The form is used when the Assignor transfers, assigns, and conveys to Assignee an overriding royalty interest in the Leases and all of the oil, gas and other minerals produced, saved and marketed from the Lease equal to a pecentage of 8/8 (the Override ).

Delaware Assignment of Overriding Royalty Interest by Overriding Royalty Interest Owner, No Proportionate Reduction,

Description

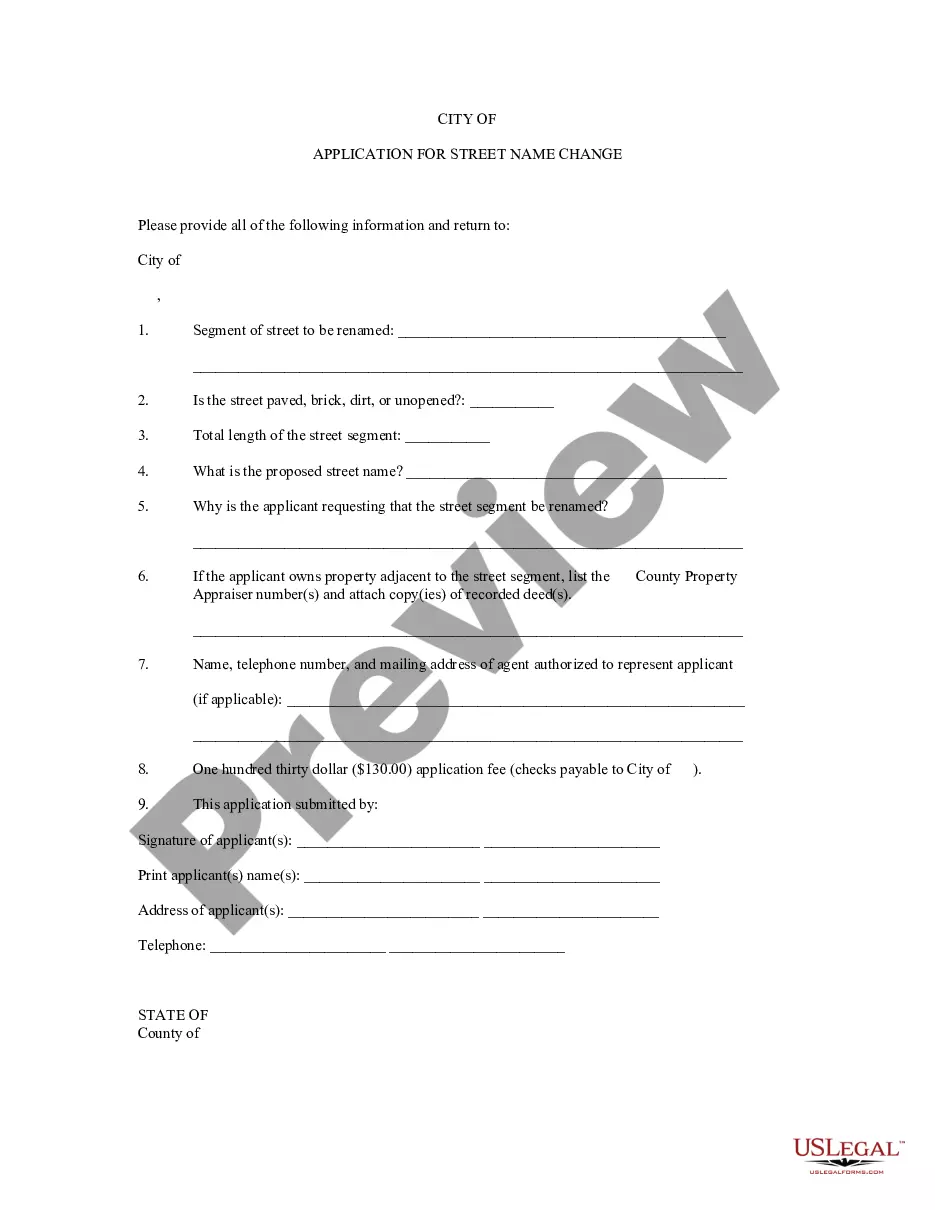

How to fill out Assignment Of Overriding Royalty Interest By Overriding Royalty Interest Owner, No Proportionate Reduction,?

If you need to comprehensive, acquire, or produce authorized document templates, use US Legal Forms, the biggest assortment of authorized varieties, that can be found on-line. Utilize the site`s simple and convenient research to find the documents you need. A variety of templates for organization and personal reasons are categorized by groups and says, or keywords and phrases. Use US Legal Forms to find the Delaware Assignment of Overriding Royalty Interest by Overriding Royalty Interest Owner, No Proportionate Reduction, in just a handful of mouse clicks.

When you are presently a US Legal Forms buyer, log in to your profile and click on the Obtain switch to obtain the Delaware Assignment of Overriding Royalty Interest by Overriding Royalty Interest Owner, No Proportionate Reduction,. You may also entry varieties you in the past saved within the My Forms tab of your profile.

