A Delaware Grant Agreement from 501(c)(3) to 501(c)(4) is a legal document that outlines the terms and conditions under which funds are transferred from a nonprofit organization with a 501(c)(3) tax-exempt status to another nonprofit organization operating under a 501(c)(4) tax-exempt status in the state of Delaware. The agreement serves as a contractual arrangement between the donating organization, known as the granter, and the receiving organization, known as the grantee. It specifies the purpose of the grant, the amount of funding being provided, and any conditions or restrictions attached to the grant. Keywords: Delaware, Grant Agreement, 501(c)(3), 501(c)(4), nonprofit organization, tax-exempt, terms and conditions, funds, contractual arrangement, granter, grantee, purpose of grant, amount of funding, conditions, restrictions. Different types of Delaware Grant Agreements from 501(c)(3) to 501(c)(4) may include: 1. General Operating Grant Agreement: This type of agreement involves funding being provided to support the day-to-day operations of the receiving organization. It may cover expenses such as employee salaries, facility maintenance, and program costs. 2. Program-Specific Grant Agreement: This agreement focuses on funding a particular project or program within the receiving organization. The grant's purpose could be to support educational initiatives, community outreach programs, or research projects, among others. 3. Capacity-Building Grant Agreement: This type of grant aims to enhance the overall capabilities and effectiveness of the receiving organization. The funds may be allocated towards training programs, technology upgrades, or strategic planning initiatives, allowing the organization to better fulfill its mission. 4. Capital Grant Agreement: In this agreement, the grant is specifically intended to finance capital expenditures for the receiving organization. These may include the purchase or renovation of equipment or real estate, facility expansion, or infrastructure development. 5. Restricted Grant Agreement: This type of grant agreement imposes certain restrictions on how the funds are to be used. The granter may require the grantee to allocate the funds for a specific purpose or within a designated timeframe. These restrictions aim to ensure that the funds are utilized in accordance with the granter's intentions. Regardless of the specific type of Delaware Grant Agreement from 501(c)(3) to 501(c)(4), it is essential for both parties to carefully review the agreement's provisions, ensuring that all applicable laws and regulations are adhered to. Seeking legal counsel is advisable to ensure compliance and clarity in the agreement.

Delaware Grant Agreement from 501(c)(3) to 501(c)(4)

Description

How to fill out Delaware Grant Agreement From 501(c)(3) To 501(c)(4)?

US Legal Forms - one of the largest libraries of legal kinds in America - offers an array of legal document themes it is possible to obtain or produce. Making use of the site, you may get a large number of kinds for business and person reasons, sorted by groups, says, or key phrases.You can find the most up-to-date models of kinds like the Delaware Grant Agreement from 501(c)(3) to 501(c)(4) in seconds.

If you already possess a monthly subscription, log in and obtain Delaware Grant Agreement from 501(c)(3) to 501(c)(4) in the US Legal Forms collection. The Download option will appear on each develop you view. You have access to all earlier acquired kinds within the My Forms tab of your own bank account.

If you want to use US Legal Forms for the first time, listed here are straightforward directions to obtain started off:

