Delaware Waiver Special Meeting of Shareholders refers to a specific type of meeting that allows shareholders to waive certain rights or requirements imposed by the Delaware General Corporation Law (DCL). This meeting is essential for companies incorporated in Delaware seeking flexibility in shareholder-related matters. The DCL grants significant powers to shareholders, including the right to vote on specific matters, approve amendments to the company's charter or bylaws, and elect directors. The Delaware Waiver Special Meeting of Shareholders provides a platform for shareholders to agree and waive these rights, as permitted by the DCL. By holding this meeting, companies can address unique situations, streamline decision-making processes, and ensure smooth corporate governance. Shareholders are given the opportunity to vote on resolutions that propose waiving specific rights, granting the company greater flexibility in its operations. There are different types of Delaware Waiver Special Meeting of Shareholders, each serving a distinct purpose. These include: 1. Charter Waiver Special Meeting: This type of meeting focuses on waiving specific provisions within the company's charter. Shareholders may vote to alter or waive sections that impose restrictions, such as provisions related to voting rights, quorum requirements, or board composition. 2. Bylaws Waiver Special Meeting: This meeting revolves around waiving or amending certain provisions outlined in the company's bylaws. Shareholders can vote to modify rules for conducting meetings, proxy voting requirements, or procedures for director nominations. 3. Voting Rights Waiver Special Meeting: In this type of meeting, shareholders have the opportunity to waive or revise their voting rights. They may consent to temporarily or permanently give up their voting power on specific matters, granting the board or majority shareholders the authority to make decisions without seeking their approval. 4. Director Waiver Special Meeting: This meeting focuses on waiving certain director-related requirements. Shareholders can vote to relax director qualifications, remove term limits, or modify the director nomination process. 5. Shareholder Agreement Waiver Special Meeting: This type of meeting provides an avenue for waiving or amending provisions laid out in shareholders' agreements. Shareholders can vote to revise restrictions on the transfer of shares, preemptive rights, or rights of first refusal. The Delaware Waiver Special Meeting of Shareholders is a powerful tool for companies incorporated in Delaware to customize their corporate governance and decision-making processes. It allows shareholders to collaborate and agree upon necessary waivers, leading to greater operational efficiency and adaptability.

