Delaware Assignment of Production Payment Measured by Value Received is a legal mechanism that allows a party (the assignor) to transfer their entitlement to future production payments to another party (the assignee). These production payments are typically derived from the sale or exploitation of certain assets, such as oil and gas reserves, intellectual property, or real estate. The assignment agreement is governed by Delaware law and is measured by the value received by the assignor. This means that the assignor is entitled to assign their rights to the production payments in exchange for monetary compensation or other valuable consideration. The value received can vary depending on the terms negotiated between the assignor and the assignee. There are different types of Delaware Assignment of Production Payment Measured by Value Received, including: 1. Oil and Gas Royalty Assignments: In this type of assignment, the assignor transfers their right to receive royalty payments from the production and sale of oil and gas reserves. The assignor may be a landowner or a party who previously acquired these rights and wishes to allocate them to another party. 2. Intellectual Property Royalty Assignments: This type of assignment involves the transfer of royalty payments derived from the use or licensing of intellectual property, such as patents, copyrights, or trademarks. The assignor, who owns the rights to the intellectual property, can assign their entitlement to these payments to another party. 3. Real Estate Rental Assignments: This type of assignment enables the assignor to assign their right to receive rental payments from the lease or rental of real estate properties. The assignor may be a property owner or a party who has previously acquired these rights and wishes to transfer them to another party. The Delaware Assignment of Production Payment Measured by Value Received provides a legal framework for parties involved in the transfer of production payment rights. It ensures that assignors can monetize their future income streams, while assignees can acquire a stake in these payments, potentially generating a steady flow of income. This mechanism is highly beneficial for both parties involved in transactions related to oil and gas reserves, intellectual property, or real estate.

