Delaware Term Sheet — Convertible Debt Financing is a legal document that outlines the terms and conditions for a specific type of investment strategy employed by startups and early-stage companies. This financing method allows companies to raise funds by offering convertible debt securities to investors. Convertible debt financing is a popular option for companies looking to secure financing as it offers a flexible solution that combines elements of both debt and equity financing. The Delaware Term Sheet serves as an agreement between the company and its investors, stipulating the terms and conditions of the investment, as well as the rights and obligations of both parties. The key feature of convertible debt financing is the potential conversion of the debt into equity at a later date. This means that the investors have the option to convert their debt investment into company shares or equity ownership, usually upon the occurrence of specific trigger events such as a subsequent equity financing round or an exit event like an IPO. The Delaware Term Sheet — Convertible Debt Financing typically includes various important provisions, such as: 1. Conversion Terms: The term sheet specifies the conversion ratio or conversion price at which the debt can be converted into equity. This ratio determines the number of shares the investor will receive upon conversion. 2. Interest Rate: The agreement outlines the interest rate at which the debt will accrue, determining the return on investment for the investors. This interest may be payable periodically or upon conversion. 3. Maturity Date: The term sheet sets a maturity date, signaling the timeframe within which the company must repay the debt if it has not been converted into equity. If the debt remains outstanding after the maturity date, it may trigger default provisions. 4. Default and Remedies: In case of non-payment or breach of certain terms, the term sheet outlines the consequences, potential default provisions, and the remedies available to the investors. 5. Voting Rights: The agreement defines the voting rights associated with the convertible debt. Investors may gain certain rights and influence over company decisions, especially if the debt remains unpaid after the maturity date. While there isn't a specific classification of types of Delaware Term Sheet — Convertible Debt Financing, variations may arise based on the specific terms negotiated between the company and the investors. Some possible types or variations of convertible debt financing might include: 1. Simple Convertible Debt: This represents the basic structure of convertible debt financing, employing standard provisions for conversion, interest rates, and maturity dates. 2. Discounted Convertible Debt: In this variation, the investors receive the benefit of a discount when converting their debt into equity, meaning they get to convert at a lower price or better terms than future investors in an equity round. 3. Cap Convertible Debt: This version includes a valuation cap, specifying a maximum value or price at which the debt can convert into equity. This cap ensures that investors are protected from potential downside risks if the company's valuation increases significantly in the future. 4. Participating Convertible Debt: This type allows investors to participate in the upside potential even after converting their debt into equity. They may receive additional equity or a share of the profits upon an exit event, in addition to their initial equity ownership. Overall, the Delaware Term Sheet — Convertible Debt Financing provides a framework for companies and investors to negotiate and agree upon the terms and conditions of their financial arrangement. It offers flexibility and potential benefits for both parties, allowing startups to raise capital while providing investors with the opportunity for future equity participation.

Delaware Term Sheet - Convertible Debt Financing

Description

How to fill out Delaware Term Sheet - Convertible Debt Financing?

US Legal Forms - one of several biggest libraries of authorized types in the USA - gives a wide array of authorized document layouts you are able to obtain or print out. Using the internet site, you will get a huge number of types for company and specific purposes, sorted by categories, claims, or search phrases.You will find the most up-to-date variations of types such as the Delaware Term Sheet - Convertible Debt Financing within minutes.

If you already possess a monthly subscription, log in and obtain Delaware Term Sheet - Convertible Debt Financing through the US Legal Forms library. The Acquire key can look on every single form you look at. You have accessibility to all in the past delivered electronically types within the My Forms tab of your accounts.

If you want to use US Legal Forms for the first time, listed here are basic instructions to help you began:

