Delaware Due Diligence Review Summary is an essential process that involves the thorough and comprehensive evaluation of a company or business entity incorporated in Delaware. With Delaware being a popular choice for incorporating due to its business-friendly laws and attractive tax benefits, conducting a due diligence review is crucial for individuals, investors, and potential partners or buyers who seek insight and assurance before engaging in business transactions. The Delaware Due Diligence Review Summary entails meticulously examining various aspects of a company's operations, financial standing, legal compliance, and potential risks. This process aims to provide a clear and transparent overview of the company's strengths, weaknesses, opportunities, and threats, helping stakeholders make informed decisions moving forward. It is typically undertaken by legal professionals, investment bankers, consultants, or specialized due diligence firms. The review is usually divided into several categories to ensure a comprehensive assessment. The following are common types of Delaware Due Diligence Review Summaries: 1. Financial Due Diligence: Assessing the company's financial health, including its revenue streams, profitability, cash flow, debt obligations, tax compliance, and financial statements. This analysis enables interested parties to evaluate the company's financial stability, potential growth, and any potential financial red flags. 2. Legal Due Diligence: Scrutinizing the company's legal structure, including corporate governance, compliance with Delaware corporate laws, licenses and permits, litigation history, intellectual property ownership, contracts and agreements, and any regulatory or legal issues. This review ensures a comprehensive understanding of the company's legal standing and helps identify potential legal risks. 3. Operational Due Diligence: Evaluating the company's operational processes, including production and manufacturing procedures, supply chain management, IT infrastructure, human resources, key performance indicators, and any operational inefficiencies or risks. This assessment aims to gauge the company's operational effectiveness and efficiency. 4. Commercial Due Diligence: Investigating the company's market positioning, competitive landscape, target audience, sales and marketing strategies, customer base, and industry trends. This type of due diligence review helps stakeholders assess the company's market potential, growth prospects, and overall competitiveness. 5. Environmental, Social, and Governance (ESG) Due Diligence: Examining the company's environmental impact, social responsibility initiatives, and governance structure. This review is crucial for organizations and investors who value sustainable and ethical practices, allowing them to assess the company's ESG performance and identify any potential risks or areas of improvement. By conducting a Delaware Due Diligence Review Summary, individuals and organizations can gain a comprehensive overview of a company's affairs and make informed decisions regarding partnerships, investments, acquisitions, or mergers. This process ultimately mitigates risks and increases transparency, fostering trust and confidence among stakeholders.

