Delaware Due Diligence Field Review and Checklist

Description

How to fill out Due Diligence Field Review And Checklist?

If you have to complete, acquire, or printing legitimate file layouts, use US Legal Forms, the most important variety of legitimate types, which can be found on-line. Utilize the site`s simple and easy practical search to discover the documents you will need. Numerous layouts for enterprise and personal functions are categorized by classes and suggests, or search phrases. Use US Legal Forms to discover the Delaware Due Diligence Field Review and Checklist in a handful of clicks.

Should you be already a US Legal Forms customer, log in to your bank account and click on the Acquire switch to have the Delaware Due Diligence Field Review and Checklist. You can even entry types you previously downloaded in the My Forms tab of your own bank account.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have selected the shape to the proper city/country.

- Step 2. Take advantage of the Preview choice to examine the form`s articles. Don`t forget to see the description.

- Step 3. Should you be not satisfied using the develop, take advantage of the Search field near the top of the display screen to discover other types in the legitimate develop web template.

- Step 4. Upon having located the shape you will need, click the Get now switch. Select the rates strategy you choose and add your references to sign up for an bank account.

- Step 5. Method the deal. You should use your charge card or PayPal bank account to complete the deal.

- Step 6. Find the file format in the legitimate develop and acquire it on your gadget.

- Step 7. Complete, edit and printing or signal the Delaware Due Diligence Field Review and Checklist.

Each and every legitimate file web template you purchase is yours for a long time. You possess acces to every single develop you downloaded in your acccount. Select the My Forms section and select a develop to printing or acquire once more.

Contend and acquire, and printing the Delaware Due Diligence Field Review and Checklist with US Legal Forms. There are many expert and state-specific types you may use for the enterprise or personal demands.

Form popularity

FAQ

The Four Due Diligence Requirements Complete and Submit Form 8867. (Treas. Reg. section 1.6695-2(b)(1)) ... Compute the Credits. (Treas. Reg. section 1.6695-2(b)(2)) ... Knowledge. (Treas. Reg. section 1.6695-2(b)(3)) ... Keep Records for Three Years.

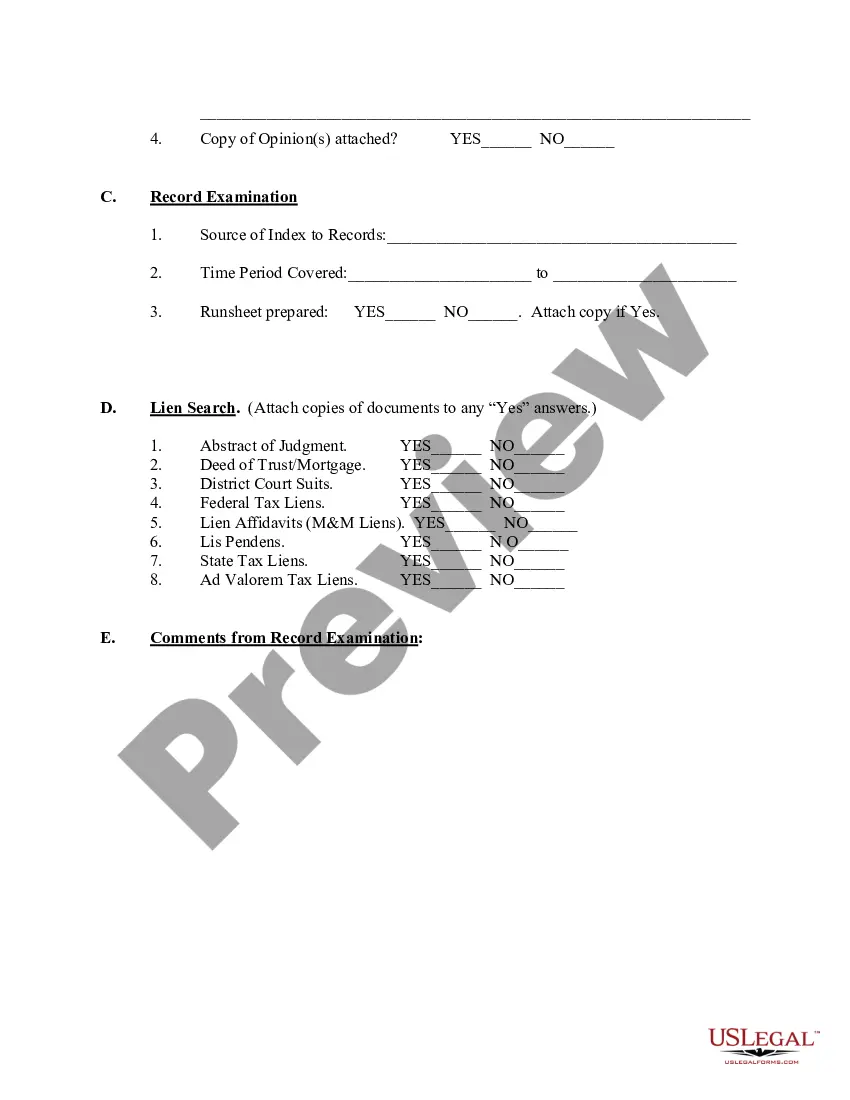

However, a standard due diligence report should include the following components: Executive summary. Company overview. Purpose and objective of the diligence. Financial due diligence. Legal due diligence. Operational due diligence. Market and commercial due diligence. Risk assessment.

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property, and the board of directors.

Complete Due Diligence Documents Checklist Shareholder certificate documents. Local/state/federal business licenses. Occupational license. Building permits documents. Zonal and land use permits. Tax registration documents. Power of attorney documents. Previous or outstanding legal cases.

Taxpayer's response 1 How long have you owned your business? 2 Do you have any documentation to substantiate your business? 3 Who maintains the business records for your business? 4 Do you have separate bank accounts for personal and business transactions?

A due diligence questionnaire is a formal assessment made up of questions designed to outline the way a business complies with industry standards, implements cybersecurity initiatives, and manages its network.

How to Conduct Due Diligence in a Private Company Review of MCA Documents. ... Review of Article of association. ... Assessment of statutory registers of the company. ... Review of books of accounts and financial statements. ... Review of Taxation Aspects. ... Review of legal aspects. ... Review of operational aspects.

Additionally, there are four due diligence requirements that paid tax preparers must meet when preparing returns for clients that claim certain tax benefits, which you can read more about on the IRS website.