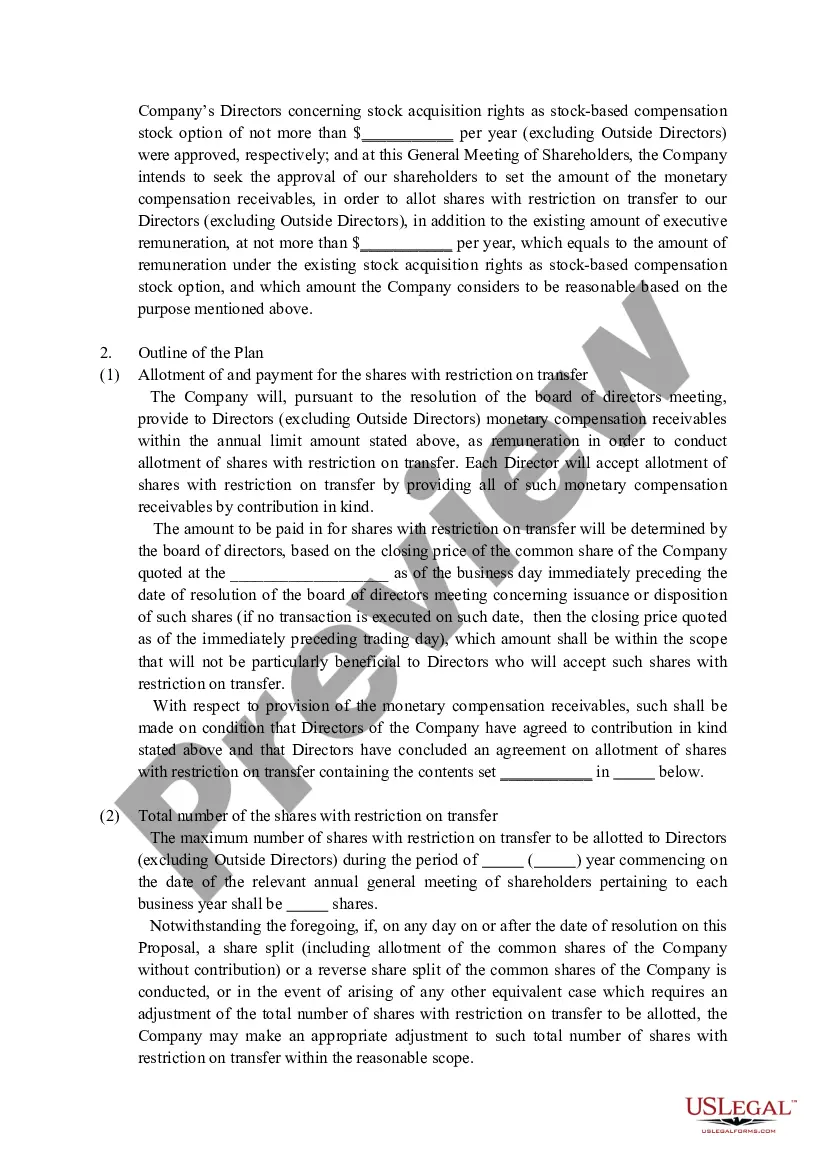

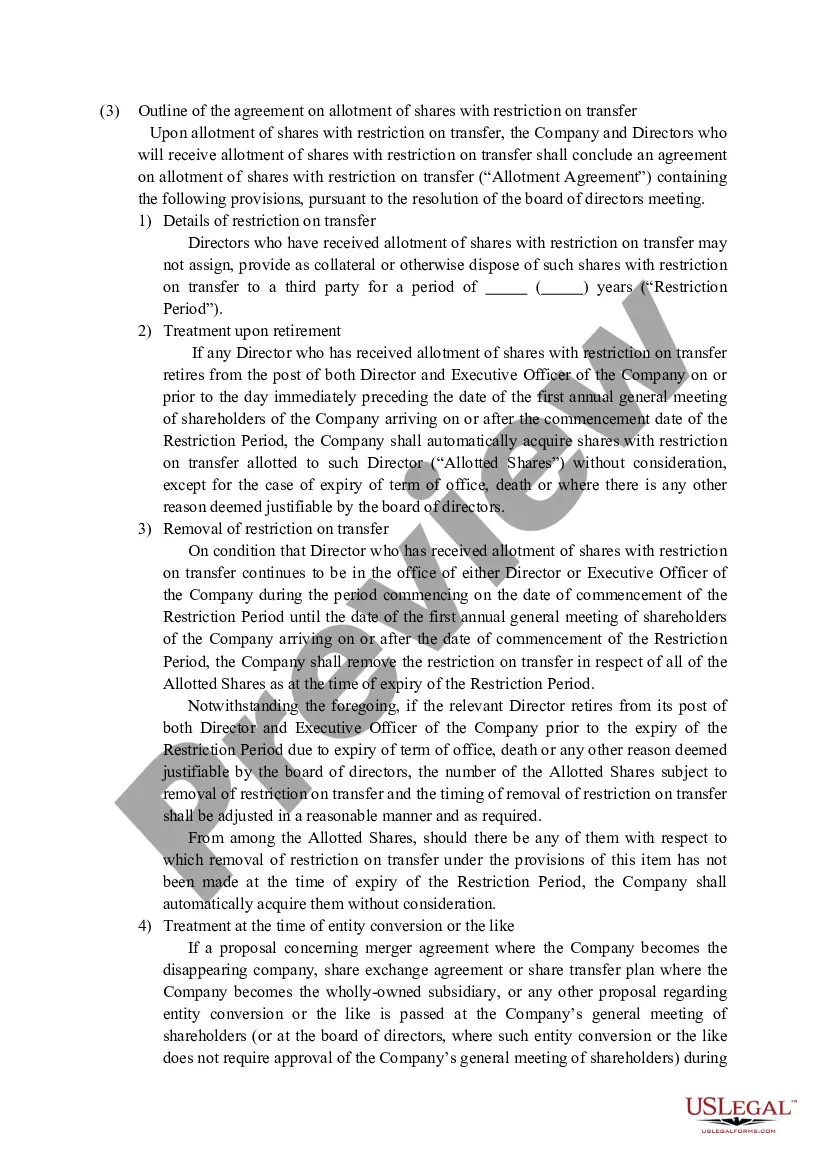

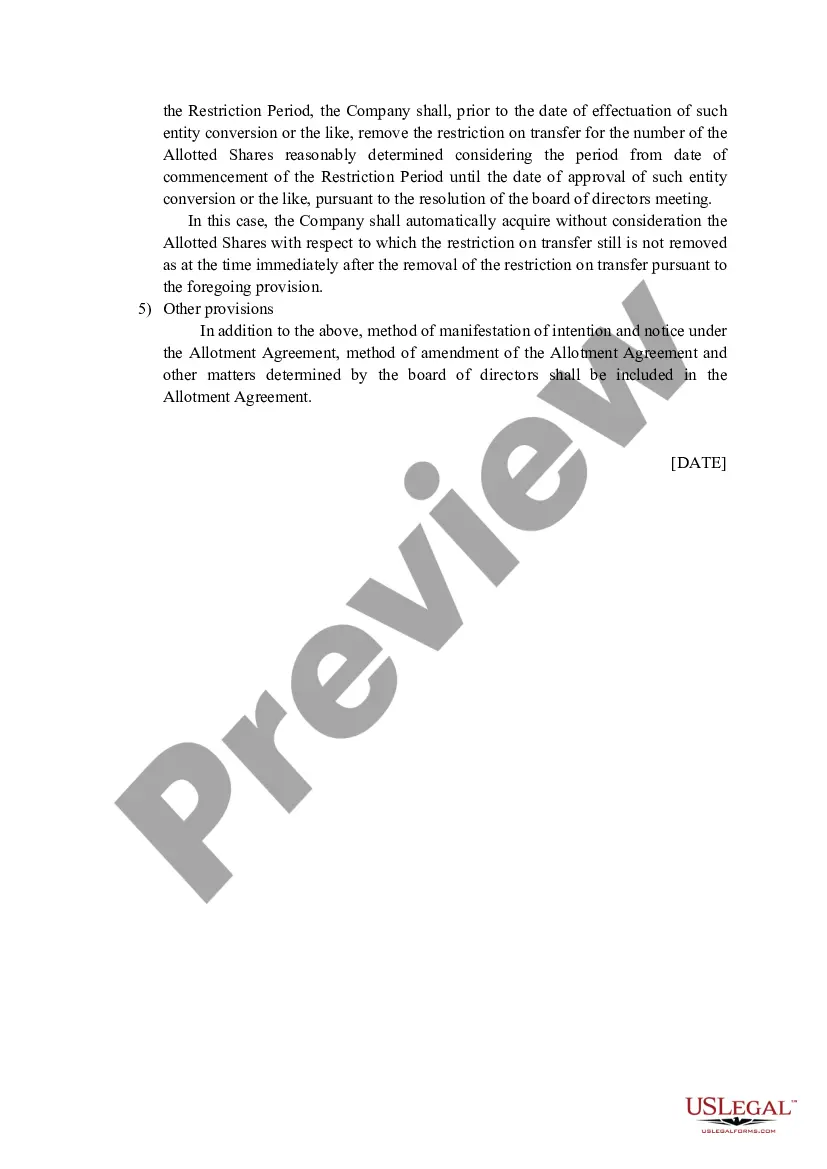

Delaware Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on Transfer

Description

How to fill out Notice Concerning Introduction Of Remuneration Plan For Shares With Restriction On Transfer?

