Delaware is a state located in the Mid-Atlantic region of the United States. It is known for its favorable business climate, which attracts numerous corporations and entrepreneurs. One of the important aspects of conducting business in Delaware includes understanding the various types of private placement offerings and their summary of terms. A private placement offering is a method through which companies can raise capital by selling securities to a select group of investors, rather than through public offerings. Delaware, being a popular state for incorporating businesses, has its own set of rules and regulations that govern private placement offerings. The summary of terms of a proposed private placement offering in Delaware includes several key elements. These terms primarily revolve around the securities being offered, their pricing, investor qualifications, and the overall structure of the offering. Here are some relevant keywords to understand these terms: 1. Securities: The summary provides detailed information about the type of securities being offered, such as stocks, bonds, or convertible notes. It highlights any particular features or rights associated with these securities. 2. Pricing: This section outlines the price at which the securities will be offered to investors. It may include information like the offering price per share or the initial conversion price for convertible notes. 3. Investor Qualifications: Delaware requires private placement offerings to be limited to accredited investors, who are financially sophisticated individuals or institutional investors. The summary of terms specifies the qualification criteria that potential investors should meet. 4. Use of Proceeds: Companies planning a private placement offering need to specify how they intend to use the funds raised. This section highlights the purposes for which the capital will be utilized and provides transparency to potential investors. 5. Offering Structure: The summary of terms outlines the structure of the private placement offering, including the size of the offering (in terms of the total dollar amount), the minimum and maximum investment thresholds, and any imposed limitations on reselling the securities. Different types of private placement offerings in Delaware may include Regulation D offerings, which can be further divided into Rule 504, 505, and 506 offerings. Each type has its own set of requirements and restrictions, which determine who can invest and how the offering can be marketed. In conclusion, Delaware's summary of terms for a proposed private placement offering encompasses crucial information regarding the securities, pricing, investor qualifications, use of proceeds, and offering structure. Understanding the specific requirements and different types of private placement offerings in Delaware are vital for businesses seeking to raise capital through this method.

Delaware Summary of Terms of Proposed Private Placement Offering

Description

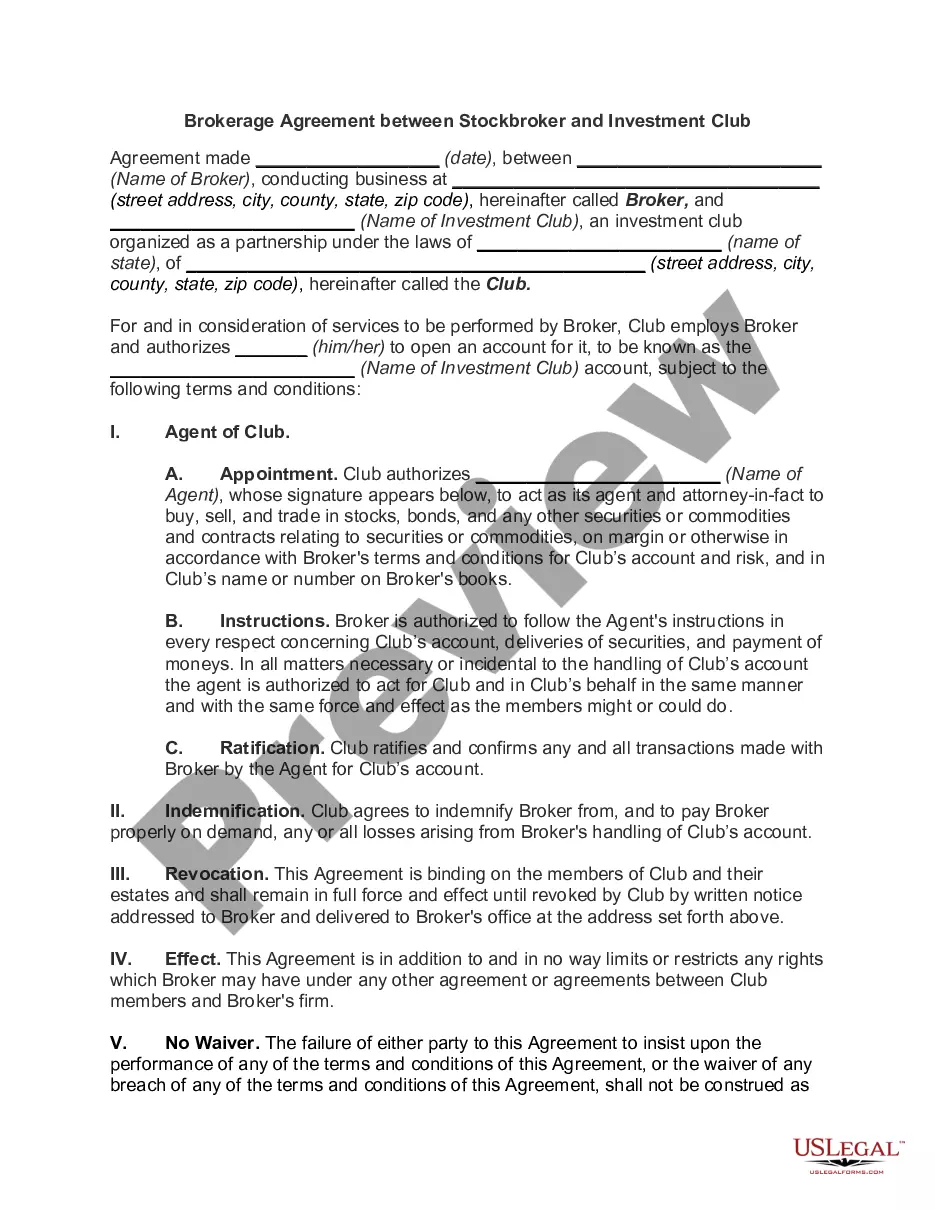

How to fill out Delaware Summary Of Terms Of Proposed Private Placement Offering?

Choosing the best authorized papers template might be a have a problem. Naturally, there are a lot of web templates available on the net, but how do you get the authorized kind you want? Take advantage of the US Legal Forms internet site. The assistance offers 1000s of web templates, like the Delaware Summary of Terms of Proposed Private Placement Offering, that you can use for organization and private requires. All of the kinds are checked by professionals and meet state and federal demands.

If you are previously authorized, log in in your accounts and click the Down load key to find the Delaware Summary of Terms of Proposed Private Placement Offering. Utilize your accounts to look from the authorized kinds you might have bought formerly. Proceed to the My Forms tab of your accounts and have yet another copy in the papers you want.

If you are a fresh end user of US Legal Forms, listed here are straightforward guidelines so that you can comply with:

- Initial, ensure you have chosen the appropriate kind for the metropolis/county. It is possible to look over the form while using Preview key and look at the form information to guarantee it will be the right one for you.

- If the kind fails to meet your preferences, use the Seach industry to discover the right kind.

- When you are certain the form is proper, go through the Get now key to find the kind.

- Choose the prices plan you would like and enter in the essential information. Build your accounts and pay money for your order making use of your PayPal accounts or credit card.

- Pick the file file format and down load the authorized papers template in your gadget.

- Total, revise and printing and sign the attained Delaware Summary of Terms of Proposed Private Placement Offering.

US Legal Forms may be the most significant library of authorized kinds in which you can discover numerous papers web templates. Take advantage of the company to down load professionally-created papers that comply with status demands.