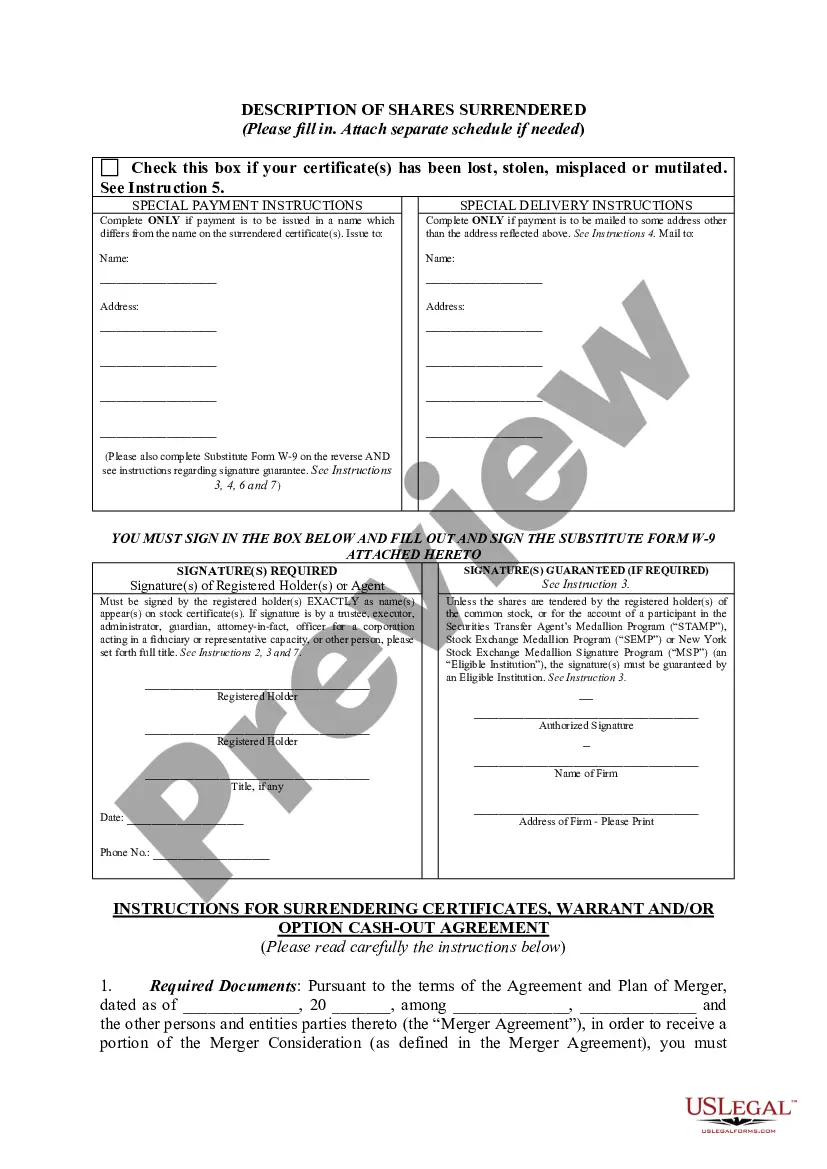

Delaware Letter of Transmittal to Accompany Certificates of Common Stock

Description

How to fill out Letter Of Transmittal To Accompany Certificates Of Common Stock?

If you have to complete, obtain, or print out authorized record layouts, use US Legal Forms, the largest collection of authorized varieties, that can be found online. Make use of the site`s easy and convenient lookup to obtain the documents you want. Numerous layouts for business and person uses are categorized by categories and says, or keywords. Use US Legal Forms to obtain the Delaware Letter of Transmittal to Accompany Certificates of Common Stock within a handful of mouse clicks.

If you are presently a US Legal Forms customer, log in to the profile and then click the Down load key to have the Delaware Letter of Transmittal to Accompany Certificates of Common Stock. You may also accessibility varieties you formerly saved from the My Forms tab of your respective profile.

If you work with US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have selected the form to the proper metropolis/country.

