Delaware Well Takeover

Description

How to fill out Well Takeover?

Are you presently within a place that you need to have papers for either organization or specific purposes just about every time? There are a variety of lawful papers templates available online, but locating versions you can rely is not straightforward. US Legal Forms offers thousands of develop templates, just like the Delaware Well Takeover, that are composed to meet federal and state demands.

If you are already knowledgeable about US Legal Forms website and possess your account, merely log in. Following that, it is possible to obtain the Delaware Well Takeover web template.

Unless you offer an account and would like to begin to use US Legal Forms, abide by these steps:

- Discover the develop you want and ensure it is for the right metropolis/state.

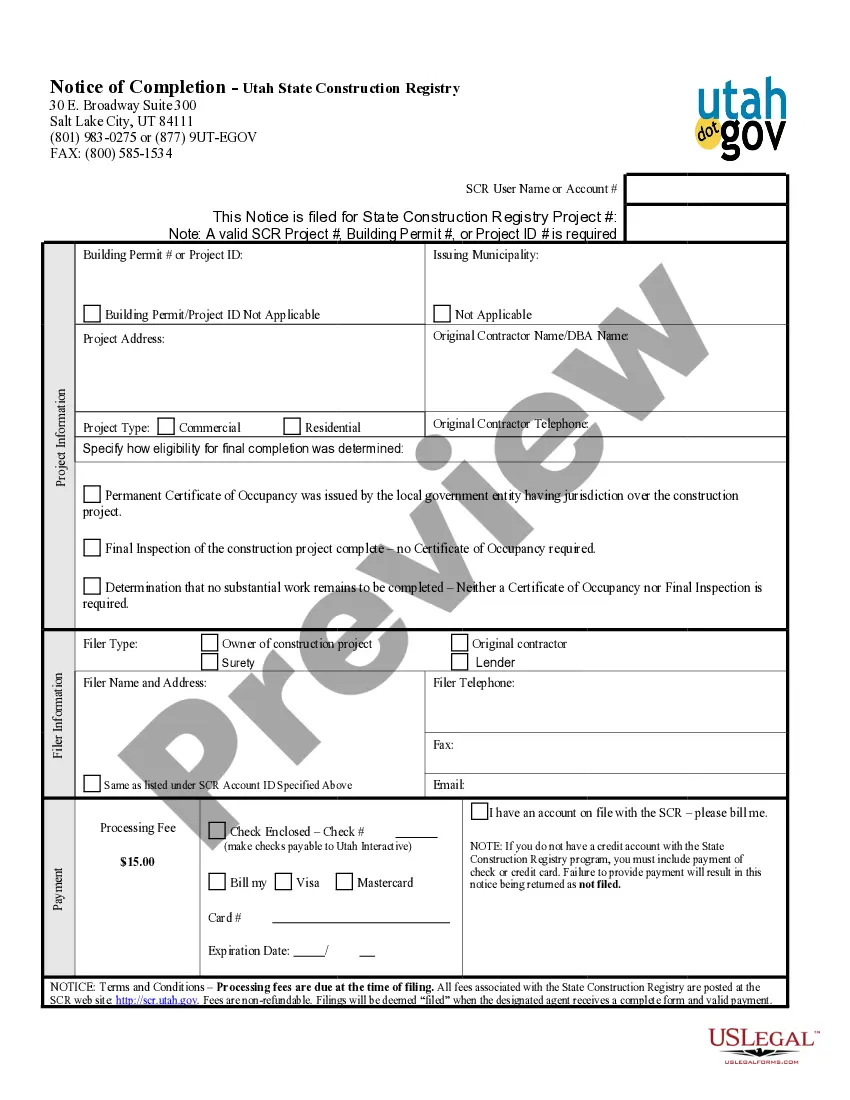

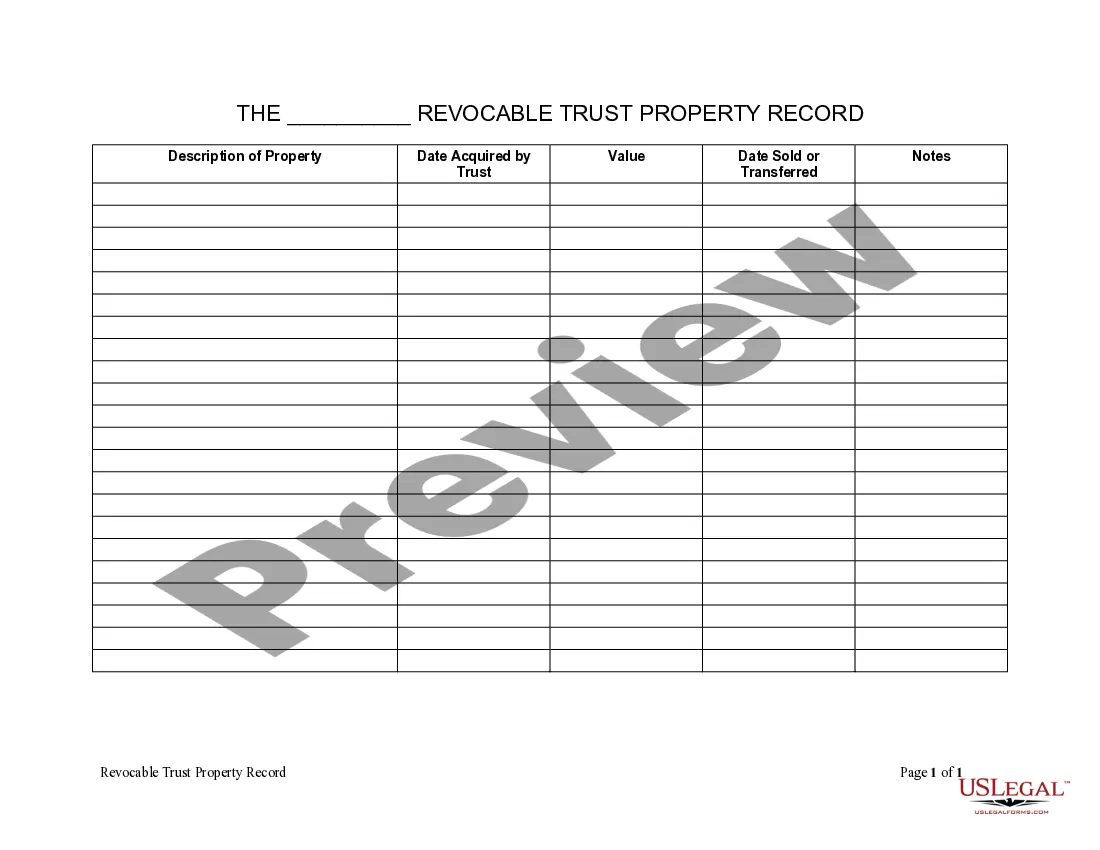