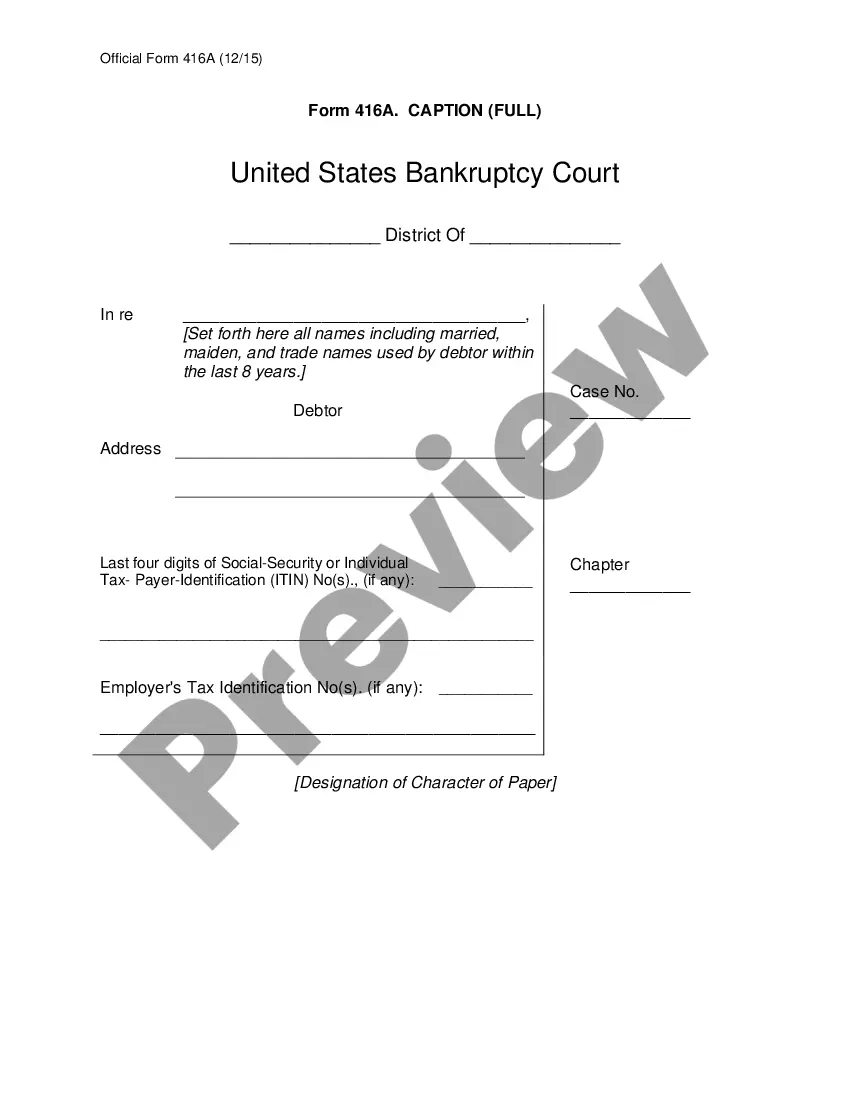

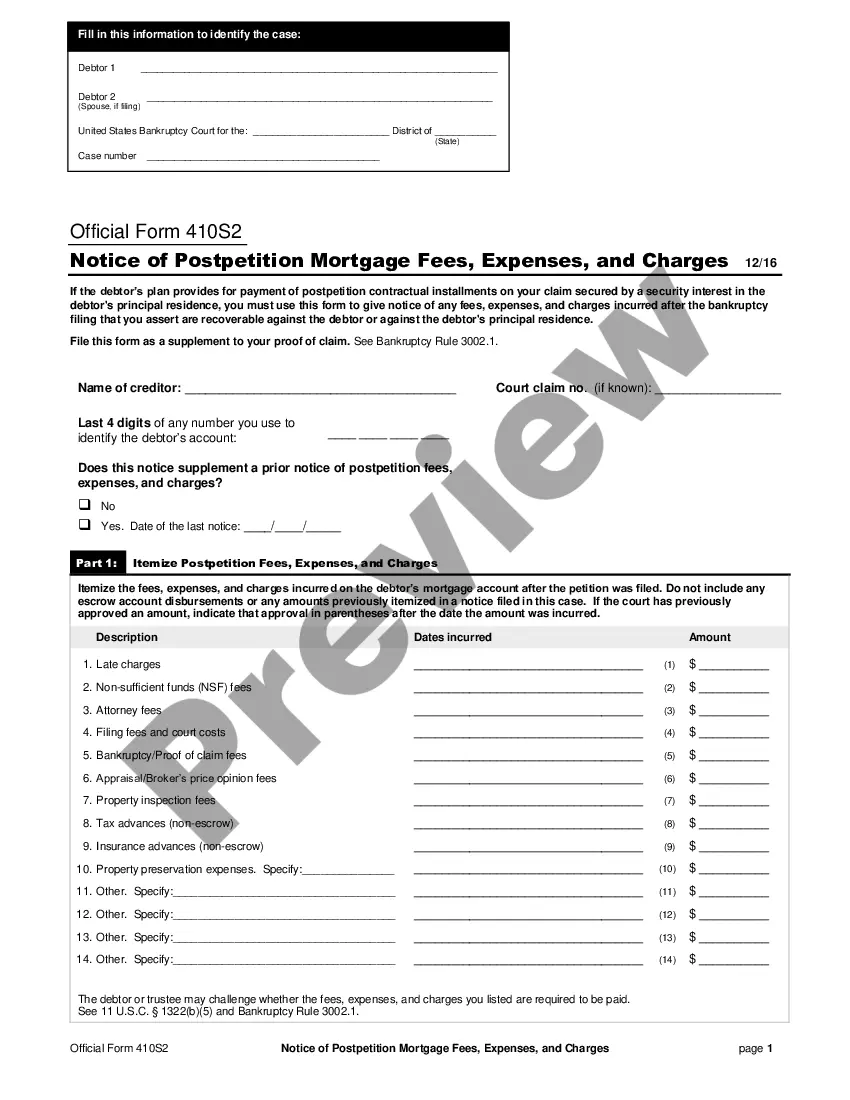

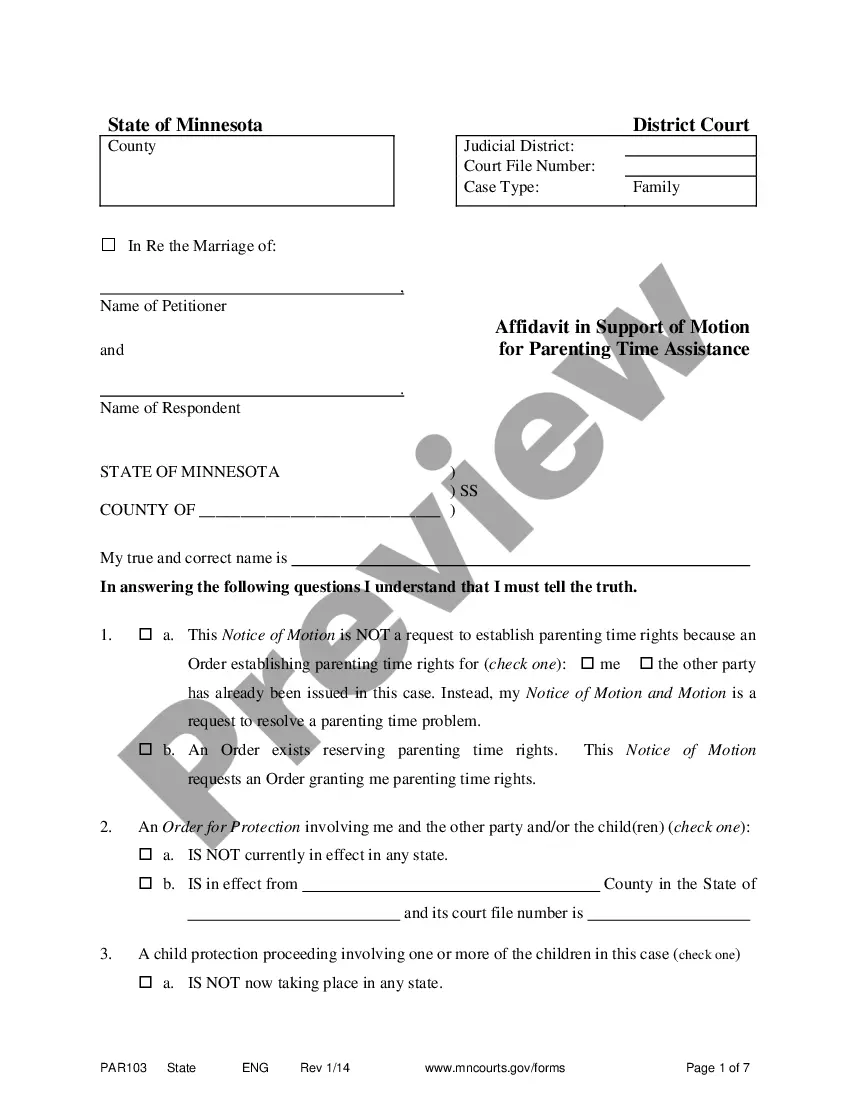

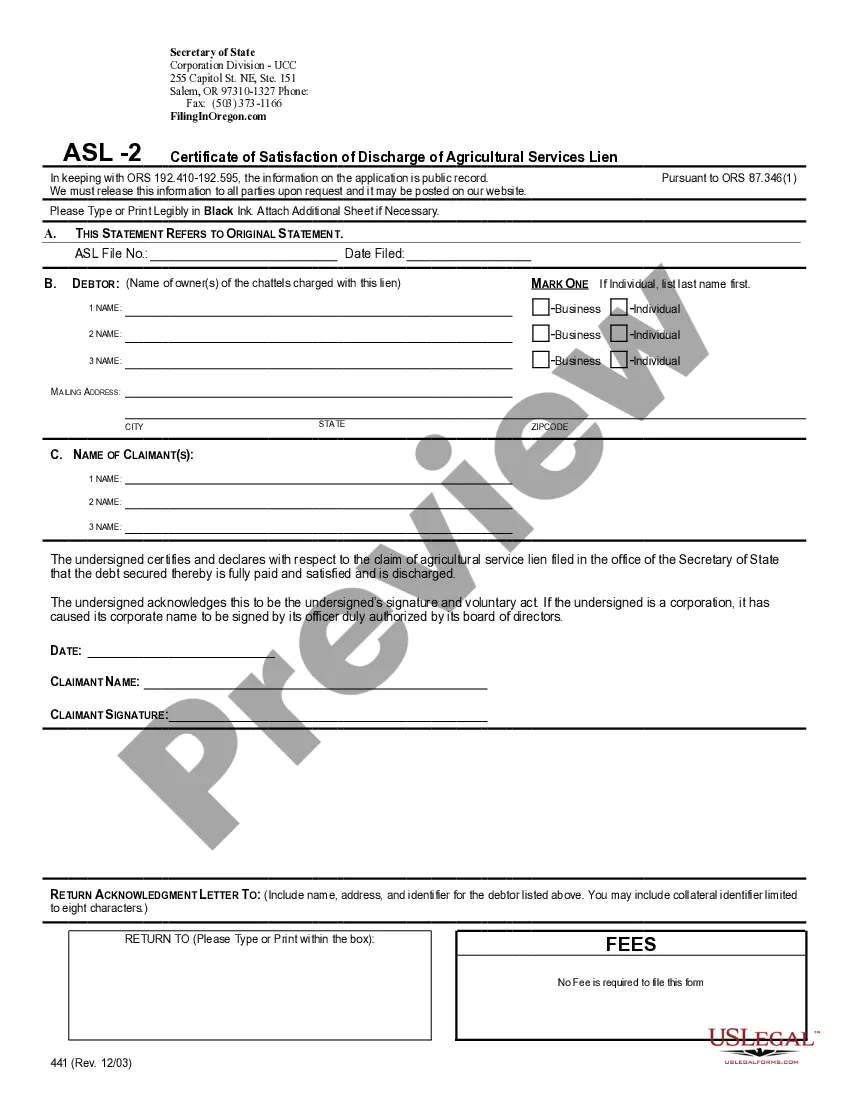

- Make sure you have chosen the correct develop for your personal area/area. Click on the Preview option to check the form`s content material. Look at the develop explanation to ensure that you have selected the appropriate develop.

- In case the develop does not match your demands, use the Look for field near the top of the display to find the one who does.

- If you are content with the shape, validate your decision by simply clicking the Get now option. Then, pick the rates prepare you prefer and provide your accreditations to register for an bank account.

- Procedure the transaction. Use your bank card or PayPal bank account to accomplish the transaction.

- Find the formatting and obtain the shape on your own gadget.

- Make alterations. Load, change and produce and indication the acquired Delaware Grant Agreement from 501(c)(3) to 501(c)(4).

Every format you included with your bank account does not have an expiration time and is also your own property eternally. So, if you would like obtain or produce another version, just proceed to the My Forms portion and click on in the develop you require.