- Step 2. Make use of the Review solution to check out the form`s content. Do not forget about to learn the description.

- Step 3. If you are unsatisfied with the develop, take advantage of the Search field at the top of the screen to get other types in the authorized develop template.

- Step 4. When you have identified the form you want, click the Purchase now key. Select the rates strategy you prefer and include your references to sign up on an profile.

- Step 5. Procedure the purchase. You can use your bank card or PayPal profile to complete the purchase.

- Step 6. Choose the format in the authorized develop and obtain it on the device.

- Step 7. Full, change and print out or sign the Delaware Letter of Transmittal to Accompany Certificates of Common Stock.

Every single authorized record template you acquire is yours forever. You have acces to each develop you saved inside your acccount. Click the My Forms area and decide on a develop to print out or obtain once more.

Contend and obtain, and print out the Delaware Letter of Transmittal to Accompany Certificates of Common Stock with US Legal Forms. There are thousands of specialist and status-distinct varieties you may use to your business or person requirements.

Form popularity

FAQ

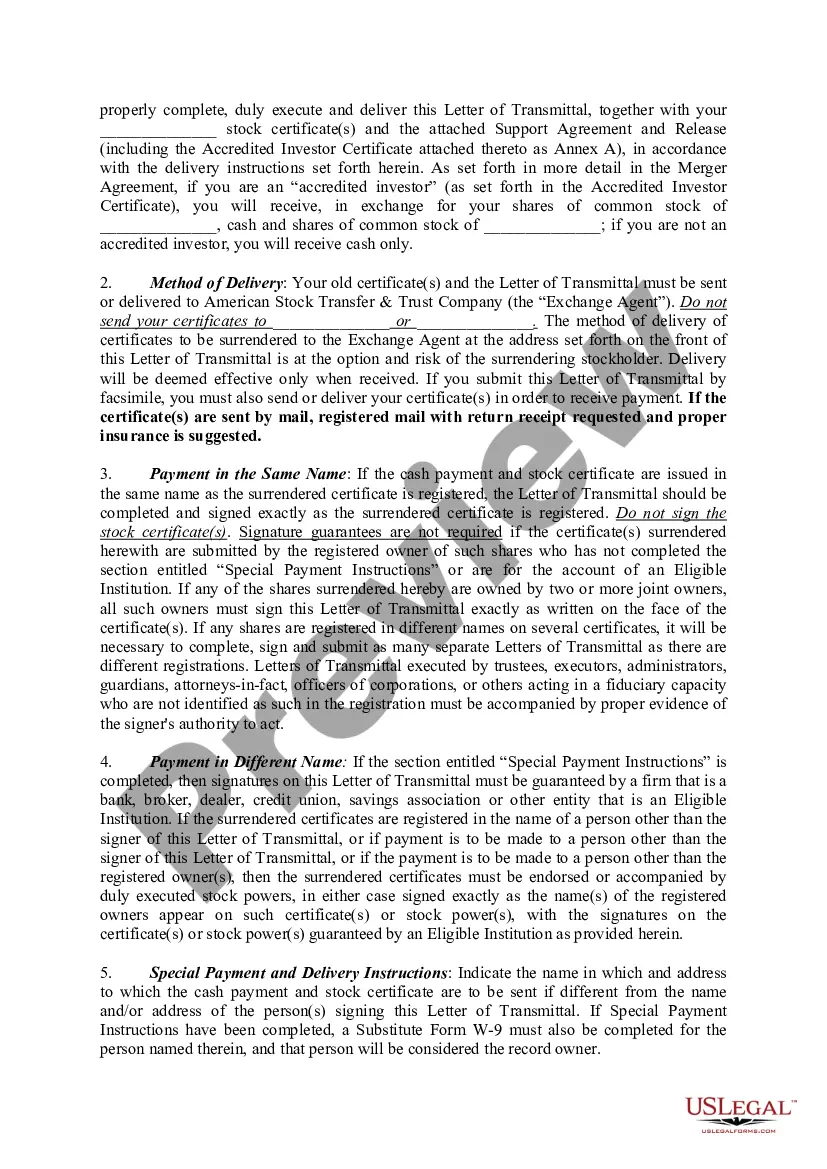

The letter of transmittal ?announces? the arrival of the report. It can be in letter or memo format (usually the norms of the organization will dictate which one), and should be addressed either to the person who has been your primary contact or to someone in senior management.

