Title: Understanding Delaware Accredited Investor Certification: Types and Detailed Overview Introduction: Delaware Accredited Investor Certification is a crucial aspect of securities regulations, ensuring the protection of investors and enabling access to private investment opportunities. In this detailed description, we will explore the concept of Delaware Accredited Investor Certification, its significance, requirements, and potential types. Key Keywords: Delaware, Accredited Investor Certification, securities regulations, private investment, requirements, types. 1. What is Delaware Accredited Investor Certification? Delaware Accredited Investor Certification refers to the process of verifying an individual's eligibility to participate in private investment opportunities. This certification signifies that an investor meets certain income or net worth thresholds, allowing them to invest in private offerings that are typically restricted to accredited investors. 2. Significance and Benefits: Being an accredited investor means having the experience and financial capacity to understand and assume the potential risks associated with private investments. Accredited investors can access a broader range of investment opportunities, including hedge funds, venture capital funds, private equity, and more. 3. Accredited Investor Certification Requirements: To obtain Delaware Accredited Investor Certification, individuals must meet specific criteria outlined by the Securities and Exchange Commission (SEC). The most common requirements include: a. Income Threshold: An individual must have an annual income of at least $200,000 (or $300,000 for joint filers) for the past two years, with the expectation of maintaining the same income level in the present year. b. Net Worth Threshold: An individual must have a net worth exceeding $1 million, either individually or jointly with their spouse, excluding the value of their primary residence. c. Professional Certifications: Certain professional certifications, such as the Series 7, 65, or 82 licenses, can also qualify individuals for accreditation. 4. Types of Delaware Accredited Investor Certifications: Although there is no specific 'type' of Delaware Accredited Investor Certification, various entities offer services to verify an individual's accreditation status. These entities may include financial institutions, law firms, or accredited investor verification platforms. The certification process typically involves a thorough review of financial documents and relevant information. 5. Maintaining Accredited Investor Status: It is important to note that Delaware Accredited Investor Certification is not a one-time process. Investors must periodically update their accredited status based on their income and net worth. This ensures compliance with ongoing regulation and allows continued access to private investment opportunities. Conclusion: Delaware Accredited Investor Certification is a vital mechanism that promotes investor protection and expands access to private investment opportunities. By meeting specific income or net worth criteria, individuals can enjoy the benefits of being classified as accredited investors. Adhering to the regulations guarantees continued eligibility for various exclusive investment opportunities.