Delaware Assignment of Production Payment Measured by Value Received

Description

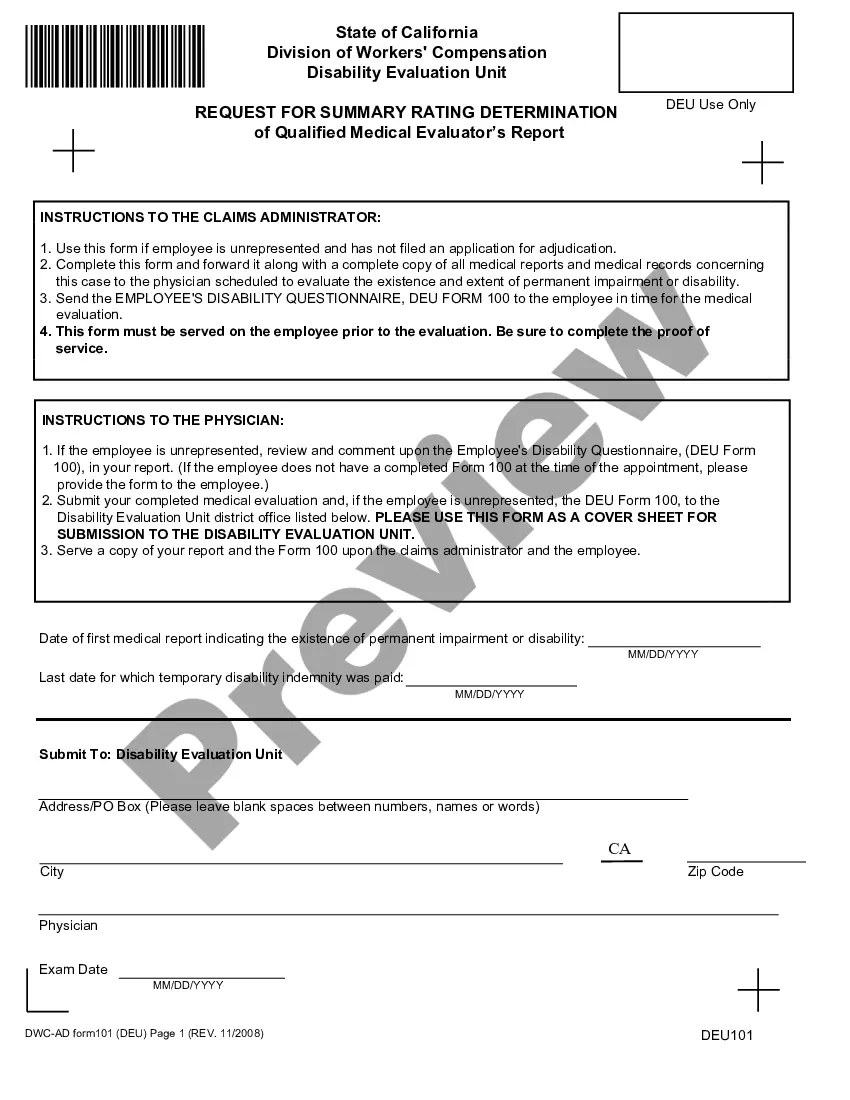

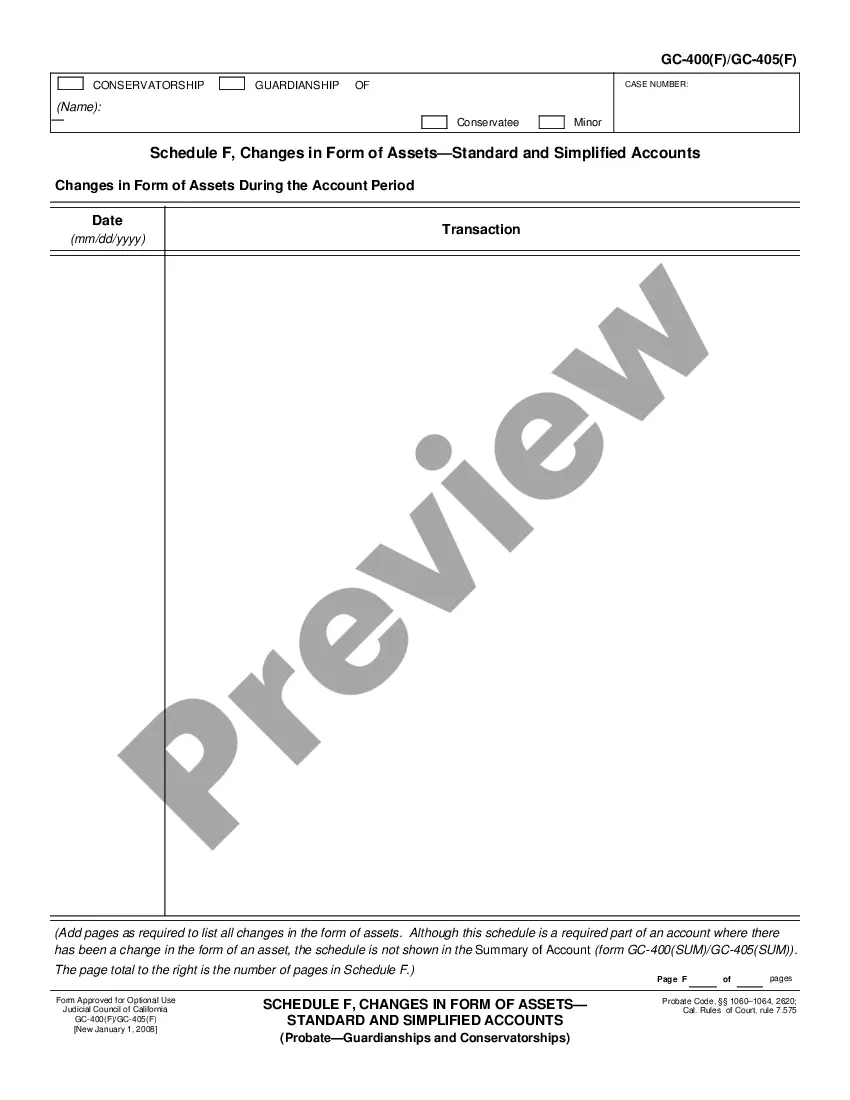

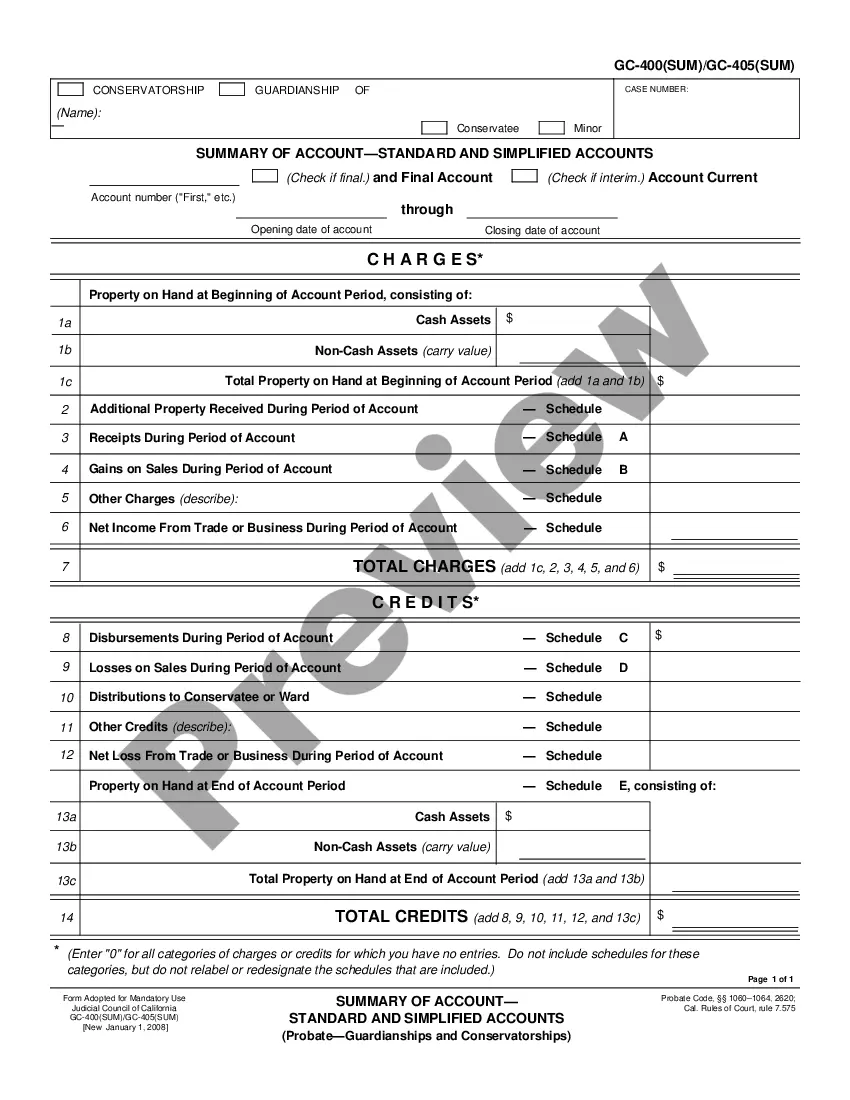

How to fill out Delaware Assignment Of Production Payment Measured By Value Received?

Are you currently inside a situation where you need paperwork for sometimes company or specific reasons virtually every working day? There are plenty of legitimate file templates available online, but discovering types you can rely isn`t straightforward. US Legal Forms offers 1000s of form templates, like the Delaware Assignment of Production Payment Measured by Value Received, that happen to be composed in order to meet federal and state requirements.

If you are presently knowledgeable about US Legal Forms internet site and also have your account, simply log in. After that, you may obtain the Delaware Assignment of Production Payment Measured by Value Received format.

If you do not provide an account and wish to begin to use US Legal Forms, abide by these steps:

- Discover the form you want and make sure it is for that right city/area.

- Utilize the Review key to examine the form.

- Look at the outline to actually have selected the correct form.

- In the event the form isn`t what you`re looking for, take advantage of the Search area to get the form that meets your requirements and requirements.

- Once you discover the right form, simply click Get now.

- Opt for the rates strategy you would like, submit the specified information to produce your bank account, and purchase an order with your PayPal or credit card.

- Choose a hassle-free document structure and obtain your backup.

Locate all the file templates you may have bought in the My Forms menus. You can obtain a more backup of Delaware Assignment of Production Payment Measured by Value Received any time, if possible. Just click the required form to obtain or printing the file format.

Use US Legal Forms, by far the most considerable collection of legitimate kinds, to conserve some time and stay away from mistakes. The assistance offers professionally created legitimate file templates that can be used for a selection of reasons. Make your account on US Legal Forms and begin producing your lifestyle easier.

Form popularity

FAQ

See § 1145. The Revised Uniform Unclaimed Property Act (RUUPA) provides a five-year statutory period for all types of property if a holder files a return and a 10-year statute of repose.