Delaware Due Diligence Review Summary

Description

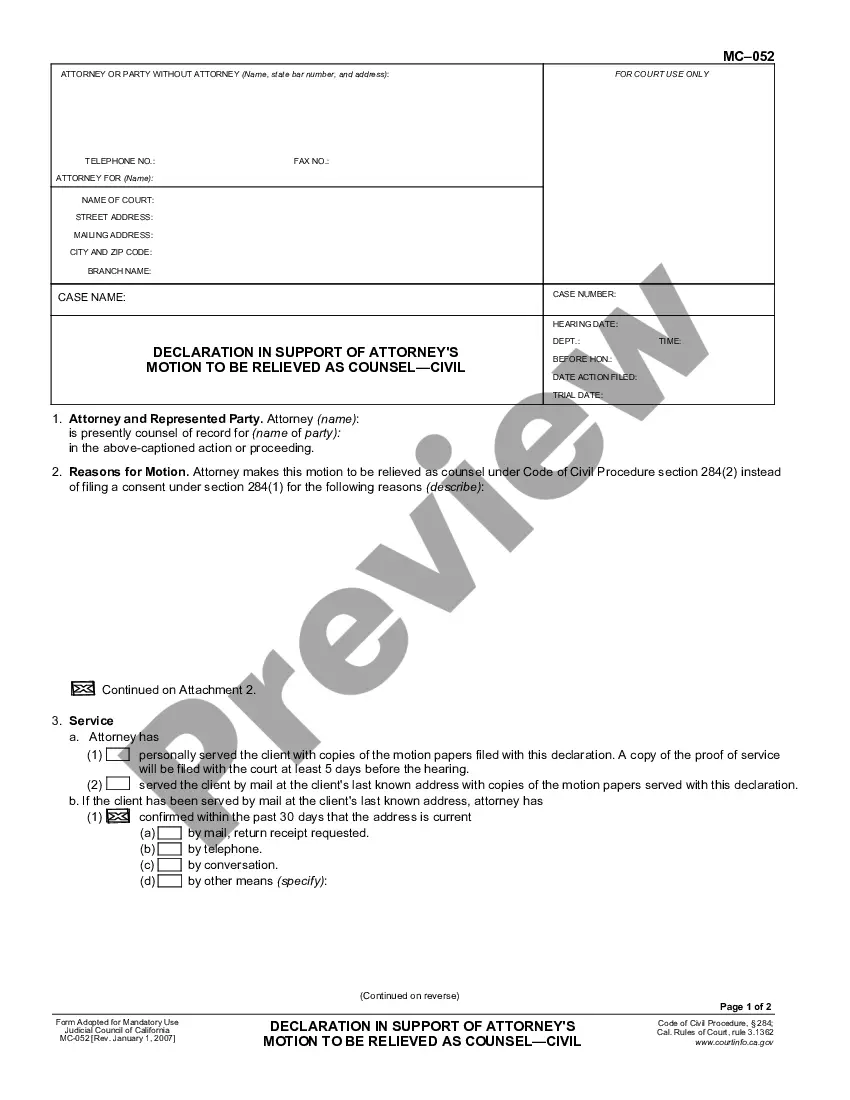

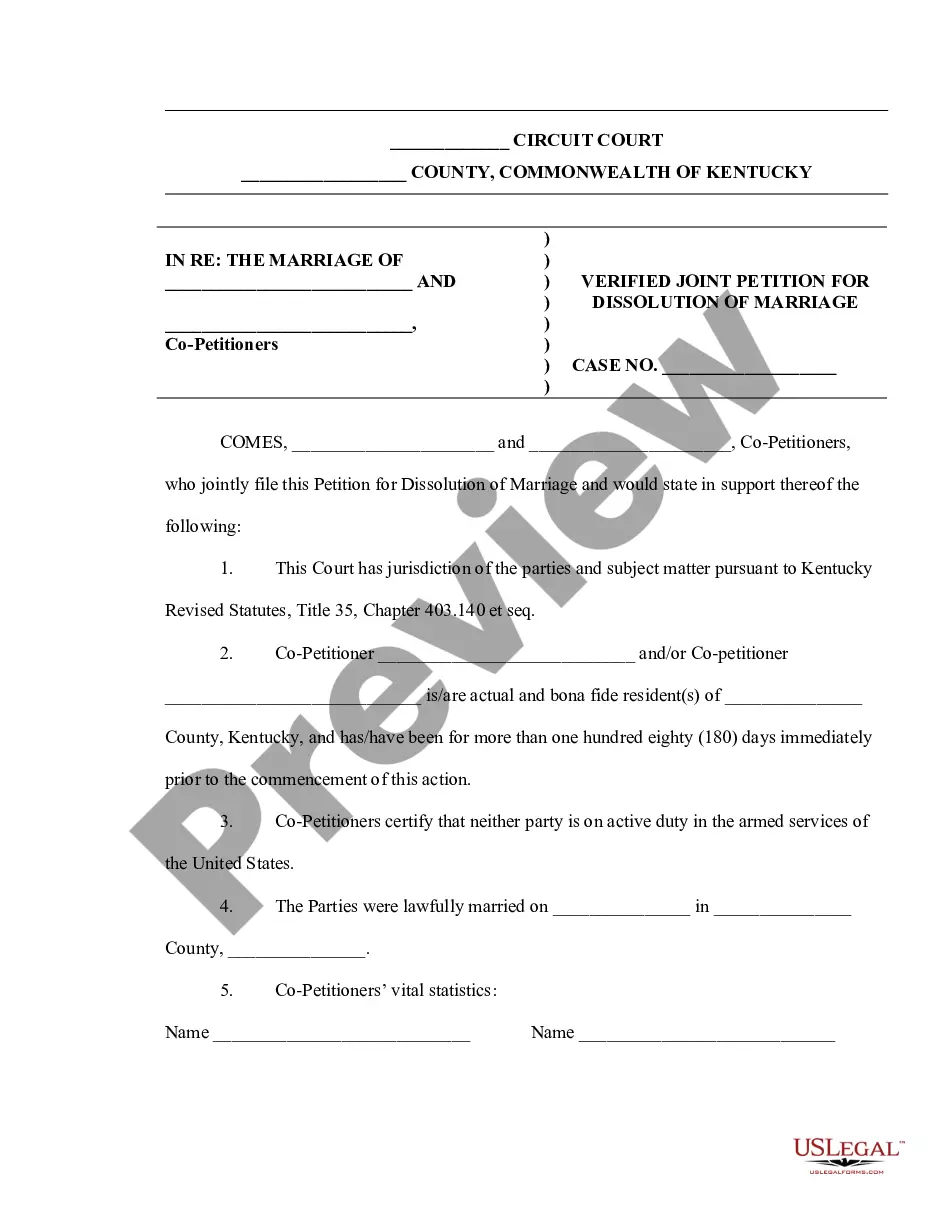

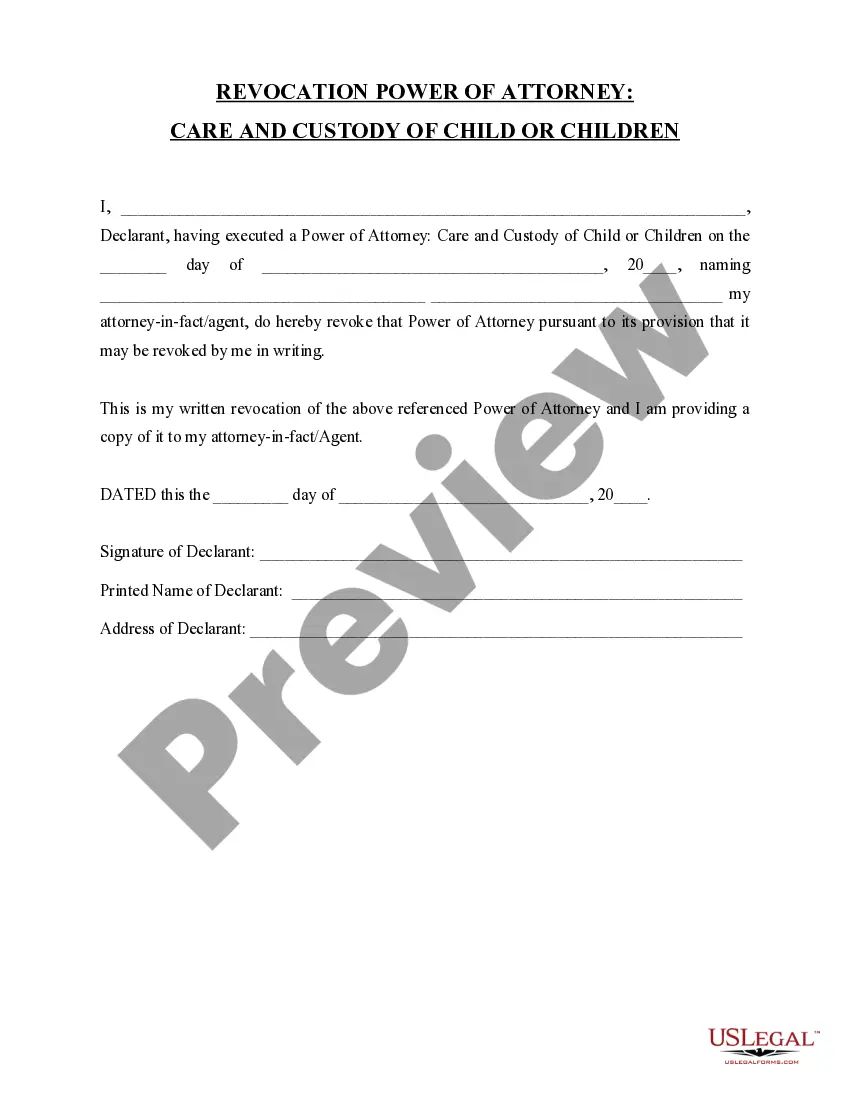

How to fill out Delaware Due Diligence Review Summary?

US Legal Forms - one of the biggest libraries of authorized forms in America - offers a wide range of authorized file web templates you may download or print. While using site, you can get thousands of forms for business and person uses, categorized by groups, states, or keywords.You can get the newest models of forms just like the Delaware Due Diligence Review Summary within minutes.

If you currently have a membership, log in and download Delaware Due Diligence Review Summary from your US Legal Forms local library. The Acquire option will appear on every single kind you view. You have accessibility to all in the past downloaded forms in the My Forms tab of your respective account.

In order to use US Legal Forms for the first time, listed here are straightforward guidelines to help you get started off:

- Be sure you have selected the right kind for your personal area/county. Select the Preview option to examine the form`s content. See the kind information to ensure that you have chosen the appropriate kind.

- When the kind does not suit your requirements, make use of the Look for field near the top of the display screen to get the the one that does.

- If you are content with the form, validate your choice by simply clicking the Purchase now option. Then, choose the costs plan you favor and give your accreditations to register for the account.

- Process the purchase. Make use of your bank card or PayPal account to finish the purchase.

- Find the format and download the form on your system.

- Make modifications. Load, revise and print and sign the downloaded Delaware Due Diligence Review Summary.