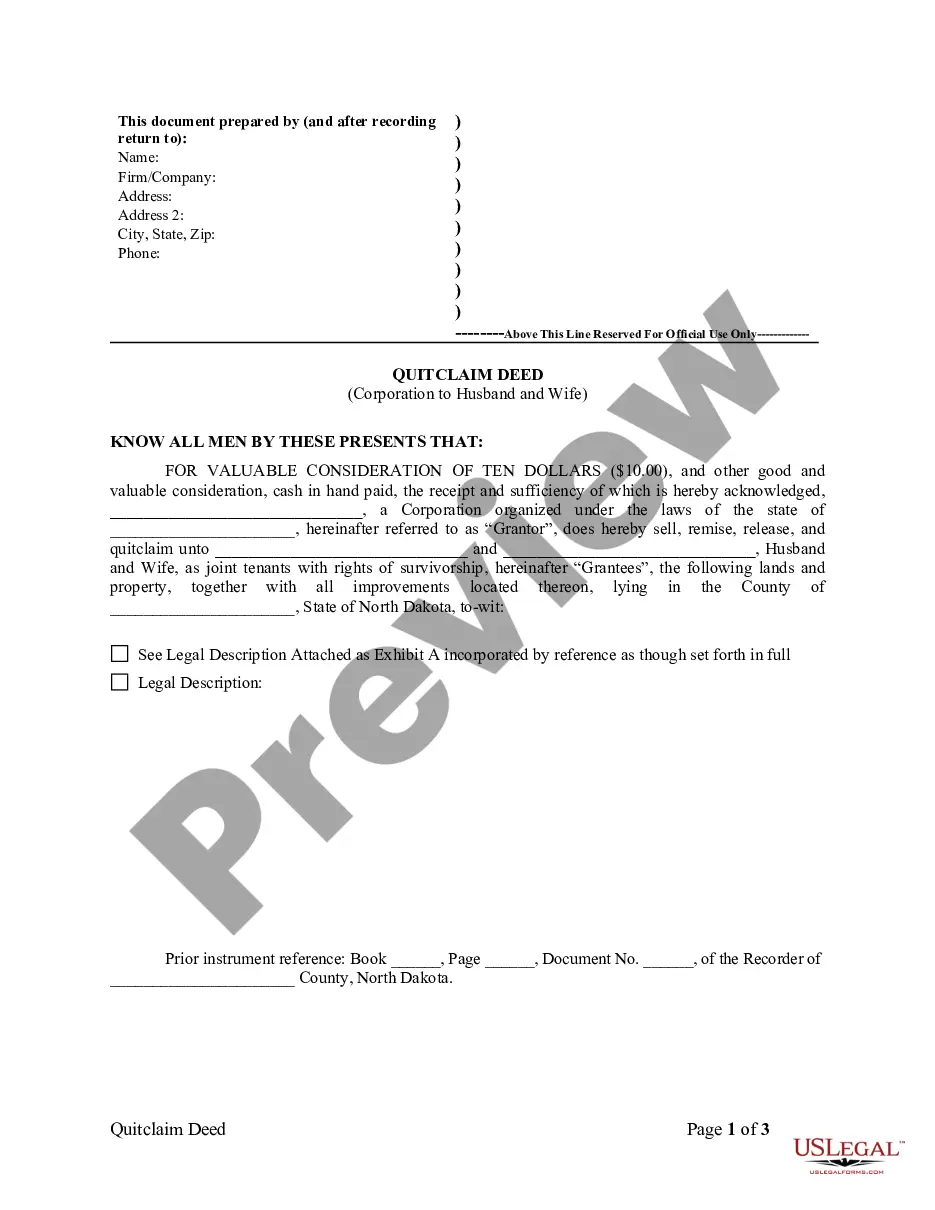

- Ensure you have chosen the right form to your metropolis/area. Select the Review key to check the form`s information. See the form outline to ensure that you have chosen the appropriate form.

- When the form does not suit your demands, take advantage of the Look for field at the top of the display screen to obtain the one which does.

- If you are happy with the form, confirm your option by simply clicking the Purchase now key. Then, pick the costs plan you prefer and supply your qualifications to sign up for an accounts.

- Procedure the financial transaction. Utilize your bank card or PayPal accounts to perform the financial transaction.

- Pick the format and obtain the form on your gadget.

- Make adjustments. Load, edit and print out and signal the delivered electronically Delaware Term Sheet - Convertible Debt Financing.

Each and every format you included in your money lacks an expiry date and it is yours permanently. So, if you wish to obtain or print out an additional copy, just visit the My Forms portion and then click about the form you need.

Obtain access to the Delaware Term Sheet - Convertible Debt Financing with US Legal Forms, one of the most extensive library of authorized document layouts. Use a huge number of specialist and status-distinct layouts that fulfill your business or specific needs and demands.