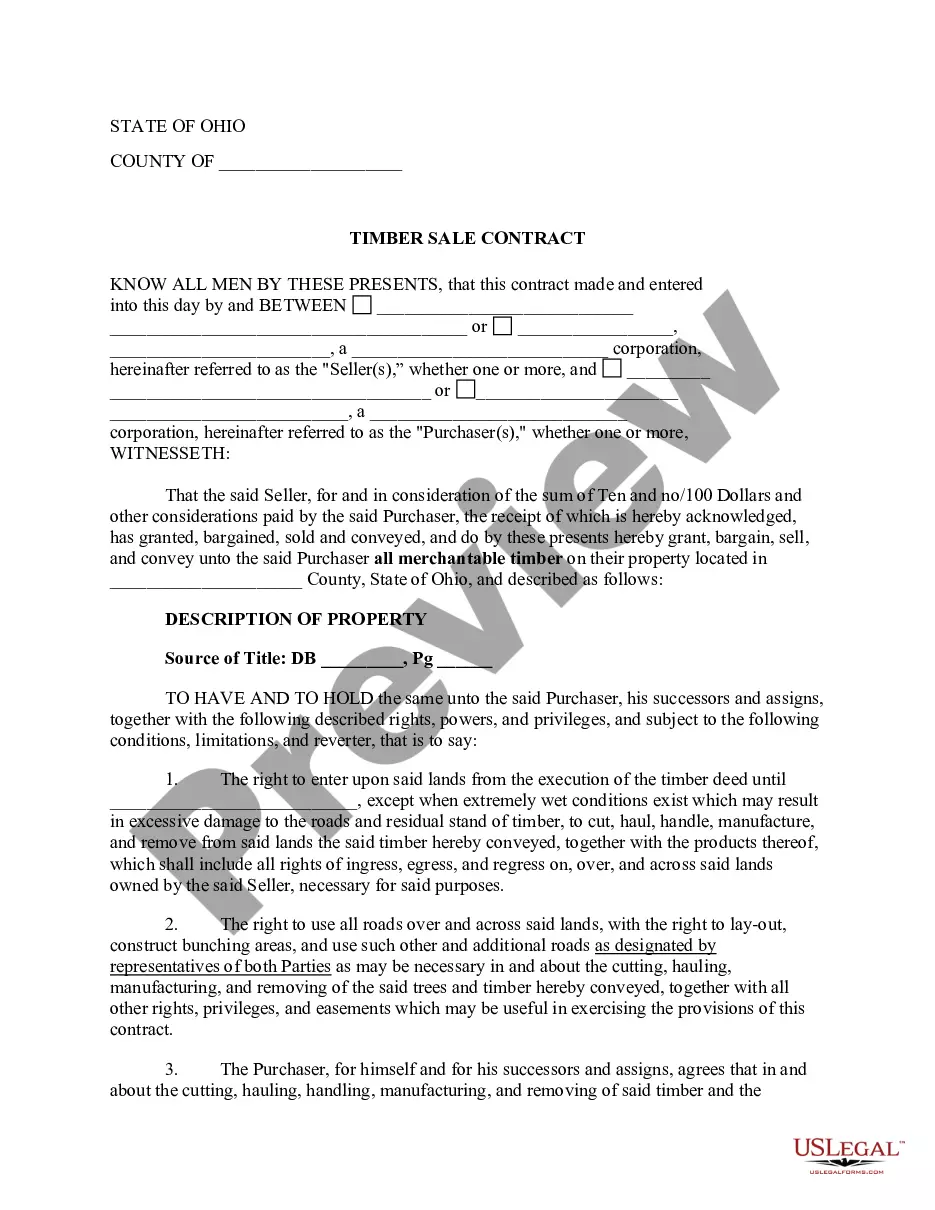

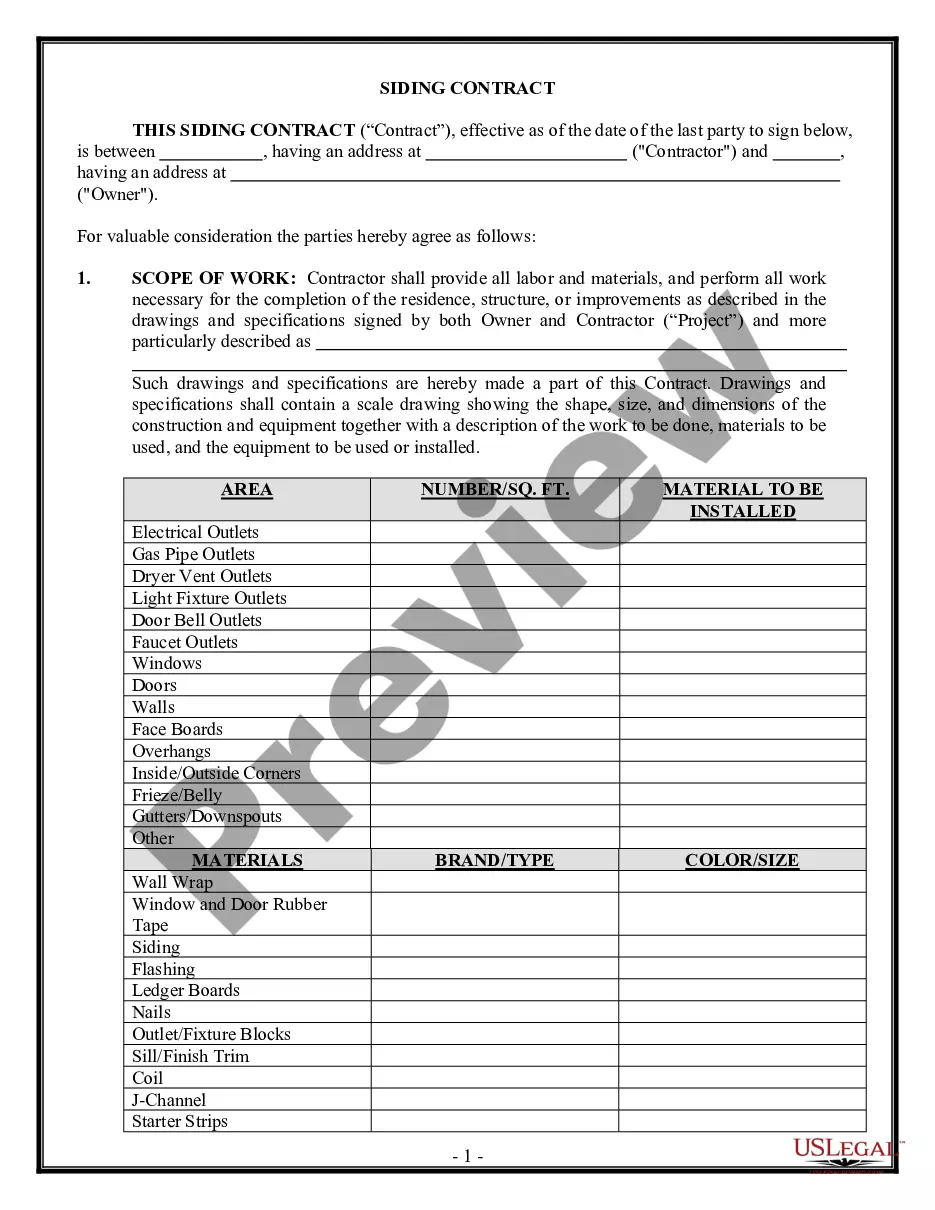

- Make use of the Review option to examine the shape.

- Look at the explanation to ensure that you have selected the proper develop.

- In the event the develop is not what you`re looking for, utilize the Research industry to discover the develop that meets your requirements and demands.

- When you discover the right develop, simply click Get now.

- Select the costs prepare you want, complete the desired info to create your account, and purchase an order making use of your PayPal or credit card.

- Pick a handy paper structure and obtain your duplicate.

Locate each of the papers templates you have purchased in the My Forms menu. You can get a more duplicate of Delaware Well Takeover whenever, if required. Just go through the needed develop to obtain or printing the papers web template.