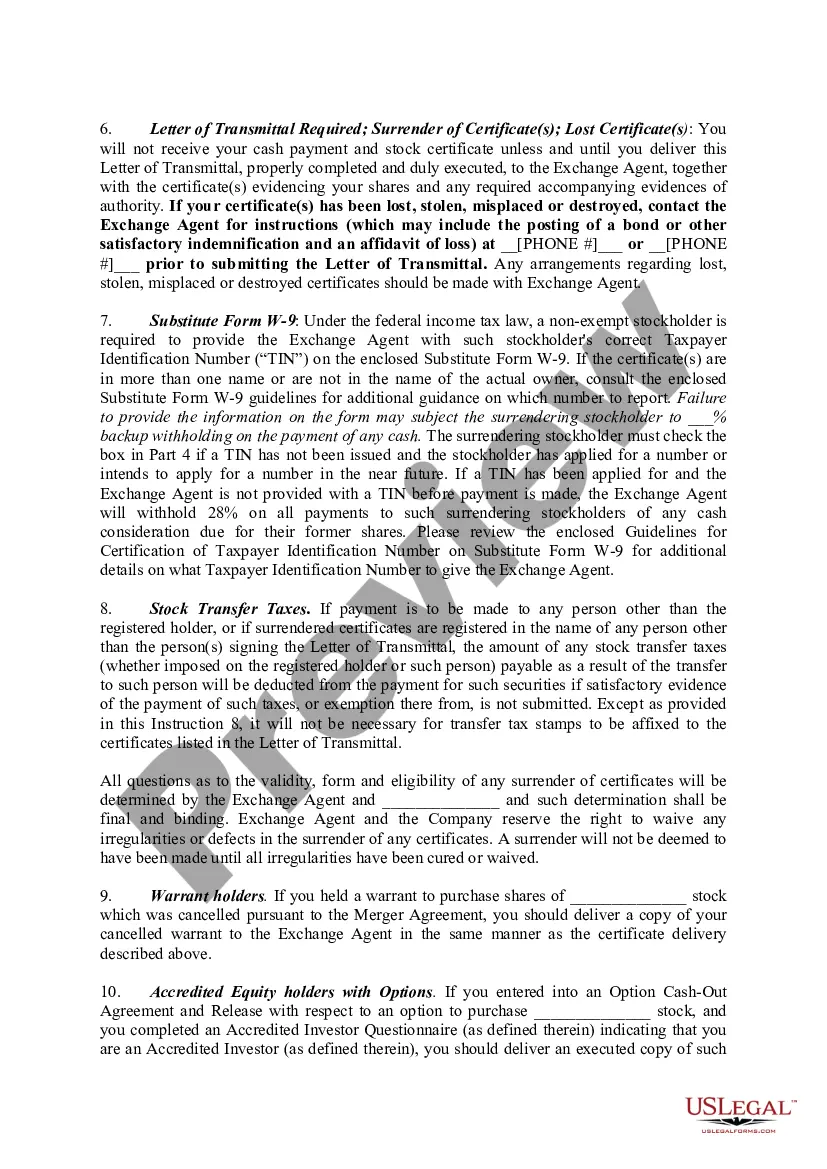

In order to cash in the stock, you need to fill out the transfer form on the back of the certificate and have it notarized. Once complete, send the notarized certificate to the transfer agent, who will register the stock to you as owner.

A transmittal or cover letter accompanies a larger item, usually a document. The transmittal letter provides the recipient with a specific context in which to place the larger document and simultaneously gives the sender a permanent record of having sent the material. Transmittal letters are usually brief.

