Delaware Founders Agreement

Description

How to fill out Founders Agreement?

You may commit hours on the web looking for the legitimate file web template that fits the federal and state requirements you need. US Legal Forms offers thousands of legitimate kinds that are examined by experts. It is simple to download or print the Delaware Founders Agreement from our assistance.

If you have a US Legal Forms accounts, it is possible to log in and click on the Acquire key. Following that, it is possible to total, modify, print, or signal the Delaware Founders Agreement. Every single legitimate file web template you get is your own permanently. To get an additional backup associated with a obtained kind, go to the My Forms tab and click on the corresponding key.

If you are using the US Legal Forms website the very first time, adhere to the straightforward recommendations under:

- Very first, make sure that you have selected the correct file web template for your state/town of your choosing. Look at the kind explanation to ensure you have chosen the proper kind. If accessible, utilize the Review key to appear through the file web template as well.

- If you wish to get an additional variation of the kind, utilize the Research discipline to get the web template that meets your requirements and requirements.

- Upon having identified the web template you need, click Get now to continue.

- Pick the costs strategy you need, key in your credentials, and register for a free account on US Legal Forms.

- Complete the purchase. You may use your Visa or Mastercard or PayPal accounts to pay for the legitimate kind.

- Pick the file format of the file and download it for your product.

- Make changes for your file if required. You may total, modify and signal and print Delaware Founders Agreement.

Acquire and print thousands of file layouts using the US Legal Forms Internet site, that provides the greatest selection of legitimate kinds. Use specialist and express-distinct layouts to handle your company or individual demands.

Form popularity

FAQ

Honesty is the best policy, giving your story the genuine tone it needs. The story should share the founder's raw emotions throughout their journey?especially their gratitude to those who continued to support the business through challenges (such as the employees, customers, investors, and partners).

A Founders' Agreement is a legally binding contract between two or more people that sets out how their business will be run and what percentage each person will receive of ownership, as well as how the ownership will vest on the co-founders. Founders' Agreement for Startups: The Complete Guide - WinSavvy winsavvy.com ? founders-agreement winsavvy.com ? founders-agreement

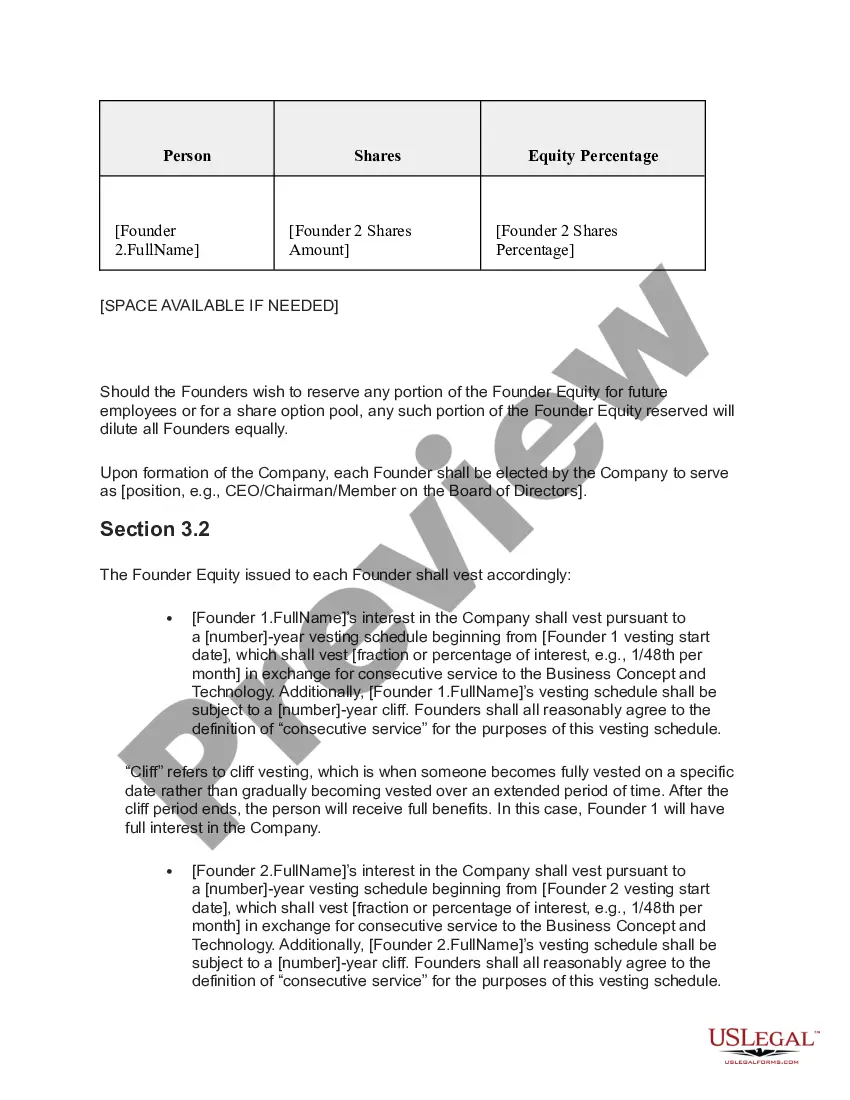

Splitting equity amongst co-founders fairly Rule 1: Aim to split as equally and fairly as possible; Rule 2: Don't take on more than 2 co-founders; Rule 3: Your co-founders should complement your competencies, not copy them; Rule 4: Use vesting. ... Rule 5: Keep 10% of the company for the most important employees; How to split equity amongst founders? (Updated in 2022) rst.software ? blog ? how-to-split-equity-am... rst.software ? blog ? how-to-split-equity-am...

