Delaware Investors Rights Agreement refers to a legally binding agreement utilized by businesses incorporated in the state of Delaware that outlines the rights and protections granted to investors. This agreement is crucial in safeguarding the interests of investors and establishing a clear framework for their participation in the company's decision-making processes and future capital raising activities. Investor Rights Agreement is typically entered into between a company and its investors, including venture capital firms, angel investors, and other stakeholders. The Delaware Investors Rights Agreement typically includes key provisions such as: 1. Voting Rights: This provision outlines the rights of investors to vote on specific matters, including the election of the board of directors, major corporate transactions, mergers, and acquisitions. 2. Information Rights: Investors have the right to access certain information about the company, such as financial statements, reports, and other relevant documents. This provision ensures transparency and accountability to protect investor interests. 3. Preemptive Rights: Investors may be granted preemptive rights that allow them to maintain their proportional ownership in the event of future equity financing rounds. This provision enables investors to retain their investment percentage and avoid dilution. 4. Board Representation: The agreement may allow investors, typically larger shareholders or major investors, to appoint a representative to the company's board of directors. This provision gives investors a direct say in the management and strategic decision-making processes of the company. 5. Tag-Along and Drag-Along Rights: Tag-along and drag-along rights allow minority investors to have their shares sold alongside majority shareholders in the event of a sale or exit. This provision protects investors' ability to realize the value of their investment. 6. Anti-Dilution Provisions: The agreement may include anti-dilution clauses that protect investors in case of subsequent equity issuance sat a lower price than what they initially paid. This provision ensures that investors retain the value of their investment and are not unfairly disadvantaged. Different types or variations of the Delaware Investors Rights Agreement may be tailored to meet the specific needs and circumstances of the company and its investors. These may include: 1. Series Seed Investors Rights Agreement: Designed for early-stage startups seeking venture capital investments or seed funding. It covers the rights, protections, and roles of seed investors. 2. Series A Investors Rights Agreement: Typically used for companies that have already raised seed capital and are now moving forward with their Series A round. The agreement may contain additional provisions compared to the seed stage agreement. 3. Preferred Stock Investors Rights Agreement: This agreement is specific to investors who hold preferred stock rather than common stock. It provides additional rights and preferences to preferred stockholders, such as priority in receiving dividends or liquidation proceeds. In summary, the Delaware Investors Rights Agreement is a vital legal document that safeguards investor interests and outlines their rights and protections in a company. It ensures transparency, accountability, and active participation in decision-making processes. Different types of this agreement exist to cater to the specific requirements of different stages and types of investors in a company's development.

Delaware Investors Rights Agreement

Description

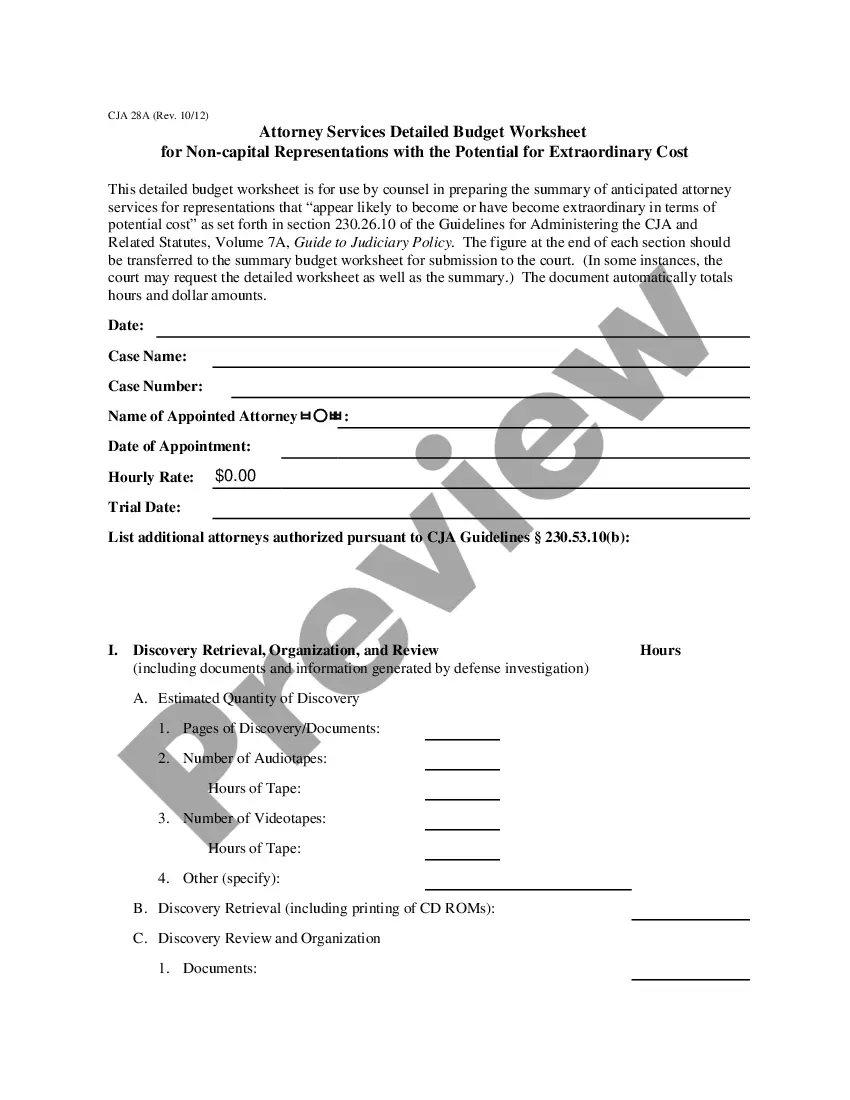

How to fill out Delaware Investors Rights Agreement?

Choosing the right lawful papers format can be quite a battle. Of course, there are a lot of themes available on the Internet, but how will you discover the lawful form you need? Utilize the US Legal Forms internet site. The assistance provides thousands of themes, such as the Delaware Investors Rights Agreement, which you can use for organization and private requirements. Each of the forms are checked out by specialists and meet state and federal specifications.

In case you are currently listed, log in to your accounts and click on the Down load button to have the Delaware Investors Rights Agreement. Make use of accounts to check with the lawful forms you may have bought earlier. Proceed to the My Forms tab of your own accounts and obtain yet another version of your papers you need.

In case you are a new consumer of US Legal Forms, here are straightforward instructions that you should follow:

- First, make certain you have selected the appropriate form for your personal area/region. You may check out the form utilizing the Preview button and study the form description to ensure this is basically the best for you.

- When the form does not meet your needs, take advantage of the Seach field to find the right form.

- When you are certain the form is suitable, go through the Purchase now button to have the form.

- Choose the rates plan you want and type in the essential information and facts. Create your accounts and pay money for your order with your PayPal accounts or Visa or Mastercard.

- Select the data file file format and acquire the lawful papers format to your system.

- Complete, revise and printing and sign the received Delaware Investors Rights Agreement.

US Legal Forms is the most significant local library of lawful forms where you can see a variety of papers themes. Utilize the company to acquire skillfully-created files that follow status specifications.