Each and every template you included with your account does not have an expiry day which is yours forever. So, in order to download or print another backup, just proceed to the My Forms segment and then click about the kind you require.

Get access to the Delaware Due Diligence Review Summary with US Legal Forms, the most comprehensive local library of authorized file web templates. Use thousands of professional and condition-distinct web templates that satisfy your small business or person requirements and requirements.

Form popularity

FAQ

Pursuant to Chapter 11 of Title 12 Section 1173 of Delaware's Abandoned or Unclaimed Property Laws, the Delaware Secretary of State is authorized to enter into unclaimed property voluntary disclosure agreements with holders of unclaimed property and settle past amounts due.

How long is the look-back period? The look-back period is 10 report years (or 15 transaction years as Delaware has a 5 year dormancy period for most property types) from the date the Holder enrolls in the VDA.

In both unclaimed property audits and the VDA program, Delaware state law requires a look-back period of 10 report years, plus the five-year dormancy period for most property types, which equates to a 15-year transactional review period.

In spite of fraudulent imitators, the state maintains an unclaimed property database on online at finance.delaware.gov. Residents can search the database for unclaimed property or call the Department of Finanice at 302-577-8220.

Most states have formal programs to allow non-registered taxpayers to disclose their sales tax liability in exchange for a limited look-back period and penalty relief, this is called a voluntary disclosure agreement or VDA.

See § 1145. The Revised Uniform Unclaimed Property Act (RUUPA) provides a five-year statutory period for all types of property if a holder files a return and a 10-year statute of repose.