Are you currently in the placement in which you need paperwork for both organization or person functions almost every day time? There are a variety of legal document themes available online, but locating kinds you can rely is not effortless. US Legal Forms offers a huge number of kind themes, like the Delaware Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on, that are composed in order to meet state and federal demands.

In case you are already informed about US Legal Forms web site and also have your account, basically log in. Afterward, it is possible to acquire the Delaware Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on format.

If you do not provide an bank account and want to begin to use US Legal Forms, abide by these steps:

- Obtain the kind you require and make sure it is for the right area/region.

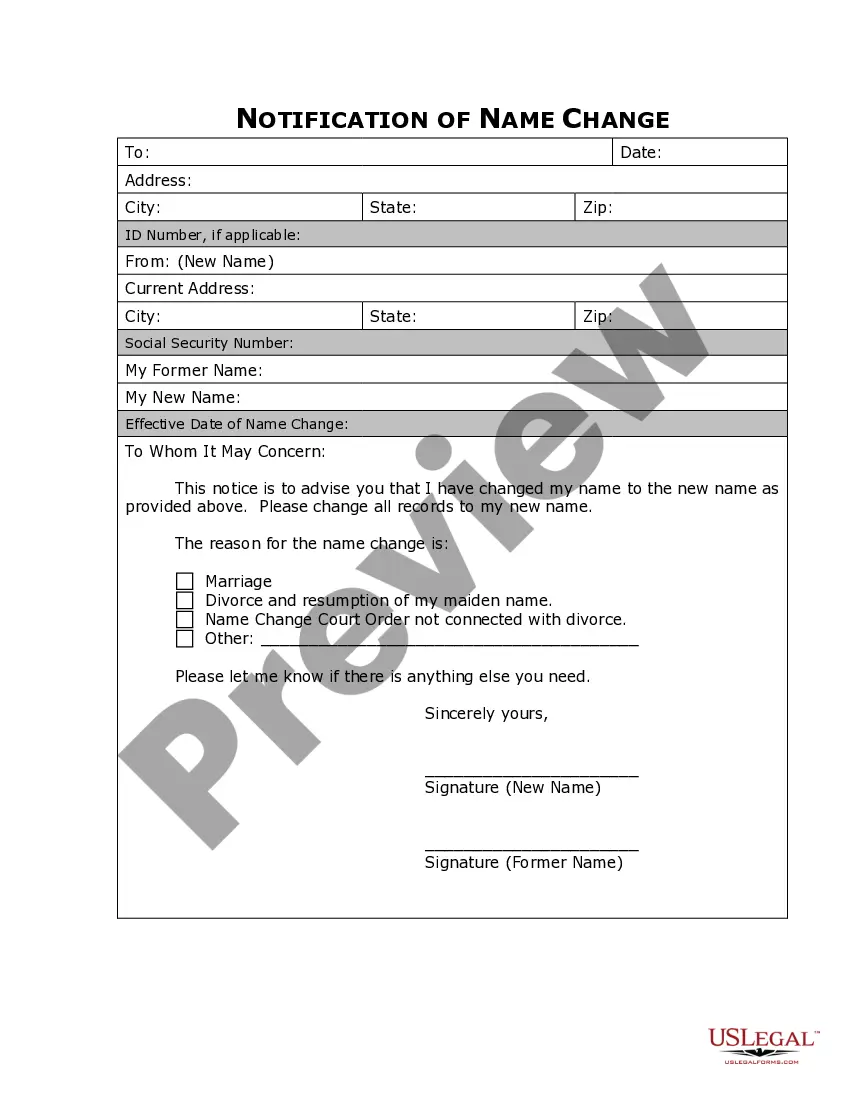

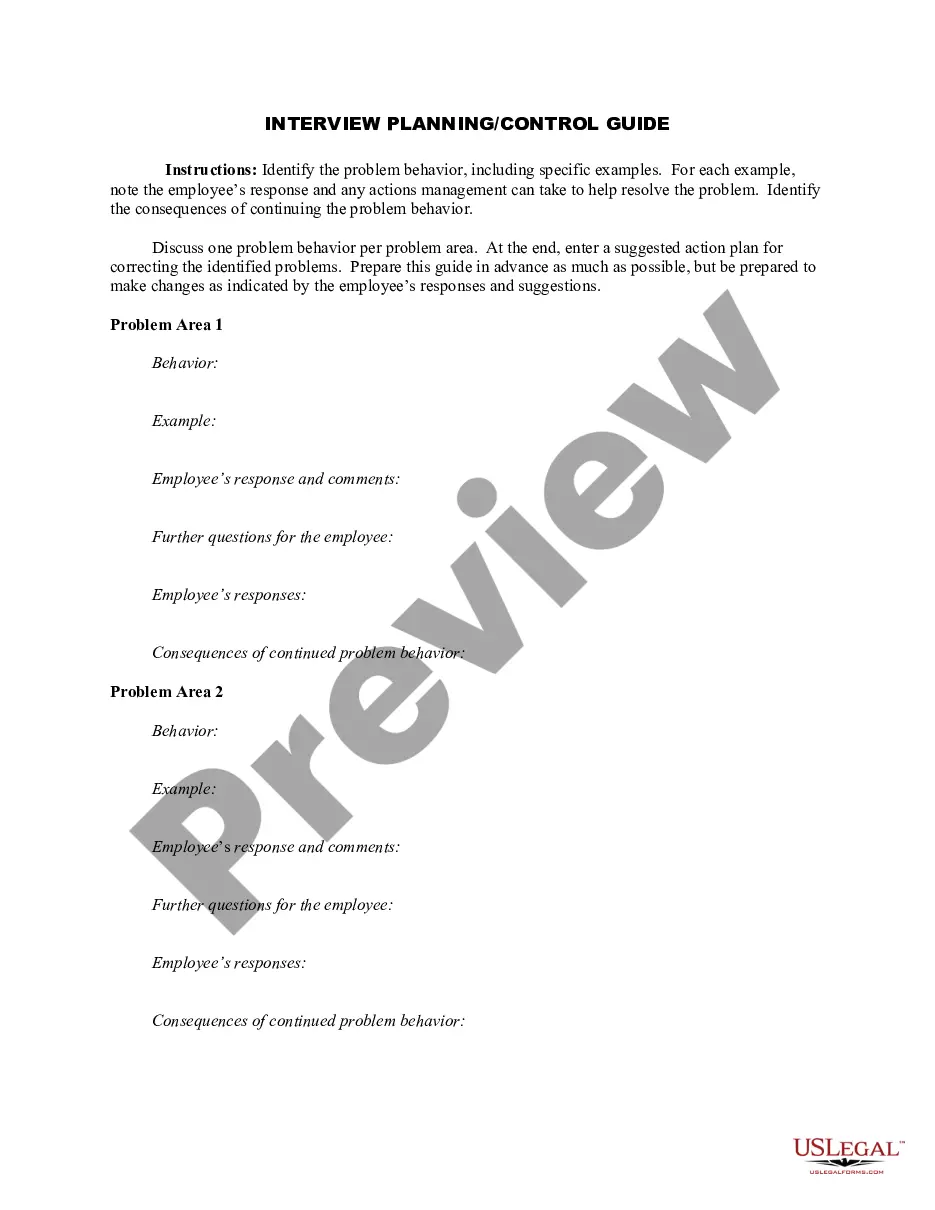

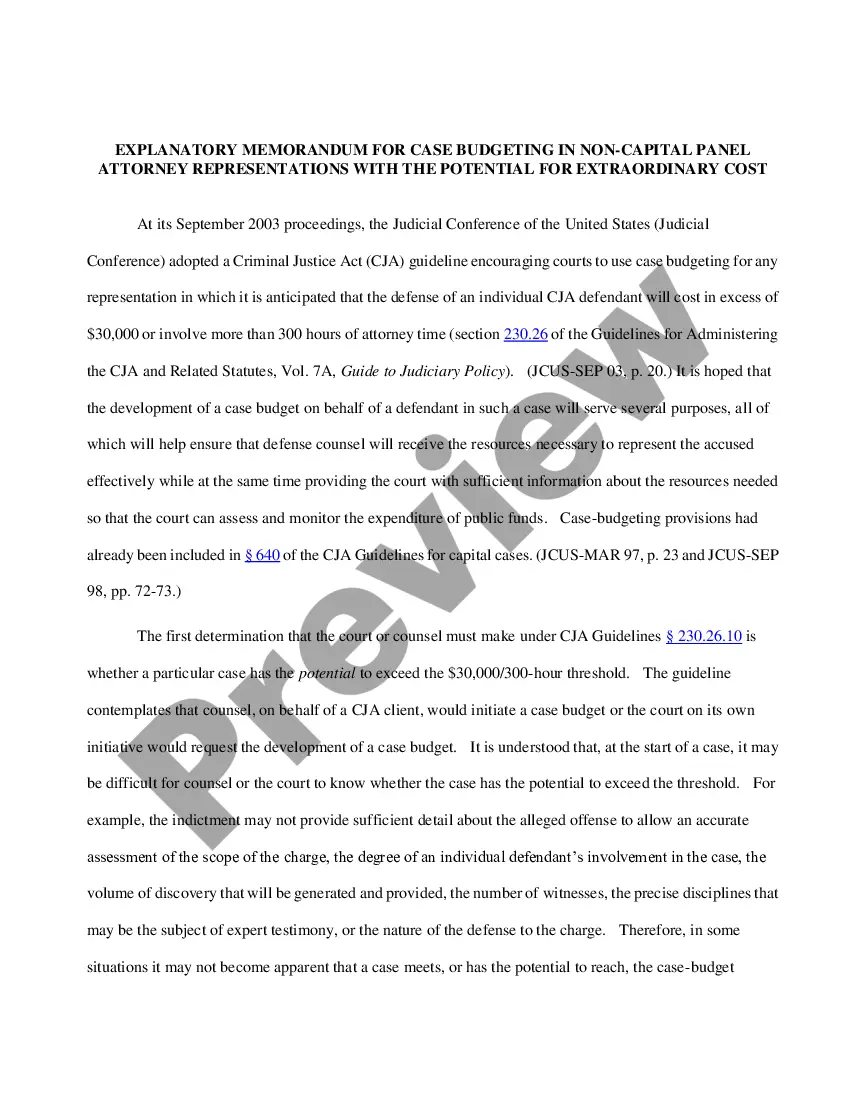

- Use the Preview option to analyze the form.

- Look at the outline to actually have chosen the proper kind.

- When the kind is not what you are seeking, utilize the Lookup discipline to get the kind that meets your requirements and demands.

- If you obtain the right kind, just click Buy now.

- Select the rates prepare you need, fill in the specified info to make your account, and buy your order using your PayPal or credit card.

