This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Delaware Audit of Lessee's Books and Records

Description

How to fill out Audit Of Lessee's Books And Records?

Are you currently within a situation in which you need to have paperwork for possibly company or personal reasons almost every day? There are a lot of authorized papers themes available on the Internet, but finding ones you can rely is not easy. US Legal Forms gives thousands of develop themes, such as the Delaware Audit of Lessee's Books and Records, that happen to be created to meet state and federal demands.

In case you are currently familiar with US Legal Forms internet site and possess your account, simply log in. After that, you may obtain the Delaware Audit of Lessee's Books and Records design.

Should you not provide an bank account and wish to start using US Legal Forms, follow these steps:

- Find the develop you want and make sure it is for your proper metropolis/state.

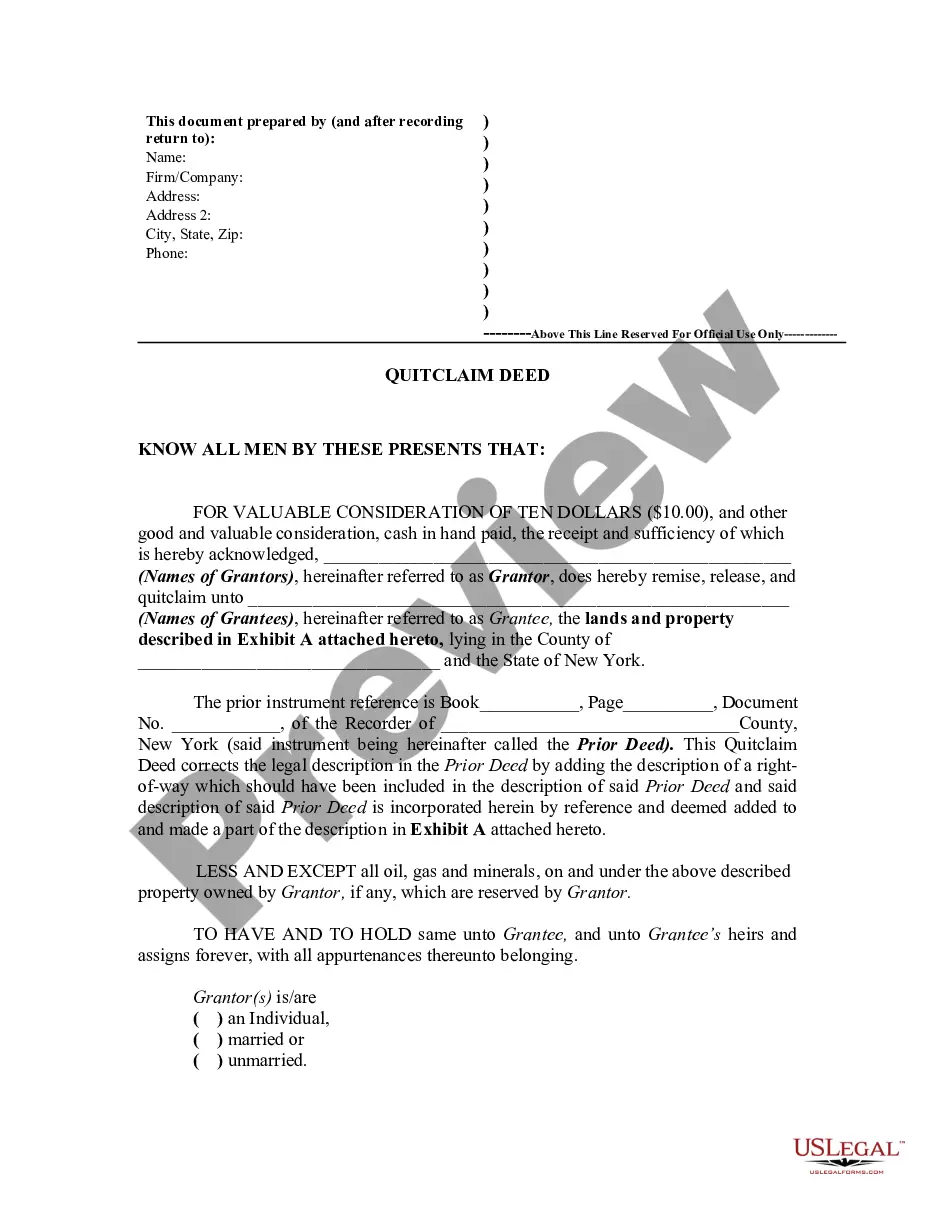

- Use the Preview option to review the form.

- See the description to actually have selected the appropriate develop.

- If the develop is not what you are seeking, use the Lookup industry to find the develop that fits your needs and demands.

- When you get the proper develop, simply click Get now.

- Choose the pricing plan you would like, fill out the required details to make your bank account, and purchase the transaction making use of your PayPal or bank card.

- Select a handy file file format and obtain your duplicate.

Get every one of the papers themes you have purchased in the My Forms menu. You can get a extra duplicate of Delaware Audit of Lessee's Books and Records anytime, if necessary. Just go through the necessary develop to obtain or print the papers design.

Use US Legal Forms, probably the most substantial variety of authorized types, to conserve time as well as avoid blunders. The services gives skillfully produced authorized papers themes which you can use for a selection of reasons. Create your account on US Legal Forms and start creating your lifestyle a little easier.

Form popularity

FAQ

The Act provides state-level protections similar to the federal Fair Housing Act (FHA) and affects all housing providers, including common interest communities in Delaware. The Delaware Division of Human Relations administers the law.

The Delaware Freedom of Information Act, first established in 1977, is a series of laws guaranteeing that the public has access to the public records of governmental bodies.

Delaware Uniform Common Interest Ownership Act ("DUCIOA"), codified in Chapter 81 of Title 25 of the Delaware Code, governs all common interest communities (planned communities, condominiums, cooperatives, and subdivisions) created after September 30, 2009, unless otherwise exempted.

(11) ?Common interest community? means real estate described in a declaration with respect to which a person, by virtue of that person's ownership of a unit, is obligated to pay for a share of real estate taxes, insurance premiums, maintenance, or improvement of or services or other expenses related to common elements, ...

§ 220. Inspection of books and records. (a) As used in this section: (1) ?Stockholder? means a holder of record of stock in a stock corporation, or a person who is the beneficial owner of shares of such stock held either in a voting trust or by a nominee on behalf of such person.

The Delaware Uniform Common Interest Ownership Act applies to condominiums, cooperatives, planned unit communities, and timeshares. A condominium is real estate with sections identified for separate ownership (unit) and the remaining property dedicated to common elements with undivided interests by the unit owners.

Delaware Uniform Common Interest Ownership Act ("DUCIOA"), codified in Chapter 81 of Title 25 of the Delaware Code, governs all common interest communities (planned communities, condominiums, cooperatives, and subdivisions) created after September 30, 2009, unless otherwise exempted.

The Auditor of Accounts is an elected office serving Delawareans by ensuring accountability in the use of taxpayer dollars, auditing and reporting on funds raised and spent by the State of Delaware annually.