This Formula System for Distribution of Earnings to Partners provides a list of provisions to conside when making partner distribution recommendations. Some of the factors to consider are: Collections on each partner's matters, acquisition and development of new clients, profitablity of matters worked on, training of associates and paralegals, contributions to the firm's marketing practices, and others.

Delaware Formula System for Distribution of Earnings to Partners

Description

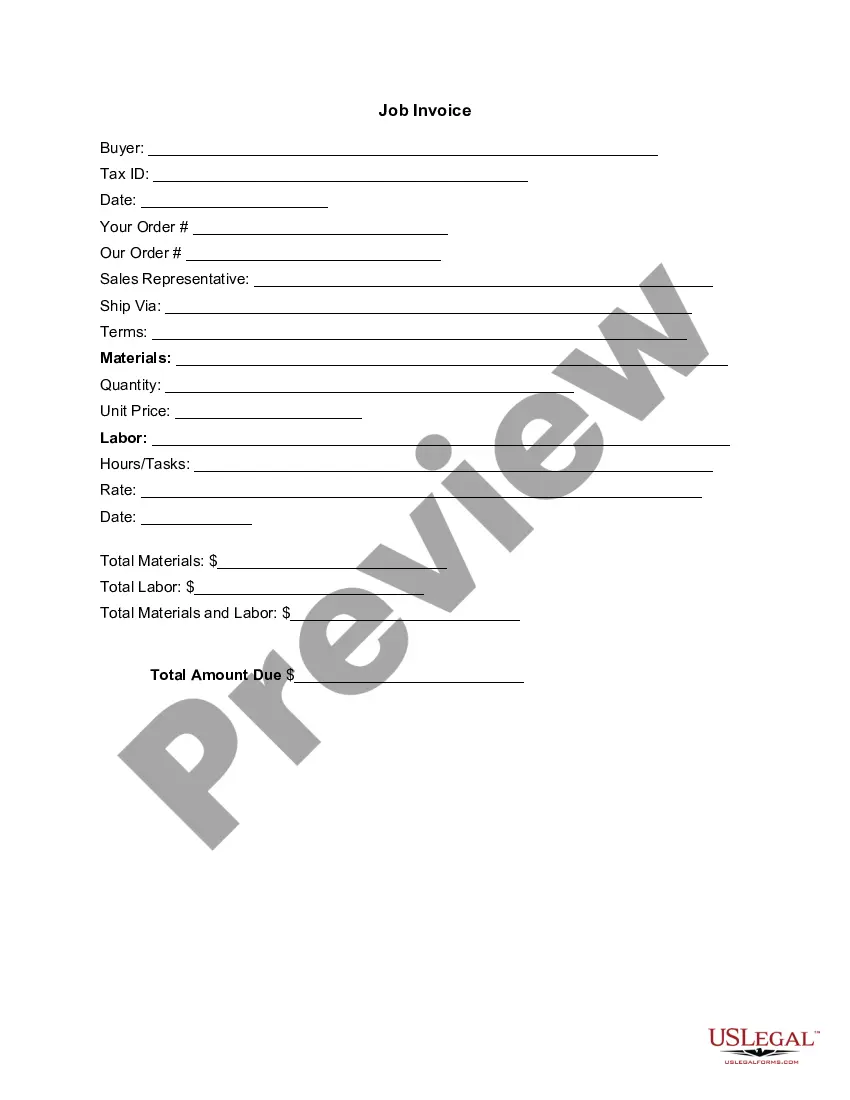

How to fill out Formula System For Distribution Of Earnings To Partners?

If you have to full, download, or print legal document templates, use US Legal Forms, the most important variety of legal kinds, which can be found on the web. Utilize the site`s simple and hassle-free lookup to discover the papers you require. Various templates for company and person uses are categorized by types and claims, or keywords and phrases. Use US Legal Forms to discover the Delaware Formula System for Distribution of Earnings to Partners within a handful of mouse clicks.

If you are already a US Legal Forms consumer, log in for your accounts and then click the Acquire button to obtain the Delaware Formula System for Distribution of Earnings to Partners. You can also accessibility kinds you previously saved in the My Forms tab of your own accounts.

If you work with US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the form for the proper town/nation.

- Step 2. Make use of the Preview method to examine the form`s articles. Don`t forget about to read through the information.

- Step 3. If you are unhappy together with the develop, use the Search field near the top of the monitor to get other models of the legal develop format.

- Step 4. Upon having identified the form you require, click the Buy now button. Select the prices strategy you choose and add your qualifications to sign up to have an accounts.

- Step 5. Process the deal. You can use your charge card or PayPal accounts to perform the deal.

- Step 6. Choose the file format of the legal develop and download it in your system.

- Step 7. Complete, modify and print or indication the Delaware Formula System for Distribution of Earnings to Partners.

Every legal document format you acquire is your own property forever. You possess acces to every single develop you saved inside your acccount. Select the My Forms area and choose a develop to print or download yet again.

Contend and download, and print the Delaware Formula System for Distribution of Earnings to Partners with US Legal Forms. There are many professional and status-certain kinds you can use for your company or person demands.

Form popularity

FAQ

In other words, 1099 forms are relevant for reporting the income of the partnership as a whole. Schedule K-1 is relevant to the individuals of the partnership when reporting their share of the profit or loss on their income tax return. A partner will almost never receive a 1099 from the partnership that they own.

The maximum amount of salary, bonus, commission or other remuneration to all the partners during the previous year should not exceed the limits given below: On first 3 lakhs of book profit or in case of loss ? ? 1, 50,000 or 90% of book profits (whichever is higher). On the balance book profit 60% of book profit.

The net income for a partnership is divided between the partners as called for in the partnership agreement. The income summary account is closed to the respective partner capital accounts. The respective drawings accounts are closed to the partner capital accounts.

Distributions from a partnership or LLC may be subject to self-employment tax (Social Security or SECA) in addition to other income taxes.

Distributions to partners may be extracted directly from their capital accounts, or they may first be recorded in a drawing account, which is a temporary account whose balance is later shifted into the capital account. The net effect is the same, whether a drawing account is used or not.

Are partnership distributions taxable? Because each individual partner pays taxes on their share of the partnership income, they are not taxed on any withdrawals or distributions.

Each partner reports their share of the partnership's income or loss on their personal tax return. Partners are not employees and shouldn't be issued a Form W-2. The partnership must furnish copies of Schedule K-1 (Form 1065) to the partner. For deadlines, see About Form 1065, U.S. Return of Partnership Income.

Are partnership distributions taxable? Because each individual partner pays taxes on their share of the partnership income, they are not taxed on any withdrawals or distributions.