Delaware Waiver Special Meeting of Shareholders

Description

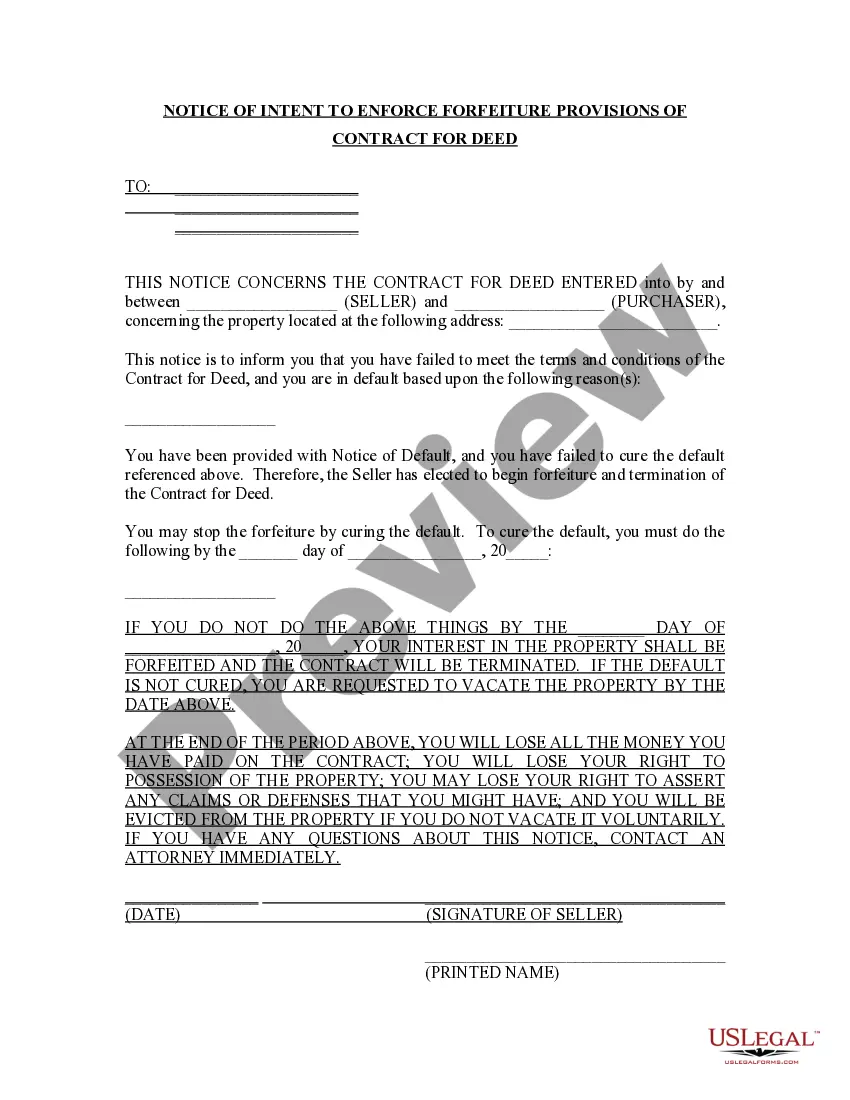

How to fill out Delaware Waiver Special Meeting Of Shareholders?

US Legal Forms - among the greatest libraries of authorized kinds in the USA - provides a wide array of authorized papers web templates you are able to obtain or print. Using the site, you will get 1000s of kinds for enterprise and specific functions, sorted by classes, states, or search phrases.You will find the newest types of kinds just like the Delaware Waiver Special Meeting of Shareholders in seconds.

If you already possess a monthly subscription, log in and obtain Delaware Waiver Special Meeting of Shareholders from your US Legal Forms library. The Acquire switch can look on every kind you perspective. You gain access to all earlier saved kinds inside the My Forms tab of the account.

If you would like use US Legal Forms the very first time, listed below are easy guidelines to help you get started:

- Be sure you have picked out the best kind to your city/county. Click the Review switch to check the form`s content. Look at the kind description to ensure that you have chosen the correct kind.

- If the kind doesn`t fit your specifications, take advantage of the Search industry near the top of the display to discover the the one that does.

- Should you be satisfied with the shape, verify your decision by clicking the Purchase now switch. Then, pick the costs plan you favor and offer your accreditations to sign up on an account.

- Procedure the transaction. Make use of your charge card or PayPal account to complete the transaction.

- Pick the structure and obtain the shape on your system.

- Make alterations. Fill out, change and print and signal the saved Delaware Waiver Special Meeting of Shareholders.

Every design you put into your bank account lacks an expiry date and is your own property eternally. So, if you want to obtain or print another copy, just go to the My Forms segment and then click about the kind you need.

Get access to the Delaware Waiver Special Meeting of Shareholders with US Legal Forms, probably the most extensive library of authorized papers web templates. Use 1000s of professional and state-particular web templates that meet your organization or specific requirements and specifications.

Form popularity

FAQ

Section 204 of the DGCL provides the procedure by which corporations may ratify a defective corporate act that is otherwise void or voidable due to a failure to properly authorize these acts, such as officer or director appointments or stock issuances.

Delaware corporations are required to hold an annual meeting of shareholders, where the corporation's officers and directors are elected and other important matters of operation are discussed.

A person who is the owner of 20% or more of the outstanding voting stock of any corporation, partnership, unincorporated association or other entity shall be presumed to have control of such entity, in the absence of proof by a preponderance of the evidence to the contrary; Notwithstanding the foregoing, a presumption ...

Contents and Timing of Notice. Under Delaware law, stockholders must be given between 10 and 60 days' notice of an annual meeting of stockholders except for meetings held to vote on the adoption of a merger agreement, which require at least 20 days' notice.

Delaware law requires every corporation to hold an annual shareholders meeting at least once every 13 months. Generally, the date of the annual meeting is contained in the bylaws of the corporation. A meeting must be held, regardless of the number of shareholders in the corporation.

Meeting Requirements for Corporations. State laws and a corporation's bylaws will dictate specific meeting requirements for corporations. In general, however, most corporations are required to have at least one shareholders' meeting per year. Corporations are also required to prepare and retain minutes of these meeting ...

Stockholder Approval Required to: Amend the Certificate of Incorporation. Enter into fundamental corporate transactions (sale of company, merger, sale of substantially all assets of corporation, etc.) Elect Directors (though vacant seats from departed directors can often be filled by Board)

A corporation must hold an annual meeting to elect directors, but its governing documents will provide for an annual meeting (and, depending on the corporation, other periodic meetings) and special meetings (called as needed).