A Delaware Release of Mortgage, also referred to as a Deed of Trust — Full Release, is a legal document that serves as proof that a mortgage or deed of trust on a property has been fully paid and satisfied. This document is typically entered into public records to notify interested parties, such as lenders and potential buyers, that the property is no longer encumbered by a mortgage or deed of trust. The Delaware Release of Mortgage / Deed of Trust — Full Release is essential for homeowners who have successfully repaid their mortgage or fulfilled the terms of their deed of trust. It protects the homeowner by ensuring that the property's title is clear from any liens or encumbrances caused by the mortgage or deed of trust. Key components of a Delaware Release of Mortgage / Deed of Trust — Full Release include: 1. Identification of the parties involved: The document identifies the property owner (mortgagor or granter) and the lender (mortgagee or beneficiary) who hold an interest in the mortgage or deed of trust. 2. Property details: The document provides a detailed description of the property that was originally mortgaged or subject to the deed of trust. This includes the property's legal description, address, and any identifying information. 3. Release clause: The release clause states that the mortgage or deed of trust is fully satisfied, and the lender releases all claims and rights to the property. 4. Notary acknowledgement: The release of mortgage must be notarized to validate its authenticity. 5. Recording information: The document includes information necessary for recording in the public records, such as the county where the property is located and the book and page number. While the term "Delaware Release of Mortgage / Deed of Trust — Full Release" generally refers to the complete satisfaction of a mortgage or deed of trust, there may be different variations or types depending on specific circumstances. Some examples include: 1. Partial Release: This type of release occurs when a portion of the property secured by the mortgage or deed of trust is released from the lien. This could be due to partial repayment or the subdivision of a larger property. 2. Subordination Agreement: In certain cases, a release may be accompanied by a subordination agreement, which alters the priority of multiple mortgages or deeds of trust on a property. 3. Assignment of Mortgage / Deed of Trust: Instead of a release, a lender may assign their interest in a mortgage or deed of trust to another party. This is typically done when the loan is sold or transferred to a new lender. It is crucial to consult with an attorney or a qualified professional to ensure the accuracy and validity of a Delaware Release of Mortgage / Deed of Trust — Full Release and to determine the appropriate type based on the specific circumstances of the property and loan.

