Delaware Correction Assignment to Correct Amount of Interest

Description

How to fill out Correction Assignment To Correct Amount Of Interest?

Choosing the right legal document format can be a battle. Needless to say, there are plenty of layouts available on the Internet, but how do you get the legal kind you need? Utilize the US Legal Forms site. The assistance offers a huge number of layouts, for example the Delaware Correction Assignment to Correct Amount of Interest, that can be used for organization and private requirements. All of the kinds are checked out by professionals and fulfill state and federal specifications.

In case you are currently authorized, log in to your profile and click the Download switch to have the Delaware Correction Assignment to Correct Amount of Interest. Make use of your profile to check with the legal kinds you have acquired previously. Proceed to the My Forms tab of your own profile and obtain one more duplicate in the document you need.

In case you are a new customer of US Legal Forms, allow me to share easy directions for you to comply with:

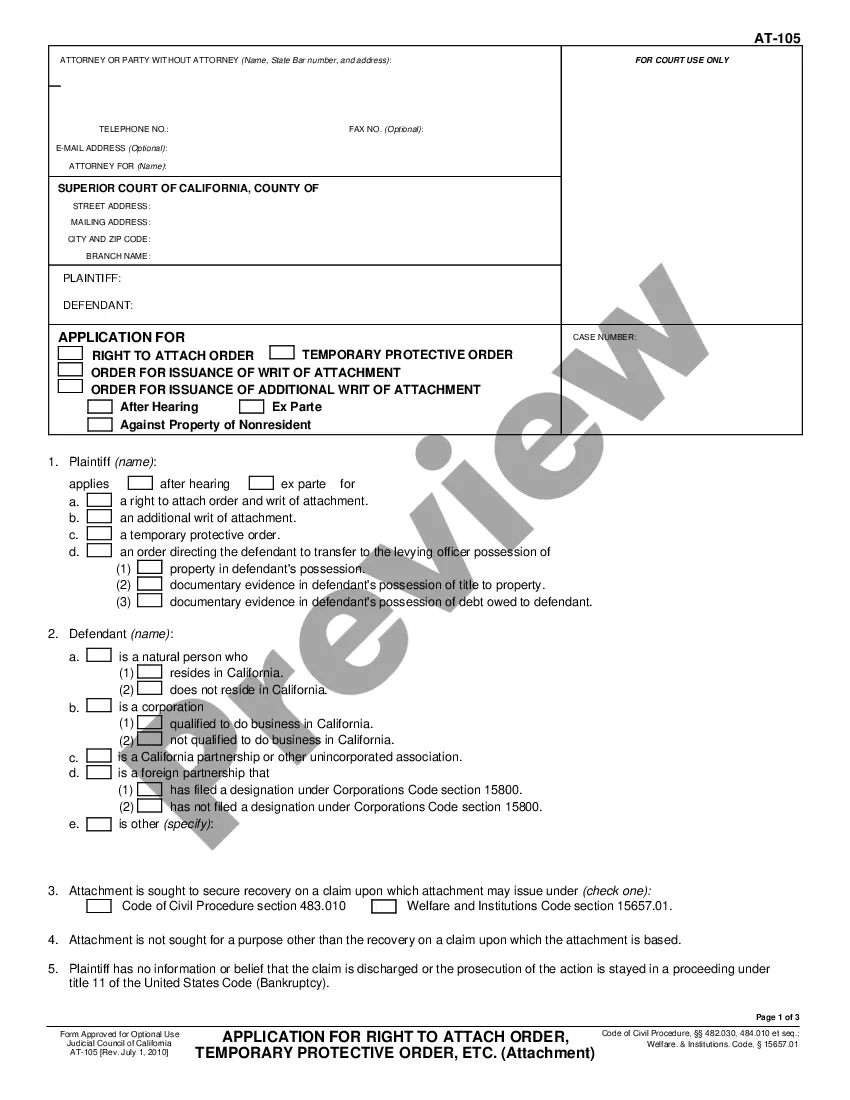

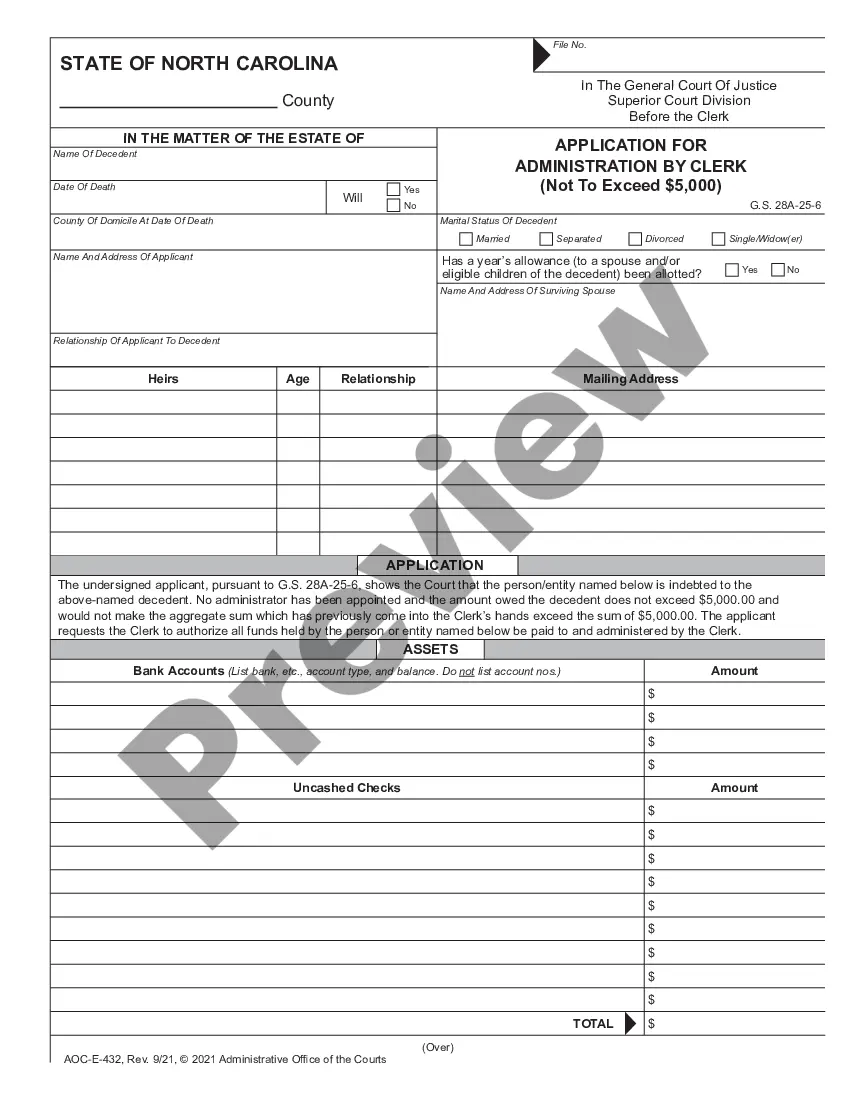

- First, be sure you have selected the proper kind for your personal town/state. You can look through the form utilizing the Review switch and look at the form description to make certain this is basically the right one for you.

- In the event the kind fails to fulfill your needs, use the Seach industry to get the proper kind.

- Once you are positive that the form would work, select the Get now switch to have the kind.

- Choose the rates strategy you desire and enter the necessary information. Build your profile and pay for your order utilizing your PayPal profile or charge card.

- Pick the data file structure and obtain the legal document format to your product.

- Complete, modify and produce and signal the obtained Delaware Correction Assignment to Correct Amount of Interest.

US Legal Forms will be the greatest local library of legal kinds for which you can discover various document layouts. Utilize the service to obtain professionally-made files that comply with status specifications.

Form popularity

FAQ

The mission of DOC is to ensure public safety for citizens of the District of Columbia by providing an orderly, safe, secure and humane environment for the confinement of pretrial detainees and sentenced inmates, while providing meaningful opportunities for community reintegration.

DOC Mission Statement: Protect the public by supervising adult offenders through safe and humane services, programs and facilities.