Delaware Complaint regarding Insurer's Failure to Pay Claim

Description

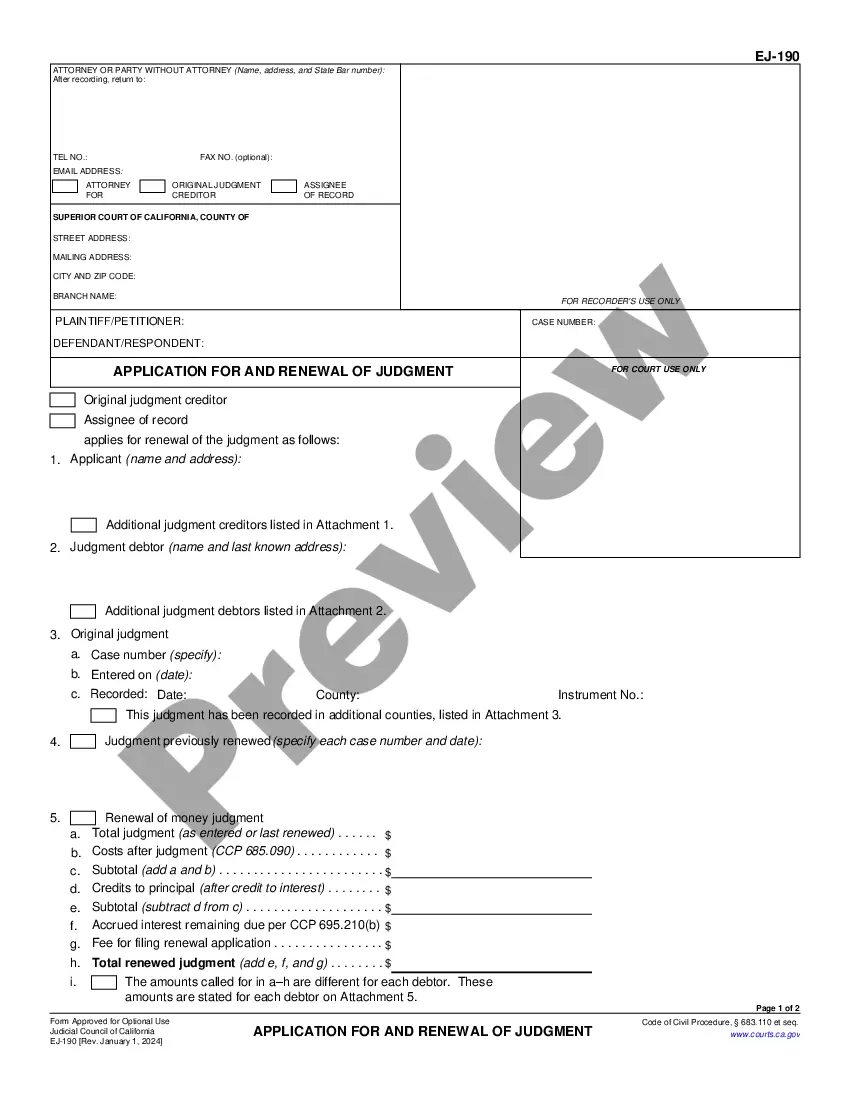

How to fill out Complaint Regarding Insurer's Failure To Pay Claim?

US Legal Forms - one of many most significant libraries of legitimate forms in the USA - provides a variety of legitimate document web templates you may download or printing. Making use of the web site, you may get 1000s of forms for organization and person uses, categorized by categories, says, or key phrases.You will discover the newest variations of forms much like the Delaware Complaint regarding Insurer's Failure to Pay Claim within minutes.

If you already have a subscription, log in and download Delaware Complaint regarding Insurer's Failure to Pay Claim in the US Legal Forms catalogue. The Down load switch can look on each develop you look at. You have accessibility to all earlier acquired forms inside the My Forms tab of your respective accounts.

If you would like use US Legal Forms for the first time, listed below are basic recommendations to get you started out:

- Ensure you have picked the right develop for the area/area. Go through the Preview switch to check the form`s content material. Look at the develop description to actually have selected the proper develop.

- In case the develop does not suit your needs, take advantage of the Look for industry at the top of the display screen to obtain the one which does.

- When you are pleased with the shape, verify your selection by clicking on the Buy now switch. Then, choose the prices plan you favor and offer your qualifications to sign up on an accounts.

- Procedure the deal. Use your charge card or PayPal accounts to accomplish the deal.

- Find the structure and download the shape on the system.

- Make changes. Load, modify and printing and indicator the acquired Delaware Complaint regarding Insurer's Failure to Pay Claim.

Each format you put into your bank account lacks an expiry particular date and is yours permanently. So, if you want to download or printing another copy, just visit the My Forms area and click on in the develop you will need.

Gain access to the Delaware Complaint regarding Insurer's Failure to Pay Claim with US Legal Forms, probably the most considerable catalogue of legitimate document web templates. Use 1000s of skilled and status-particular web templates that meet up with your company or person demands and needs.

Form popularity

FAQ

Information To Include in Your Letter Give the basics. Tell your story. Tell the company how you want to resolve the problem. Be reasonable. File your complaint. Your Address. Your City, State, Zip Code. [Your email address, if sending by email] Date.

Not sure who to call? Dial (302) 674-7300 for the receptionist and you will be directed to the staff member who can best assist you. Thank you for visiting our website.

A charge may be filed in person at the Department of Labor office in Dover or Wilmington. You may start the process by downloading and completing Discrimination Intake Form. Submit the completed questionnaire to our offices. We will contact you to set up an appointment to finalize the filing process.

Please feel free to contact the Consumer Services Division with general questions you have about insurance or if you have problems or complaints by email , or call 1-800-282-8611 in Delaware or (302) 674-7310.

As Commissioner, he leads the office charged with protecting, educating, and advocating for Delaware residents. The Department offers free Medicare counseling services and works on the Health Insurance Marketplace, provides arbitration services to residents, and fights and prevents fraud.

The law prohibits business from making false statements about their own goods or services or the goods and services offered by other businesses. If you are unable to fill out the following Consumer Complaint Form, please call (800) 220-5424 or e-mail consumer.protection@delaware.gov for assistance.