Here are six key steps you can follow to write a resume as the founder of an organization: Design a resume header. ... Write a concise summary statement. ... Describe your professional experience. ... Add your education. ... Make a skills section. ... Include any relevant certifications.

Founder's Note is a collection of essays written by Ji Qi, the founder/co- founder of three Chinese billion-dollar enterprises: Ctrip Travel Network, Home Inns Group and Huazhu Hotel Group. This book is divided into three parts: Heaven, Earth and Man.

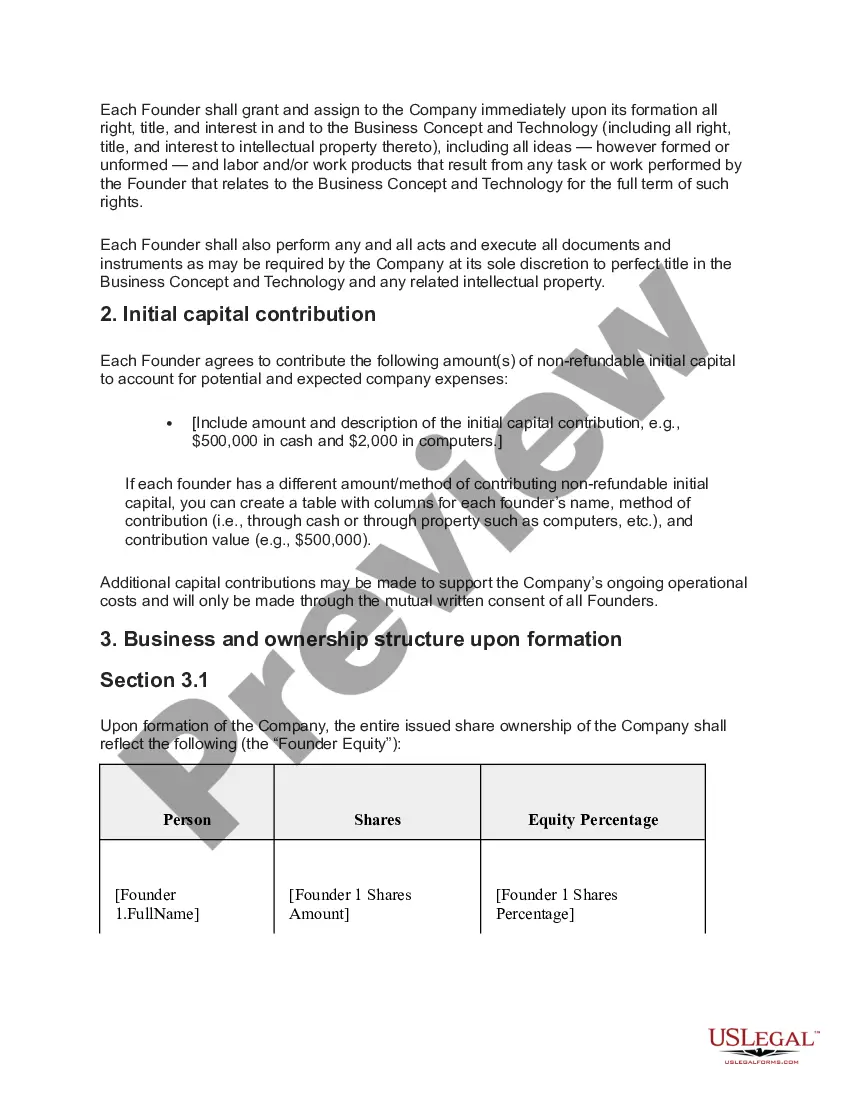

What Should be Included in a Founders Agreement? Names of Founders and Company. Ownership Structure. The Project. Initial Capital and Additional Contributions. Expenses and Budget. Taxes. Roles and Responsibilities. Management and Legal Decision-Making, Operating, and Approval Rights.

The Elements of the Perfect Founder Letter Personal Anecdote. A personal letter from the founder should be, well, personal. ... Gratitude. Whether you're sharing good news or bad, a little gratitude goes a long way. ... The News (duh) ... Humility. ... Vulnerability. ... Belief / Vision / Mission. ... What's Next. The 7 Things that Should Be in Every Founder Letter - Propllr Blog propllr.com ? how-to-write-a-founder-letter propllr.com ? how-to-write-a-founder-letter