Delaware Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool)

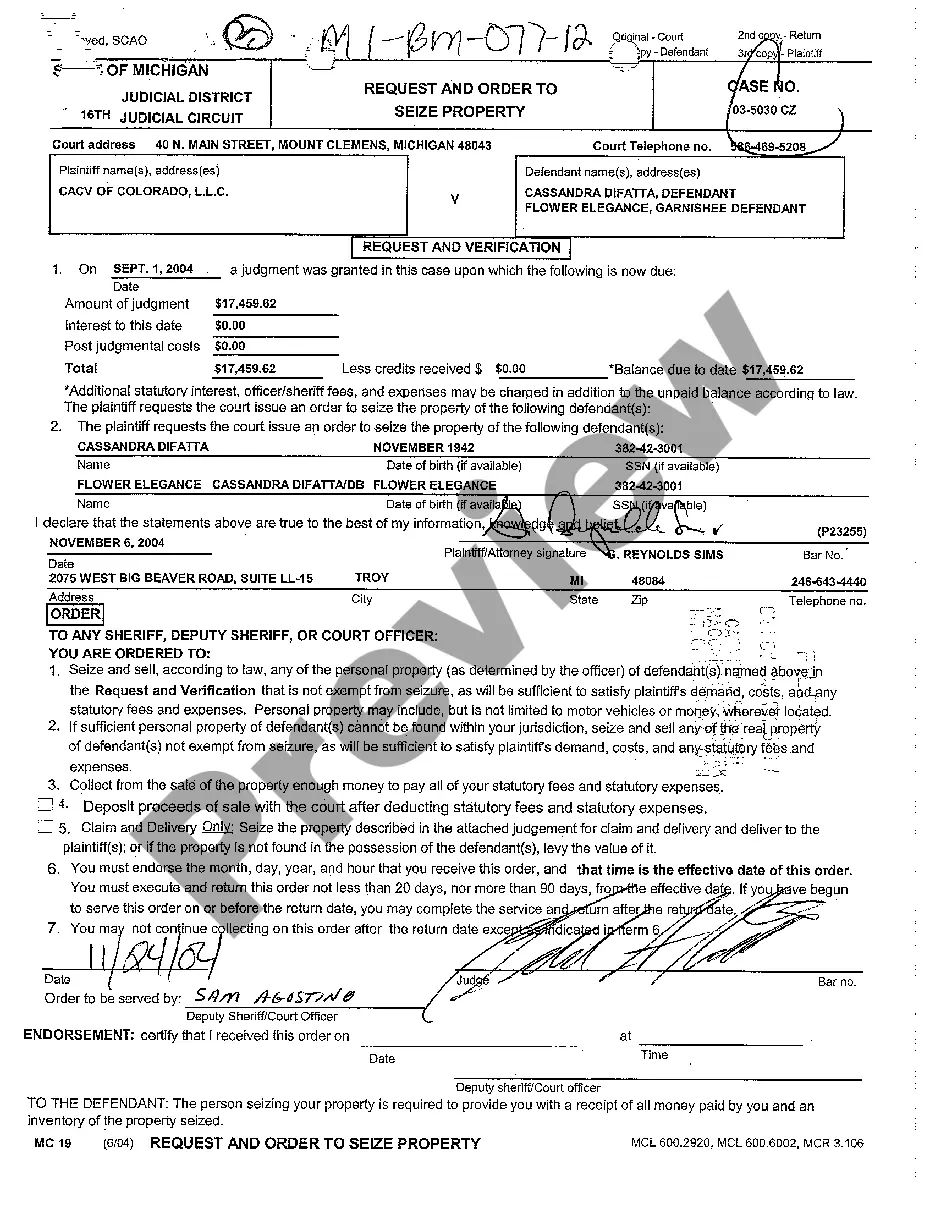

Description

How to fill out Assignment Of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right To Pool)?

If you wish to full, obtain, or print lawful file templates, use US Legal Forms, the greatest variety of lawful forms, which can be found on the Internet. Use the site`s basic and hassle-free look for to obtain the documents you want. Various templates for organization and personal reasons are categorized by classes and suggests, or key phrases. Use US Legal Forms to obtain the Delaware Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) in just a number of clicks.

When you are presently a US Legal Forms customer, log in for your bank account and click on the Download option to have the Delaware Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool). You can also gain access to forms you formerly acquired in the My Forms tab of your own bank account.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have chosen the shape to the correct metropolis/land.

- Step 2. Use the Review choice to look through the form`s articles. Don`t overlook to learn the outline.

- Step 3. When you are not satisfied together with the type, use the Research discipline near the top of the display screen to locate other versions of the lawful type design.

- Step 4. Upon having located the shape you want, click on the Get now option. Choose the pricing strategy you favor and add your accreditations to register on an bank account.

- Step 5. Approach the deal. You should use your charge card or PayPal bank account to accomplish the deal.

- Step 6. Find the file format of the lawful type and obtain it on your device.

- Step 7. Complete, edit and print or indicator the Delaware Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool).

Each and every lawful file design you purchase is the one you have for a long time. You have acces to every type you acquired within your acccount. Click the My Forms area and pick a type to print or obtain once again.

Be competitive and obtain, and print the Delaware Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) with US Legal Forms. There are millions of skilled and condition-specific forms you can utilize for your personal organization or personal requirements.

Form popularity

FAQ

A royalty interest is a property interest that entitles the owner to receive a share of the production revenue. An individual or company that owns a royalty interest does not have to pay for any of the operational costs required to produce the resource, but they still own a portion of the revenue produced.

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners. The formula using proportionate reduction is LRR * RI = NPRI.

Once the lease ends, the lessee can obtain a new lease from the mineral owner without any overriding royalty obligation. To prevent this scenario, the ?anti-washout provision? was created. This provision is designed to ensure that the overriding royalty interest remains intact if the lease is extended.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

Typically, NPRIs are created by an express grant or reservation in a deed and are entirely different from a ?leasehold? royalty. The holder of a NPRI has no power to negotiate or execute an oil and gas lease and has no power to enter upon the land to extract the hydrocarbons.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.