Delaware Accredited Investor Certification

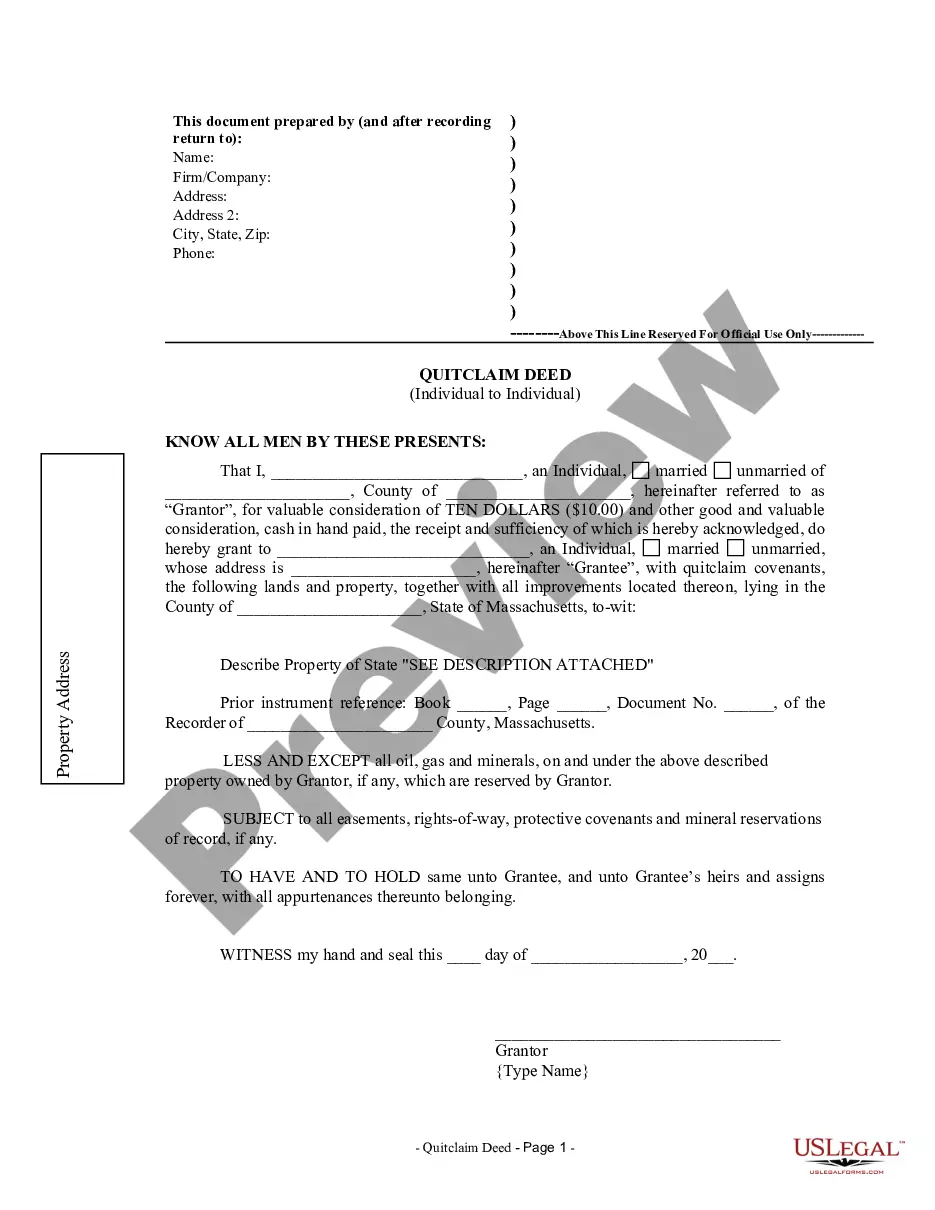

Description

How to fill out Delaware Accredited Investor Certification?

You may commit hours online looking for the authorized file web template which fits the state and federal demands you require. US Legal Forms provides 1000s of authorized types that happen to be evaluated by professionals. It is simple to download or print out the Delaware Accredited Investor Certification from your assistance.

If you already possess a US Legal Forms profile, you can log in and click on the Down load button. Next, you can comprehensive, revise, print out, or indication the Delaware Accredited Investor Certification. Each and every authorized file web template you buy is the one you have permanently. To have one more backup for any obtained develop, proceed to the My Forms tab and click on the corresponding button.

If you use the US Legal Forms internet site the very first time, keep to the straightforward directions below:

- Initially, make sure that you have selected the right file web template for that region/town of your choice. Look at the develop outline to ensure you have selected the right develop. If accessible, utilize the Review button to check with the file web template at the same time.

- In order to locate one more model of the develop, utilize the Look for industry to obtain the web template that suits you and demands.

- After you have identified the web template you want, click on Purchase now to continue.

- Pick the costs strategy you want, key in your qualifications, and register for an account on US Legal Forms.

- Full the transaction. You should use your bank card or PayPal profile to purchase the authorized develop.

- Pick the formatting of the file and download it to the device.

- Make alterations to the file if necessary. You may comprehensive, revise and indication and print out Delaware Accredited Investor Certification.

Down load and print out 1000s of file web templates using the US Legal Forms site, which provides the largest collection of authorized types. Use professional and condition-particular web templates to handle your organization or specific requires.