Delaware Release of Mortgage / Deed of Trust - Full Release

Description

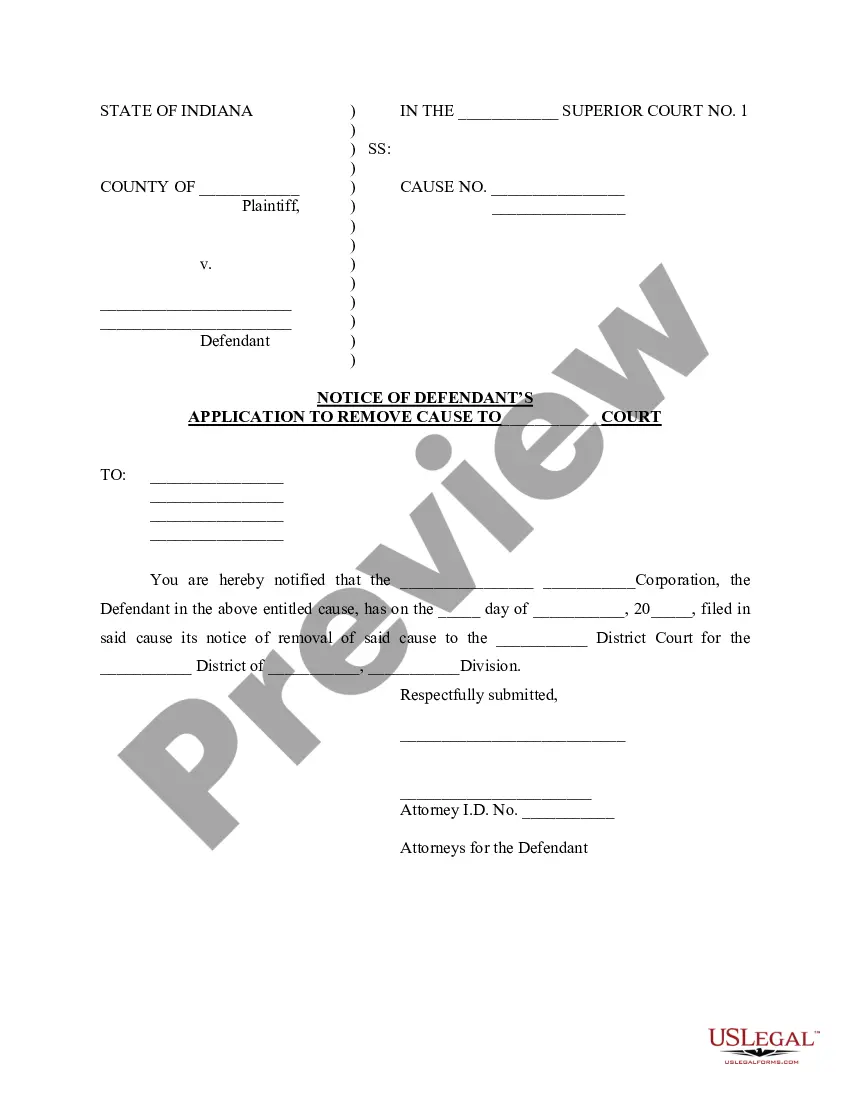

How to fill out Release Of Mortgage / Deed Of Trust - Full Release?

It is possible to invest several hours online trying to find the lawful file format that meets the federal and state requirements you need. US Legal Forms supplies a huge number of lawful forms that are reviewed by experts. It is possible to acquire or produce the Delaware Release of Mortgage / Deed of Trust - Full Release from my service.

If you already have a US Legal Forms profile, you are able to log in and then click the Obtain key. Next, you are able to full, change, produce, or indicator the Delaware Release of Mortgage / Deed of Trust - Full Release. Every single lawful file format you get is your own property eternally. To obtain one more version of any bought kind, check out the My Forms tab and then click the corresponding key.

If you use the US Legal Forms website the first time, keep to the easy guidelines under:

- First, make certain you have chosen the right file format for your region/city of your choosing. Browse the kind outline to ensure you have chosen the correct kind. If readily available, take advantage of the Preview key to look with the file format at the same time.

- If you would like find one more edition of your kind, take advantage of the Research field to discover the format that fits your needs and requirements.

- Upon having found the format you need, click Purchase now to move forward.

- Choose the pricing prepare you need, type in your references, and register for your account on US Legal Forms.

- Full the transaction. You can use your bank card or PayPal profile to fund the lawful kind.

- Choose the file format of your file and acquire it to the device.

- Make adjustments to the file if possible. It is possible to full, change and indicator and produce Delaware Release of Mortgage / Deed of Trust - Full Release.

Obtain and produce a huge number of file themes making use of the US Legal Forms website, which offers the greatest selection of lawful forms. Use skilled and condition-distinct themes to take on your organization or person needs.

Form popularity

FAQ

Most states require that you include: Names and addresses of both parties involved. The amount paid. Legal description of the property and tax parcel number.

A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower. satisfaction of mortgage | Wex | US Law | LII / Legal Information Institute cornell.edu ? wex ? satisfaction_of_mor... cornell.edu ? wex ? satisfaction_of_mor...

Sample Satisfaction of Mortgage That Mortgagee hereby acknowledges full payment and satisfaction of the Mortgage, does hereby surrender the Mortgage as cancelled, releases the property from the lien of the Mortgage, and directs the Clerk of the Circuit Court in and for , to cancel the same record. Free Satisfaction of Mortgage Template - Rocket Lawyer rocketlawyer.com ? real-estate ? document rocketlawyer.com ? real-estate ? document

A satisfaction of mortgage, also known as release, cancellation or discharge of mortgage, is a type of legal document that proves you paid your mortgage in full. As a result, it also certifies that the property's title is clear of any liens. What Is a Satisfaction of Mortgage? | SmartAsset smartasset.com ? mortgage ? satisfaction-of-mortg... smartasset.com ? mortgage ? satisfaction-of-mortg...

Print. You Release a Mortgage or Charge when the property charged has been released from the charge or no longer forms part of the company's property. You Satisfy a Mortgage or Charge when the debt of the charge has been paid or satisfied in full or part.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid in full and the lender no longer has an interest in your property.

What is a Mortgage Release? A mortgage release, also referred to as ?deed in lieu of foreclosure? (DIL), is when a homeowner relinquishes the ownership of their property voluntarily to the owner of the mortgage, often a bank or lender, in exchange for a release from the mortgage and all future mortgage payments. Avoid Foreclosure with a Mortgage Release - Home.Loans home.loans ? mortgage-release home.loans ? mortgage-release

If the satisfaction isn't recorded within a minimum of 60 days, they may incur penalties and be held liable for damages and attorney's fees.