Use US Legal Forms, probably the most comprehensive assortment of lawful forms, to conserve time as well as steer clear of mistakes. The support offers professionally manufactured lawful papers templates which you can use for a variety of purposes. Make your account on US Legal Forms and start producing your way of life a little easier.

Form popularity

FAQ

Earthstone Energy is a publicly traded (NYSEMKT:ESTE) oil and gas company based in the Woodlands, Texas. The company was formed in 2012 by Frank Lodzinski and his technical team, which over the past 20 years has an established track record of value creation at various public and private companies.

Maple: Vital Energy agreed to purchase all of Maple's Delaware Basin assets in an all-equity transaction consisting of 3.31 million common shares, net of customary closing price adjustments.

Section 203 is an antitakeover statute in Delaware which provides that if a person or entity (an ?interested stockholder?) acquires 15% or more of the voting stock of a Delaware corporation (the ?target?) without prior approval of the target's board, then the interested stockholder may not engage in a business ...

Meanwhile, Earthstone in mid-August closed on its $1 billion net acquisition of the Northern Delaware Basin assets of Novo Oil & Gas Holdings.

Company record daily production led to Adjusted EBITDAX of approximately $239 million and Free Cash Flow of approximately $42 million for the quarter.

Earthstone Energy has completed the $1.5bn acquisition of the US-based privately owned energy company Novo Oil & Gas Holdings (Novo). The acquisition was made in partnership with Northern Oil and Gas (NOG), which acquired a 33.3% stake in Novo's assets for $500m.

US-based oil and gas company Permian Resources has completed the acquisition of Earthstone Energy. The $4.5bn all-stock deal, which included Earthstone's debt, was announced in August 2023.