Delaware Oil and Gas Division Order

Description

How to fill out Oil And Gas Division Order?

If you need to full, acquire, or produce authorized papers templates, use US Legal Forms, the largest variety of authorized forms, that can be found online. Use the site`s basic and practical look for to find the documents you will need. Numerous templates for enterprise and person uses are categorized by types and says, or key phrases. Use US Legal Forms to find the Delaware Oil and Gas Division Order with a few clicks.

If you are already a US Legal Forms client, log in to your profile and click the Down load key to find the Delaware Oil and Gas Division Order. You can even accessibility forms you earlier delivered electronically from the My Forms tab of the profile.

If you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have selected the shape for that proper city/country.

- Step 2. Make use of the Preview method to check out the form`s articles. Don`t forget to read through the information.

- Step 3. If you are not satisfied together with the form, utilize the Research area near the top of the screen to locate other models in the authorized form format.

- Step 4. Once you have found the shape you will need, go through the Purchase now key. Choose the costs plan you favor and include your qualifications to sign up to have an profile.

- Step 5. Approach the transaction. You may use your bank card or PayPal profile to complete the transaction.

- Step 6. Choose the structure in the authorized form and acquire it on the gadget.

- Step 7. Total, change and produce or signal the Delaware Oil and Gas Division Order.

Every authorized papers format you get is your own property for a long time. You have acces to each form you delivered electronically inside your acccount. Select the My Forms portion and pick a form to produce or acquire once more.

Remain competitive and acquire, and produce the Delaware Oil and Gas Division Order with US Legal Forms. There are millions of specialist and express-certain forms you may use to your enterprise or person demands.

Form popularity

FAQ

A division order is a contract between you and the operator (an oil and gas company). Typically, receiving a division order means that the operator is about to drill, or that the operator has already drilled a well and your minerals are producing.

As for receiving an oil and gas royalty payment, you will receive it ONLY IF the oil company drills a well and ONLY IF the well is a successful producer. Most wells drilled in a new area have only a 20% probability of being successful. There is a lot of money to be made in receiving monthly royalty checks.

?To pay Lessor for gas (including casinghead gas) and all other substance covered hereby, a royalty of 3/16 of the proceeds realized by Lessee from the sale thereof.? This simply means the operator will pay a royalty of 3/16 of revenue generated from production on the property.

Take, for example, a landowner who has 300 acres in a 500-acre production unit while signing an oil and gas lease of 15% royalty. Their decimal interest is calculated as follows: (300/500) × 0.15 equals 0.09, which represents their decimal interest.

To put it another way the formula is: lessor's acres in unit ÷ total number of acres in unit × lessor's ownership interest × lessor's royalty percentage = lessor's decimal interest.

You may have noticed on your check stubs an ?owner interest? or ?net revenue interest? or a ?decimal interest?. The operator will then multiply your interest by the quantity of oil and gas produced and the current price to determine your oil and gas royalty payments.

If there is more than one mineral owner, multiply the net revenue by the fractional interest of each owner to determine their respective royalty interest.

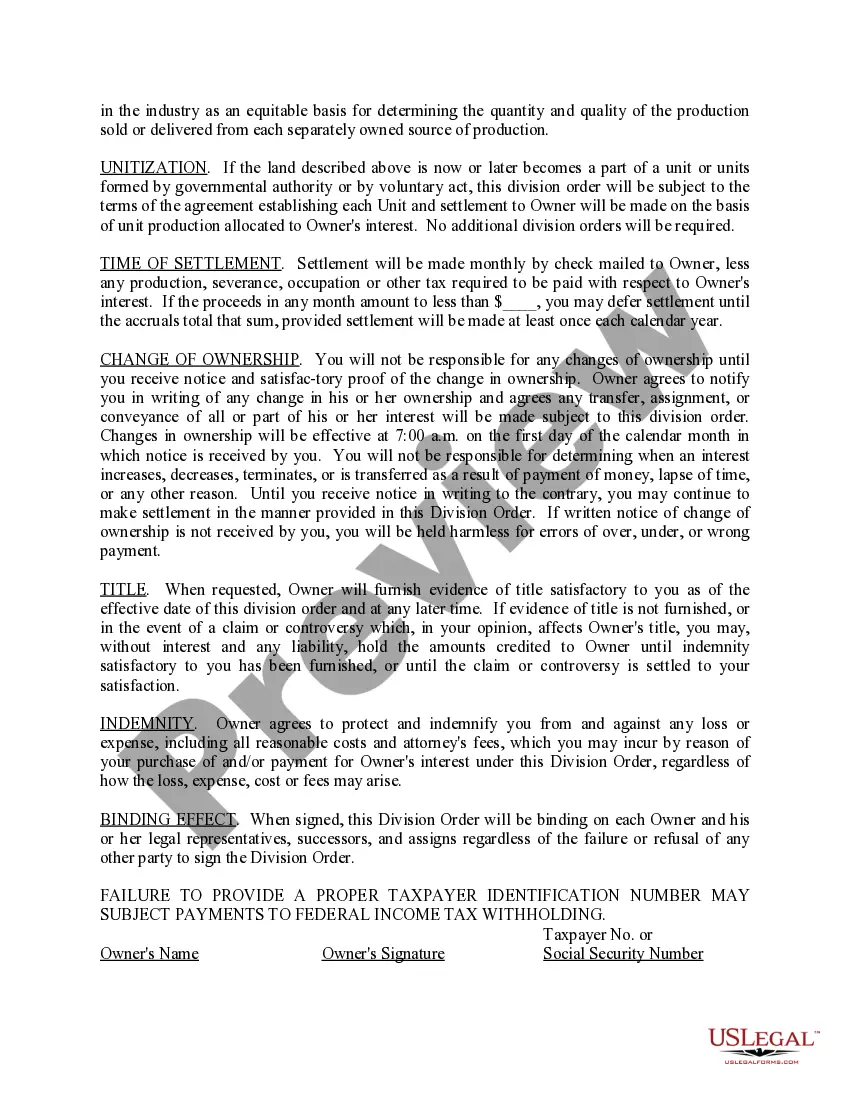

A Division order is an instrument that records an owner's interest in a specific well. It should include the name of the well, the well number, interest type, and your decimal interest.