The common interest doctrine occasionally allows separately represented clients to share privileged communications without waiving that fragile protection. Nearly all courts require that the common interest doctrine participants share a common legal interest, rather than merely a common financial interest.

A person is guilty of abandonment of a child when, being a parent, guardian or other person legally charged with the care or custody of a child, the person deserts the child in any place intending permanently to abandon the child. Abandonment of a child is a class E felony unless the child is 14 years of age or older.

The duration of the dormancy period varies depending on the type of property in question, but the vast majority of property types in Delaware have a five year dormancy period.

Common interest community means real estate described in a declaration with respect to which a person, by virtue of such person's ownership of a unit, is obligated to pay for real estate taxes, insurance premiums, maintenance, or improvement of other real estate described in a declaration.

The Delaware Uniform Common Interest Ownership Act applies to condominiums, cooperatives, planned unit communities, and timeshares. A condominium is real estate with sections identified for separate ownership (unit) and the remaining property dedicated to common elements with undivided interests by the unit owners.

As used in this section, ?cohabitation? means regularly residing with an adult of the same or opposite sex, if the parties hold themselves out as a couple, and regardless of whether the relationship confers a financial benefit on the party receiving alimony.

The State Escheator may take custody of property that is presumed abandoned, whether located in this State or another state, or in a foreign country if the last-known address of the owner, as shown on the records of the holder, is in this State. 81 Del. Laws, c.

Delaware Uniform Common Interest Ownership Act ("DUCIOA"), codified in Chapter 81 of Title 25 of the Delaware Code, governs all common interest communities (planned communities, condominiums, cooperatives, and subdivisions) created after September 30, 2009, unless otherwise exempted.

(11) ?Common interest community? means real estate described in a declaration with respect to which a person, by virtue of that person's ownership of a unit, is obligated to pay for a share of real estate taxes, insurance premiums, maintenance, or improvement of or services or other expenses related to common elements, ...