- Decide on a hassle-free document structure and acquire your copy.

Discover each of the document themes you might have bought in the My Forms food selection. You may get a further copy of Delaware Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on at any time, if required. Just select the necessary kind to acquire or print out the document format.

Use US Legal Forms, the most extensive collection of legal types, to save lots of time as well as avoid faults. The assistance offers expertly manufactured legal document themes that can be used for an array of functions. Produce your account on US Legal Forms and begin generating your lifestyle easier.

Form popularity

FAQ

The number of authorized shares of any such class or classes of stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the stock of the corporation entitled to vote irrespective of this subsection, if so provided in the ...

Here are the steps to issue shares in a corporation: Decide how much capital to raise. ... Decide the number of shares to be issued. ... Decide corporation will be public or private. ... Set value for each share. ... Choose the type of stock. ... Prepare a shareholder agreement. ... Issue stock certificates.

Unless the certificate of incorporation or bylaws of a professional corporation, or a separate contract among all of the shareholders of the professional corporation, provides otherwise for the manner in which such sale or transfer of shares as permitted under this section is to take place, the sale or transfer may be ...

The number of authorized shares can be increased by the shareholders of the company at annual shareholder meetings, provided a majority of the current shareholders vote for the change.

§ 243. Retirement of stock. (a) A corporation, by resolution of its board of directors, may retire any shares of its capital stock that are issued but are not outstanding.

Issuing new shares typically requires approval from the company's shareholders. This may involve holding a vote at a shareholder meeting or obtaining written consent from a majority of shareholders. The approval process will depend on the company's bylaws and state laws governing the issuance of new shares.

How to make stock amendments in Delaware Corporation? Hold a company meeting and get the appropriate authorities of the company to approve the changes to the stock number of the company. Create the Certificate of Amendment for giving to the Secretary of State of Delaware.

Section 242 of the DGCL governs the procedures by which a corporation may amend its certificate of corporation, or charter, and generally requires approval by (a) the board of directors and (b) holders of a majority in voting power of the outstanding stock entitled to vote thereon and by the holders of a majority in ...