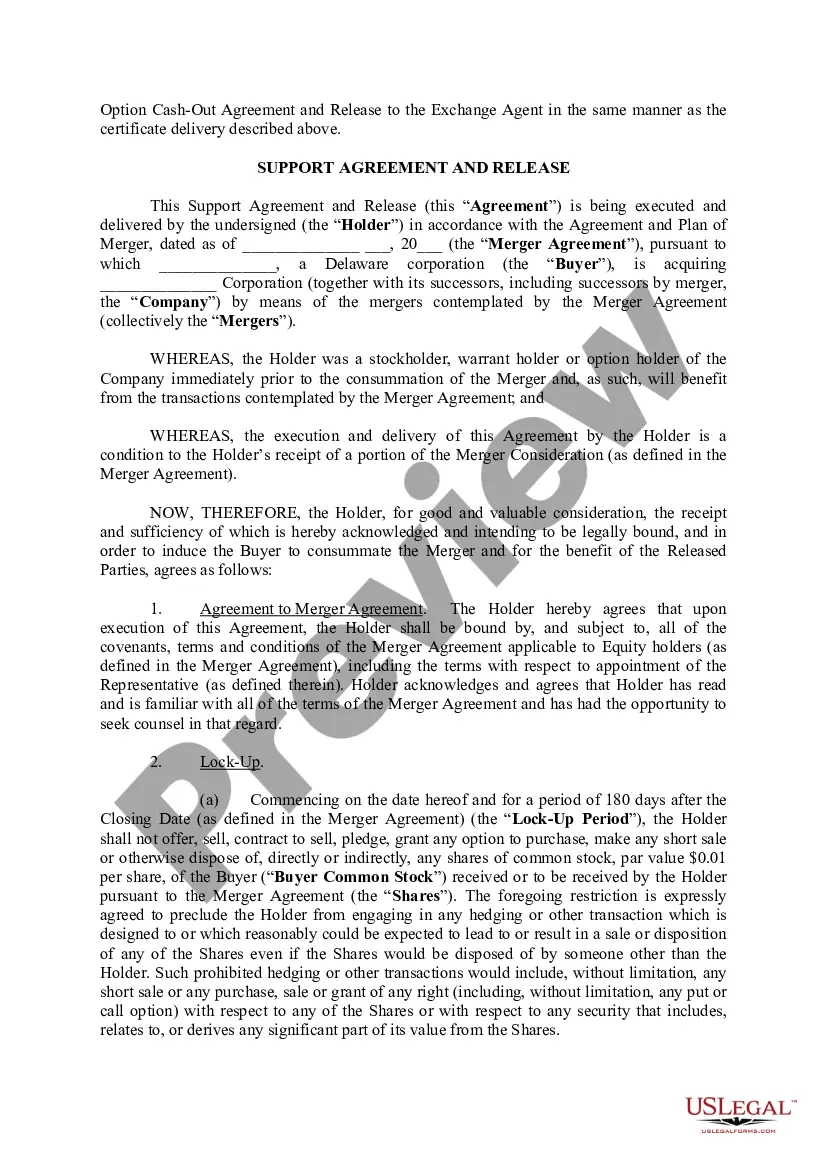

What is a Letter of Transmittal? A Letter of Transmittal is a form generally used for an exchange of stock and/or cash payment.

Letters of transmittal are usually brief, often with three paragraphs, each one devoted to a specific purpose: review the purpose of the report, offer a brief overview of main ideas in the report, and offer to provide fuller information as needed, along with a ?thank you? and contact information.

What is a Letter of Transmittal? A Letter of Transmittal is a form generally used for an exchange of stock and/or cash payment.

Sometimes known as the cover sheet to a financial statement, the letter of transmittal is the first page of the financial statement (after a table of contents) that on a basic level describes the reporting period the statement covers (fiscal, six months, etc.)

To fill out a stock certificate, you fill in the name of the shareholder, the name of the corporation, the number of shares represented by the certificate, the date, and possibly an identification number. There is also a space for a corporate officer to sign on behalf of the corporation and to affix the corporate seal.