Get access to the Delaware Grant Agreement from 501(c)(3) to 501(c)(4) with US Legal Forms, one of the most extensive collection of legal document themes. Use a large number of specialist and condition-certain themes that meet up with your small business or person requirements and demands.

Form popularity

FAQ

9 Essential Components of a Good Grant Proposal [Template Included] Proposal Summary. Provide a short overview of the entire proposal. ... Introduction to the Applicant. ... The Need/The Problem Statement. ... The Objectives and Outcomes. ... Program Plan. ... The Capacity. ... Evaluation Plan. ... Program Budget.

Here are the common steps, in order, that are often included when writing a formal grant proposal: Include a cover letter. ... Include an executive summary. ... Describe a statement of need. ... List objectives and goals. ... Describe methods and strategies. ... Detail a plan of evaluation. ... Include a budget. ... Detail organizational information.

Grants from a 501(c)(3) to a 501(c)(4) should not be made to cover fundraising costs or general support of the 501(c)(4) (this is to protect the 501(c)(3) from the grant being used for impermissible purposes).

If you plan to write a grant proposal, you should familiarize yourself with the following parts: Introduction/Abstract/Executive Summary. ... Organizational Background. ... Problem Statement/Needs Assessment. ... Program Goals and Objectives. ... Methods and Activities. ... Evaluation Plan. ... Budget/Sustainability.

In addition to standard terms describing grant amounts and purposes, agreements also include provisions regarding intellectual property rights, reporting requirements, and indemnification, among other subjects. Special provisions are included that deal with international philanthropy.

In addition to 501c3 organizations, 501c3 nonprofits can also donate to 501c4 organizations. These contributions must be used for charitable purposes, and no amount can be used for political activities.

Grant writing tends to be hard because it is intricate and has a number of components to learn. If you come to grant writing with strong writing skills, knowledge of the grant writing process broadly, and a basic understanding of what grant funding is, you'll probably be able to learn grant writing quickly.

Key takeaways Understand the grant requirements. From the funding organization's goals to application deadlines ? it is essential to understand the grant requirements and guidelines thoroughly. Develop a compelling narrative. ... Demonstrate impact. ... Provide a detailed budget. ... Include supporting materials. ... Follow-up.