If you are using US Legal Forms initially, refer to the instructions under:

- Step 1. Ensure you have selected the form for your right town/nation.

- Step 2. Use the Review solution to examine the form`s content. Don`t overlook to read through the information.

- Step 3. When you are unsatisfied using the develop, take advantage of the Look for area near the top of the display screen to discover other types of your authorized develop format.

- Step 4. Upon having located the form you need, go through the Acquire now switch. Choose the prices plan you prefer and include your references to sign up for an profile.

- Step 5. Procedure the deal. You can utilize your credit card or PayPal profile to perform the deal.

- Step 6. Find the file format of your authorized develop and acquire it on your system.

- Step 7. Full, edit and produce or indication the Delaware Assignment of Overriding Royalty Interest by Overriding Royalty Interest Owner, No Proportionate Reduction,.

Every single authorized document format you purchase is your own forever. You might have acces to every develop you saved with your acccount. Click the My Forms segment and pick a develop to produce or acquire yet again.

Contend and acquire, and produce the Delaware Assignment of Overriding Royalty Interest by Overriding Royalty Interest Owner, No Proportionate Reduction, with US Legal Forms. There are many professional and express-certain varieties you may use to your organization or personal requirements.

Form popularity

FAQ

What Determines the Value of an Overriding Royalty Interest? Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

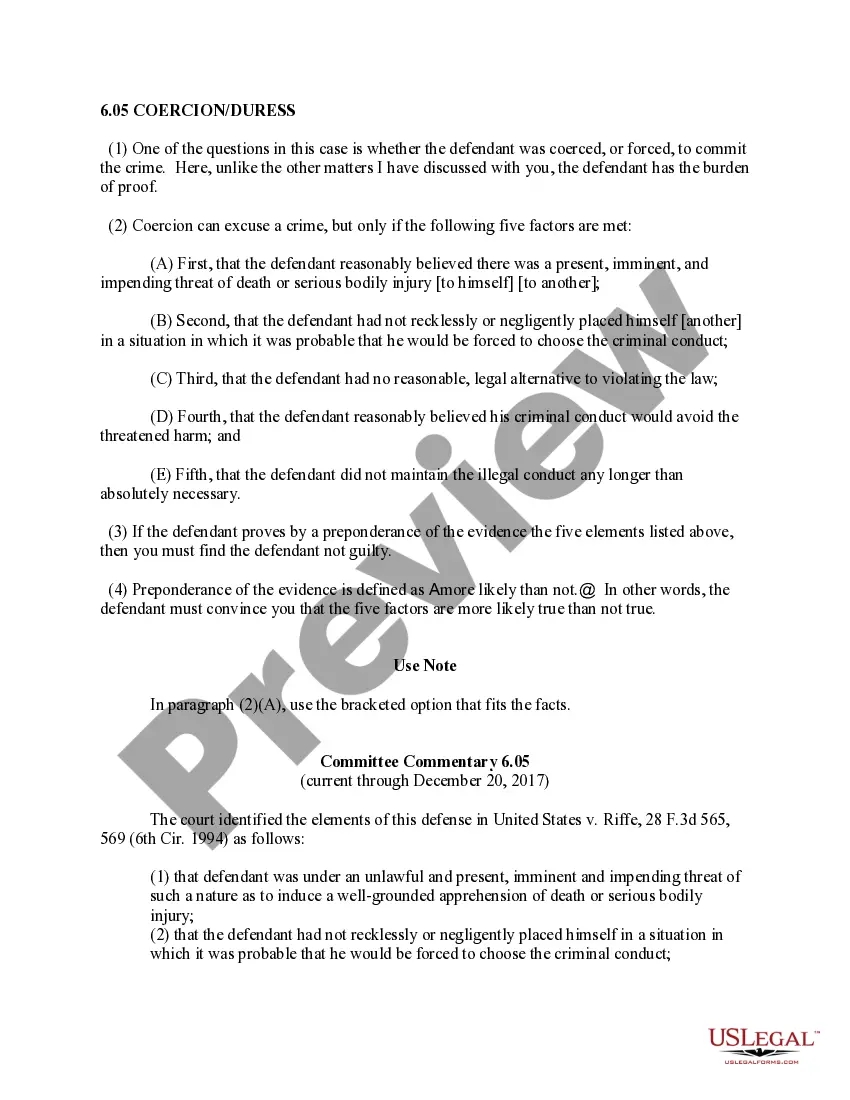

If at any time Assignee desires to transfer or dispose of all or any portion of the Overriding Royalty Interest, Assignee must first give to Assignor written notice thereof stating: (a) the amount of the Overriding Royalty Interest offered by Assignee; (b) the form of consideration (which shall be either cash or a ...

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

There are three main types of royalty interests: Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...