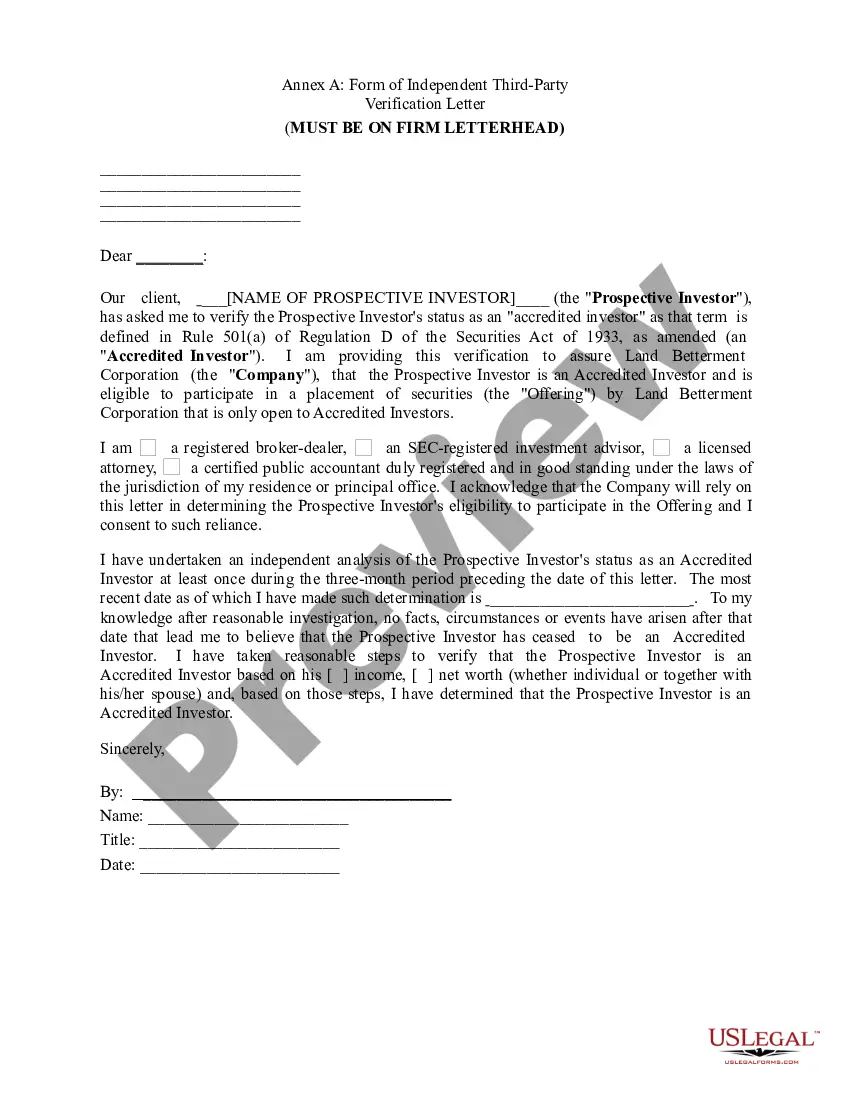

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

Delaware Accredited Investor Certification Letter is an official document that confirms an individual or entity's status as an accredited investor in the state of Delaware. Accredited investors are individuals or entities with a high net worth or sufficient knowledge and experience in financial matters, enabling them to participate in certain types of investment opportunities that are restricted to non-accredited investors. The Delaware Accredited Investor Certification Letter serves as concrete proof of an individual's accredited investor status, allowing them to access investment opportunities like private equity offerings, hedge funds, venture capital funds, and other private placements. It grants investors eligibility to participate in these exclusive investment opportunities, which may possess higher potential returns but are often accompanied by greater risks. The letter includes essential details such as the investor's name, address, and contact information, along with a statement verifying their accredited investor status under applicable federal and state securities laws. It also highlights the criteria met by the investor to qualify as an accredited investor, such as net worth or annual income requirements, which helps ensure compliance with the Securities and Exchange Commission (SEC) regulations. While Delaware Accredited Investor Certification Letter typically refers to one standard document, variations may exist based on the specific purpose or issuing entity. Here are some common types: 1. Individual Delaware Accredited Investor Certification: This type applies to individuals who meet the necessary qualifications for accredited investor status, such as having a net worth exceeding $1 million (excluding primary residence) or an annual income surpassing $200,000 ($300,000 joint income with spouse). These individuals may obtain the letter to participate in various investment opportunities. 2. Entity Delaware Accredited Investor Certification: This variation is for entities, including corporations, limited liability companies (LCS), partnerships, and trusts, seeking accredited investor status. The letter verifies that the entity meets the required asset threshold, such as having total assets exceeding $5 million. It allows these entities to explore investment options unavailable to non-accredited investors. 3. Delaware Accredited Investor Verification Letter for Offering: This type specifically pertains to investment offerings made to accredited investors. Issued by the offering entity, it certifies that the investor has met the necessary criteria, ensuring compliance with regulatory requirements. This letter aids companies in facilitating the offering process by verifying the accredited investor status of potential participants. Delaware Accredited Investor Certification Letters play a crucial role in verifying and granting access to exclusive investment opportunities within the state. These documents ensure compliance with federal and state securities laws while enabling accredited investors to explore potentially lucrative investments that may not be available to non-accredited individuals or entities.